Dublin, April 10, 2024 (GLOBE NEWSWIRE) -- The "Paints and Coatings Market Report by Product, Material, Application, and Region 2024-2032" report has been added to ResearchAndMarkets.com's offering.

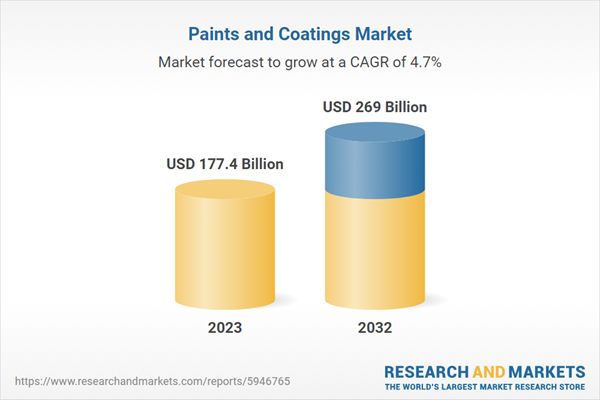

The global paints and coatings market reached US$ 177.4 billion in 2023. Looking forward, market is projected to reach US$ 269 billion by 2032, exhibiting a growth rate (CAGR) of 4.7% during 2023-2032. The market is experiencing steady growth driven by the increasing awareness and stringent regulations regarding environmental impact, the rising global urbanization and industrialization, particularly in emerging economies, and the significant growth in the construction and automotive industries.

Increasing demand in construction and automotive industries

The market is significantly influenced by the significant growth in the construction and automotive sectors. In construction, they are essential for both protective and aesthetic purposes, catering to residential, commercial, and industrial demands. Additionally, the innovation in formulations, such as eco-friendly and durable options, aligns with the growing emphasis on sustainability and longevity in construction materials. Similarly, in the automotive industry, there's a consistent need for advanced coating solutions to enhance vehicle appearance, durability, and corrosion resistance. Along with this, the development of new technologies, such as UV-curable coatings and waterborne coatings, further propels this demand by offering more efficient and environmentally friendly options. This symbiotic relationship with these dynamic industries ensures a steady market demand, adapting to changing needs and technological advancements.

Technological innovations and product advancements

Technological progress is a pivotal driver in the industry. This factor encompasses the development of new materials and formulations that meet specific requirements including improved environmental sustainability, enhanced durability, and better aesthetic qualities. In addition, innovations such as nanocoatings, green coatings, and smart coatings are reshaping market dynamics. These advancements address environmental concerns, such as reducing VOC emissions, and cater to the growing consumer demand for higher quality and functionality. Moreover, the integration of technology in manufacturing processes leads to more efficient production methods, reducing costs, and improving the quality consistency of products. This continuous development in product offerings ensures that the industry stays aligned with changing regulatory landscapes and consumer preferences, fostering growth and expansion.

Rising awareness and regulations concerning environmental impact

Environmental regulations and a growing public awareness of ecological concerns are significantly shaping the market. Governments worldwide are implementing stricter regulations on the use of volatile organic compounds (VOCs) and other harmful substances in paints and coatings. This regulatory landscape is prompting manufacturers to invest in research and development of eco-friendly products, such as water-based and bio-based coatings. These products comply with environmental standards and appeal to the growing segment of environmentally conscious consumers. Furthermore, the trend towards sustainability is leading to innovations in recycling and waste reduction in the production process. This shift towards eco-friendly practices is a response to regulatory pressures and is becoming a pivotal factor in brand differentiation and market competition, influencing consumer choices and industry trends.

Paints and Coatings Industry Segmentation

The report provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2024-2032. The report has categorized the market based on product, material, and application.

Breakup by Product:

- Waterborne Coatings

- Solvent-borne Coatings

- Powder Coatings

- High Solids/Radiation Curing

- Others

According to the report, waterborne coatings represented the largest segment.

Waterborne coatings, the largest segment in the market, are preferred for their lower environmental impact, as they emit fewer volatile organic compounds (VOCs) compared to solvent-borne coatings. These coatings use water as a solvent, making them more eco-friendly and easier to clean up. They are widely used in various applications, from automotive to architectural coatings, due to their versatility and improved safety profile. Additionally, the ongoing advancements in waterborne technology, such as enhanced durability and faster drying times, are further solidifying their dominance in the market.

