Dublin, March 28, 2024 (GLOBE NEWSWIRE) -- The "Global Industry 5.0 Market by Technology (Digital Twin, Al in Manufacturing, Industrial Sensors, Augmented & Virtual Reality, Industrial 3D Printing, Robotics), Sustainability (Waste-to-Energy Conversion, Recycle, Material), Industry - Forecast to 2029" report has been added to ResearchAndMarkets.com's offering.

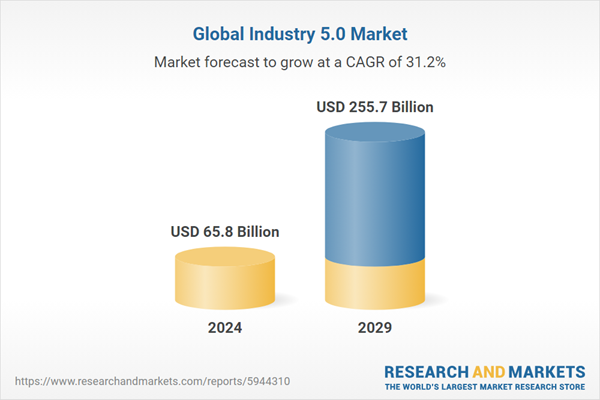

The global Industry 5 market was valued at USD 65.8 billion in 2024 and is estimated to reach USD 255.7 billion by 2029, registering a CAGR of 31.2% during the forecast period.

Implementing Industry 5 principles enables different industries to leverage cutting-edge technologies such as artificial intelligence, the Internet of Things, advanced robotics, and big data analytics to optimize operations, improve product quality, and create new business models. Additionally, Industry 5 promotes collaboration and partnership among industry players, developing ecosystems and value networks that drive innovation and growth.

AI in manufacturing technology is expected to grow at a significant CAGR during the forecast period

AI offers numerous advantages in the manufacturing process, revolutionizing traditional methods by introducing unprecedented levels of efficiency, precision, and adaptability. Through machine learning algorithms and predictive analytics, AI enables predictive maintenance, allowing manufacturers to anticipate equipment failures before they occur, thereby reducing downtime and optimizing production schedules. AI-driven automation streamlines repetitive tasks, increasing productivity and freeing up human resources for more complex and creative endeavors. Quality control benefits from AI's ability to detect defects with unmatched accuracy, ensuring that only flawless products reach the market. Furthermore, AI enhances supply chain management by optimizing inventory levels and forecasting demand, leading to cost savings and improved customer satisfaction. Overall, AI empowers manufacturers to achieve higher levels of efficiency, flexibility, and competitiveness in an increasingly dynamic and data-driven industry landscape.

Energy & Power segment is projected to contribute significant share in the industry 5 market

By integrating advanced digital technologies such as AI, IoT, and big data analytics, energy and power companies can optimize their operations in real time, enhancing grid management, asset performance, and energy distribution. Predictive maintenance enabled by Industry 5 technologies minimizes downtime and extends the lifespan of critical infrastructure, ensuring a reliable energy supply while reducing maintenance costs and environmental impact. Moreover, smart grid systems empowered by Industry 5 facilitate the integration of renewable energy sources and demand response programs, promoting sustainability and energy conservation. AI-driven predictive analytics improves energy forecasting accuracy, enabling more effective resource allocation and grid balancing.

North America to dominate industry 5.0 market

In recent years, North America has witnessed several transformative initiatives aligned with the principles of Industry 5.0. Notable efforts include promoting automated manufacturing practices through initiatives like the National Institute of Standards and Technology's innovation programs related to manufacturing. Additionally, industry-academia collaborations, exemplified by partnerships between research institutions such as MIT and Stanford University with industry players, drive innovation in advanced technologies like artificial intelligence and robotics. Many manufacturing companies across North America have embarked on digital transformation journeys, embracing technologies such as cloud computing, big data analytics, and IoT sensors to optimize operations and enhance competitiveness. Moreover, regions like Silicon Valley, the Research Triangle Park, and the Greater Toronto Area have established themselves as advanced manufacturing hubs, fostering collaboration and innovation in the sector. These initiatives collectively embody the essence of Industry 5.0, integrating digital technologies with traditional manufacturing to drive efficiency, innovation, and competitiveness in North America's industrial landscape.

The report provides insights on the following :

- Market size from 2020 to 2029

- Average selling prices (ASPs) of industrial sensors (A technology segment of Industry 5.0) calculated by the weighted average method

- Updated research assumptions and limitations

- Information related to trends/disruptions impacting businesses of customers, as well as information on the ecosystem of industry 5.0, trade analysis, regulatory analyses, technology analysis, patents analysis, and case studies pertaining to the industry 5 market.

- Updated financial information until 2023 (depending on the availability) for each listed company, which helps in the easy analysis of the present status of the profiled companies in terms of their financial strength, profitability, key revenue-generating regions/countries, and the highest revenue-generating business segments.

- Recent developments that help assess market trends and growth strategies adopted by leading market players

- Key manufacturers offering industry 5 solutions; top 25 manufacturers of industry 5.0, which are categorized into star, pervasive, emerging leader, and participant companies based on their performance on various parameters such as product footprint, focus on product innovations, and geographic footprint.

- Market share analysis of various players operating in the industry 5 market for 2022

- Small - and medium-sized enterprises (SME) matrix that brief some business strategies and product offerings of 15 SME players operating in the market, which are classified into four groups: progressive, dynamic, responsive companies, and starting blocks

- Brief information regarding the competitive situations and trends in the Industry 5 market

- The product, application, and geographic footprints of the top 25 manufacturers of industry 5 solutions

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the industry 5 market

- Market Development: Comprehensive information about lucrative markets - the report analyses the industry 5 market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the industry 5 market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like ABB, Honeywell International, 3D Systems, Rockwell Automation, Siemens, and Emerson Electric Co, among others in the industry 5 market.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 223 |

| Forecast Period | 2024 - 2029 |

| Estimated Market Value (USD) in 2024 | $65.8 Billion |

| Forecasted Market Value (USD) by 2029 | $255.7 Billion |

| Compound Annual Growth Rate | 31.2% |

| Regions Covered | Global |

Key Topics Covered:

Executive Summary

- Digital Twin Segment to Account for Largest Market Share in 2029

- Energy & Power Segment to Hold Largest Market Share in 2029

- Automotive Segment to Dominate Industry 5.0 Market During Forecast Period

- North America to Exhibit Highest CAGR During Forecast Period

Premium Insights

- Attractive Growth Opportunities for Players in Industry 5.0 Market -Emphasis on Human-Machine Collaboration Leveraging Automation to Contribute to Market Growth

- Industry 5.0 Market, by Technology -Industrial Sensors Segment to Hold Largest Market Share in 2024

- Industry 5.0 Market, by Process Industry - Oil & Gas Segment to Hold Largest Share of Industry 5.0 Market in 2024

- Industry 5.0 Market, by Discrete Industry - Automotive Segment to Register Highest CAGR Between 2024 and 2029

- Industry 5.0 Market, by Country - North America to Exhibit Highest CAGR in Industry 5.0 Market During Forecast Period

Market Dynamics

Drivers

- Rising Adoption of AI and Robotics in Manufacturing and Production Processes

- Surging Focus on Implementing Green Technologies for Sustainable Manufacturing

- Increasing Government Spending on 3D Printing Technologies

Restraints

- Lack of Proficient Workforce Acquainted with Advanced Manufacturing Equipment

- Limited Adoption of Industry 5.0 Solutions Among Startups due to High Implementation Costs

- Health Implications of Excessive Use of AR and VR

Opportunities

- Proliferation of 3D Printing Technology in Manufacturing of Medical Equipment and Customized Drugs

- Increasing Investments in Infrastructure Development Projects

Challenges

- Need for Continuous Technological Advancements

- High Costs Associated with Deployment of VR Technology

Technology Analysis

- Key Technologies

- Artificial Intelligence (AI)

- Internet of Things (IoT)

- Complementary Technologies

- Blockchain

- Augmented Reality (AR) and Virtual Reality (VR)

- Adjacent Technology

- Green Technology

Case Study Analysis

- Lematic Developed SaaS Solution to Provide Access to Critical Information

- NBC Bearings Established Connected Smart Factory to Streamline Information Flow

Companies Profiled

- ABB

- Emerson Electric

- Honeywell International

- Schneider Electric

- Siemens

- Yokogawa Electric

- Cisco Systems

- 3D Systems

- Stratasys

- SAP

- Oracle

- Intel

- Keyence

- Nvidia

- Samsung

- Sony

- Universal Robots

- Omron

- Ams-Osram

- Rockwell Automation

- Mitsubishi Electric

- Ottobock

- Wikitude

- DNV

For more information about this report visit https://www.researchandmarkets.com/r/qbimwj

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment