Dublin, April 19, 2024 (GLOBE NEWSWIRE) -- The "Supply Chain Finance Market - Global Industry Size, Share, Trends, Opportunity, & Forecast 2019-2029" report has been added to ResearchAndMarkets.com's offering.

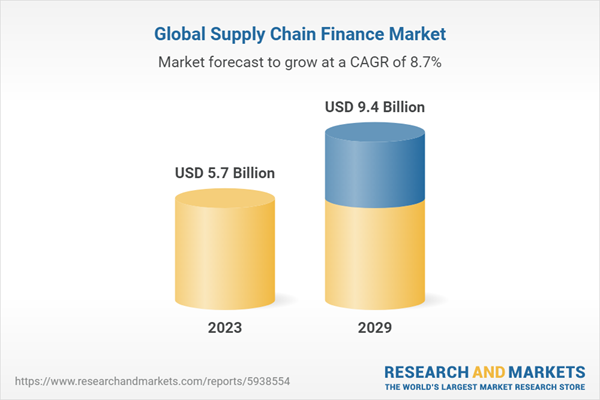

The Global Supply Chain Finance Market was valued at USD 5.7 billion in 2023 and is anticipated to grow with a CAGR of 8.7% through 2029, reaching USD 9.4 billion.

The growth of the market is driven by several factors, including favorable policies, the financing needs of small and medium-sized enterprises (SMEs), and the increasing complexity of global supply chains. The emergence of complex and diverse supply chains globally has led to an increase in the number of suppliers, which has created a need for financing optimization for enterprises.

The rise of economic nationalism, the global financial crisis of 2008, and the COVID-19 pandemic have exposed weaknesses in global supply chains, which have triggered a rise in research on supply chain finance. The adoption of advanced technologies, such as blockchain initiatives and technology platforms, has also contributed to the growth of the market.

Additionally, the increasing emphasis on sustainable sourcing is one of the key drivers of this growth. The market is expected to witness significant adoption of strategies that provide differentiated and innovative solutions to suppliers that require liquidity and working capital.

Report Scope

In this report, the Global Supply Chain Finance market has been segmented into the following categories:

By Offering:

- Export and Import Bills

- Letter of Credit

- Performance Bonds

- Shipping Guarantees

- Others

By Provider:

- Banks

- Trade Finance House

- Others

By End User:

- Large Enterprises

- Small and Medium-sized Enterprises

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Regional Insights

While the melody of supply chain finance (SCF) resonates globally, Europe's orchestra is tuning up a particularly compelling movement. As a region long familiar with complex trade networks and sophisticated financial systems, Europe is experiencing a robust ascent in SCF adoption, offering a harmonious blend of established practices and innovative approaches.

Several factors fuel this crescendo. First, Europe's intricate web of interconnected economies necessitates efficient cash flow management across borders. SCF solutions, like early payment programs and receivables financing, enable smoother cross-border transactions, minimizing operational friction and unlocking growth potential for both multinational giants and small-to-medium enterprises.

Second, European businesses are increasingly open to technological advancements. The region boasts a thriving fintech ecosystem, and banks are readily integrating SCF platforms into their portfolios. This tech-savvy environment fosters an environment for agile solutions, tailored to the diverse needs of various industries and supply chains.

Third, Europe's focus on sustainability aligns perfectly with the emerging trend of green SCF. Innovative financing models are supporting environmentally responsible practices, from renewable energy projects to sustainable sourcing initiatives. This convergence of SCF and sustainability creates a win-win situation, enhancing financial resilience and fostering a more equitable global trade landscape.

Challenges remain, of course. Harmonizing regulations across diverse European markets and addressing data privacy concerns are crucial next steps. However, with its collaborative spirit, technological prowess, and commitment to sustainability, Europe is poised to become a global leader in the SCF symphony. As its unique melody blends seamlessly with the international chorus, Europe promises to write a compelling chapter in the future of efficient and responsible global trade.

Key Attributes

| Report Attribute | Details |

| No. of Pages | 182 |

| Forecast Period | 2023-2029 |

| Estimated Market Value (USD) in 2023 | $5.7 Billion |

| Forecasted Market Value (USD) by 2029 | $9.4 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |

A selection of companies mentioned in this report includes, but is not limited to:

- Royal Bank of Scotland plc

- Mitsubishi UFJ Financial Group, Inc.

- BANK OF AMERICA CORPORATION

- HSBC Group

- Eulers Herms

- Citigroup, Inc.

- BNP Paribas

- JPMORGAN CHASE & CO.

- Asian Development Bank

- Standard Chartered

For more information about this report visit https://www.researchandmarkets.com/r/90g2le

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment