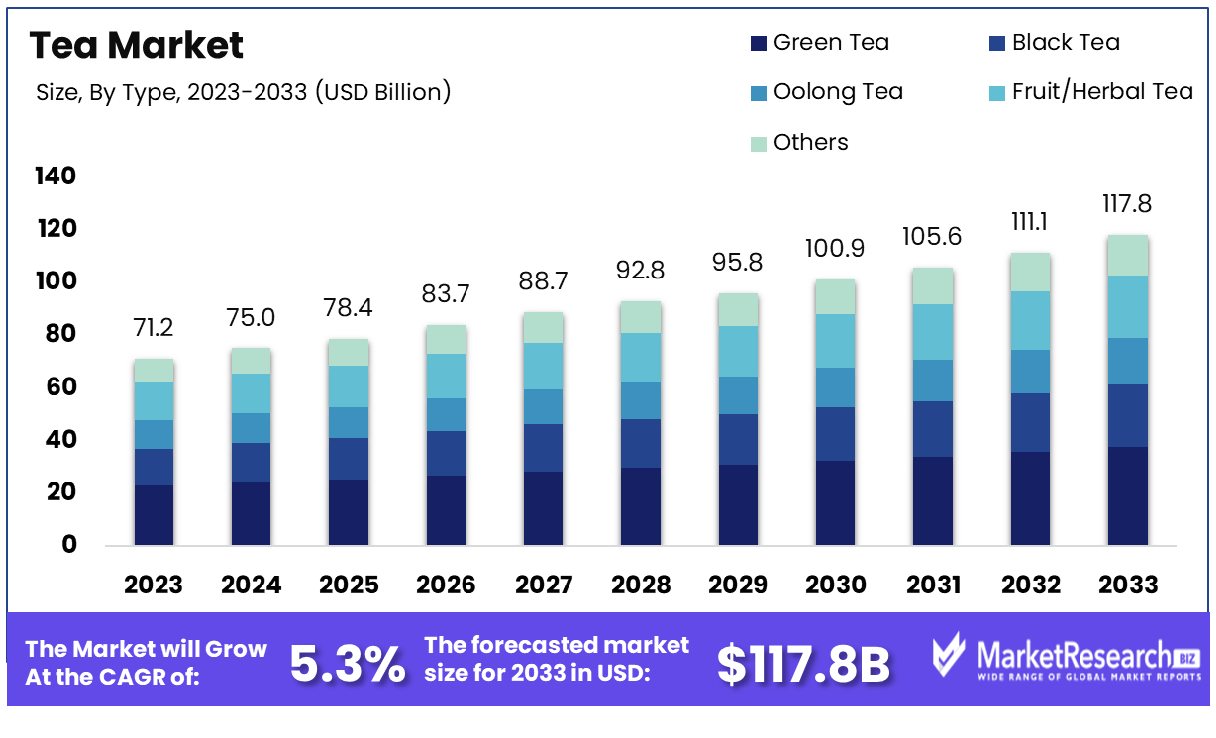

New York, Feb. 20, 2024 (GLOBE NEWSWIRE) -- The Global Tea Market, valued at USD 71.2 billion in 2023 and anticipated to reach USD 117.8 billion by 2033 with a 5.3% CAGR, experiences surging demand driven by evolving flavor preferences and changing customer choices.

Defined as a beverage infused with dried leaves from the Camellia sinensis plant, grown in various regions globally, tea has deep roots in traditional growing areas like China, India, Japan, and Sri Lanka. New players in tea production, including Bangladesh, Kenya, and Vietnam, have emerged.

To get additional highlights on major revenue-generating segments, Request a Tea Market sample report at https://marketresearch.biz/report/global-tea-market/request-sample/

The flavor nuances are influenced by factors such as soil type, plant variety, altitude, and age of the tea plant, with specific regions gaining recognition for certain tea types—like Japan for green tea, China for white and pu-erh, and Sri Lanka for black tea. China leads as the largest global tea producer, followed by India and Kenya. In 2023, China alone produced 68% of the world's tea, contributing significantly to Sri Lanka's GDP and reinforcing its tea leadership.

Shifting customer preferences, driven by health consciousness, propels the market forward, with tea offering diverse health benefits such as cholesterol reduction, promoting peaceful sleep, reducing depression risks, enhancing focus, and lowering hyperglycemia risk. As consumers increasingly turn to tea as a daily beverage, its multifaceted health advantages will drive market expansion during the forecast period.

Key Takeaways

- Green tea holds a strong position in this market segment due to its growing health-conscious consumer base, antioxidant properties, and health benefits.

- Paperboards lead the packaging market segment due to their eco-friendly nature, recycling, and biodegradability.

- Residential segment dominates the application market due to the widespread consumption of tea in households across the globe, driven by its role as a staple beverage in many cultures.

- Supermarkets/ hypermarkets rule the distribution market segment due to their wide reach, variety of choices, and convenience, offering consumers a one-stop solution for their tea-purchasing needs.

- Asia Pacific commands a substantial 37% share of the global tea market.

Driving Factors

Rise in ready to drinks augments the tea market growth.

The Ready-to-Drink (RTD) tea segment, marked by its convenience, caters to the fast-paced lifestyle of modern consumers. Brands like Lipton and Snapple have adeptly capitalized on this segment's growth rate, illustrating the market's adaptation to evolving consumer preferences. The RTD tea's rise is indicative of a broader trend where convenience, without compromising on quality, is paramount.

Health and wellness drive market expansion.

This growing health consciousness has magnified the appeal of tea, particularly green tea, which is renowned for its high antioxidant content. A study revealed that individuals who consume three or more cups of tea daily have a 21% reduced stroke risk compared to those who drink less than one cup. The perception of tea as a healthful, natural beverage is central to its market expansion, resonating with consumers' increasing pursuit of healthier lifestyles.

To understand how our report can bring a difference to your business strategy, Inquire about a brochure at https://marketresearch.biz/report/global-tea-market/#inquiry

Restraining Factors

A change in customer preference hinders the black tea market.

There has been an impressive decline in the market for black tea of the traditional variety, a category that has traditionally been the dominant segment of the market. Consumers are increasingly gravitating toward alternative tea varieties such as green tea and herbal infusions, driven by health consciousness and diverse taste preferences. This shift in consumer preference poses a significant challenge to producers and marketers of traditional black tea, necessitating adaptations in product offerings and marketing strategies to align with the evolving tastes and health trends of consumers.

Growth Opportunities

A new innovation related to tea-based culinary is the new face of cafes and restaurants.

This trend involves the creative incorporation of tea into various culinary formats, such as tea pairings, tea-infused cocktails and mocktails, tea-flavored dishes, and tea smoothies. This approach allows tea's diverse flavors to be explored in innovative and appealing ways, enhancing its appeal beyond traditional consumption. For instance, Starbucks' inclusion of tea lattes and tea-based refreshers showcases the potential of tea-based menu items. The challenge for the industry lies in broadening tea's appeal and availability beyond specialist tea shops to mainstream dining and café environments.

Have Queries? Speak to an expert or To Download/Request a Sample, Click here.

| Report Attribute | Details |

| Market Value (2023) | US$ 71.2 Billion |

| Market Size (2033) | US$ 117.8 Billion |

| CAGR (from 2024 to 2033) | 5.3% from 2024 to 2033 |

| Asia Pacific Region Revenue Share | 37% |

| Historic Period | 2016 to 2023 |

| Base Year | 2023 |

| Forecast Year | 2024 to 2033 |

Regional Analysis

Asia Pacific commands a substantial 37% share of the global tea market, led by tea-rich countries like China, India, and Sri Lanka. Favorable climatic conditions, a deep-rooted tea culture, and a rising trend of premiumization and health consciousness contribute to the region's dominance. Europe's market, though smaller, emphasizes specialty and premium teas, driven by health awareness and the popularity of organic products. In North America, a shift from traditional coffee to tea is underway, fueled by health benefits, with a notable rise in iced and ready-to-drink tea products reflecting changing consumption habits and diversification in the market.

Segment Analysis

By type analysis, green tea holds a strong position in the market segment due to its growing health-conscious consumer base, antioxidant properties, and health benefits, including weight loss support and a reduced risk of heart disease. Black tea remains popular for its robust flavor and cultural significance in many regions, while oolong tea is appreciated by tea connoisseurs for its unique taste. Fruit and herbal teas have gained popularity due to their variety of flavors and perceived health benefits.

By packaging analysis, paperboards lead the market segment due to their eco-friendly nature, recyclable nature, and biodegradability. Moreover, paperboards offer versatility in design, aiding brands in marketing and distinguishing their products on retail shelves. Tea bags, which are convenient and easy to use, have a significant market presence, particularly in Western countries. However, the environmental concerns associated with plastic and the move towards sustainable packaging underscore the leading position of paperboard packaging in the tea market.

By application analysis, the residential segment dominates the market due to its widespread consumption of tea in households across the globe, driven by its role as a staple beverage in many cultures. The commercial sector, which includes cafes, restaurants, and hotels, also significantly consumes tea, often offering specialized selections to cater to diverse consumer preferences. Despite this, the ingrained habit of tea consumption in residential settings, coupled with its role in daily life, underscores the dominance of the residential application segment.

By distribution analysis, supermarkets, and hypermarkets rule the market segment due to their wide reach, variety of choices, and convenience, offering consumers a one-stop solution for their tea purchasing needs. These retail giants cater to a broad consumer base, providing an extensive range of tea products, from premium to budget-friendly options. The comprehensive range and accessibility provided by supermarkets and hypermarkets solidify their status as the most significant distribution channel in the tea market.

For more insights on the historical and Forecast market data from 2016 to 2033 - download a sample report at https://marketresearch.biz/report/global-tea-market/request-sample/

Segments covered in this report

By Type

- Green Tea

- Black Tea

- Oolong Tea

- Fruit/Herbal Tea

- Others

By Packaging

- Paperboards

- Plastic Containers

- Loose Tea

- Aluminium Tins

- Tea Bags

By Application

- Residential

- Commercial

By Distribution Channel

- Supermarkets/ Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Grow your profit margin with Marketresearch.biz - Purchase This Premium Report at https://marketresearch.biz/purchase-report/?report_id=43309

Competitive Landscape Analysis

In the dynamic tea market, major players contribute distinct strengths and strategies. Twinings, with a rich British heritage, excels in classic and flavored teas, epitomizing quality and tradition on a global scale. Tetley, part of Tata Global Beverages, stands out for innovation, introducing round tea bags and drawstring variants, solidifying its dominant global presence. Harney & Sons in the USA caters to a premium niche with high-quality loose teas and unique blends, emphasizing craftsmanship and luxury packaging, setting them apart in the upscale tea segment. Each company's approach adds diversity and value to the evolving tea industry.

Key Players

- Twinings (UK)

- Tetley (owned by Tata Global Beverages)

- Harney & Sons (USA)

- Dilmah (Sri Lanka)

- Gujarat Tea Processors & Packers Ltd. (Wagh Bakri brand)

- Society Tea (India)

- Tata Tea (India)

- Red Rose Tea (owned by Teekanne in the US and Unilever in Canada)

- Tim Hortons (owned by Restaurant Brands International)

- Akbar Tea (Sri Lanka)

- Alghazaleen Tea (Sri Lanka)

- Bogawantalawa (BPL Teas)

- Heladiv (Sri Lanka)

- Tazo and Teavana (Starbucks)

- Luzianne (Reily Foods Company)

Recent Developments

- In December 2023, KOI Thé, the renowned milk tea brand, partnered with Suyen Corporation to enter the Philippines, opening its flagship store in Makati City. They introduced two new offerings, Dark Lava Milo O and Strawberry Macchiato, to the Philippine market.

- In November 2023, Coca-Cola India introduced Honest Tea, a ready-to-drink organic green tea-based beverage sourced exclusively from Luxmi Tea's Makaibari Tea Estate, known for its exceptional Darjeeling tea. Honest Tea offers two flavors: lemon-tulsi and mango, catering to diverse consumer preferences.

- In November 2023, Shavuot International introduced "Boost" tea, a locally manufactured blend of turmeric, ginger, and ginseng. This herbal tea aims to provide a natural energy boost as an alternative to caffeine.

Browse More Related Reports

Bubble Tea Market is projected to reach USD 5.6 billion by 2032, with a CAGR of 7.4% between 2022 and 2032.

Caffeine Substitute Market is forecasted to achieve USD 3.6 billion by 2032, growing at an 8.7% CAGR from 2022 to 2032.

Ready To Drink Coffee Market is anticipated to hit USD 56 billion by 2032, showing a 5.7% CAGR during 2022-2032.

Turmeric Market is poised to attain USD 115.2 billion by 2032, with a 6.4% CAGR spanning from 2022 to 2032.

Dried Herbs Market is expected to reach USD 5.9 billion by 2032, driven by a 5.8% CAGR from 2022 to 2032.

About Us:

MarketResearch.Biz (Powered by Prudour Pvt Ltd) specializes in in-depth market research and analysis and has been proving its mettle as a consulting and customized market research company, apart from being a much sought-after syndicated market research report-providing firm. MarketResearch.Biz provides customization to suit any specific or unique requirement and tailor-made reports as per request. We go beyond boundaries to take analytics, analysis, study, and outlook to newer heights and broader horizons.

Follow Us on LinkedIn: https://www.linkedin.com/company/marketresearch-biz/

Follow Us on Facebook: https://www.facebook.com/marketresearch.biz

Follow Us on Twitter: https://twitter.com/PrudourResearch