Dublin, April 23, 2024 (GLOBE NEWSWIRE) -- The "Reverse Logistics Global Market Report 2024" report has been added to ResearchAndMarkets.com's offering.

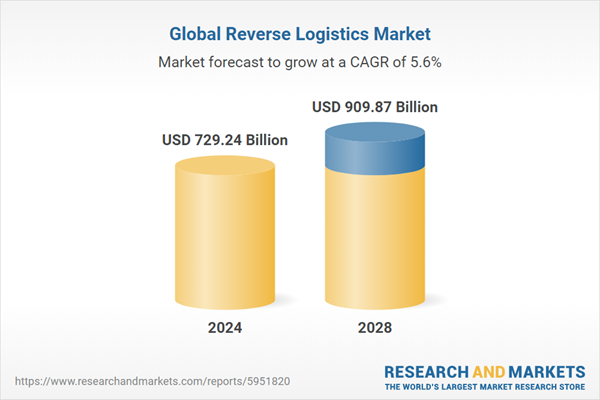

The reverse logistics market size has grown strongly in recent years. It will grow from $682.1 billion in 2023 to $729.24 billion in 2024 at a compound annual growth rate (CAGR) of 6.9%. The reverse logistics market size is expected to see strong growth in the next few years. It will grow to $909.87 billion in 2028 at a compound annual growth rate (CAGR) of 5.6%.

The historic growth in the remanufacturing market can be attributed to several factors, including environmental regulations promoting sustainable practices, the extension of product life cycles, the globalization of supply chains creating opportunities for remanufacturing, the increasing market competition driving companies to explore cost-effective solutions, and the growing awareness of the benefits of remanufactured products among consumers.

Asia-Pacific was the largest region in the reverse logistics market in 2023. The countries covered in the reverse logistics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The forecasted growth can be attributed to several factors, including increasing product complexity, a focus on sustainability, evolving consumer expectations, the rise of rental and subscription models, and an emphasis on data analytics. Major trends in the forecast period include the integration of technology, predictive analytics for returns management, the use of sustainable packaging and materials, adoption of circular economy practices, and the implementation of robotic process automation (RPA).

The rapid growth of e-commerce is expected to drive the expansion of the reverse logistics market. E-commerce, the buying and selling of goods and services online, utilizes reverse logistics to manage returned products from customers back to the original point of origin, such as the warehouse or store. This process helps maintain customer trust, minimize losses, and promote sustainable business practices. For example, in November 2023, the United States Census Bureau reported a 7.6% increase in e-commerce in the third quarter of 2023 compared to the fourth quarter of 2022, with online stores accounting for 15.4% of all sales in the second quarter of 2023. This growth in e-commerce is a key driver behind the expansion of the reverse logistics market.

Major companies in the reverse logistics market are introducing innovative platforms such as UPS Pickup Point locations to tackle the intricate and time-critical aspects of healthcare logistics. These pickup points, designated locations for gathering individuals or items, were exemplified when UPS Healthcare, a US-based reverse logistics firm, rolled out a service in Europe in October 2023. Termed UPS Pickup Point locations, this service offers a novel reverse logistics solution tailored for health laboratory clients.

The primary objective of these pickup points is to optimize the collection and transportation of samples to a central laboratory, thus enhancing efficiency for healthcare firms by reducing collection sites and enhancing reliability and oversight. This endeavor is prompted by the challenges inherent in managing reverse logistics for healthcare shipments. Moreover, the advantages provided by UPS Pickup Point locations render them a convenient and effective choice for fulfilling shipping and receiving requirements.

In November 2023, BlueYonder, a supply chain solutions provider based in the United States, completed the acquisition of Doddle Parcel Services Ltd., the Swiss-based provider of reverse logistics for carriers, for an undisclosed sum. This acquisition is anticipated to bolster Blue Yonder's capabilities in both the first and final mile segments through the integration of Doddle's innovative products. Consequently, Blue Yonder is poised to offer comprehensive end-to-end solutions in supply chain management and logistics, encompassing services such as reverse logistics and returns management, catering to the needs of retailers and third-party logistics providers (3PL).

Competitive Landscape and Company Profiles

- Deutsche Post DHL Group

- United Parcel Service Inc.

- FedEx Corporation

- Schenker AG

- Kuehne + Nagel International AG

Other Major and Innovative Companies

- DSV Panalpina A/S

- C.H. Robinson Worldwide

- Dachser SE

- Nippon Express Co. Ltd.

- Expeditors International of Washington Inc.

- J.B. Hunt Transport Services Inc.

- Ryder System Inc.

- Kerry Logistics Network Limited

- XPO Logistics Inc

- Landstar System Inc.

- Kintetsu World Express Inc.

- ArcBest Corporation

- Zebra Technologies Corp

- Hellmann Worldwide Logistics

- Echo Global Logistics Inc.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 175 |

| Forecast Period | 2024 - 2028 |

| Estimated Market Value (USD) in 2024 | $729.24 Billion |

| Forecasted Market Value (USD) by 2028 | $909.87 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

Key Topics Covered:

1. Executive Summary

2. Reverse Logistics Market Characteristics

3. Reverse Logistics Market Trends And Strategies

4. Reverse Logistics Market - Macro Economic Scenario

4.1. Impact Of High Inflation On The Market

4.2. Ukraine-Russia War Impact On The Market

4.3. COVID-19 Impact On The Market

5. Global Reverse Logistics Market Size and Growth

5.1. Global Reverse Logistics Market Drivers and Restraints

5.1.1. Drivers Of The Market

5.1.2. Restraints Of The Market

5.2. Global Reverse Logistics Historic Market Size and Growth, 2018 - 2023, Value ($ Billion)

5.3. Global Reverse Logistics Forecast Market Size and Growth, 2023 - 2028, 2033F, Value ($ Billion)

6. Reverse Logistics Market Segmentation

6.1. Global Reverse Logistics Market, Segmentation By Return Type, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- Recalls

- Commercial Returns

- Repairable Returns

- End-Of-Use Returns

- End Of Life Returns

6.2. Global Reverse Logistics Market, Segmentation By Service, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- Transportation

- Warehousing

- Reselling

- Replacement Management

- Refund Management Authorization

- Other Services

6.3. Global Reverse Logistics Market, Segmentation By End User, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

- E-Commerce

- Automotive

- Pharmaceutical

- Consumer Electronic

- Retail

- Luxury Goods

- Reusable Packaging

7. Reverse Logistics Market Regional And Country Analysis

7.1. Global Reverse Logistics Market, Split By Region, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

7.2. Global Reverse Logistics Market, Split By Country, Historic and Forecast, 2018-2023, 2023-2028F, 2033F, $ Billion

For more information about this report visit https://www.researchandmarkets.com/r/7v24lb

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment