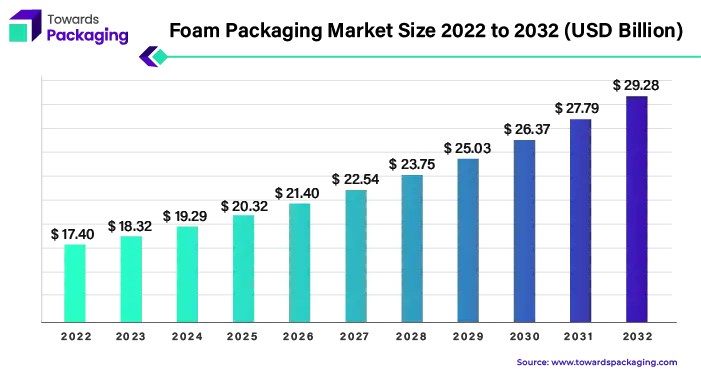

Ottawa, May 03, 2024 (GLOBE NEWSWIRE) -- The global foam packaging market size was valued at USD 18.32 billion in 2023 and is anticipated to reach around USD 27.79 billion by 2031, a study published by Towards Packaging a sister firm of Precedence Research.

Report Highlights: Important Revelations

- Emergence of the foam packaging market in the Asia Pacific region.

- Importance of North America in the foam packaging sector.

- Exploring the diverse applications of eps foam beyond packaging.

- Versatility of flexible polyurethane foam across industries.

- Foamed polystyrene's dominance in food packaging applications.

For the short version of this report @ https://www.towardspackaging.com/personalized-scope/5150

The foam packaging is the process of encasing things in foam, such as expanded polystyrene (EPS) or polyethylene (PE), to keep them safe during handling and transportation. These materials were selected because they are very effective at absorbing shocks and are lightweight. 98% of foam packing is air. The development of foam packing has been characterised by an ongoing search for innovation to satisfy changing industry demands. The market has seen a radical shift from conventional Styrofoam blocks to custom-molded foam inserts, propelled by developments in material science and production technology. Foam packing was first only used for simple protective purposes. Customisation and sustainability, however, have been the industry's main growth pillars over time.

The importance of foam packing cannot be emphasised. It is a strong solution that guarantees the protection and safety of fragile items while they are in transit. Foam packing is essential for minimising damage and lowering returns for businesses because of its capacity to cushion delicate objects and absorb shocks. The adaptability of foam packing is one of its main benefits. Foam materials have several uses in a variety of sectors, from securing electronics to preserving perishable items. Foam packing has become an essential part of contemporary supply chains, whether it is used to protect food items or secure medical equipment during transit.

Enhancing the recyclability and biodegradability of foam packaging goods is another priority for producers in order to comply with environmental standards and meet consumer expectations. Manufacturers are investing resources on R&D to provide cutting-edge foam solutions that balance sustainability and performance. Foam packaging continues to be a vital component of effective and dependable product protection since it conforms to industry requirements and changes to accommodate new trends. It is crucial for businesses to select the appropriate packaging solutions as they handle the intricacies of the supply chain. The foam packaging market is characterised by a dynamic landscape where success is contingent upon achieving excellence in quality, sustainability, and innovation.

For Instance,

- In February 2023, Cruz Foam, located in Santa Cruz, California, has announced the introduction of a new line of protective packing solutions that it claims will satisfy particular client requirements for consumers and businesses transporting delicate and temperature-sensitive items.

If you have any questions, please feel free to contact us at sales@towardspackaging.com

Foam Packaging Market Trends

- The utilisation of cutting-edge materials that provide better performance and sustainability is changing in the foam packaging business.

- Technology integration in foam packing is growing in popularity because it makes it possible to track, monitor, and secure goods better while they're in transit.

- Brands are choosing tailored choices that meet particular product needs over universal packaging solutions.

- Designs for interactive packaging are becoming more popular in the market, enabling customers to interact with the product via digital tools like QR codes or augmented reality.

Rise of the Foam Packaging Market in Asia Pacific

Asia Pacific region has emerged as a market leader in foam packaging, accounting for the majority of global revenue. Asia-Pacific is the most important foam packaging sales market, processing almost one tonne of polystyrene per second. The demand for polystyrene and expandable polystyrene (EPS) is rising significantly in countries like Saudi Arabia, China, India, and Iran.

The emergence of e-commerce and the growing emphasis on efficient packaging solutions has spurred demand for foam packaging in the logistics industry. Foam packing is essential for the expanding e-commerce sector as it protects and insulates delicate goods during transit. Foam packing is becoming more and more necessary to safeguard fragile parts and equipment as a result of the aerospace industry growth that is occurring in Asia-Pacific.

Foam packing contributes to the region's dominance in this industry by ensuring that aeronautical items reach their destinations safely and undamaged. The industrial sector in the area is expanding quickly, particularly in nations like China where business is booming in the manufacturing sector. The need for packaging foams is increased by manufacturers that depend on foam packaging solutions to protect their goods during handling, storage, and transportation.

Customize this study as per your requirement @ https://www.towardspackaging.com/customization/5150

The industrial sector in the region is expanding quickly, particularly in nations like China where business is growing rapidly in the manufacturing sector. The need for packaging foams is increased by manufacturers that depend on foam packaging solutions to protect their goods during handling, storage, and transportation. China developing as a major participant and Asia Pacific leading the foam packaging market, the region's sector appears to have a bright future. The foam packaging market is expected to have continuous expansion and innovation because to the increasing demand in emerging nations and various industries such as logistics, aerospace production, and manufacturing operations.

For Instance,

- The polyethylene foam producer and fabricator Fagerdala Singapore Pte Ltd. was acquired by Sealed Air Corporation.

North America is the second-largest regional stakeholder in the foam packaging industry, following the Asia Pacific. This is mainly due to the region's vast customer base and high levels of disposable income, which fuel demand for a variety of foam packaging goods. Numerous well-known foam packaging firms with a reputation for using cutting-edge technology and creative solutions are based in North America.

The food packaging sector benefits greatly from the foam polystyrene industry, which also makes a large economic contribution to the US. The production, marketing, and export of foam packaging materials stimulate innovation, create jobs, and promote economic progress. Almost all manufacturing waste is gathered and recycled in the United States. As to the Carpet Cushion Council's estimation, the manufacturing of carpet cushions saves over 1.2 billion pounds of post-industrial and post-consumer foam scrap per year from ending up in landfills. The US foam packaging market is constantly evolving and adapting to new customer demands and environmental laws, with a focus on sustainability and recyclability.

The foam packaging business confronts new possibilities and challenges as consumer tastes change towards eco-friendly and sustainable packaging alternatives. The advancement of foam packaging for products is being propelled by developments in biodegradable materials, recycling technology, and circular economy activities. The foam packaging industry in North America is expected to have sustained growth and development in the upcoming years, with particular emphasis on product diversification, market expansion, and resource efficiency.

For Instance,

- In November 2023, A portfolio business of the Spell Family Office, Complete Packaging is situated in Monroe, Michigan, and was acquired by Specialised Packaging Group (SPG), a prominent vertically integrated supplier of protective packaging goods.

Foam Packaging Market, DRO

Demand:

- The demand for safe packing options has increased as online shopping grows in popularity. Foam packaging minimises damage and returns by ensuring that items get to customers undamaged.

Restraint:

- Governments everywhere are enforcing strict laws against using specific types of foam packing, claiming risks to the environment and public health.

Opportunity:

- Enhancing the industry's environmental image may be achieved by collaborating with recycling firms to guarantee the appropriate disposal and recycling of foam packaging materials.

Beyond Packaging Multifaceted Uses of EPS Foam

Expanded polystyrene (EPS) foam is a flexible material with a wide range of uses in the foam packaging sector. EPS foam, which is recognised for its flexibility and low weight, is used in many different industries, including building, cushioning, thermal insulation, flotation, transportation, and packaging. Its composition, which consists of only 2% plastic and 98% trapped air, is one of the characteristics that set EPS foam apart. It's highly efficient as an insulating and packing material because of its special makeup. It’s entirely recyclable quality and minimal raw material utilisation make it an affordable option.

EPS foam has several appealing qualities that increase its popularity across a wide range of sectors. Its resilience assures endurance and dependability in a variety of applications, while its lightweight design makes handling and shipping easier. EPS foam is resistant to moisture, which means that it may be used in places where there is a lot of humidity or exposure to moisture. Another characteristic of EPS foam that makes it a great option for insulation is its thermal efficiency. Its efficient temperature regulation improves energy economy and lowers heating and cooling expenses. EPS foam also performs exceptionally well in absorbing shocks, protecting fragile goods from harm during handling or transportation.

Products made of EPS foam are in high demand, especially in the food and beverage, building, infrastructure, and industrial sectors. Due to its structural stability and capacity to withstand loads and backfill stresses, it is an essential tool in construction contexts where dependability and longevity are important.

For Instance,

- In December 2022, A pioneer in the development and production of personalised protective packaging and cold chain solutions, Engineered Foam Packaging (EFP) has announced the purchase of NatureKool, Incorporated, a North Carolina-based business that created the first natural fibre insulated shipper in history.

Versatile World of Flexible Polyurethane Foam

The flexible foaming category is the leading force in the globally market for foam packaging. Flexible polyurethane foam is used in this market sector to provide cushioning for a wide range of consumer and commercial items. According to its adaptability, flexible foam finds significant use in a variety of applications, including furniture and bedding, automobile interiors, carpet underlay, and packaging.

The most important factors are flexible foam's capacity to be shaped into a variety of forms and stiffness levels, offering customised protection for breakable objects including instruments, medical equipment, and electronics. Its supportive, long-lasting, and lightweight qualities provide ideal cushioning without adding undue weight. This aspect leads to substantial cost savings during shipping in place of improving product safety.

Flexible foam can be easily modified, making it possible for it to adapt smoothly to a variety of product forms and sizes, unlike its rivals made of stiff foam. This flexibility guarantees the best defence against shocks and vibrations, protecting products all while going through the supply chain. Using flexible polyurethane foam supports initiatives aimed at preserving the environment. The total environmental impact of packing materials is decreased by the recyclable nature of some flexible foam varieties. Furthermore, flexible foam's lightweight characteristics support environmentally friendly transportation methods by reducing carbon emissions.

Flexible polyurethane foam accounts for around 30% of the polyurethane market in North America, where it commands a sizable market share. The fact that it is widely used in industries like automobile, furniture, and bedding highlights how essential it is to many others. A flexible and lightweight packaging solution is essential in today's industry, as demonstrated by the growth of the flexible foaming category. Flexible polyurethane foam remains the material of choice for protective packaging applications because to its many advantages, including environmental sustainability, customisation, and durability.

For Instance,

- In November 2023, Carpenter has agreed to purchase NCFI's consumer goods division's flexible foam business. The company, which is headquartered in Mount Airy, North Carolina, produces tailored foams for a variety of industries, including the medical, furniture, mattress, aviation, and aerospace sectors.

Dominance of Foamed Polystyrene in Food Packaging

The food companies overflowing with foamed polystyrene, frequently referred to as Styrofoam. It has been praised for its lightweight and insulating characteristics, which keep food warm or cold during travel and storage, prolonging shelf life and decreasing spoiling. Polystyrene has evolved into an indispensable tool for food service operators, ranging from steaming coffee cups to takeout containers.

There is a substantial environmental cost associated with this convenience. Oil and natural gas are two non-renewable resources that are used to make almost all Styrofoam packaging. The plastics sector, which depends largely on these resources, may use up to 20% of the world's oil supply by 2050. Polystyrene is disposed of in landfills after usage, where it takes generations for it to break down, releasing toxic compounds into the atmosphere and threatening animals.

The food industry is confronted with a decision. Even while polystyrene has many advantages, its effects on the environment cannot be overlooked. Going forward, there is an urgent need for sustainable options that preserve food quality without endangering the environment.

For Instance,

- In February 2023, A collaboration between AmSty, a prominent producer of polystyrene and a pioneer in the circular recycling of polystyrene, and Pactiv Evergreen, a leading producer of fresh food and beverage packaging, aims to support large food companies in meeting significant sustainability targets.

Styrene-based goods are produced by BASF's Styrenics subsidiary for the packaging and construction sectors. One of the biggest providers of styrene-based goods in Europe, BASF sets itself apart among other things by consistently expanding its product line. Styrenic foams such as polystyrene and styrene, extruded polystyrene (XPS) Styrodur®, and expanded polystyrene (EPS) Styropor® and Neopor®, BASF now provides product variations based on resource-saving production procedures, the mass balancing approach.

For Instance,

- In March 2022, Expandable polystyrene (EPS) granulates made of graphitic material is now part of BASF's product line. Ten percent of Neopor® F 5 McycledTM's material is recycled, making it ideal for a variety of architectural applications—especially façade insulation.

Key Players and Competitive Dynamics in the Foam Packaging Market

The competitive landscape of the foam packaging market is dominated by established industry giants such as Sealed Air Corporation, Sonoco Products Company, BASF SE (Germany), Dart Container Corporation, Pactiv LLC, WinCup, Genpak, Zotefoams Plc (U.K.), Arkema (France), Kaneka Corporation (Japan), Rogers Corporation (U.S.), Synthos SA (Poland), Armacell (Germany), JSP (Japan), and Foampartner Group (Switzerland) and Pregis LLC. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Sealed air company Businesses are able to protect their items during shipment with a customisable solution when they use foam for packaging. Superior cushioning offered by foam packing materials protects goods from compromise while reducing the total transportation footprint. Foam packing offers customisable options for density, size, and form, making it ideal for protecting a wide range of products, including fragile goods and electronics.

For Instant,

- In February 2022, Foxpak Flexibles Ltd. (Foxpak) has been acquired by SEE as part of its SEE Ventures strategy, which aims to accelerate growth by investing in revolutionary technology and business models.

Products based on styrene are produced by BASF's Styrenics business for the packaging and construction sectors. One of the biggest providers of styrene-based goods in Europe, BASF sets itself apart among other things by consistently expanding its product line. Together with styrenic foams like polystyrene and styrene, extruded polystyrene (XPS) Styrodur®, and expandable polystyrenes (EPS) Styropor® and Neopor®, BASF now provides product variations based on resource-saving production techniques called the mass balance method.

Expandable polystyrene (EPS) granulates made of graphitic material is now part of BASF's product line. Ten percent of Neopor® F 5 McycledTM's material is recycled, making it ideal for a variety of architectural applications—especially façade insulation.

Browse More Insights of Towards Packaging:

- The global footwear packaging market size expected to increase from USD 5.45 billion in 2022 to achieve an approximation USD 8.26 billion by 2032, growing at a 4.3% CAGR between 2023 and 2032.

- The global flexible plastic packaging market size to expand from USD 178.60 billion in 2022 to secure USD 289.52 billion by 2032, growing at a 5.0% CAGR between 2023 and 2032.

- The packaging 5.0 recognizes of the increasing consumer demand for personalized products. To meet this demand, packaging technologies that combine big data and artificial intelligence are being implemented.

- The global secondary packaging market size presumed to grow from USD 232.85 billion in 2022 to reach a conjectured USD 366.81 billion by 2032, growing at a 4.7% CAGR between 2023 and 2032.

- The global packaging market size is speculated to escalate from USD 1.20 trillion in 2022 to acquire a anticipated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

- The global bakery packaging market size envisaged to surge from USD 3.40 billion in 2022 to secure a forecasted USD 5.40 billion by 2032, growing at a 4.8% CAGR between 2023 and 2032.

- The global lip powder packaging market size prognosticated to elevate from USD 1,798.20 million in 2022 to hit a presumed USD 3,328.10 million by 2032, expanding at a 6.4% CAGR between 2023 and 2032.

- The global packaging automation market size predicted to climb from USD 64.70 billion in 2022 to obtain a projected USD 136.47 billion by 2032, growing at a 7.8% CAGR between 2023 and 2032.

- The global returnable transport packaging market size expected to increase from USD 8,786.68 million in 2022 to attain a calculated USD 16,570.80 million by 2032, increasing at 6.6% CAGR between 2023 and 2032.

- The global aerosol packaging market size anticipated to rise from USD 6.74 billion in 2022 to achieve an approximation USD 10.58 billion by 2032, growing at a 4.62% CAGR between 2023 and 2032.

Foam Packaging Market Player

Foam packaging leading market players are Sealed Air Corporation, Sonoco Products Company, BASF SE (Germany), Dart Container Corporation, Pactiv LLC, WinCup, Genpak, Zotefoams Plc (U.K.), Arkema (France), Kaneka Corporation (Japan), Rogers Corporation (U.S.), Synthos SA (Poland), Armacell (Germany), JSP (Japan), and Foampartner Group (Switzerland) and Pregis LLC.

Market Segmentation

By Material

- Expanded Polystyrene (EPS)

- Polyurethane (PU)

- Polyethylene (PO)

- Polyvinyl chloride (PVC)

- Polyvinylidene fluoride (PVDF)

- Others

By Structure

- Flexible

- Rigid

By End Use

- Food and Beverage

- Pharmaceutical

- Personal Care

- Automotive

- Industrial

- Others

By Region

- Asia Pacific

- North America

- Europe

- LAMEA

Own your copy of our reach study and stay informed: https://www.towardspackaging.com/price/5150

Explore the statistics and insights concerning the packaging industry and its segmentation: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Web: https://www.precedenceresearch.com/

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/