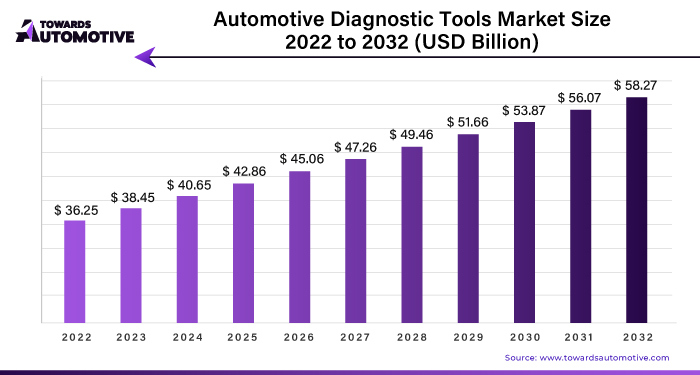

Ottawa, May 09, 2024 (GLOBE NEWSWIRE) -- The global automotive diagnostic tools market size was valued at USD 38.45 billion in 2023 and is predicted to hit around USD 56.07 billion by 2031, a study published by Towards Automotive a sister firm of Precedence Research.

Download a short version of this report @ https://www.towardsautomotive.com/insight-sample/1036

Automotive scan tools are essential devices used for diagnosing and troubleshooting various issues in vehicles. These tools encompass a combination of electronics and software that enable users to identify and rectify traffic problems efficiently. By interfacing with the vehicle's onboard diagnostics system (OBD), car scan tools can access crucial data and parameters to pinpoint malfunctions and abnormalities across different systems within the vehicle.

The functionality of automotive scan tools extends to checking, detecting, and controlling any malfunctions present in the vehicle, ensuring that potential issues are addressed before they escalate. This proactive approach not only helps prevent breakdowns and accidents but also contributes to prolonging the lifespan of the vehicle and maintaining optimal performance.

Automotive industry, including the market for automobile inspection equipment, faced significant challenges during the COVID-19 pandemic. Compliance with laws and regulations, such as quarantine measures and social distancing protocols, led to restrictions on transportation and reduced demand for vehicles. This downturn in demand resulted in the closure of factories and losses for automotive companies.

Post-pandemic period has seen a resurgence in the automobile inspection equipment market. As the automotive industry rebounds and production ramps up, there has been a renewed focus on implementing advanced diagnostic tools and technologies to ensure vehicle safety and reliability. This has led to increased demand for car scan tools, driving business growth and profitability in the sector.

The automotive diagnostic scanning equipment market is experiencing significant growth driven by technological advancements and increasing market demand. These diagnostic tools play a crucial role in identifying faults and malfunctions in various vehicle systems, including the engine, fuel system, battery, transmission, and other electronic components. By providing detailed information and insights, these tools facilitate efficient troubleshooting and repair processes, thereby contributing to business growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Garage manufacturers have developed sophisticated diagnostic tools that enable mechanics and technicians to connect directly to a vehicle's onboard diagnostic (OBD) system. Through this connection, diagnostic equipment can access real-time data and diagnostic trouble codes (DTCs), allowing for quick and accurate identification of issues. This capability is particularly valuable as modern vehicles become more complex and rely increasingly on electronic systems.

The integration of software and electronics within vehicles has further enhanced the capabilities of automotive diagnostic scanning equipment. These tools can now detect and diagnose problems with greater precision and efficiency, leading to faster repair times and reduced costs for vehicle owners.

Moreover, there is a growing trend towards the installation of diagnostic equipment directly within vehicles themselves. This onboard diagnostic capability enables continuous monitoring and diagnostics, providing proactive alerts for potential issues before they escalate. As a result, vehicle manufacturers are increasingly incorporating advanced diagnostic features into their vehicles, further driving the demand for automotive diagnostic scanning equipment.

Government initiatives aimed at promoting vehicle safety and emissions compliance are also fueling market growth. With regulatory requirements becoming more stringent, there is a heightened focus on the development and adoption of advanced diagnostic technologies to ensure vehicle compliance and performance.

Key stakeholders in the automotive industry, including manufacturers, suppliers, and service providers, are actively involved in driving innovation and introducing new developments in diagnostic scanning equipment. This collaboration and investment in research and development efforts are driving market expansion and increasing revenue opportunities.

Increasing Sales of Passenger Cars

The automotive diagnostic scanning device market is intricately linked with the sales of passenger cars, which are experiencing steady growth globally. Major automotive markets, including China, the United States, and Europe, are witnessing increased demand for passenger cars. Several factors contribute to this growth trajectory, including the rising need for energy-efficient vehicles and government initiatives supporting vehicle inspections, compelling companies worldwide to invest in automotive diagnostic equipment.

Passenger cars represent a significant segment of the automotive market and are anticipated to continue growing robustly in the forecast period. This sustained growth in passenger car sales directly translates to increased demand for automotive diagnostic tools. Moreover, the performance of the passenger car industry often serves as a barometer for economic stability, making it a crucial indicator of market trends.

The expansion of the automotive diagnostic scanning equipment market is further propelled by rapid urbanization in emerging markets. As urban populations grow, there is a corresponding rise in the demand for autonomous cars and advanced automotive technologies. Urbanization drives the need for efficient transportation solutions, prompting investment in innovative diagnostic tools to ensure vehicle safety, reliability, and compliance with regulatory standards.

High Initial Cost of Advanced Diagnostic Tools

As automotive technology advances, repair shops face increasing demand for diagnostic equipment, yet many struggle to afford the latest tools. While the overall costs of diagnostic equipment have decreased over time, the introduction of new technologies, particularly those surpassing the OBD-I standard, has brought higher price tags. This disparity in affordability can potentially hinder the adoption of new and innovative diagnostic technologies.

Manufacturers of diagnostic scan tools are under constant pressure from Original Equipment Manufacturers (OEMs) to reduce costs. This pressure stems from the need to provide cost-effective solutions to repair shops while keeping up with the evolving automotive landscape. However, the reluctance of some companies to invest in research and development (R&D) activities, particularly in developing countries where OEMs may still be introducing models with simpler diagnostic procedures, presents a challenge.

Moreover, the regulatory landscape adds another layer of complexity and cost. Strict regulations governing vehicle inspections necessitate the use of specialized tools and equipment, further increasing the overall expenses for repair shops. Additionally, as regulations evolve, repair shops must update their equipment to remain compliant, adding to the financial burden.

Advancements in automotive technology hold promise for improved diagnostics and repair processes, challenges related to affordability, R&D investment, and regulatory compliance persist. Finding a balance between innovation and cost-effectiveness remains crucial for both diagnostic tool manufacturers and repair shops striving to meet the evolving needs of the automotive industry.

Consumer Preference for High-End Cars

The current trend in developing countries is a growing demand for quality cars equipped with advanced and efficient diagnostic equipment. This trend is fueled by several factors, including the significant growth of the luxury automotive market, a shift in consumer preferences towards SUVs, and increasing disposable incomes. As consumers seek more sophisticated vehicles, the need for On-Board Diagnostics (OBD) solutions for both private and commercial vehicles remains high.

The automotive industry is witnessing significant technological advancements, with vehicles incorporating new technologies to enhance efficiency and performance. Trends such as connected electric vehicles and cars require advanced diagnostic equipment to control and maintain high-voltage systems. Emerging markets, notably China, are playing a crucial role in driving this growth, with efforts to adopt modern screening equipment.

However, the adoption of such technology faces challenges, particularly related to cost and operational complexity. High-end diagnostic tools come with a hefty price tag, making them inaccessible to many consumers. Moreover, the operational complexity of these tools may pose a barrier to adoption.

To address these challenges, manufacturers are developing more affordable and versatile OBD2 scanners. These scanners cater to the average car owner and offer a wide range of diagnostic features. Additionally, there is a growing market for advanced OBD2 scanners designed for DIY enthusiasts and professionals, offering an extensive array of features to meet diverse diagnostic needs.

Passenger Cars Segment is Estimated to Hold the Largest Share of the Overall Automotive Diagnostic Scan Tools Market

Passenger cars indeed represent a significant source of vehicle pollution emissions, making the monitoring and identification of malfunctions in their emission control systems crucial. Diagnostic scan tools play a vital role in this process, enabling the detection of issues that may lead to increased emissions. The ubiquitous "Check Engine" light serves as an indicator of potential malfunctions, prompting vehicle owners to address issues promptly.

Traditionally, vehicle malfunctions were identified and addressed by trained technicians in compliance with industry standards such as ASE A6, A8, and L1. However, the advent of mobile diagnostic tools has empowered consumers to perform DIY diagnostics for minor issues, leading to an increase in self-service diagnostics among vehicle owners.

The past decade has witnessed significant improvements in consumer lifestyles, driven by rapid globalization and economic growth in emerging markets like Brazil, Mexico, and India. This economic prosperity has translated into higher disposable incomes and increased consumer spending, particularly in the automotive sector. As a result, there has been a surge in demand for passenger cars, further fueling the growth of the passenger car market.

Major Original Equipment Manufacturers (OEMs) such as General Motors, Ford, and Honda have responded to this growing demand by introducing new passenger car models that cater to consumer preferences and lifestyle trends. By embracing concepts such as consumerism and incorporating advanced technologies, these OEMs aim to capture a larger share of the passenger car market and meet the evolving needs of consumers worldwide.

USB Is Estimated to be the Largest Market During the Forecast Period

USB connectivity has become ubiquitous in OBD-II equipped vehicles, facilitating easy access to onboard computer systems for monitoring various vehicle parameters such as emissions, mileage, and speed. The OBD-II system relies on indicators like the Check Engine light to alert drivers when the onboard computer detects potential issues.

USB connectivity offers a cost-effective and user-friendly solution, allowing vehicle owners to connect their tablets, laptops, or netbooks directly to the vehicle's diagnostic port. This enables real-time monitoring and control of vehicle performance, empowering users to diagnose and address issues promptly.

However, there is a growing demand for wireless diagnostic equipment, prompting the need to replace traditional USB cables with more advanced wireless technologies such as Bluetooth and Wi-Fi. Wireless connectivity offers greater convenience and flexibility, allowing users to perform diagnostics without being tethered to the vehicle. Additionally, wireless connections eliminate the need for physical cables, reducing clutter and simplifying the diagnostic process.

As automotive technology continues to evolve, incorporating wireless connectivity into diagnostic tools will likely become more prevalent, providing users with enhanced functionality and usability. This shift towards wireless testing equipment reflects the ongoing pursuit of innovation and efficiency in the automotive diagnostics industry.

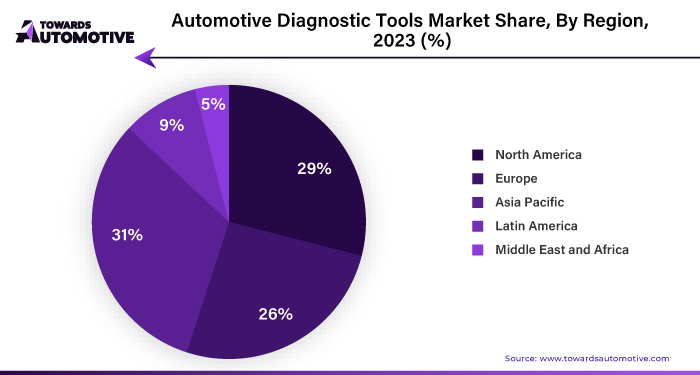

Asia-Pacific Region Expected to Hold Dominant Share in the Market

The Asia-Pacific region, encompassing major automotive markets like India, China, and Japan, is poised to make significant contributions to the automotive diagnostic tools market. This region is home to prominent manufacturers such as Hyundai, Toyota, Tata, and Honda, and despite adherence to international OBD standards, variations exist in implementation methods, particularly in markets like India.

The Asia-Pacific market is witnessing a surge in technological advancements and a commitment to reducing vehicle emissions, enhancing vehicle performance, and improving maintenance practices. This, in turn, is expected to drive the demand for automotive diagnostic equipment in the region. Automotive manufacturers are also aligning with these advancements, with the implementation of standards addressing defects in OBD systems and supporting the development of advanced diagnostics.

The enforcement of regulations such as the Bharat VI emission standards in April 2020 has further propelled the growth of automotive electronics, underscoring the necessity for advanced diagnostic equipment. Consequently, this has led to increased sales and innovations in the sector.

For instance, Innova Electronics Corporation, a leading player in the automotive aftermarket diagnostic tools market, recently unveiled a new firmware and software update for its OBD2 scanner in January 2023. Such developments highlight the ongoing efforts to enhance diagnostic capabilities and meet the evolving needs of the automotive industry in the Asia-Pacific region.

Automotive Diagnostic Tools Market Key Players

- ACTIA Group

- Delphi Automotive PLC

- Continental AG

- Robert Bosch GmbH

- Snap-On Incorporated

- Carman Scan

- Vector Informatik GmbH

- Softing AG

- KPIT Technologies Ltd

- Hella KGaA Hueck & Co.

Automotive Diagnostic Tools Market Recent Developments

- In August 2023, AutoTech announced a strategic partnership with Vehicle Health Technologies to enhance vehicle diagnostic capabilities. This collaboration aims to integrate AutoTech's advanced diagnostic tools with Vehicle Health Technologies' predictive maintenance solutions to offer comprehensive vehicle health monitoring services.

- In June 2023, DiagnoseMaster unveiled its latest diagnostic software update, featuring enhanced vehicle scanning capabilities and improved user interface. The updated software allows technicians to perform detailed vehicle diagnostics quickly and accurately, streamlining the repair process.

- AutoDiag, a leading provider of automotive diagnostic solutions, launched its next-generation diagnostic scanner in April 2023. The new scanner offers advanced scanning capabilities and wireless connectivity options, enabling technicians to diagnose vehicle issues more efficiently.

- CarCheck Technologies introduced its innovative vehicle diagnostic platform in March 2023. The platform utilizes artificial intelligence and machine learning algorithms to analyze vehicle data in real-time, providing actionable insights for vehicle owners and service centers.

- Diagnostic Innovations Inc. partnered with a major automotive dealership network in February 2023 to deploy its advanced diagnostic software across multiple service centers. The partnership aims to improve service efficiency and customer satisfaction by leveraging cutting-edge diagnostic technology.

- In January 2023, VehiTech Solutions announced the launch of its cloud-based diagnostic platform, offering remote vehicle diagnostics and maintenance services. The platform enables vehicle owners to monitor their vehicle's health status and receive personalized maintenance recommendations from certified technicians.

Browse More Insights of Towards Automotive:

- The heavy-duty tire market size reached a value of USD 26.28 billion in 2022 and is projected to reach USD 36.83 billion by 2032, with a compound annual growth rate (CAGR) of 3.37% during the forecast period.

- The mild hybrid vehicles market size was valued at USD 112.76 billion in 2022 and is projected to reach USD 376.24 billion by 2032, with a CAGR of 11.69% during the forecast period.

- The global automotive air suspension systems market size was at USD 19.15 Billion in 2022 estimated to grow at a CAGR of 4.88% from 2023 to 2032 and reach USD 29.41 billion by the end of 2032.

- The global automotive composites market size is projected to grow significantly, reaching USD 21.03 billion by 2032. The market is expected to achieve a double digit CAGR of 10.76% during the forecast period, starting from USD 8.39 billion in 2022.

- The automotive anti-lock braking system market size was valued at USD 59.58 billion in 2022 and is expected to reach USD 131.58 billion by 2032, growing at a CAGR above 9% during the forecast period (2023 - 2032).

- The lightweight cars market size was at USD 65.18 billion in 2023 to reach USD 114.86 billion by 2032, expanding at CAGR of 6.50% during the forecast period.

- The traffic signal recognition market size to rise from USD 36.22 billion in 2023 to hit USD 51.49 billion by 2032, increasing at a 4.54% between 2023 and 2032.

- The low-emission vehicle market size to rise from USD 167.97 billion in 2023 to attain USD 488.08 billion by 2032, growing at a CAGR of 12.58% between 2023 and 2032.

- The global e-bike motors market size to rise from USD 4.98 billion in 2022 to calculate USD 16.14 billion by 2032, expanding at CAGR of 13.96% between 2023 and 2032.

- The automotive night vision system market size to surge from USD 2.98 billion in 2022 and predicted to hit USD 11.41 billion by 2032, expanding at CAGR of 12.3% from 2023 to 2032.

Automotive Diagnostic Tools Market Segmentation

By Offering

• Diagnostic Hardware

• Scanner

• Code Reader

• Tester

• Analyzer

• Others

• Diagnostic Software

• ECU Diagnosis Software

• Vehicle Tracking and Emissions Analysis Software

• Vehicle System Testing Software

• Others

• Diagnostic Services

• Vehicle Maintenance and Repair

• Custom, Training, Support and Integration

By Workshop Equipment

• Exhaust Gas Analyzer

• Wheel Alignment Equipment

• Paint Scan Equipment

• Dynamometer

• Headlight Tester

• Fuel Injection Diagnostic

• Pressure Leak Detection

• Engine Analyzer

By Connectivity

• USB

• Wi-Fi

• Bluetooth

By Vehicle Type

• Passenger Cars

• Commercial Vehicles

By Handheld Scan Tools

• Scanners

• Code Readers

• TPMS Tools

• Digital Pressure Tester

• Battery Analyzer

By Type

• OEMs Diagnostic

• Professional Diagnostics

• DIY Diagnostics

By Geography

- North America

- United States

- Canada

- Rest of North America

- Europe

- Germany

- United Kingdom

- France

- Italy

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America

- Brazil

- Rest of Latin America

- Middle East and Africa

- South Africa

- Rest of Middle-East and Africa

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1036

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

Web: https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive