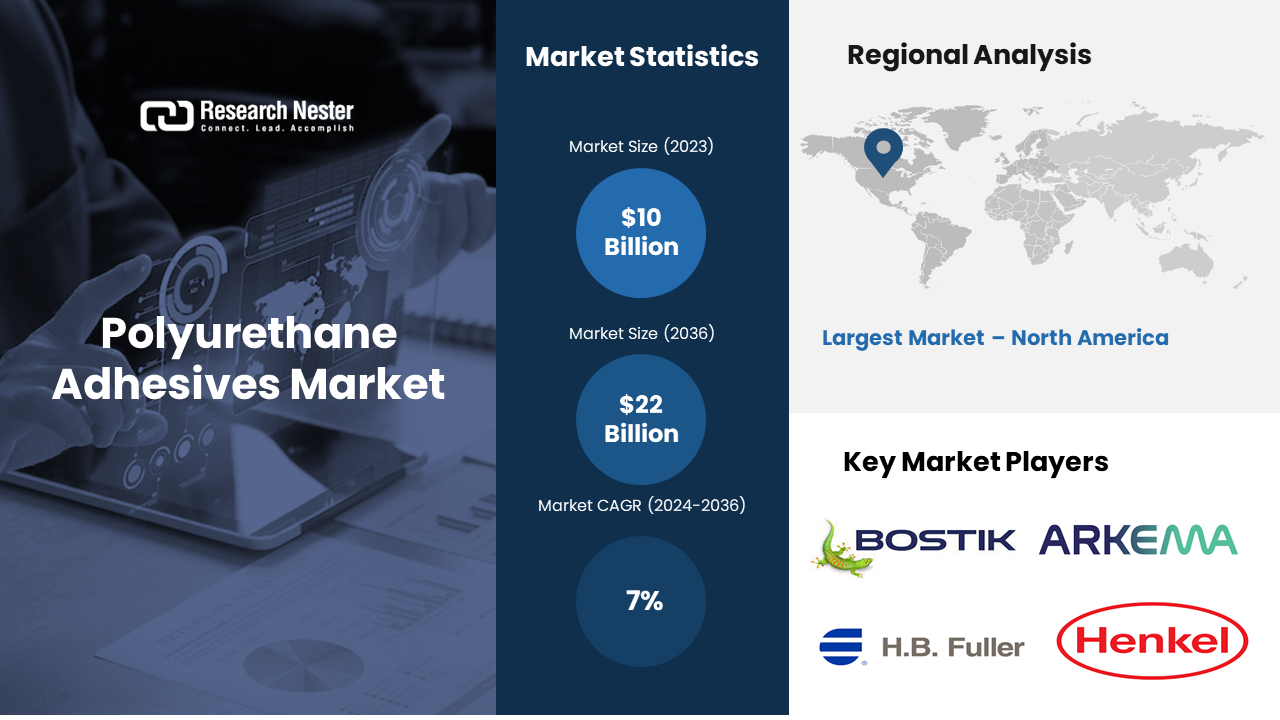

New York , March 12, 2024 (GLOBE NEWSWIRE) -- The global polyurethane adhesives market size is projected to grow at a CAGR of over 7% from 2024 to 2036. The market is expected to garner a revenue of USD 22 billion by the end of 2036, up from a revenue of USD 10 billion in the year 2023. Increasing application of polyurethane in the automotive industries owing to the characteristics of polyurethane adhesives including strength, and lightweight is estimated to boost the market growth. The demand for less-weight and high-efficiency cars that require less fuel in the automobile sector is driving the market growth. Polyurethane foam seating is used in automobiles to reduce the thickness by 50% thereby reducing the weight of the vehicle.

Request Free Sample Copy of this Report @ https://www.researchnester.com/sample-request-3610

In addition, the demand for polyurethane adhesives across the end-user sector worldwide is proliferating the market trends in the coming years. Polyurethane is also used as a substitute for plastic and other raw materials which is anticipated to hike the market size. A new sustainable polyurethane adhesive was developed without using solvents by combining the furfuryl amine and BMI (bismaleimide) through the Diels-Alder reaction as of 2023 research.

Polyurethane Adhesives Market: Key Takeaways

- Market in North America region to propel the highest growth.

- The Building & Construction segment to garner the highest growth

- Market in Asia Pacific region to grow at the highest rate

Rise in Demand for Eco-Friendly Products Globally is Surging the Growth of the Polyurethane Adhesives Market

The preference for eco-friendly products and goods worldwide on account of growing concern about environmental effects is propagating the market size. Besides, the polyurethane adhesives emit very low levels of volatile organic compounds which is likely to propel the market growth. It was reported that 1 kilogram of polyurethane systems can produce nearly 4 kilograms of carbon dioxide but can decrease a 50-year lifetime of emissions which is approximately over 330 kilograms.

Polyurethane Adhesives Market: Regional Overview

Existence of Key Players in the Automobile Industry is Fueling the Market Growth in the North America Region

The North American market region is reckoned to hold a significant market share of 35% during the forecast period owing to the rising presence of prominent players in the automobile industry. The high disposable income and rising construction activities are also the reason for market demand in the region. Construction of non-residential buildings in the U.S. in 2022 increased by over 35% with the construction of new factory buildings.

Rising Demand for Furniture is Driving the Market Expansion in the Asia Pacific Region

The Asia Pacific region market is assessed to secure a noteworthy share of 26% in the coming years. The market growth is attributed to the expanding demand for furniture which is surging the use of polyurethane adhesives across the region. Further, enhancing vehicle production, imports, and exports is propagating the market size. As per the reports, vehicle sales in Indonesia increased from 84,000 units in 2021 to 105,000 units in 2022.

Polyurethane Adhesives Segmentation by Application

- Automotive

- Transportation

- Footwear

- Building

- Construction

- Furniture

The polyurethane adhesives market from the building and construction segment is predicted to register a significant market revenue share of 31% by the end of 2036. The rise of the market segment size is credited to the growing residential and commercial building constructions and increasing expenditure on infrastructure development. It was estimated that residential building works across the world grew by more than 35 in 2022 and non-residential building works grew by 5% in New Zealand. Besides, the inclusion of polyurethane adhesives in the construction enhances the construction sector benefits owing to its properties.

Polyurethane Adhesives Segmentation by Technology

- Solvent-Borne

- Solids

- Dispersion

A solvent-based segment of the polyurethane adhesives market is evaluated to set a market share of 52% in the coming era. The demand for aromatic polyurethanes is outlined to surge the market segment size. The hydroxyl-terminated polyurethane dissolves easily in the solvent and forms a solvent-borne PU adhesive and the aromatic polyurethanes including toluene diisocyanates and diphenylmethane isocyanates decrease the properties of adhesives and give a look of regular urethane adhesives. Toluene diisocyanate and methylene diphenyl diisocyanate comprise more than 85% of the polyurethane sector in North America and are used in flexible foams and the production of sealants, and elastomers respectively.

Polyurethane Adhesives Segmentation by Type

- Thermoset

- Thermoplastics

A few of the well-known market leaders in the global polyurethane adhesives market that are profiled by Research Nester are Bostik, Arkema Group, H.B. Fuller Company, Henkel Corporation, Lonza Group AG, Sika AG, Toyochem Co., Ltd, Akzo Nobel N.V., and others.

Make an Inquiry Before Buying this Report @ https://www.researchnester.com/inquiries-before-buying-3610

Recent Development in the Market

- H.B. Fuller Company declared the acquisition of Fourny N.V. which is a Belgium-based firm and supplier of construction adhesives with over 70 years of experience in advancements exclusively on commercial roofing, construction, and other private label industrial specialties.

- Henkel launched a new solvent-free and elastic adhesive Loctite UK 2073-2173 with two-component polyurethane (2K-PU) technology developed for enhanced functionality on different substrates. With this, the company expands its portfolio of 2K-Pus and allows automobile manufacturers to comply with the advanced automotive performance standards.

Read our insightful Blogs and Data-driven Case Studies:

- Green Chemistry: A continuously-evolving frontier

Explore the significance and influence of Green Chemistry in this article. Gain knowledge about how this changing field is revolutionizing our perspective on chemical processes and their effects, on the environment.

- Identifying Bulk Chemicals Company Supply and Demand Triggers

A chemical company failed to recognize the probable risks related to price and supply chain. Determining focused choices followed by prioritizing the production helped the company to draw out correct production strategy.

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach to helping global industrial players, conglomerates, and executives for their future investments while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided the right guidance at the right time is available through strategic minds.