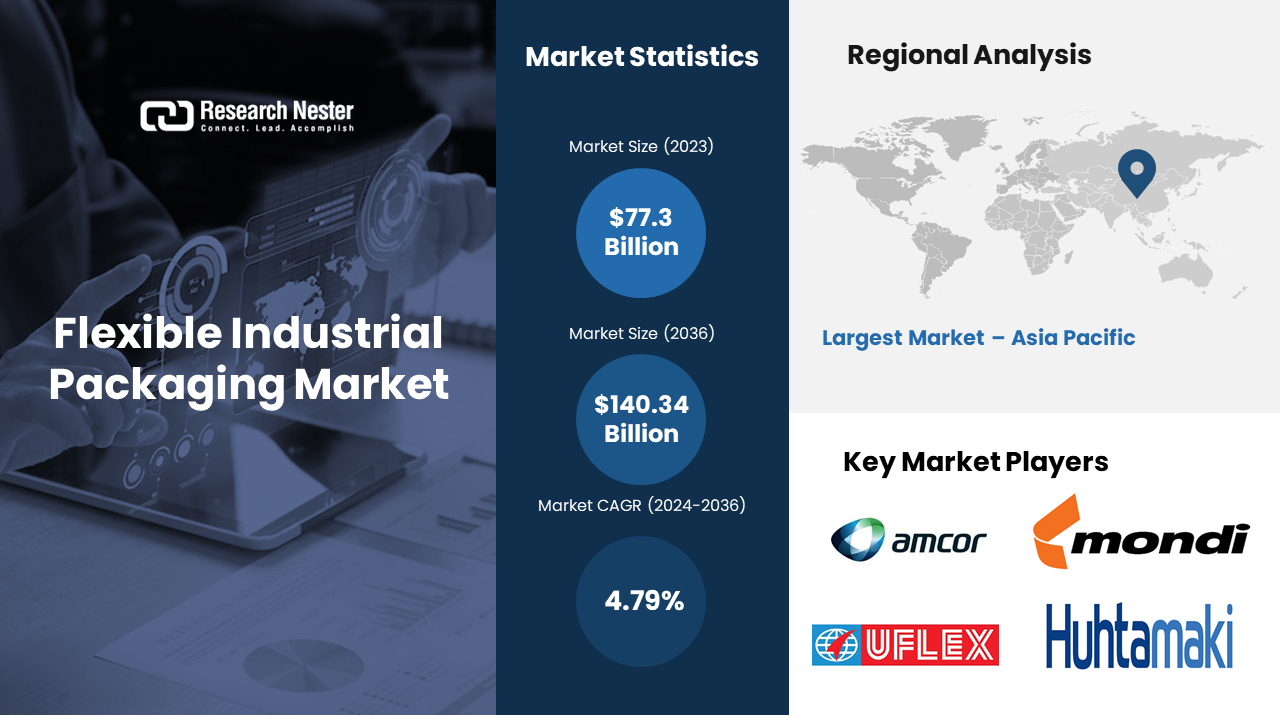

New York , Feb. 13, 2024 (GLOBE NEWSWIRE) -- The global flexible industrial packaging market size is poised to grow at a CAGR of over 4.79% from 2024 to 2036. The market is anticipated to garner a revenue of USD 140.34 billion by the end of 2036, up from a revenue of USD 77.3 billion in the year 2023. The growth of the market can be attributed to the increasing demand for flexible packaging in several industries. Plastic has become the primary material used for packaging in all industries in recent decades, replacing traditional materials such as paper and cardboard, metal, and glass in many items due to rising demand. Of the whole plastic packaging used globally, flexible plastic packaging accounts for nearly 26% and only 19% is rigid plastic. In addition to these, factors that are believed to fuel the growth of the market include the rapid shift of companies from traditional packaging and flexible packaging.

Request Free Sample Copy of this Report @ https://www.researchnester.com/sample-request-5415

Many fast-moving consumer products companies are reinventing packaging to meet circularity goals while lowering GHG emissions. Currently, the consumer products industry accounts for 45% of global emissions, and the top ten contributors to waste made of plastic among consumers are all in the consumer products industry. Moreover, the cosmetic industry is also opting for flexible packaging to contribute to environmental sustainability. The cosmetic company identified ways to reduce packaging GHG emissions by more than 40% by 2030 by using 20% less packaging material, delivering products with half recycled plastic ingredients, and creating 100% of all packaging ingredients reusable, recyclable, or compostable.

Flexible Industrial Packaging Market: Key Takeaways

- Market in Asia Pacific to propel highest growth

- The plastic segment to garner the highest growth

- Market in Europe to grow at a highest rate

Increasing E-commerce Industry across the Globe to Boost Market Growth

Global retail e-commerce sales topped USD 5 trillion for the first time in 2022, representing over a fifth of total retail sales. Moreover, despite slowing growth, overall spending will exceed USD 7 trillion by 2025. The upcoming value chain will become increasingly intricate as the e-commerce sector grows, backed by higher volumes and technology, and affected by the demand for more appropriate and sustainable packaging. Packaging must withstand the rigors of the e-commerce supply chain, which includes several points of contact. Amazon is making the switch to more flexible plastic. New materials are being invented to replace less sustainable solutions, and bioplastics and EPS replacements will most certainly be used more in the future. The efficient use of resources is one of the key cost advantages of flexible packaging. Unlike rigid packaging, which frequently needs additional supplies, flexible packaging makes use of lightweight films and laminates that reduce resource usage. The packaging's flexibility enables economical design and material utilization. Flexible packaging's capacity to be customized in terms of size, shape, and dimensions promotes the best possible space utilization and minimizes unnecessary material waste.

Flexible Industrial Packaging Industry: Regional Overview

The global flexible industrial packaging market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa region.

Economic Expansion and Increased Industrial Output to Drive the Market Growth in Asia Pacific Region

The flexible industrial packaging market in Asia Pacific region is estimated to garner the largest revenue by the end of 2036. The economic expansion in the Asia Pacific region, coupled with increased industrial output, has significantly fueled the demand for flexible industrial packaging. Growing manufacturing sectors, especially in emerging economies, have resulted in a higher volume of goods that require efficient and adaptable packaging solutions. According to the Asian Development Outlook 2021, the Asia Pacific region is projected to grow by 7.3% in 2021, following a contraction of 0.1% in 2020. The surge in e-commerce activities, particularly in densely populated countries like China and India, has been a major catalyst for the flexible industrial packaging market. The need for durable and flexible packaging materials that can withstand the rigors of transportation while being visually appealing has witnessed a considerable uptick. The growing environmental consciousness among consumers has led to a notable shift towards sustainable packaging solutions in the Asia Pacific region. Flexible industrial packaging, with its lighter environmental footprint and recyclability, has gained traction as companies aim to align with eco-friendly practices.

Growing Regulatory Emphasis on Sustainability to Propel the Growth in the European Region

The Europe flexible industrial packaging market is estimated to garner the highest CAGR by the end of 2036. Europe's stringent regulatory landscape, particularly in the context of sustainability, is a significant driver for the market. The push towards environmentally friendly practices has led to a notable increase in the adoption of recyclable and biodegradable materials, driving innovation within the industry. The emphasis on sustainability extends to the reduction of carbon footprint through lightweight packaging. Flexible industrial packaging, being inherently lighter than traditional rigid alternatives, contributes significantly to minimizing transportation-related emissions and aligns with Europe's focus on eco-friendly solutions. Lightweight flexible packaging solutions have been shown to reduce transportation-related CO2 emissions by up to 60%, according to a study. The thriving e-commerce sector in Europe has been a pivotal driver for the market. The need for packaging materials that can withstand the challenges of online retail, such as increased handling and transportation, positions flexible solutions as a preferred choice for companies operating in the region.

Make an Inquiry Before Buying this Report @ https://www.researchnester.com/inquiries-before-buying-5415

Flexible Industrial Packaging Segmentation by Material

- Plastic

- Aluminum Foil

- Paperboard

- Others

Amongst these segments, the flexible industrial packaging market plastic segment is anticipated to hold the largest share over the forecast period. The growth of the segment can be attributed to the rising use of flexible plastic in all industries. For instance, flexible plastic packaging effectively protects pharmaceutical and medical supplies. It helps to keep sensitive pharmaceuticals and medical equipment safe from light, moisture, and other contaminants. Moreover, the heavy usage of plastic and the growing need to switch from traditional plastic to flexible plastic is boosting the segment’s growth. Global plastics consumption has increased dramatically in recent decades, reaching an estimated 460 million metric tons in recent years. Packaging accounted for nearly 31% of this total, making it by far the greatest consumer of plastics.

Flexible Industrial Packaging Segmentation by End User

- Chemical

- Construction

- Food & Beverage

- Pharmaceutical

- Others

Amongst these segments, the flexible industrial packaging market food & beverage segment is anticipated to hold a significant share over the forecast period. Shifting consumer preferences towards healthier and more sustainable food options are reshaping the food and beverage landscape. The demand for plant-based and organic products has surged, compelling industry players to adapt their offerings, packaging, and marketing strategies to cater to this evolving consumer mindset. A study reports that 39% of consumers globally are actively trying to eat more plant-based foods. The digital transformation of the food and beverage sector, accelerated by the COVID-19 pandemic, has resulted in a substantial increase in online grocery shopping. Consumers now prefer the convenience of ordering food products online, prompting companies to optimize their supply chain and packaging to meet the demands of e-commerce distribution. Growing health consciousness among consumers has spurred the demand for functional and nutritious food and beverage products.

Flexible Industrial Packaging Segmentation by Type

- Pouches

- Spouted Pouch

- Others

- Bags

- Films & Wraps

- Others

Flexible Industrial Packaging Segmentation by Pouch Size

- Less Than 200 MI

- 200 MI-500 MI

- 500 MI-1000 MI

- More Than 1000 MI

Flexible Industrial Packaging Segmentation by Filling Process

- Standard

- Aseptic

- Retort

- Hot-Filled

Flexible Industrial Packaging Segmentation by Application

- Food

- Dairy Products

- Dips & Dressing

- Soups & Sauces

- Beverage

- Alcoholic

- Non-alcoholic

Flexible Industrial Packaging Segmentation by Layer

- Four

- Three

- Two

Few of the well-known market leaders in the global flexible industrial packaging market that are profiled by Research Nester are Aluflexpack AG, Amcor Plc, Mondi, Sonoco Products Company, Uflex Ltd., Huhtamäki Oyj, Flexibles Industrial Packages Co (SAOC), HOSOKAWA YOKO Co., Ltd., Constantia Flexibles, Berry Global Group, Inc., and other key market players.

Recent Development in the Flexible Industrial Packaging Market

- AMCOR Plc a global pioneer in creating and manufacturing responsible packaging solutions, has agreed to buy Phoenix Flexibles, increasing Amcor's capacity in the fast-growing Indian market. The purchase of Phoenix Flexibles adequately funded and advantageously situated production facility would instantly improve Amcor's capacity to meet continuing high demand and drive good profits for shareholders.

- Berry Global Group, Inc. has joined hands with Printpack, a film converter, and producer, to create packaging solutions that contribute to increasing demand from customers for more sustainable packaging. The firms have collaborated to launch the PreserveTM PE PCR recyclable* polyethylene (PE) bag.

Read our insightful Blogs and Data-driven Case Studies:

- Packaging Industry - Benefits, Trends, & Innovations

Know about the significance of packaging for selling a product. Our guide uncovers the benefits and latest trend in packaging market which include digital printing, flexible printing, sustainable packaging and others.

https://www.researchnester.com/blog/packaging/packaging-industry-trends

- How a consumer-packaged goods company faced supply-chain issues and mitigated the crisis?

This case study explores the challenges faced by a consumer-packaged goods company when their supply chain was disrupted due to unforeseen circumstances. Learn how this company overcame supply-chain issues and emerged stronger than ever before.

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.