Dublin, March 01, 2024 (GLOBE NEWSWIRE) -- The "Global Carbon Fiber Market by Raw Material Type (PAN, Pitch), Fiber Type (Virgin, Recycled), Product Type, Modulus (Standard, Intermediate, High), Application (Composites, Non-Composites), End-Use Industry, & Region - Forecast to 2033" report has been added to ResearchAndMarkets.com's offering.

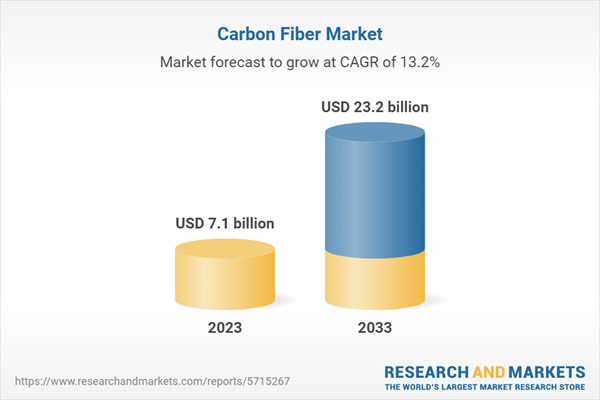

The carbon fiber market was estimated at USD 7.1 billion in 2023 and is projected to reach USD 23.2 billion by 2033, at a CAGR of 13.2% from 2023 to 2033. Pitch is a viscoelastic material made up of aromatic hydrocarbons, produced during the distillation of carbon-based materials such as plants, crude oil, and coal. Pitch-based carbon fibers have a wide range of tensile moduli, ranging from low modulus (55GPa) to ultra-high modulus (900GPa). High modulus is very appealing for applications requiring high stiffness and light weight. Aside from high modulus and stiffness, pitch-based carbon fiber has a high thermal conductivity.

In terms of value, continuous carbon fiber accounted for the largest share of the overall carbon fiber market.

Continuous carbon fibers offer higher tensile strength than other carbon fiber product types. These fibers can be used in layup, weaving, prepreg, filament winding, braiding, and pultrusion processes for manufacturing composite parts for various end-use industries such as aerospace & defense, automotive, and wind energy. Continuous carbon fibers are ideal for making unidirectional tapes used in aerospace and FRP tank applications.

In terms of value, aerospace & defense industry accounted for the largest share of the overall Carbon fiber market.

In 2022, the aerospace & defense industry accounted for the largest share of the carbon fiber market, in terms of value. This is attributed to the high consumption of carbon fiber by commercial and defense aircraft manufacturers such as Boeing, Airbus, and Lockheed Martin. There is a high demand for carbon fiber in next-generation aircraft. Carbon fiber composites are used to design carbon fiber fuselage and wings in the aerospace & defense industry. New players such as Irkut Corporation (Russia) and COMAC Aerospace Company (China) have also started producing commercial aircraft, which has further boosted the consumption of carbon fibers in the aerospace & defense industry.

During the forecast period, the Carbon Fiber market in North America region is projected to be the second-largest region

New product developments, capacity expansions, and the establishment of plants by various leading players in this region majorly drive the growth of the carbon fiber market in North America. Demand for composites from the automotive, aerospace & defense, and wind energy industries is projected to increase due to new product innovations and technological advancements in the applications of composites in these industries. In North America, the aerospace & defense, automotive, and wind energy industries are the major industries which have applications of carbon fiber composites.

The report provides insights on the following:

- Analysis of key drivers (Rising demand for manufacture of satellite parts, High demand from aerospace & defense industry, Stringent eco-friendly regulations to drive adoption of carbon fiber and related composites in automotive applications, Rising use in wind energy industry, Rising demand of regular tow carbon in pressure vessels leading the growth of carbon fiber based composites), restraints (high cost of carbon fiber, lack of standardization in manufacturing technologies), opportunities (Increased investments for development of low-cost coal-based carbon fibers, potential opportunities in new applications, increasing demand for fuel cell electric vehicles (FCEVs), rising use of carbon fiber in 3D printing), and challenges (Production of low-cost carbon fiber, capital intensive production and complex manufacturing process) influencing the growth of the Carbon Fiber market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Carbon fiber market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Carbon Fiber market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Carbon Fiber market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Toray Industries Inc., (Japan), Teijin Limited (Japan), Mitsubishi Chemical Group Corporation (Japan), Hexcel Corporation (US), Solvay (Belgium), SGL Carbon (Germany), Hyosung Advanced Materials (South Korea), Zhongfu Shenying Carbon Co., Ltd. (China), Kureha Corporation (Japan), DowAksa (Turkey), Jilin Chemical Fiber Group Co., Ltd. (China), Jiangsu Hengshen Co., Ltd. (China), Anshan Sinoda Carbon Fibers Co., Ltd. (China), and China National Bluestar (Group) Co., Ltd. (China), among others in the Carbon fiber market

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 322 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value (USD) in 2023 | $7.1 billion |

| Forecasted Market Value (USD) by 2033 | $23.2 billion |

| Compound Annual Growth Rate | 12.6% |

| Regions Covered | Global |

Key Topics Covered:

1 Introduction

2 Research Methodology

3 Executive Summary

Figure 5 Pan-based Segment Led Carbon Fiber Market in 2022

Figure 6 Composites Application Dominated Carbon Fiber Market in 2022

Figure 7 Aerospace & Defense End-use Industry Led Carbon Fiber Market in 2022

Figure 8 Market in China to Grow at Highest CAGR During Forecast Period

Figure 9 Europe Accounted for Largest Market Share in 2022

4 Premium Insights

4.1 Attractive Opportunities for Players in Carbon Fiber Market

Figure 10 Increase in Demand for Manufacturing Pressure Vessels to Drive Carbon Fiber Market

4.2 Carbon Fiber Market, by Raw Material

Figure 11 Pan-based Segment Dominated Carbon Fiber Market in 2022

4.3 Carbon Fiber Market, by Application

Figure 12 Composites Application Dominated Carbon Fiber Market in 2022

4.4 Carbon Fiber Market, by End-use Industry

Figure 13 Wind Energy Segment Accounted for Largest Share in 2022

4.5 Carbon Fiber Market Growth, by Key Country

Figure 14 Market in China to Grow at Highest CAGR During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Growth in Demand for Manufacture of Satellite Parts

5.2.1.2 High Demand from Aerospace & Defense Industry

5.2.1.3 Stringent Eco-Friendly Regulations to Drive Adoption of Carbon Fiber and Related Composites in Automotive Applications

5.2.1.4 Increased Use in Wind Energy Industry

5.2.1.5 Rise in Demand for Regular Tow Carbon in Pressure Vessels

5.2.2 Restraints

5.2.2.1 High Cost of Carbon Fiber

5.2.2.2 Lack of Standardization in Manufacturing Technologies

5.2.3 Opportunities

5.2.3.1 Increased Investments for Development of Low-Cost Coal-based Carbon Fibers

5.2.3.2 Potential Opportunities in New Applications

5.2.3.3 Increasing Demand for Fuel Cell Electric Vehicles

5.2.3.4 Increase in Use of Carbon Fiber in 3D Printing

5.2.4 Challenges

5.2.4.1 Production of Low-Cost Carbon Fiber

5.2.4.2 Capital-Intensive Production and Complex Manufacturing Process

5.3 Porter's Five Forces Analysis

5.4 Supply Chain Analysis

5.5 Value Chain Analysis

5.6 Ecosystem Map

5.7 Ecosystem: Carbon Fiber Market

5.8 Pricing Analysis

5.9 Average Selling Price Trends

5.10 Key Stakeholders and Buying Criteria

5.11 Technology Analysis

5.12 Case Study Analysis

5.13 Trends Impacting Customers' Businesses

5.14 Trade Analysis

5.15 Tariffs and Regulations

5.16 Key Conferences & Events in 2023-2024

5.17 Patent Analysis

6 Carbon Fiber Market, by Raw Material

7 Carbon Fiber Market, by Fiber Type

8 Carbon Fiber Market, by Modulus

9 Carbon Fiber Market, by Product Type

10 Carbon Fiber Market, by Application

11 Carbon Fiber Market, by End-use Industry

12 Carbon Fiber Market, by Region

13 Competitive Landscape

14 Company Profiles

- Toray Industries, Inc.

- Teijin Limited

- Mitsubishi Chemical Group Corporation

- Hexcel Corporation

- Solvay

- Sgl Carbon

- Hyosung Advanced Materials

- Zhongfu Shenying Carbon Fiber Co. Ltd.

- Kureha Corporation

- Dowaksa

- Jilin Chemical Fiber Group Co. Ltd.

- Jiangsu Hengshen Co. Ltd.

- Anshan Sinoda Carbon Fibers Co. Ltd.

- China National Bluestar (Group) Co. Ltd.

- Weihai Guangwei Composite Materials Co. Ltd.

- Umatex Group

- Nippon Graphite Fiber Corporation

- Changzhou Jlon Composite Co. Ltd.

- Bcircular

- Vartega Inc.

- Jilin Tangu Carbon Fiber Co. Ltd.

- Wuxi Gde Technology Co. Ltd.

- Sinofibers Technology Co. Ltd.

- Jilin Jiyan High-Tech Fibers Co. Ltd.

- Tianniao

- China Petrochemical Corporation (Sinopec)

- Sichuan Xinwanxing Carbon Fiber Composites Co. Ltd.

- Flink International Co. Ltd.

- Acp Composites, Inc.

- Yixing Zhongtan Technology Co. Ltd.

- Yixing Junchao Carbon Fiber Products Co. Ltd.

- China Composites Group Corporation Ltd.

For more information about this report visit https://www.researchandmarkets.com/r/4sx7ls

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment