Dublin, April 29, 2024 (GLOBE NEWSWIRE) -- The "Global Active Pharmaceutical Ingredients Market Size, Share & Trends Analysis Report by Type Of Synthesis (Biotech, Synthetic), Type Of Manufacturer (Captive, Merchant), Type, Application, Type Of Drug, Region, and Segment Forecasts, 2024-2030" report has been added to ResearchAndMarkets.com's offering.

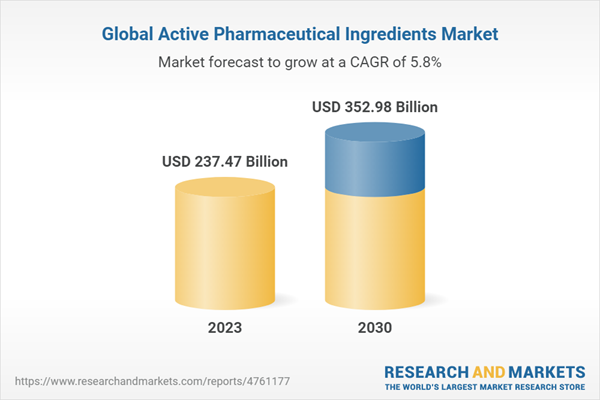

The global active pharmaceutical ingredients market size is expected to reach USD 352.98 billion by 2030, expanding at a compound annual growth rate (CAGR) of 5.75% from 2024 to 2030. The market is driven by the growth of the biopharmaceutical sector, advancements in active pharmaceutical Ingredients (API) manufacturing, and an increase in the geriatric population.

The growth of the captive API segment is propelled by companies investing in solving challenges and developing new chemical ways for the production of APIs in-house. This aids in reducing costs and the risk of contamination. Artificial intelligence and protein synthesis are expected to facilitate faster development with greater control over the process.

The rising prevalence of chronic and lifestyle-based conditions, such as cardiovascular diseases, is accelerating the demand for API. For instance, as per U.S. Pharmacist in 2020, 47% of adults have at least one risk factor that supports cardiovascular disease development. Cardiovascular diseases are one of the global, critical public health burdens driving extensive R&D for APIs in the field.

The increasing importance of generics, rise in consumption of biopharmaceuticals, and expanding drug research and development activities for drug manufacturing are the primary drivers driving the growth of the market. However, the market's expansion is likely to be hampered by unfavorable drug price control regimes in several countries and high manufacturing costs.

Developing nations like India are receiving an increased preference in the market over dominant API market countries, like China, owing to geopolitical situations. Furthermore, India has quality raw materials and products, a large workforce, a vast distribution network, and government subsidies.

To address unmet medical needs, companies are collaborating to develop novel treatments. This allows firms to use their resources to aid in the development of products and enhance the supply chain. In November 2021, Merck & Co Inc. announced that it has acquired Acceleron Pharma, this acquisition would help Merck & Co to expand their cardiovascular portfolio and pipeline.

Active Pharmaceutical Ingredients Market Report Highlights

- Innovative APIs held the largest share of 62% in 2023, owing to increasing research and development activities for novel drug development and positive government initiatives

- Captive APIs segment held the largest market share of 51.03% in 2023

- The synthetic API segment dominated the market with the largest revenue share of 70.66% in 2023, owing to the higher availability of raw materials and easier protocols for the synthesis of these molecules

- North America accounted for the largest revenue share of 38.26% in 2023 and is expected to maintain its lead over the forecast period. This is attributed to the rising epidemiology of cancer, along with other lifestyle-induced diseases, thus encouraging the R&D activities, thereby boosting the market growth

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 191 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value (USD) in 2023 | $237.47 Billion |

| Forecasted Market Value (USD) by 2030 | $352.98 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

Key Topics Covered:

Chapter 1. Methodology and Scope

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Segmentation and Scope

3.2. Market Lineage Outlook

3.3. Market Dynamics

3.4. Market Drivers

3.4.1. Increasing geriatric population

3.4.2. Rising prevalence of target diseases such as hospital-acquired infections, genetic, cardiovascular, and neurological diseases

3.4.3. Increasing preference for targeted therapy approach in cancer treatment

3.4.4. Increasing preference for outsourcing APIs

3.5. Market Restraint Analysis

3.5.1. High capital investments and production cost

3.5.2. Stringent Safety and handling regulations regarding APIs

3.6. Business Environment Analysis

Chapter 4. Type of Synthesis Business Analysis

4.1. Active Pharmaceutical Ingredients Market: Type of Synthesis Movement Analysis

4.2. Biotic APIs

4.2.1. Biotic APIs Market, 2018 - 2030 (USD Billion)

4.2.1.2. Generic APIs

4.2.1.3. Innovative APIs

4.2.1.4. Biotech APIs Market, By Product (Revenue, USD Billion, 2018 - 2030)

4.2.1.5. Monoclonal Antibodies

4.2.1.6. Hormones

4.2.1.7. Cytokines

4.2.1.8. Recombinant Proteins

4.2.1.9. Therapeutic Enzymes

4.2.1.10. Vaccines

4.2.1.11. Blood Factors

4.3. Synthetic APIs

4.3.1. Synthetic APIs Market, 2018 - 2030 (USD Billion)

4.3.1.2. Generic APIs

4.3.1.3. Innovative APIs

Chapter 5. Type of Manufacturer Business Analysis

5.1. Active Pharmaceutical Ingredients Market: Type of Manufacturer Movement Analysis

5.2. Captive APIs

5.3. Merchant APIs

Chapter 6. Type Business Analysis

6.1. Active Pharmaceutical Ingredients Market: Type Movement Analysis

6.2. Generic APIs

6.3. Innovative APIs

Chapter 7. Application Business Analysis

7.1. Active Pharmaceutical Ingredients Market: Application Movement Analysis

7.2. Cardiovascular Diseases

7.3. Oncology

7.4. CNS and Neurology

7.5. Orthopedic

7.6. Endocrinology

7.7. Pulmonology

7.8. Gastroenterology

7.9. Nephrology

7.10. Ophthalmology

7.11. Others

Chapter 8. Type of Drug Business Analysis

8.1. Active Pharmaceutical Ingredients Market: Type of Drug Movement Analysis

8.2. Prescription

8.2.1. Prescription Market, 2018 - 2030 (USD Billion)

8.2.1.1. OTC

8.2.1.2. OTC Market, 2018 - 2030 (USD Billion)

Chapter 9. Regional Business Analysis

9.1. Active Pharmaceutical Ingredients Market Share By Region, 2023 & 2030

Chapter 10. Competitive Landscape

10.1. Participant's overview

10.2. Financial performance

10.3. Company Profiles

- Dr. Reddy's Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Cipla Inc.

- AbbVie Inc.

- Aurobindo Pharma

- Sandoz International GmbH (Novartis AG)

- Viatris Inc.

- Fresenius Kabi AG

- STADA Arzneimittel AG

For more information about this report visit https://www.researchandmarkets.com/r/i6tccc

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment