Board Highlights Proven Turnaround Strategy Executed by New Leadership Team Since Early 2022

Erez’s Materials Demonstrate Lack of Understanding of Whitestone’s Business

Mr. Schanzer’s Indicating He Never Advocated For a "Corporate Unwind Scenario" Displays His Lack of Honesty and Transparency with Shareholders

Erez’s One-Dimensional Strategy Is an Attempt to Generate Short-Term Gains at the Expense of Long-Term Shareholder Value Creation

HOUSTON, April 29, 2024 (GLOBE NEWSWIRE) -- Whitestone REIT (NYSE: WSR) (“Whitestone” or the “Company”) announced today that it has mailed a letter to shareholders in connection with its 2024 Annual Meeting of Stockholders scheduled to be held on May 14, 2024, urging shareholders to vote the WHITE proxy card “FOR ALL” of Whitestone’s highly qualified trustees standing for election. Shareholders of record as of February 21, 2024 will be entitled to vote at the meeting.

The full text of the letter being mailed to shareholders follows:

Dear Fellow Shareholders:

We are writing to you at a critical moment for our Company.

Whitestone has been undergoing a series of transformations since 2022, including at the Board and management level, to execute on our “reset strategy.” Under the new leadership of Independent Chairman David Taylor, and CEO David Holeman, Whitestone’s Board and management team put in place a new reset strategy that is generating results as demonstrated by the Company’s recent performance.

Our strong results were driven by the leadership’s focus on improving operating performance, the company’s balance sheet, corporate governance and transparency with our investors. Our communications with our investors, as well as independent commentary and research from the market, have strongly validated that the actions we have taken and the strategy and plan we have in place are working. We are committed to accelerating our efforts to deliver stronger profitability and long-term value for our shareholders.

But we are also concerned as a new activist, Erez Asset Management (“Erez”), threatens to disrupt our progress, derail our strategy, and destroy our momentum to generate value for our shareholders. We are not interested in tit-for-tat fight letters with Erez. But we do feel a duty to explain our perspective to shareholders, to expose the inconsistent and incoherent strategy advocated by Erez, which is focused on disrupting the work that is continuing to take place to drive value. Accordingly, we believe it is imperative to set the record straight for shareholders as they decide on the future direction of their Company.

Our Reset Strategy Is Working and Has Momentum

The last two years have been a transition period for Whitestone. The Board made the difficult decision of terminating our former CEO for cause, then naming David Holeman as our new CEO, and appointing David Taylor as our new Chairman on January 18, 2022. Although it was a difficult decision, our results demonstrate that this was the right decision for our shareholders.

We are proud of Whitestone's accomplishments under our new leadership, as evidenced by:

- Strong Operations: Our occupancy reached a multi-year high of 94.2% in the fourth quarter of 2023. Our average annual same-store NOI growth since 2022 was a solid +5.3% (the third highest out of 13 shopping center REITs) 1.

- Positive Earnings Growth: Core FFO per Share has grown from $0.86 in 2021 to $0.91 for 2023 (up nearly 6%), despite the impact of higher interest rates.

- Lower Leverage and Proactive Balance Sheet Management: We reduced leverage (measured as Net Debt / EBITDA) from 10.2x in 2020 to 7.8x for 2023. We also proactively renewed our corporate credit facility and extended its maturity to 2027. Furthermore, we have limited near-term debt maturities, with less than 10% of our debt maturing over the next two years.

- Improved Corporate Governance: We refreshed our Board with three new candidates, right-sized compensation, split the Chairman and CEO role, and provided shareholders with access to bylaws.

- Successful Resolution of Past Litigation Matters: We concluded the litigation with our former CEO (with a favorable ruling for Whitestone) and are working to monetize our stake in Pillarstone, thereby eliminating an overhang that had weighed on our stock.

The market has recognized our accomplishments:

- Superior total shareholder returns (TSR): Sector-leading +25% from the start of Mr. Holeman's tenure through April 22, 2024 (#1 ranked shopping center REIT out of 13, and outperforming the MSCI U.S. REIT index, which delivered negative 16% TSR) 2. Even if we stop the measurement period right before the “Bloomberg leak” on October 26, 2023, we still outperform most peers (ranked #2 out of 13 with flat total returns) and the MSCI U.S. REIT index (which delivered negative 27% TSR).

- Outperformance over various standard measurement periods: Outperformed our peers and the MSCI U.S. REIT index over the past 1, 3 and 5-year periods 3.

- Bridged the valuation gap vs. peers: The gap in NTM FFO multiples as of year-end 2021 was 7x, it has shrunk to less than 2x currently 4.

- Recognition by Research Analyst Community: Research analysts have positively commented on this "transformative" period for Whitestone and commended our efforts.

We are committed to keep delivering results, improving our corporate governance and maximizing shareholder value:

- Our 2024 guidance implies 11% in Core FFO per Share growth year-over-year.

- We carefully evaluate all opportunities to maximize shareholder value against our going-concern business plan. We are not opposed to selling the Company or exploring strategic alternatives if they lead to maximizing shareholder value. Upon receipt of the letter from Erez, we opted to be transparent with our shareholders and publicly shared our response to Erez on December 13, 2023, along with their original letter which called for a “corporate unwind”.

The Keys to Our Success and the Risks Posed by Erez’s Misguided Strategy:

Our success has been made possible by the trust, collaboration and cohesion between our Board and our management team. Unfortunately, Erez is seeking to interrupt our progress and derail our value-creation strategy by nominating two interlocked nominees with no experience in our markets, limited knowledge of our strategy, and no value-enhancing ideas.

Quite the opposite: their fixation on a "sale of assets or of the company outright" (per their letter dated November 6, 2023) would crystallize shareholder value under very adverse market conditions and lead to value destruction and lost valuation upside.

Clear evidence directly contradicts Erez’s claim that Mr. Schanzer did not focus on selling the Company. In an offering memorandum dated November 3, 2023, Erez states that “the foregoing activist investment strategy is intended to cause [WHITESTONE] management to commence a bidding process.” Additionally, in a letter from Erez to the Company dated November 6, 2023 (Exhibit 99.3 of this link), Mr. Schanzer states ”I sincerely hope that you will embrace the view – as I did – that the challenge of maximizing value for the shareholders of a small market cap REIT such as Whitestone can only be surmounted, as a practical matter, through a well-executed portfolio monetization or change of control transaction.”

But since Erez has now realized that “running a full company sale process” is unlikely to “achieve an optimal outcome” under existing market conditions, they are now conveniently recommending for Whitestone “not to rush into a sale”. Their inconsistency is also reflected in their ascribed value for our assets, which can be worth “at least $16/share” (November 6, 2023), although shareholders would only get “approximately $14 per share” (November 6, 2023) or “$17.65 per share” based on their presentation (dated April 22, 2024). It shows that Mr. Schanzer and Ms. Clark may not have as good a grasp on valuation as they claim.

As part of their activist campaign and short-term focus, instead of offering value-enhancing ideas for Whitestone, Mr. Schanzer and Ms. Clark are more interested in the following playbook:

- Ignore recent positive momentum and superior total returns of Whitestone under its new leadership

- Focus primarily on actions undertaken years ago under our old CEO and his board leadership as chairman

- Distract investors from looking at their own track record of value destruction at Cedar Realty Trust (“CDR”) and RPT Realty (“RPT”)

But the facts speak for themselves and are undeniable, Mr. Schanzer and Ms. Clark are both burdened by their track record of value destruction at CDR and RPT:

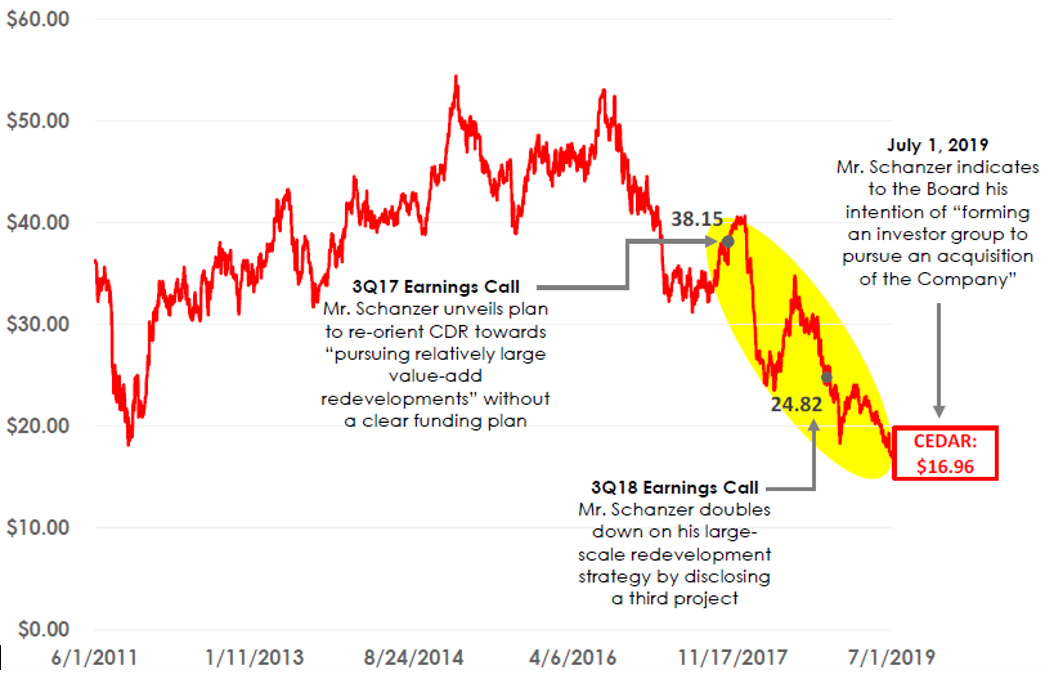

Mr. Schanzer’s Track Record as CEO of CDR:

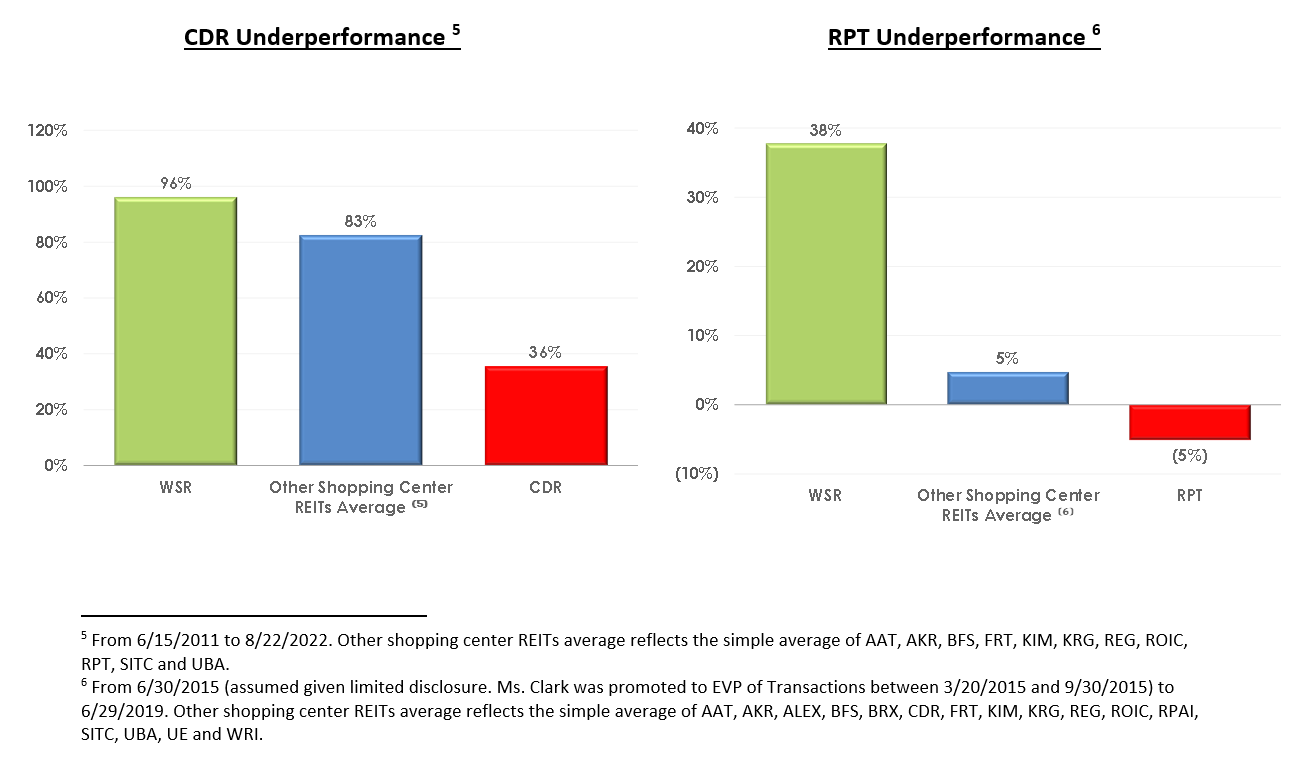

- During Mr. Schanzer’s tenure as CEO of Cedar Realty Trust, CDR total shareholder returns were +36%. Over the same period, WSR delivered +96% to its shareholders.

- CDR’s underperformance was the result of Mr. Schanzer’s strategic blunder and his fixation on development projects that CDR could not finance. Mr. Schanzer is a self-proclaimed capital allocation expert, but could not develop a sound funding plan for his ambitious development projects at CDR.

- Right before Mr. Schanzer announced his large-scale development strategy, CDR’s stock price was $38.15. It sank to $16.96 within less than 2 years. After sinking his company’s stock by 56%, Mr. Schanzer indicated to the Board his intention to pursue an acquisition of CDR. Our investors should question the character and honesty of a CEO who tanks his company’s stock, and then offers to buy it from shareholders.

Cedar’s Stock Price Drops 56% Following Bruce Schanzer’s Strategic Missteps

- The Company ultimately sold for $29.00, representing nearly a 25% discount to the price before Mr. Schanzer announced his ambitious development strategy. Once again, our investors should carefully evaluate Mr. Schanzer and his objective to replicate his strategy at CDR with your Company.

- Mr. Schanzer earned a staggering $31 million pay-out at the completion of this self-motivated transaction, representing 8% of the equity value of CDR.

- The sale of CDR in August 2022 was premised on a concept devised by Mr. Schanzer, which consisted of a cram down of CDR’s preferred stock amounting to ~$160mm (at liquidation value) and of preferred shareholders (many of whom were also common shareholders) into a highly-levered, illiquid vehicle (Wheeler) – this led to significant value destruction to the preferred shareholders.

- In short, at the same time Whitestone welcomed a new leadership that decisively implemented a transformational reset strategy in early 2022, Mr. Schanzer was engaging in a self-serving transaction that destroyed value for his company’s shareholders and employees. As summarized by JMP, A Citizen’s Company (March 18, 2024):

- “WSR’s management and board has been actively engaging with shareholders in the past two years, as part of the company’s strategy to enhance governance and provide increased transparency to investors. It has been dealing with a shareholder, Erez… looking for board representation and a company sale/liquidation. Erez is managed by Bruce Schanzer, former President/CEO of Cedar Realty, which sold in early 2022. We view Mr. Schanzer’s tenure at Cedar as unsuccessful as the stock consistently trailed in performance. The 10-year period leading to the announcement date of Cedar’s sale (March 2022), saw the stock decline 22% while the broader REIT sector increased 85%”

Ms. Clark’s Track Record as EVP – Transactions of RPT:

- During Ms. Clark’s tenure as EVP-Transactions at RPT, total shareholder returns were negative 5%. Over the same period, WSR delivered +38% to its shareholders.

- Ms. Clark has no experience in our markets – real estate is a local business: deep market knowledge and a broad network of connections in our markets are critical to our success.

- The two most strategic transactions executed by RPT (the GIC joint venture and the sale to Kimco) happened after Ms. Clark had left the company.

- Ms. Clark may have transacted “billions in shopping center assets” while at RPT, but the shareholder results at RPT reflect undeniable value destruction during her tenure. We at Whitestone are more careful with our acquisitions, dispositions and overall capital recycling strategy. We have built something that Ms. Clark could not at RPT: a strong portfolio of attractive shopping centers in desirable markets based on a consistent and time-tested strategy.

The Path Forward: Board Overseeing Strategy to Drive Value Creation

Our Board nominees are committed to keep Whitestone’s momentum going:

Since 2022, Whitestone has been working on a transformation at both the Board and management level to ensure the Company has the right leadership as it implements and executes on its reset strategy to generate value for our shareholders. The new Chairman David Taylor and Nandita Berry, the Chair of Nominating and Corporate Governance Committee, led as “change agents” to refresh the Board. Under their stewardship, the Board appointed/nominated new independent trustees Amy Feng and Julia Buthman, as well as new CEO David Holeman as an executive member of the Board – effectively turning over 50% of the Board to add trustees with necessary skill sets to oversee strategy execution and value creation at Whitestone.

Conveniently, Erez has ignored this revitalization of Whitestone’s Board and has nominated interlocked nominees, Mr. Schanzer and Ms. Clark. More critically, neither Mr. Schanzer nor Ms. Clark possess the specialized expertise within our largest market that Ms. Berry provides our Board.

David Taylor and Nandita Berry, along with the rest of our Board, all possess the necessary differentiated experience and expertise needed to continue delivering superior returns for Whitestone shareholders. Taken together, they provide a broad range of knowledge and skills that have benefited Whitestone shareholders and will continue to drive future value creation.

David Taylor has been instrumental to Whitestone’s successful strategy and growth. Mr. Taylor spearheaded the decisive action taken to remove our former CEO for the benefit of shareholders. Since his appointment as chairman in 2022, he has overseen significant and ongoing Board refreshment to ensure a balance of deep institutional knowledge and fresh perspectives. Further, since Mr. Taylor’s appointment to the Board, Whitestone has outperformed the NAREIT Shopping Center Index by 23%. Replacing Mr. Taylor with Mr. Schanzer or Ms. Clark would add low quality and destructive performers with a clearly stated desire for liquidation at the expense of a committed and successful leader at Whitestone.

Nandita Berry brings exceptional local expertise in our largest market. Ms. Berry has spent nearly her entire career in leadership roles within Texas, while neither Mr. Schanzer nor Ms. Clark have any notable experience in our largest market. As the 109th Texas Secretary of State, Ms. Berry has significant experience promoting business and economic opportunities in Texas. Since Ms. Berry’s appointment to the Board, Whitestone has outperformed the NAREIT Shopping Center Index by 17%.

The choice is clear, Whitestone has a cohesive Board and Management team with a track record of value creation. In contrast, Erez is nominating two interlocked trustees with a public track record of self-dealing, underperformance and value destruction, and with the single-minded strategy to sell the Company under adverse market conditions. Erez is focused on doing what’s best for his fund and not for the Whitestone shareholders.

Your vote is critical in ensuring Whitestone’s positive momentum can continue.

Our trustee nominees are best qualified to successfully deliver Whitestone’s business plan and drive superior shareholder value.

Do not allow Erez to derail Whitestone’s positive trajectory by replacing our trustees with individuals who lack the necessary skills, have a history of value destruction, and are bent on selling your Company at the worst possible time.

Protect the value of your investment and vote the WHITE proxy card today.

1 Peers include AKR, BFS, BRX, FRT, IVT, KIM, KRG, PECO, REG, ROIC, SITC and UE. Per peer 2022 and 2023 public filings. Some differences exist in terms of peer reporting of SS NOI, including, but not limited to adjustments for prior period rents. Best efforts have been made to utilize

comparable numbers, which do not include prior period rent adjustments.

2 From 1/18/2022 to 4/22/2024. Peers include AKR, BFS, BRX, FRT, IVT, KIM, KRG, PECO, REG, ROIC, SITC and UE.

3 Represents the 1, 3 and 5-year periods ending 4/22/2024. Peers include AKR, BFS, BRX, FRT, IVT, KIM, KRG, PECO, REG, ROIC, SITC and UE.

4 NTM FFO multiples based on NTM FactSet consensus estimates as of 12/31/2021 and 4/22/2024. Peers include AKR, BFS, BRX, FRT, IVT, KIM, KRG, PECO, REG, ROIC, SITC and UE.

5 From 6/15/2011 to 8/22/2022. Other shopping center REITs average reflects the simple average of AAT, AKR, BFS, FRT, KIM, KRG, REG, ROIC, RPT, SITC and UBA.

6 From 6/30/2015 (assumed given limited disclosure. Ms. Clark was promoted to EVP of Transactions between 3/20/2015 and 9/30/2015) to 6/29/2019. Other shopping center REITs average reflects the simple average of AAT, AKR, ALEX, BFS, BRX, CDR, FRT, KIM, KRG, REG, ROIC, RPAI, SITC, UBA, UE and WRI.

About Whitestone REIT

Whitestone REIT (NYSE: WSR) is a community-centered real estate investment trust (REIT) that acquires, owns, operates, and develops open-air, retail centers located in some of the fastest growing markets in the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio.

Our centers are convenience focused: merchandised with a mix of service-oriented tenants providing food (restaurants and grocers), self-care (health and fitness), services (financial and logistics), education and entertainment to the surrounding communities. The Company believes its strong community connections and deep tenant relationships are key to the success of its current centers and its acquisition strategy. For additional information, please visit www.whitestonereit.com.

Important Additional Information and Where to Find It

Whitestone REIT has filed a definitive proxy statement on Schedule 14A (the “2024 Proxy Statement”) and a WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for its 2024 Annual Meeting of Shareholders (the “2024 Annual Meeting”). SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ THE 2024 PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE WHITE PROXY CARD, AND ANY OTHER DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain a free copy of the 2024 Proxy Statement, any amendments or supplements to the 2024 Proxy Statement and other documents that the Company files with the SEC from the SEC’s website at www.sec.gov or the Company’s website at https://ir.whitestonereit.com/corporate-profile/default.aspx as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

Certain Information Regarding Participants in Solicitation

Whitestone REIT, its trustees and certain of its executive officers may be deemed to be participants in the solicitation of proxies from Company shareholders in connection with the matters to be considered at the 2024 Annual Meeting Information regarding the direct and indirect interests, by security holdings or otherwise, of the persons who may, under the rules of the SEC, be considered participants in the solicitation of shareholders in connection with the 2024 Annual Meeting is included in the 2024 Proxy Statement of the, which was filed with the SEC on April 4, 2024. To the extent securities holdings by the Company’s trustees and executive officers as reported in the 2024 Proxy Statement have changed, such changes have been or will be reflected on Statements of Change in Ownership on Forms 3, 4 or 5 filed with the SEC, which can also be found through the Company’s website (https://ir.whitestonereit.com/corporate-profile/default.aspx) in the section “Investor Relations” or through the SEC’s website. These documents are available free of charge as described above.

Forward-Looking Statements

This Report contains forward-looking statements within the meaning of the federal securities laws, including discussion and analysis of our financial condition and results of operations, statements related to our expectations regarding the performance of our business, and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on its knowledge and understanding of our business and industry. Forward-looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “potential,” “predicts,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” or the negative of such terms and variations of these words and similar expressions, although not all forward-looking statements include these words. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements.

Factors that could cause actual results to differ materially from any forward-looking statements made in this Report include: the imposition of federal income taxes if we fail to qualify as a real estate investment trust (“REIT”) in any taxable year or forego an opportunity to ensure REIT status; uncertainties related to the national economy, the real estate industry in general and in our specific markets; legislative or regulatory changes, including changes to laws governing REITs; adverse economic or real estate developments or conditions in Texas or Arizona, Houston and Phoenix in particular, including the potential impact of public health emergencies, such as COVID-19, on our tenants’ ability to pay their rent, which could result in bad debt allowances or straight-line rent reserve adjustments; increases in interest rates, including as a result of inflation operating costs or general and administrative expenses; our current geographic concentration in the Houston and Phoenix metropolitan area makes us susceptible to local economic downturns and natural disasters, such as floods and hurricanes, which may increase as a result of climate change, increasing focus by stakeholders on environmental, social, and governance matters, financial institution disruption; availability and terms of capital and financing, both to fund our operations and to refinance our indebtedness as it matures; decreases in rental rates or increases in vacancy rates; harm to our reputation, ability to do business and results of operations as a result of improper conduct by our employees, agents or business partners; litigation risks; lease-up risks, including leasing risks arising from exclusivity and consent provisions in leases with significant tenants; our inability to renew tenant leases or obtain new tenant leases upon the expiration of existing leases; risks related to generative artificial intelligence tools and language models, along with the potential interpretations and conclusions they might make regarding our business and prospects, particularly concerning the spread of misinformation; our inability to generate sufficient cash flows due to market conditions, competition, uninsured losses, changes in tax or other applicable laws; geopolitical conflicts, such as the ongoing conflict between Russia and Ukraine, the conflict in the Gaza Strip and unrest in the Middle East; the need to fund tenant improvements or other capital expenditures out of operating cash flow; the extent to which our estimates regarding Pillarstone REIT Operating Partnership LP's financial condition and results of operations differ from actual results; and the risk that we are unable to raise capital for working capital, acquisitions or other uses on attractive terms or at all and other factors detailed in the Company's most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents the Company files with the Securities and Exchange Commission from time to time.

Non-GAAP Financial Measures

This release contains supplemental financial measures that are not calculated pursuant to U.S. generally accepted accounting principles (“GAAP”) including EBITDAre, FFO, NOI and net debt. Following are explanations and reconciliations of these metrics to their most comparable GAAP metric.

EBITDAre: The National Association of Real Estate Investment Trusts (“NAREIT”) defines EBITDAre as net income computed in accordance with GAAP, plus interest expense, income tax expense, depreciation and amortization and impairment write-downs of depreciable property and of investments in unconsolidated affiliates caused by a decrease in value of depreciable property in the affiliate, plus or minus losses and gains on the disposition of depreciable property, including losses/gains on change in control and adjustments to reflect the entity’s share of EBITDAre of the unconsolidated affiliates and consolidated affiliates with non-controlling interests. The Company calculates EBITDAre in a manner consistent with the NAREIT definition. Management believes that EBITDAre represents a supplemental non-GAAP performance measure that provides investors with a relevant basis for comparing REITs. There can be no assurance the EBITDAre as presented by the Company is comparable to similarly titled measures of other REITs. EBITDAre should not be considered as an alternative to net income or other measurements under GAAP as indicators of operating performance or to cash flows from operating, investing or financing activities as measures of liquidity. EBITDAre does not reflect working capital changes, cash expenditures for capital improvements or principal payments on indebtedness.

FFO: Funds From Operations: The National Association of Real Estate Investment Trusts (“NAREIT”) defines FFO as net income (loss) (calculated in accordance with GAAP), excluding depreciation and amortization related to real estate, gains or losses from the sale of certain real estate assets, gains and losses from change in control, and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. We calculate FFO in a manner consistent with the NAREIT definition and also include adjustments for our unconsolidated real estate partnership.

Core Funds from Operations (“Core FFO”) is a non-GAAP measure. From time to time, we report or provide guidance with respect to “Core FFO” which removes the impact of certain non-recurring and non-operating transactions or other items we do not consider to be representative of our core operating results including, without limitation, default interest on debt of real estate partnership, extinguishment of debt cost, gains or losses associated with litigation involving the Company that is not in the normal course of business, and proxy contest professional fees.

Management uses FFO and Core FFO as a supplemental measure to conduct and evaluate our business because there are certain limitations associated with using GAAP net income (loss) alone as the primary measure of our operating performance. Historical cost accounting for real estate assets in accordance with GAAP implicitly assumes that the value of real estate assets diminishes predictably over time. Because real estate values instead have historically risen or fallen with market conditions, management believes that the presentation of operating results for real estate companies that use historical cost accounting is insufficient by itself. In addition, securities analysts, investors and other interested parties use FFO and Core FFO as the primary metric for comparing the relative performance of equity REITs. FFO and Core FFO should not be considered as an alternative to net income or other measurements under GAAP, as an indicator of our operating performance or to cash flows from operating, investing or financing activities as a measure of liquidity. FFO and Core FFO do not reflect working capital changes, cash expenditures for capital improvements or principal payments on indebtedness. Although our calculation of FFO is consistent with that of NAREIT, there can be no assurance that FFO and Core FFO presented by us is comparable to similarly titled measures of other REITs.

NOI: Net Operating Income: Management believes that NOI is a useful measure of our property operating performance. We define NOI as operating revenues (rental and other revenues) less property and related expenses (property operation and maintenance and real estate taxes). Other REITs may use different methodologies for calculating NOI and, accordingly, our NOI may not be comparable to other REITs. Because NOI excludes general and administrative expenses, depreciation and amortization, equity or deficit in earnings of real estate partnership, interest expense, interest, dividend and other investment income, provision for income taxes, gain on sale of property from discontinued operations, management fee (net of related expenses) and gain or loss on sale or disposition of assets, and includes NOI of real estate partnership (pro rata) and net income attributable to noncontrolling interest, it provides a performance measure that, when compared year-over-year, reflects the revenues and expenses directly associated with owning and operating commercial real estate properties and the impact to operations from trends in occupancy rates, rental rates and operating costs, providing perspective not immediately apparent from net income. We use NOI to evaluate our operating performance since NOI allows us to evaluate the impact that factors such as occupancy levels, lease structure, lease rates and tenant base have on our results, margins and returns. In addition, management believes that NOI provides useful information to the investment community about our property and operating performance when compared to other REITs since NOI is generally recognized as a standard measure of property performance in the real estate industry. However, NOI should not be viewed as a measure of our overall financial performance since it does not reflect the level of capital expenditure and leasing costs necessary to maintain the operating performance of our properties, including general and administrative expenses, depreciation and amortization, equity or deficit in earnings of real estate partnership, interest expense, interest, dividend and other investment income, provision for income taxes, gain on sale of property from discontinued operations, management fee (net of related expenses) and gain or loss on sale or disposition of assets.

Same Store NOI: Management believes that Same Store NOI is a useful measure of the Company’s property operating performance because it includes only the properties that have been owned for the entire period being compared, and it is frequently used by the investment community. Same Store NOI assists in eliminating differences in NOI due to the acquisition or disposition of properties during the period being presented, providing a more consistent measure of the Company’s performance. The Company defines Same Store NOI as operating revenues (rental and other revenues, excluding straight-line rent adjustments, amortization of above/below market rents, and lease termination fees) less property and related expenses (property operation and maintenance and real estate taxes), Non-Same Store NOI, and NOI of our investment in Pillarstone OP (pro rata). We define “Non-Same Stores” as properties that have been acquired since the beginning of the period being compared and properties that have been sold, but not classified as discontinued operations. Other REITs may use different methodologies for calculating Same Store NOI, and accordingly, the Company's Same Store NOI may not be comparable to that of other REITs.

Net debt: We present net debt, which we define as total debt net of insurance financing less cash plus our proportional share of net debt of real estate partnership, and net debt to pro forma EBITDAre, which we define as net debt divided by EBITDAre because we believe they are helpful as supplemental measures in assessing our ability to service our financing obligations and in evaluating balance sheet leverage against that of other REITs. However, net debt and net debt to pro forma EBITDAre should not be viewed as a stand-alone measure of our overall liquidity and leverage. In addition, other REITs may use different methodologies for calculating net debt and net debt to pro forma EBITDAre, and accordingly our net debt and net debt to pro forma EBITDAre may not be comparable to that of other REITs.

| Whitestone REIT and Subsidiaries | |||||||

| RECONCILIATION OF NON-GAAP MEASURES | |||||||

| Initial Full Year Guidance for 2024 | |||||||

| (in thousands, except per share and per unit data) | |||||||

| Projected Range Full Year 2024 | |||||||

| Low | High | ||||||

| FFO (NAREIT) and Core FFO per diluted share and OP unit | |||||||

| Net income attributable to Whitestone REIT | $ | 16,600 | $ | 19,600 | |||

| Adjustements to reconcile to FFO (NAREIT) | |||||||

| Depreciation and amortization of real estate assets | 34,252 | 34,252 | |||||

| Depreciation and amortization of real estate assets of real estate partnership (pro rata) | 133 | 133 | |||||

| FFO (NAREIT) | $ | 50,985 | $ | 53,985 | |||

| Adjustements to reconcile to Core FFO | |||||||

| Adjustments | — | — | |||||

| Core FFO | $ | 50,985 | $ | 53,985 | |||

| Dilutive shares | 51,262 | 51,262 | |||||

| OP Units | 695 | 695 | |||||

| Dilutive share and OP Units | 51,957 | 51,957 | |||||

| Net income attributable to Whitestone REIT per diluted share | $ | 0.32 | $ | 0.38 | |||

| FFO (NAREIT) per diluted share and OP Unit | $ | 0.98 | $ | 1.04 | |||

| Net income attributable to Whitestone REIT per diluted share | $ | 0.32 | $ | 0.38 | |||

| Core FFO per diluted share and OP Unit | $ | 0.98 | $ | 1.04 | |||

| Whitestone REIT and Subsidiaries | ||||||||

| RECONCILIATION OF NON-GAAP MEASURES | ||||||||

| (in thousands, except per share and unit data) | ||||||||

| Year Ended December 31, | ||||||||

| 2023 | 2021 | |||||||

| FFO (NAREIT) AND CORE FFO | ||||||||

| Net income attributable to Whitestone REIT | $ | 19,180 | $ | 12,048 | ||||

| Adjustments to reconcile to FFO:(1) | ||||||||

| Depreciation and amortization of real estate assets | 32,811 | 28,806 | ||||||

| Depreciation and amortization of real estate assets of real estate partnership (pro rata) (2) | 1,613 | 1,674 | ||||||

| Loss on disposal of assets, net | 522 | 90 | ||||||

| Gain on sale of properties from continuing operations, net | (9,006 | ) | (266 | ) | ||||

| Gain on sale of property from discontinued operations | — | (1,833 | ) | |||||

| Gain on sale or disposal of properties or assets of real estate partnership (pro rata)(2) | — | (19 | ) | |||||

| Net income attributable to noncontrolling interests | 270 | 205 | ||||||

| FFO (NAREIT) | $ | 45,390 | $ | 40,705 | ||||

| Adjustments to reconcile to Core FFO: | ||||||||

| Early debt extinguishment costs | — | — | ||||||

| Default interest on debt of real estate partnership (1)(2) | 1,375 | — | ||||||

| Core FFO | $ | 46,765 | $ | 40,705 | ||||

| FFO PER SHARE AND OP UNIT CALCULATION | ||||||||

| Numerator: | ||||||||

| FFO | $ | 45,390 | $ | 40,705 | ||||

| Core FFO | $ | 46,765 | $ | 40,705 | ||||

| Denominator: | ||||||||

| Weighted average number of total common shares - basic | 49,501 | 45,486 | ||||||

| Weighted average number of total noncontrolling OP units - basic | 694 | 772 | ||||||

| Weighted average number of total common shares and noncontrolling OP units - basic | 50,195 | 46,258 | ||||||

| Effect of dilutive securities: | ||||||||

| Unvested restricted shares | 1,312 | 850 | ||||||

| Weighted average number of total common shares and noncontrolling OP units - diluted | 51,507 | 47,108 | ||||||

| FFO per common share and OP unit - basic | $ | 0.90 | $ | 0.88 | ||||

| FFO per common share and OP unit - diluted | $ | 0.88 | $ | 0.86 | ||||

| Core FFO per common share and OP unit - basic | $ | 0.93 | $ | 0.88 | ||||

| Core FFO per common share and OP unit - diluted | $ | 0.91 | $ | 0.86 | ||||

| Whitestone REIT and Subsidiaries | |||||||

| RECONCILIATION OF NON-GAAP MEASURES | |||||||

| (continued) | |||||||

| (in thousands) | |||||||

| Year Ended December 31, | |||||||

| 2023 | 2020 | ||||||

| EARNINGS BEFORE INTEREST, TAX, DEPRECIATION AND AMORTIZATION FOR REAL ESTATE (EBITDAre) | |||||||

| Net income attributable to Whitestone REIT | $ | 19,180 | $ | 6,034 | |||

| Depreciation and amortization | 32,966 | 28,303 | |||||

| Interest expense | 32,866 | 25,770 | |||||

| Provision for income taxes | 450 | 379 | |||||

| Net income attributable to noncontrolling interests | 270 | 117 | |||||

| (Equity) deficit in earnings of real estate partnership (1) | 3,155 | (921 | ) | ||||

| EBITDAre adjustments for real estate partnership (1) | 617 | 3,484 | |||||

| Loss (gain) loss on sale or disposal of assets, net | (8,484 | ) | 364 | ||||

| Gain on loan forgiveness | — | (1,734 | ) | ||||

| EBITDAre | 81,020 | 61,796 | |||||

| Year Ended December 31, | |||||||

| Debt/EBITDAre Ratio | 2023 | 2020 | |||||

| Outstanding debt | $ | 640,549 | $ | 645,163 | |||

| Less: Cash | (4,572 | ) | (25,777 | ) | |||

| Deposit due to real estate partnership debt default | (13,633 | ) | - | ||||

| Add: Proportional share of net debt of unconsolidated real estate partnership (1) | 8,685 | 8,912 | |||||

| Total Net Debt | $ | 631,029 | $ | 628,298 | |||

| EBITDAre | $ | 81,020 | $ | 61,796 | |||

| Ratio of debt to pro forma EBITDAre | 7.8 | 10.2 | |||||

| (1) We rely on reporting provided to us by our third-party partners for financial information regarding the Company's investment in Pillarstone OP. Because Pillarstone OP financial statements as of December 31, 2023 and 2022 have not been made available to us, we have estimated proportional share of net deb based on the information available to us at the time. | |||||||

Investor and Media Contact:

David Mordy

Director, Investor Relations

Whitestone REIT

(713) 435-2219

ir@whitestonereit.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/86062beb-19a1-45f7-9823-2154b86b87af

https://www.globenewswire.com/NewsRoom/AttachmentNg/cf8120c5-b987-4481-9f4f-a19af1510b03