On the other hand, solvent-borne coatings, although facing regulatory challenges due to their high VOC content, remain a significant segment of the market. These coatings are valued for their superior adhesion, resistance to harsh conditions, and smooth finish. They are predominantly used in industrial applications and specialized areas where durability and performance under extreme conditions are crucial. Manufacturers are continuously working on reformulating these coatings to reduce their environmental impact while maintaining their inherent advantages.

In addition, powder coatings are known for their environmental benefits, as they do not require solvents and produce minimal waste. This segment is gaining traction due to its cost-effectiveness, durability, and high-quality finish. These coatings are mainly used in appliances, automotive parts, and furniture. The technology is improving to expand its application range, including more heat-sensitive substrates, thus broadening its market reach.

Moreover, high solids/radiation curing is marked by its rapid curing times and lower VOC emissions. These coatings are becoming increasingly popular in automotive and industrial applications where efficiency and environmental compliance are paramount. Innovations in this segment focus on improving the curing process and the development of new materials that enhance performance characteristics such as durability and resistance to external factors.

Breakup by Material:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

According to the report, acrylic accounted for the largest market share.

Acrylic, forming the largest segment, is favored for its exceptional color retention, durability, and resistance to weathering. These water-based coatings are versatile and can be used in a variety of applications, from architectural coatings and automotive finishes to industrial paints. Their quick drying time and low environmental impact, coupled with continuous advancements in acrylic formulations, make them a preferred choice in both residential and commercial sectors.

On the other hand, alkyd coatings are valued for their strong adhesion, robust finish, and resistance to chipping and fading. Predominantly oil-based, these coatings are widely used in industrial and architectural applications. Though challenged by environmental concerns due to VOC emissions, alkyd coatings continue to be used for their durability, especially in environments where exposure to elements is a factor.

Along with this, polyurethane coatings are known for their excellent finish, durability, and resistance to abrasion and chemicals. They are extensively used in automotive, wood, and aerospace applications. The versatility of polyurethanes, available in both water-based and solvent-based formulations, allows for a wide range of applications.

In addition, epoxy coatings are highly regarded for their strong adhesive properties, chemical resistance, and toughness. Commonly used in industrial and marine environments, these coatings are ideal for surfaces that require a durable protective layer. The market for epoxy coatings is driven by their application in heavy-duty environments and sectors demanding high-performance coatings with long-lasting protection.

Apart from this, polyester coatings are popular for their glossy finish and ability to withstand prolonged exposure to outdoor environments. These coatings are often used in automotive, industrial, and architectural applications. The segment benefits from polyester's adaptability, enabling it to be used in various formulations to achieve specific performance requirements.

Breakup by Application:

- Architectural and Decorative

- Non-Architectural

- Automotive and Transportation

- Wood

- General Industrial

- Marine

- Protective

- Others

According to the report, architectural and decorative represented the largest segment.

The architectural and decorative segment holds the largest share of the market, driven by the increasing demand in both residential and commercial construction sectors. This segment encompasses a broad range of products used for interior and exterior applications, including wall paints, wood finishes, and enamels. Along with this, the growth in this segment is fueled by the rising global construction activities, urbanization, and the growing aesthetic and protective requirements of buildings. Additionally, the trend towards eco-friendly and sustainable products is leading to innovations in water-based and low-VOC paint formulations, further providing a boost to the demand in this segment. Moreover, the versatility and continuous development of architectural coatings to meet consumer preferences and regulatory standards make this segment a key driver of the overall market.

On the contrary, the non-architectural segment covers a wide array of industrial applications, including automotive, marine, aerospace, and protective coatings for machinery and infrastructure. This segment is characterized by its demand for specialized coatings that offer high performance in terms of durability, corrosion resistance, and resistance to extreme conditions. In confluence with this, the growth in this segment is propelled by technological advancements that lead to the development of more efficient and environmentally friendly coatings. The automotive industry, in particular, is a significant contributor to this segment, with a consistent demand for coatings that provide a high-quality finish and longevity. The diverse needs of various industrial applications ensure that this segment remains an essential part of the overall market, driving innovation and growth.

Breakup by Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

According to the report, Asia Pacific accounted for the largest market share.

The Asia Pacific region stands as the largest segment in the market, primarily driven by rapid industrialization, urbanization, and the expanding construction sector in countries such as China and India. Additionally, the region's growing automotive and manufacturing industries also contribute significantly to the demand for various types of coatings. Along with this, the increasing awareness of eco-friendly products in these markets is accelerating the adoption of waterborne and other environmentally sustainable coatings.

North America is a significant market, characterized by advanced technological innovations and stringent environmental regulations. The United States leads in the region, with a strong demand from the automotive, construction, and industrial sectors. The market in North America is also witnessing a shift towards green and sustainable coatings, driven by regulatory policies and consumer awareness. This region is known for its highly competitive landscape, with key players continually investing in R&D to develop new and advanced products.

In addition, the European market is marked by a high demand for environmentally friendly and high-performance products. The region's stringent regulations on VOC emissions and environmental protection are major drivers for innovation in sustainable coatings. Europe's well-established automotive, aerospace and marine industries significantly contribute to the market. The focus on energy-efficient buildings and the renovation of existing infrastructure also fuel the demand for architectural coatings in this region.

Apart from this, Latin America's market is growing, driven by the expansion of the construction and industrial sectors, particularly in countries such as Brazil and Mexico. The region shows potential for growth in both architectural and industrial coatings, with an increasing emphasis on sustainable and eco-friendly products.

Moreover, the market in the Middle East and Africa is expanding, with growth driven by the construction boom in the Gulf Cooperation Council (GCC) countries and increased industrial activities in African nations. Concurrently, the demand in this region is characterized by the need for high-performance coatings suitable for extreme weather conditions and industrial applications.

Leading Key Players in the Paints and Coatings Industry

Key players in the market are actively engaging in research and development to innovate and produce more environmentally friendly and efficient products. A significant focus is on developing low-VOC, waterborne, and high-solid coatings in response to stringent environmental regulations and growing consumer demand for sustainable products. These companies are also expanding their global footprint through strategic mergers, acquisitions, and partnerships, enhancing their market presence and accessing new markets. Additionally, they are investing in advanced manufacturing technologies to improve production efficiency and reduce costs. By aligning with market trends and regulatory changes, these companies are enhancing their product portfolios and reinforcing their competitive positions in the global market.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- AkzoNobel N.V.

- Asian Paints Ltd.

- Axalta Coating Systems Ltd.

- Berger Paints India Limited

- Indigo Paints Limited

- Jotun A/S

- Kansai Paint Co. Ltd.

- National Paints Factories Co. Ltd.

- PPG Industries Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Tiger Coatings GmbH & Co. KG

(Please note that this is only a partial list of the key players, and the complete list is provided in the report)

Industry News:

- June 23, 2023: AkzoNobel N.V. announced the grand opening of its state-of-the-art Research and Development (R&D) centre located in High Point, North Carolina. It serves as the company's centre for customer service and product development for wood coatings.

- Jan 09, 2023: Asian Paints Ltd. announced plans to invest Rs 2,000 crores to build a new water-based paint production plant with a 4 lakh kilolitre annual capacity. The business notified exchanges that, following land acquisition, the manufacturing at the site is anticipated to be commissioned in three years.

- January 25, 2022: Axalta Coating Systems Ltd. announced that it will completely cut its emissions of greenhouse gases (GHGs) from Scope 1 and 2 by 2030. This will enable it to achieve carbon neutrality in its activities by 2040, a full decade ahead of the timeframe established by the Paris Agreement on Climate Change.

Key Attributes

| Report Attribute | Details |

| No. of Pages | 140 |

| Forecast Period | 2023-2032 |

| Estimated Market Value (USD) in 2023 | $177.4 Billion |

| Forecasted Market Value (USD) by 2032 | $269 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

For more information about this report visit https://www.researchandmarkets.com/r/obg3yz

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment