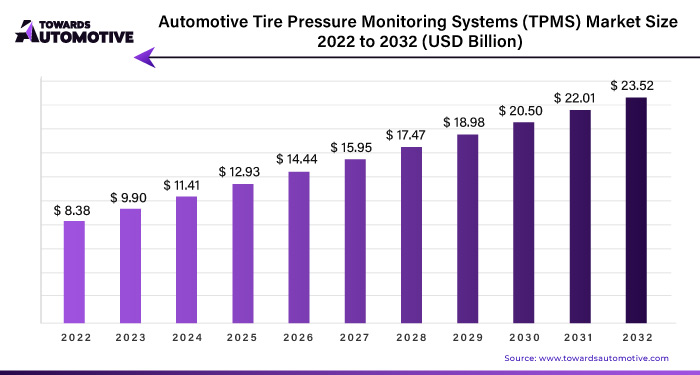

Ottawa, May 08, 2024 (GLOBE NEWSWIRE) -- The global automotive tire pressure monitoring systems market size surpassed USD 9.90 billion in 2023 and is predicted to hit around USD 22.01 billion by 2031, a study published by Towards Automotive a sister firm of Precedence Research.

Download the segmental analysis of this report in detail @ https://www.towardsautomotive.com/insight-sample/1050

Tier 2 and 3 providers dominate the vehicle tire pressure monitoring system (TPMS) industry, which includes Sensata Technologies, Huf Electronics, Continental, Infineon Technology, Lear Corporation, and ZF TRW. Continental AG has unveiled its next-generation REDI-Sensor Multi-Application tire pressure monitoring sensors. TPMS monitors low tire pressure, saving time while guaranteeing proper tire pressure. However, it only functions after 25% of tire air loss, which is around 0.5 bar on average. In November 2021, KRAIBURG Austria launched TYLOGIC, a web-based tire pressure monitoring system that detects pressure drops, probable mechanical problems, and the end of normal tire mileage. Automakers prefer large manufacturers to provide high-quality, long-lasting goods, and these major rivals have greatly expanded their R&D expenditure to combine vehicle TPMS with other safety-related technology.

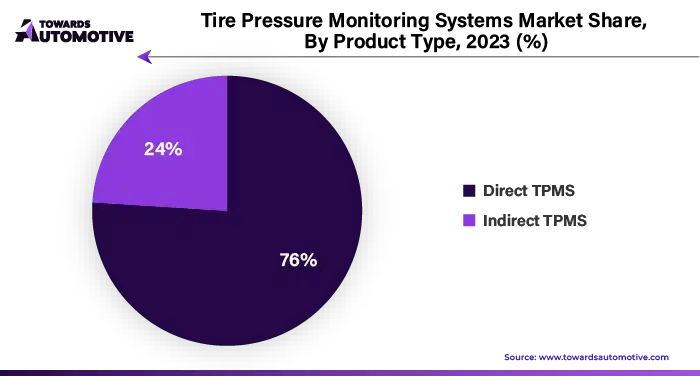

The integration of Tire Pressure Monitoring Systems (TPMS) in electric vehicles (EVs) has grown in importance due to the necessity for accurate tire pressure monitoring. Manufacturers are developing TPMS systems designed for EVs, which will provide real-time pressure monitoring and alerts customized to EV features. Direct TPMS systems, which employ sensors embedded in tires, give exact, making them more popular owing to their precision and durability.

In the commercial vehicle sector, tire maintenance is critical for both safety and cost benefits. Fleet operators are investing in TPMS solutions to monitor tire pressure in real time, detect abnormalities, and prevent tire failures. Manufacturers are integrating TPMS systems with vehicle telematics platforms to improve their performance. Telematics-enabled TPMS systems offer real-time monitoring and analysis, allowing fleet managers to track tire performance, get alerts for low pressure or temperature anomalies, and arrange repairs ahead of time.

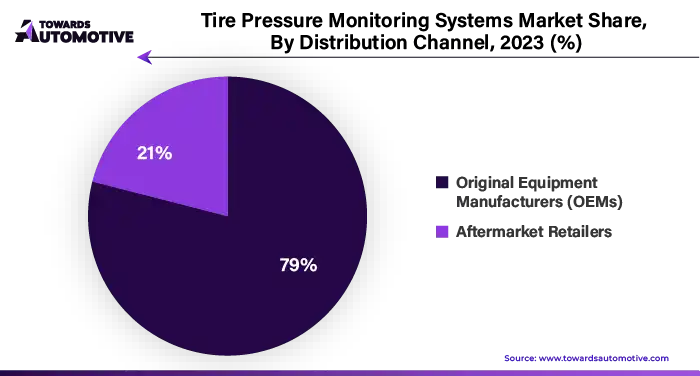

The demand for aftermarket TPMS systems is rising as users install them to improve safety and regulatory compliance. Aftermarket TPMS systems provide a low-cost alternative to retrofitting older vehicles with advanced tire pressure monitoring capabilities, fueling growth in this section of the TPMS industry.

Manufacturers are developing smart TPMS sensors with capabilities like as Bluetooth connectivity, tire temperature monitoring, and predictive analytics to enhance user experience, tire care habits, and allow for proactive tire pressure control.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Automotive Tire Pressure Monitoring Systems- Drivers, Restraints and Opportunities

The integration of vehicle safety systems is propelling the use of tire pressure monitoring systems (TPMS). Manufacturers are integrating sophisticated safety features to prevent tire accidents and increase driver and passenger safety. TPMS monitors tire pressures and informs drivers when they depart from the recommended levels, maintaining optimal tire performance while also improving vehicle control, fuel efficiency, and crash risk. Continental AG, a leading automotive technology business, offers a variety of security solutions, including TPMS technology. The technology monitors tire pressure and temperature and provides real-time data to the driver. This integration with other safety systems improves features such as stability control, anti-lock brakes, and advanced driver assistance systems, hence improving overall vehicle safety.

Tire Pressure Monitoring System (TPMS) is a device that monitors tire pressure, hence improving fuel efficiency by assuring correct tire inflation. Low tire pressure increases rolling resistance and fuel consumption, whereas PMS warns drivers of low pressure, allowing them to make appropriate changes to maintain ideal tire pressure. TPMS also increases fuel efficiency and environmental sustainability by encouraging safer driving and lowering tire-related incidents.

Ford, a renowned automotive technology business, has integrated TPMS technology into its vehicles to boost fuel efficiency. Ford's TPMS system constantly monitors tire pressure and informs drivers if it goes below predetermined limits, encouraging drivers to maintain optimal tire pressure levels and thereby enhancing fuel efficiency, lowering emissions, and promoting environmentally responsible driving behaviors.

Tire Pressure Monitoring Systems (TPMS) are critical for vehicle tracking, as they check tire pressure in real time. These systems, which often incorporate a tire-mounted sensor, inform drivers when low tire pressure is detected. However, questions have been raised concerning the possibility of distant eavesdropping on these transmissions. Each sensor emits a distinct signal that may be detected with a directional antenna, possibly jeopardizing the vehicle's privacy and security. The problems originate from signal range limitations, data type, encryption and authentication systems, and continuous attempts to improve automobile cybersecurity. Despite these issues, the automobile industry may continue to benefit from TPMS technology while still protecting car owners' privacy and security.

The lack of a universal TPMS standard makes it difficult for manufacturers to build a uniform system across different cars owing to differences in regulation and requirements across different places and nations. This results in varying standards and technology, which raises the cost and difficulty of creating and manufacturing TPMS systems to satisfy regional demands. Furthermore, compatibility issues emerge when a consumer replaces or updates their TPMS system, since it may be difficult to get entirely compatible components and sensors for a particular car type. As standardization initiatives continue, manufacturers and consumers should expect more consistency, more efficient manufacturing processes, cheaper prices, and a better user experience.

The tire pressure monitoring system (TPMS) market has tremendous potential in emerging markets such as India, thanks to increased vehicle production and customer desire for sophisticated safety features. The Indian government is aggressively promoting road safety initiatives, including making safety features required in automobiles. TPMS systems, which enable real-time tire pressure monitoring, increase vehicle safety and minimize the likelihood of accidents caused by underinflation. As a result, TPMS manufacturers have the opportunity to penetrate and gain market share in India, where automotive sales have increased significantly due to the country's enormous population and expanding middle class.

The worldwide automotive industry is transitioning to electric mobility, resulting in a considerable rise in demand for Tire Pressure Monitoring Systems (TPMS) in electric vehicles. TPMS is critical for achieving peak tire performance and efficiency, particularly in battery-powered electric vehicles (EVs). Tesla, a well-known EV manufacturer, has already included TPMS as a standard feature, delivering real-time tire pressure data for optimal safety and efficiency. This trend is projected to continue as more manufacturers add EVs into their product portfolios, opening up a lucrative market opportunity for TPMS producers.

Own our premium research instantly @ https://www.towardsautomotive.com/price/1050

Automotive Tire Pressure Monitoring System Market Analysis

Increased car emissions and industrialization contribute to global warming by 1-2 degrees Celsius every year. As a result, automakers in emerging markets are prioritizing fuel-efficient, lightweight, and small automobiles. To address energy shortages and worries about climate change, governments are adopting strict fuel economy standards. Tire pressure monitoring technology (TPMS) is being utilized to increase vehicle safety while decreasing fuel consumption by 3%. Applying TPMS to all passenger cars in the EU may reduce CO2 emissions by approximately 14.5 million tons per year.

The direct tire pressure monitoring system (TPMS) market is expected to dominate from 2023 to 2032, with 76% of the market share in 2023. TPMS monitors tire pressure in real time and informs drivers when it deviates from permitted levels, hence increasing vehicle safety. Regulations in the United States, Europe, South Korea, and China necessitate the installation of TPMS for safety and environmental concerns, which drives up demand for direct TPMS solutions.

Conventional tire pressure monitoring system (TPMS) technology is estimated to dominate the tire pressure monitoring system market in 2022, accounting for 76.0%. It is accessible in a wider range of vehicle types and price points, making it suitable to cost-conscious clients and fleet operators.

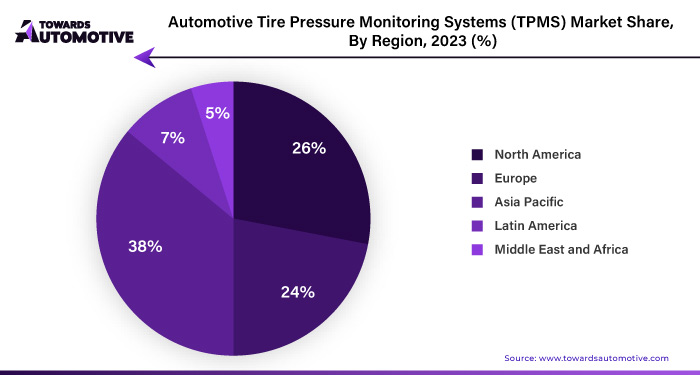

Asia-Pacific Region Expected to Hold Dominant Share in the Market

The Asia Pacific automotive tire pressure monitoring system (TPMS) market is expected to experience substantial growth, with China and India leading the region in trade. The demand for tire monitoring systems and Advanced Driver Assistance Systems (ADAS) is driven by the rising market penetration of premium vehicles and increased emphasis on vehicle safety. Safety systems like tire pressure monitoring are prevalent in large and mid-size vehicles in developed Asian economies like Japan, South Korea, and Singapore.

The surge in sales of high-end and mid-range vehicles in the Asia-Pacific region serves as the primary growth catalyst for TPMS. Major regional automotive OEMs like Hyundai and Nissan are aiming to boost their revenues through the development and integration of advanced automotive security systems. The regional market for tire inspection is currently relatively limited, but is expected to experience significant growth over the next five years.

Automotive Tire Pressure Monitoring Systems (TPMS) Market Key Players

- Delphi Automotive

- DENSO Corporation

- Continental AG

- ZF TRW

- Valor TPMS

- Pacific Industrial

- Schrader Electronics

- Hella KGaA Hueck & Co.

- Valeo

- ALLIGATOR Ventilfabrik GmbH

- Advantage PressurePro Enterprises Inc.

- Alps Electric Co. Ltd

- Sensata Technologies

- Huf Electronics

- Aptiv PLC

- Bartec USA LLC

- Doran Manufacturing LLC

- Dunlop Tech GmbH

- Garmin Ltd.,

- Infineon Technologies AG

- Knorr-Bremse AG

- Nira Dynamics

- NXP Semiconductors

- Pacific Industrial Co. Ltd.

- Sensata Technologies Inc.

- ZF Friedrichshafen AG

- Firestones

- Michelin

- Bridgestone

- Goodyear

Automotive Tire Pressure Monitoring Systems (TPMS) Market Recent Developments

- In February 2023, Continental released SmartPressure Pro, a TPMS system designed for passenger vehicles and business fleets. It combines real-time tire pressure and temperature monitoring, as well as machine learning algorithms, to forecast tire wear and possible concerns.

- In March 2023, Firestone announced the FleetGuard‚ TPMS system for commercial transportation fleets. It offers real-time tire monitoring, predictive maintenance insights, and real-time pressure and temperature measurements to help decrease downtime and improve operating efficiency.

- Michelin unveiled SafeTire Pro in June 2023, a next-generation tire management system that employs sophisticated sensor technology and cloud-based analytics to give drivers with improved tire health monitoring and predictive maintenance warnings.

- In August 2023, Bridgestone launched TPMS Pro, a device that combines sophisticated sensor technology with artificial intelligence to deliver real-time tire performance data and individualized maintenance suggestions to both consumer and commercial vehicle customers.

- Goodyear introduced IntelliGrip Pro in October 2023, a smart tire monitoring platform that improves fleet management by delivering insights into tire health, fuel economy, and performance improvement via advanced analytics and remote monitoring tools.

Automotive Tire Pressure Monitoring System Market Segmentation

By Product Type

- Direct TPMS

- Indirect TPMS

By Vehicle Type

- Passenger Cars

- Hatchbacks

- Sedans

- SUVs

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Buses and Coaches

- Off-road Vehicles

- Agriculture Tractors & Equipment

- Construction & Mining Equipment

- Industrial Vehicles (Forklifts, AGVs, etc.)

By Distribution Channel

- Original Equipment Manufacturers (OEMs)

- Aftermarket Retailers

- Online Retailers

- Automotive Parts Stores

- Independent Repair Shops

By Technology

- Ultrasonic Sensor

- Lidar Sensor

- Radar Sensor

- Camera Sensor

- Infrared Sensor

- Pressure Sensor

By Propulsion Type

- ICE Vehicles

- Diesel

- Petrol

- CNG and LPG

- Electric Vehicle

- Battery Vehicles

- Plug-in Vehicles

- Hybrid Vehicles

- Others

By Geography

- North America

- United States

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- France

- United Kindgom

- Spain

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East and Africa

- UAE

- Kingdom of Saudi Arabia

- Nigeria

- Egypt

- Morocco

- South Africa

- Rest of Middle East and Africa

Browse More Insights of Towards Automotive:

- The traffic signal recognition market size is projected to rise from USD 36.22 billion in 2023 to expand to USD 51.49 billion by 2032, reflecting 4.54% CAGR between 2023 and 2032.

- The low-emission vehicle market size to surge from USD 167.97 billion in 2023 and is expected to reach USD 488.08 billion by 2032, expanding at a CAGR of 12.58% during the forecast period.

- The off-highway vehicle engine market size calculated USD 43.31 billion in 2023 and is projected to achieve USD 78.18 billion by 2032, with a CAGR of 6.78% during the forecast period.

- The automotive lighting market size is estimated at USD 39.25 billion in 2024 to calculate USD 58.25 billion by 2032, growing at a CAGR of 5.21% during the forecast period.

- The automotive gear market size to rise from USD 5.79 billion in 2023 and predicted to hit USD 10.27 billion by 2032, expanding at 6.58% CAGR during the forecast period.

- The high-performance trucks market size was valued at USD 76.68 billion in 2023 and is expected to reach USD 110.48 billion by 2032, registering a CAGR above 4.14% during the forecast period.

- The automotive fuel tank market size was valued at USD 25.08 billion in 2023 is projected to reach USD 38.04 billion by 2032, expanding at CAGR of 4.74% during the forecast period.

- The automotive spark plugs and glow plugs market size was valued at USD 8.89 billion in the year 2022. It is anticipated to grow to USD 12.35 billion by the year 2032, registering a CAGR of 3.28% in terms of revenue during the forecast period.

- The electric vehicle battery market size is estimated at USD 43.68 billion in 2022, and is expected to reach USD 252.02 billion by 2033, growing at a CAGR of 21.50% during the forecast period (2022-2032).

- The automotive exhaust analyzer market size was valued at USD 792.47 million in the year 2022 and is projected to grow to USD 1543.35 million in the year 2032, with an expanding CAGR of 7.69% in terms of revenue during the forecasted period.

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1050

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

Web: https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive