Dublin, March 04, 2024 (GLOBE NEWSWIRE) -- The "Global Hyperscale Data Center Market - Outlook & Forecast 2023-2028" report has been added to ResearchAndMarkets.com's offering.

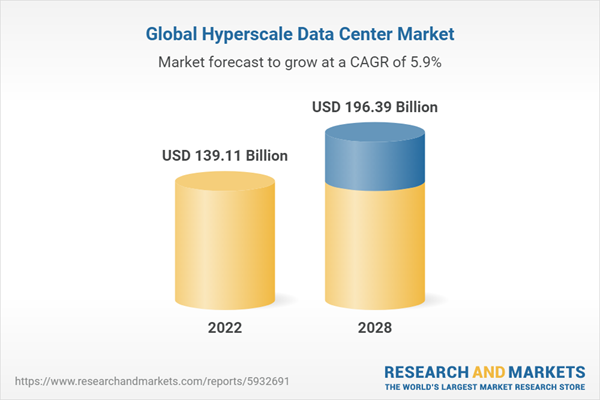

The global hyperscale data center market was valued at $139.11 billion in 2022 and is expected to reach a value of $196.39 billion by 2029, growing at a CAGR of 5.92% from 2022-2028

The rise in coverage of 5G and its deployment in various regions will attract more hyperscale data center investment across the countries globally. The use of cloud computing services and applications will continue to grow, leading to the development of large hyperscale cloud-based data centers. Governments worldwide offer incentives to attract data center investments in their countries. For instance, in the U.S., states like Virginia and Washington, DC, have seen an increase in data centers due to federal tax incentives. In Latin America, Mexico's special economic zones offer benefits like corporate tax exemptions and import/export tax exemptions.

Further, the Netherlands provides tax benefits for sustainable data center investments in the European region, including renewable energy sources, cooling towers, UPS systems, and fans. The Energy Investment Deduction (EIA) program allows for up to 55% tax-free investment cost, while the Environment Investment Deduction (MIA) program can save 13%-36% for eco-friendly data centers.

Globally, major hyperscale data center market companies are prioritizing using renewable energy as their primary power source. For example, in November 2022, Google entered into a power purchase agreement (PPA) for 942 megawatts of solar power from projects in development in Texas. Most operators in the global hyperscale data center market primarily employ free cooling solutions, and there is also a growing trend in data centers toward adopting waterless cooling systems that use free cooling chillers and indoor CRAC units.

The hyperscale data center market is likely to witness the entry of new players. For instance, Form8tion Data Centers, a new entrant in the European market formed by Thor Equities, commenced the construction of a new data center in Madrid, Spain. The operator claims its facilities will use HVO for generators and renewable energy to power the data center.

Vendors' Advancements and Challenges in the Data Center Market

In response to a growing trend, companies that provide data center infrastructure services are increasingly adopting environmentally friendly and efficient solutions. However, they are facing challenges such as supply chain issues, which are causing delays and higher procurement costs. On the construction side, companies building data centers are having trouble finding skilled workers, so they are focusing more on using recycled materials for big projects. In terms of investments, companies that offer colocation services are partnering with each other through mergers and joint ventures to expand.

For example, GDS Services is teaming up with YTL to build data centers in Malaysia. At the same time, major global cloud providers like AWS, Microsoft, and Google are making significant investments in large-scale data centers. They are doing this by building their facilities and renting space from colocation providers in multiple countries. This increase in activity is making the competition among colocation providers in the market more intense.

MARKET TRENDS & OPPORTUNITIES

Rising Procurement of Artificial Intelligence

The adoption of artificial intelligence (AI) is driving the demand for hyperscale data centers, which provide the necessary infrastructure for AI applications like machine learning and deep learning. These data centers offer vast storage capacity and powerful computing capabilities required for handling large volumes of data efficiently. Additionally, AI is being used to optimize energy consumption in data centers, as seen in Google's implementation of AI-controlled cooling systems, resulting in significant energy savings.

Growing Procurement of Big Data and IoT Solutions

Advancements in internet speed and the rise of social media users have led to a surge in data across various industries, necessitating the adoption of big data and IoT solutions. Companies like T-Mobile are introducing simplified global IoT connectivity solutions to meet this growing demand.

Automation & Intelligent Monitoring Solutions

Automation solutions in data centers help identify maintenance needs, ensuring the reliability of critical systems like generators. Remote monitoring solutions offered by vendors like Carrier and Data Aire enhance the management of cooling infrastructure.

Sustainable and Innovative Data Center Technologies

Data center operators are focusing on improving efficiency and reducing environmental impact. Initiatives include upgrading to newer technologies and exploring sustainable power sources like hydrogen fuel cells, as demonstrated by Equinix's collaboration with the National University of Singapore.

Geographical Analysis

- Hyperscale Activity Dominated by North America and APAC Persists: North America and APAC continue to lead hyperscale data center investments, with major tech companies driving significant growth in both regions.

- European Hyperscale Growth in Multiple Nations: Expansion efforts in the FLAP-D market (Frankfurt, London, Amsterdam, Paris, and Dublin) and other European countries indicate steady growth in hyperscale data center investments.

- Hyperscale Expansion Takes Hold in the Middle East: Countries like Israel, Saudi Arabia, and the UAE are experiencing growth in hyperscale data center development, fueled by colocation operators and global cloud service providers.

- The Future of Hyperscale Data Centers in Africa: South Africa remains a key player in the African hyperscale data center market, with other countries like Egypt, Kenya, Ethiopia, and Nigeria expected to emerge as destinations for future development.

- APAC Set for Higher Hyperscale Investments: Southeast Asia, South Korea, Japan, and India are anticipated to drive significant growth in the APAC hyperscale data center market, with ongoing expansion efforts in countries like Australia, China, and Singapore.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 662 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value (USD) in 2022 | $139.11 Billion |

| Forecasted Market Value (USD) by 2028 | $196.39 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

Market Opportunities & Trends

- Rising Adoption of Artificial Intelligence

- Growing Procurement of Big Data & IoT Solutions

- Automation & Intelligent Monitoring Solutions

- Sustainable & Innovative Data Center Technologies

- Rising Demand for Cloud-based Services

Market Growth Enablers

- Rising Submarine & Inland Connectivity

- Surging Mergers & Acquisitions and Joint Ventures in the Industry

- Data Center Investments Backed by Governments

- Renewable Energy Initiatives by Hyperscale & Cloud Operators

Market Restraints

- Obstacles in Choosing a Site for Data Center Development

- Data Center Growth Hindered by Security Challenges

- Lack of Skilled Workforce and Discrimination Issues

- Supply Chain Disruptions Hampering Growth

- Concerns Over Carbon Emissions from Data Centers

Vendor Landscape

Key Data Center IT Infrastructure Providers

- Cisco Systems

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies

- IBM

- Inspur

Other Prominent IT Infrastructure Providers

- Arista Networks

- ATOS

- Broadcom

- Juniper Networks

- Lenovo

- NetApp

- Extreme Networks

- Fujitsu

- Hitachi Vantara

- Inventec

- Micron Technology

- Mitac Holdings

- NIMBUS Data

- Oracle

- Pivot3

- Pure Storage

- Quanta Cloud Technology (Quanta Computer)

- Seagate Technology

- Supermicro

- Synology

- Toshiba

- Violin (StorCentric)

- Western Digital

- Wistron (WIWYNN)

Key Data Center Support Infrastructure Providers

- ABB

- Caterpillar

- Cummins

- Delta Electronics

- Eaton

- Legrand

- Rolls-Royce

- Schneider Electric

- STULZ

- Vertiv

Other Data Center Support Infrastructure Providers

- Airedale

- Alfa Laval

- Asetek

- Assa Abloy

- Bloom Energy

- Carrier

- Condair

- Cormant

- Cyber Power Systems

- Daikin Applied

- Data Aire

- Delta Electronics

- EAE

- Enlogic

- FNT Software

- Generac Power Systems

- Green Revolution Cooling (GRC)

- HITEC Power Protection

- Honeywell International

- Johnson Controls

- KOHLER

- KyotoCooling

- Mitsubishi Electric

- Munters

- Nlyte Software (Carrier)

- Natron Energy

- NetZoom

- Panduit

- Piller Power Systems

- Riello Elettronica (Riello UPS)

- Siemens

- Trane (Ingersoll Rand)

- Tripp Lite

- Yanmar (HIMOINSA)

- ZincFive

- 3M

Key Data Center Contractors

- AECOM

- DPR Construction

- Holder Construction

- Jacobs

- M+W Group (Exyte)

- Bouygues Construction

- Mercury

Other Data Center Contractors

- Arup

- Aurecon Group

- BENTHEM CROUWEL ARCHITECTS

- Cap Ingelec

- Corgan

- DAR Group

- Deerns

- DSCO Group

- Edarat Group

- Faithful+Gould

- Fluor Corporation

- Fortis Construction

- Gensler

- Gilbane Building Company

- HDR

- ISG

- Kirby Group Engineering

- KKCG Group

- Laing O'Rourke

- Larsen & Toubro (L&T)

- Linesight

- Mace

- Morrison Hershfield

- Mortenson

- NTT Facilities

- Red

- Royal HaskoningDHV

- Sterling and Wilson (Shapoorji Pallonji Group)

- STO Building Group

- Syska Hennessy Group

- Turner Construction

- Winthrop Engineering and Contracting

Key Data Center Investors

- Apple

- Amazon Web Services (AWS)

- CyrusOne

- Digital Realty

- Equinix

- Facebook (META)

- Keppel Data Centres

- Microsoft

- NTT Global Data Centers

- ST Telemedia Global Data Centres

- Vantage Data Centers

Other Data Center Investors

- 21Vianet

- Africa Data Centres

- Bharti Airtel (Nxtra Data)

- AirTrunk Operating

- Aligned

- atNorth (Partners Group)

- pl

- Big Data Exchange

- Bridge Data Centres

- Canberra Data Centers

- Chayora

- Chindata

- CloudHQ

- ClusterPower

- Cologix

- Compass Datacenters

- COPT Data Center Solutions

- CoreSite Realty

- DataBank

- DATA4

- DigiPlex (IPI Partners)

- EdgeConneX

- Etisalat

- Flexential

- GDS Services

- Global Switch

- Green Mountain

- Gulf Data Hub

- HostDime

- InterNexa

- Iron Mountain

- IXAfrica

- IXcellerate

- Moro Hub

- NEXTDC

- ODATA

- Ooredoo

- Orange Business Services

- Paratus Namibia

- QTS Realty Trust

- Raxio Group

- Rostelecom Data Centers

- Scala Data Centers

- Sify Technologies

- SUNeVision (iAdvantage)

- Tenglong Holdings Group

- Telecom Egypt

- T5 Data Centers

- Turkcell

- Wingu

- Yondr

- Yotta Infrastructure Solutions

New Data Center Investors

- AdaniConneX

- Cirrus Data Solutions

- Data Center First

- Hickory Group

- Global Technical Realty

- Kevlinx

- Novva

- Quantum Loophole

- Stratus DC Management

For more information about this report visit https://www.researchandmarkets.com/r/cqm1nm

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment