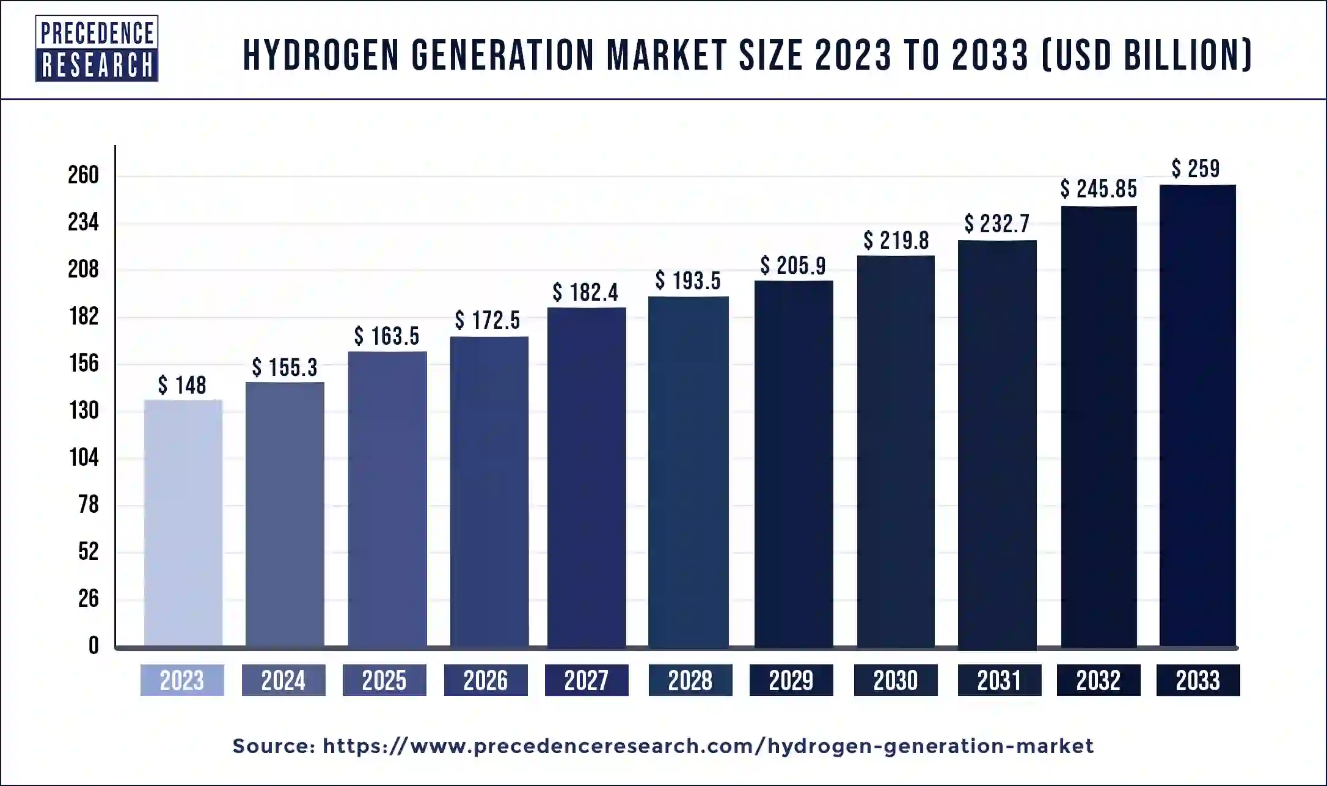

Ottawa, May 27, 2024 (GLOBE NEWSWIRE) -- According to Precedence Research, the global hydrogen generation market size is estimated to grow from USD 148 billion in 2023 to USD 245.85 billion by 2032. The hydrogen generation market is driven by increased awareness, the rise towards no-emission fuel, and advanced technologies.

U.S. Hydrogen Generation Market Size and Growth 2024 to 2033

The global U.S. Hydrogen Generation market size was valued at USD 18.3 billion in 2023 and is poised to grow from USD 19.1 billion in 2024 to USD 31.4 billion by 2033, expanding at a notable compound annual growth rate (CAGR) of 5.7% during the forecast period 2024 - 2033. The U.S. hydrogen generation market is driven by a rise in the market for clean hydrogen.

Hydrogen Generation Market Projections for Growth by Region Shows:

- North America hydrogen generation market size is expected to reach around USD 55.15 billion by 2033 and is growing at a CAGR of 5.20% from 2024 to 2033.

- Europe hydrogen generation market size is predicted to be worth around USD 42.2 billion by 2033 and is growing at a CAGR of 5.12% from 2024 to 2033.

- Latin America hydrogen generation market size is anticipated to reach USD 8.1 billion by 2033 and is registering a CAGR of 2.22% from 2024 to 2033.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1316

Hydrogen Meneration Market Revenue (USD Billion), By Technology 2020 to 2023

| Technology | 2020 | 2021 | 2022 | 2023 |

| Coal Gasification | 28.2 | 29.7 | 31.3 | 33 |

| Steam Methane Reforming | 92.1 | 95.7 | 99.6 | 104 |

| Others | 9.3 | 9.8 | 10.3 | 10.9 |

Hydrogen Meneration Market Revenue (USD Billion) By Application 2020 to 2023

| Application | 2020 | 2021 | 2022 | 2023 |

| Methanol Production | 16.4 | 17.2 | 18.1 | 19 |

| Ammonia Production | 42.6 | 44.5 | 46.6 | 48.8 |

| Ptrolium Refinary | 53 | 54.9 | 57 | 59.3 |

| Transportation | 7.8 | 8.3 | 9.4 | 10.1 |

| Power Generation | 4 | 4.3 | 4.5 | 4.8 |

| Others | 5.8 | 6 | 6.3 | 6.5 |

Hydrogen Meneration Market Revenue (USD Billion) By System 2020 to 2023

| System | 2020 | 2021 | 2022 | 2023 |

| Merchant | 96.1 | 100.1 | 104.5 | 109.4 |

| Captive | 33.5 | 35 | 36.7 | 38.6 |

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1316

The hydrogen generation market deals with the extraction, purification, transportation, and other processes related to hydrogen generation. The global search for clean energy sources has boosted interest in hydrogen as a versatile energy carrier. With high energy density, zero greenhouse gas emissions, and potential applications in transportation, power generation, and industrial processes, hydrogen is gaining recognition as a key player in the clean energy transition. Its production from diverse sources and use in various applications make it an attractive alternative to traditional fossil fuels. Hydrogen's efficiency in storage and transportation also allows for flexibility in energy distribution and remote access.

Hydrogen Generation Market Key Insights

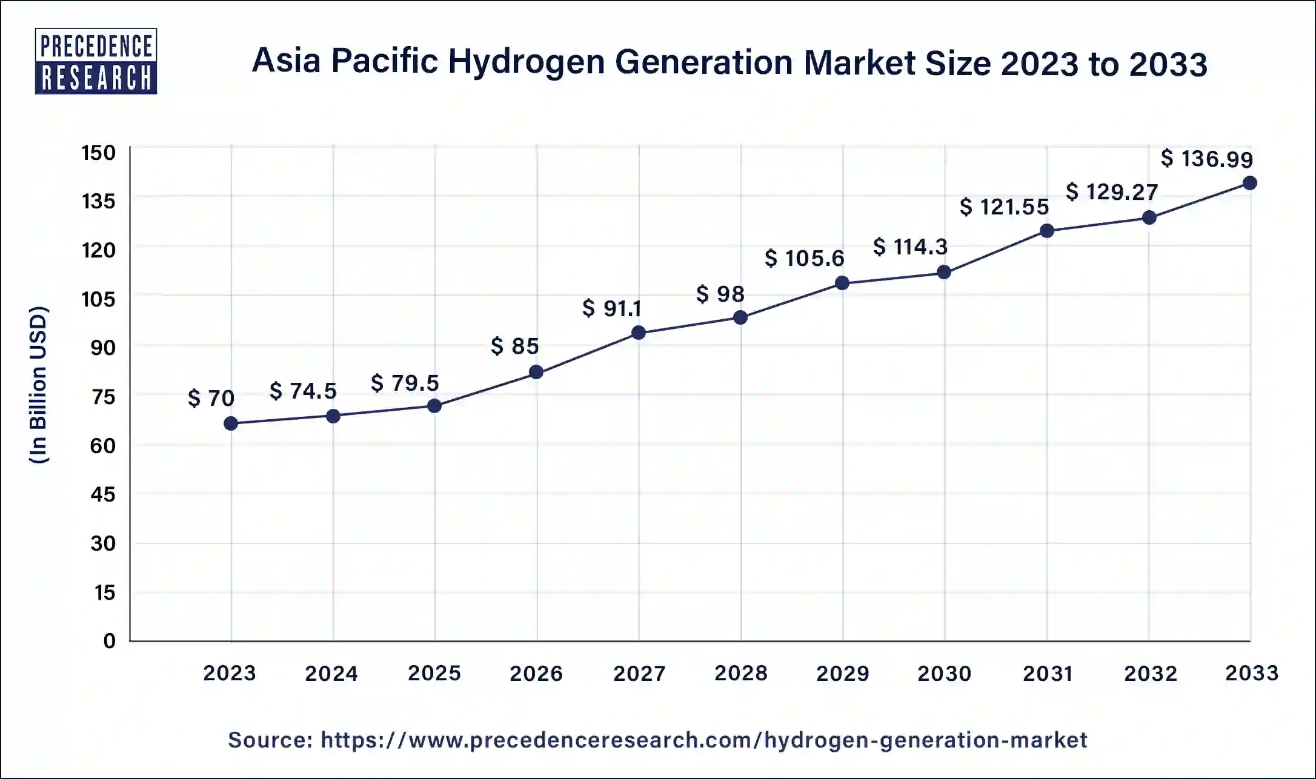

- Asia Pacific dominated the hydrogen generation market with the largest revenue share of 47.32 in 2023.

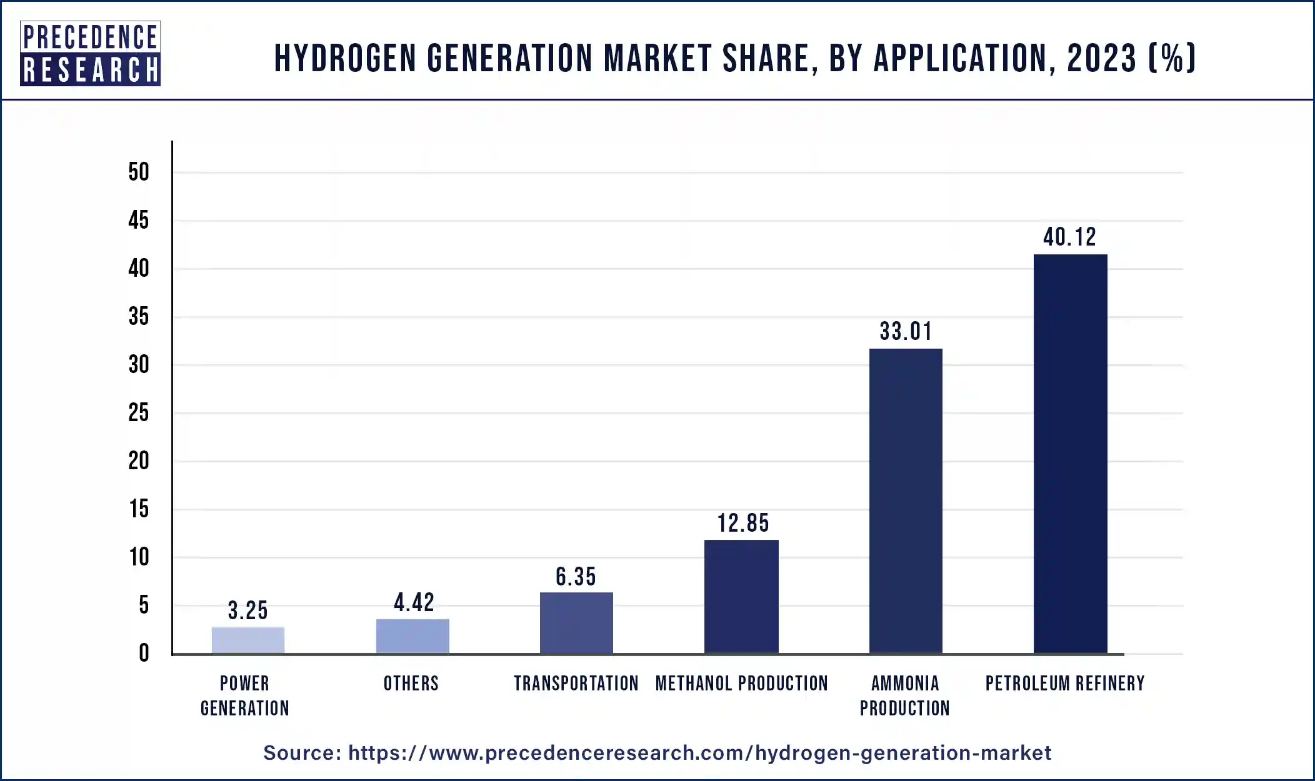

- By Application, the petroleum refinery segment has held a major revenue share of around 40.12% in 2023.

- By System, the merchant segment has contributed the biggest revenue share of 74.02% in 2023.

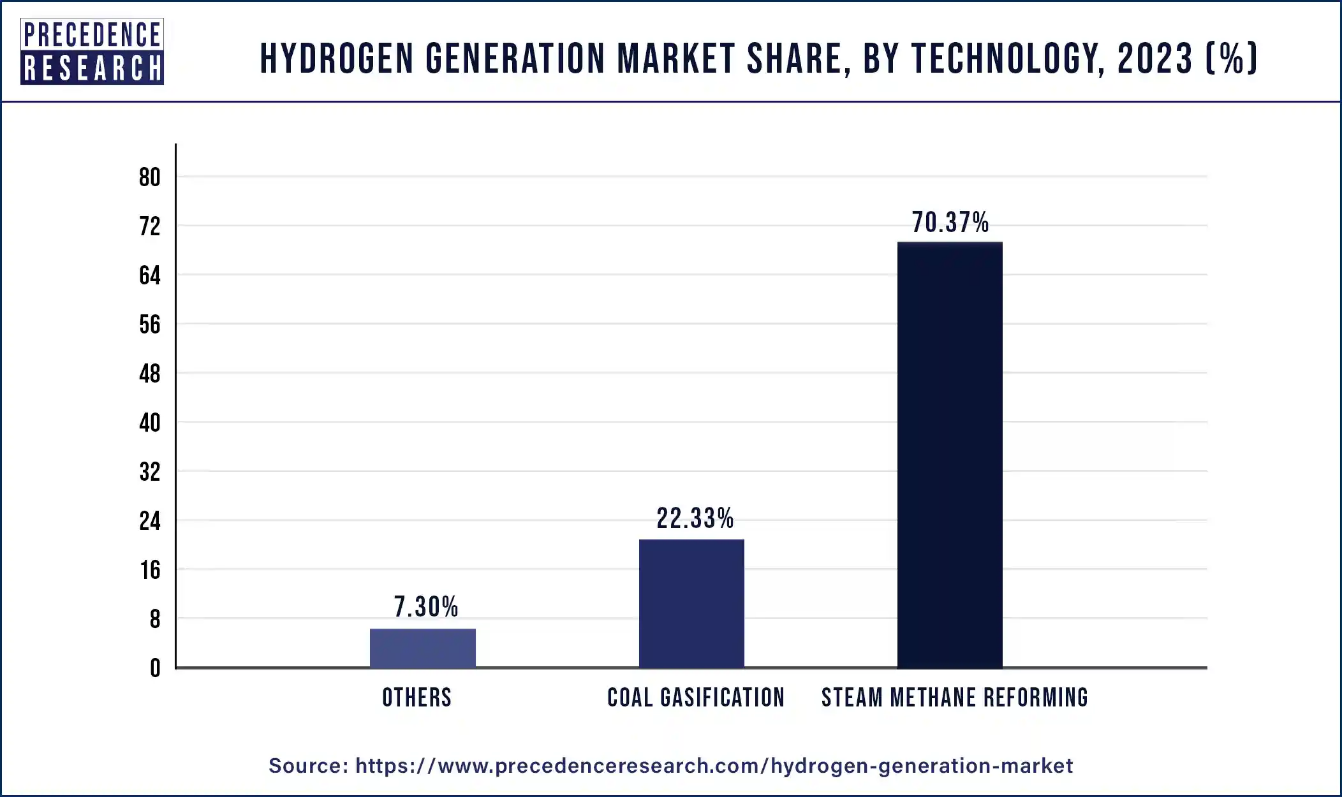

- By Technology, the steam methane reforming segment has held the largest revenue share of 70.37% in 2023.

Asia Pacific Hydrogen Generation Market Size and Growth 2024 to 2033

The Asia Pacific hydrogen generation market size accounted for USD 74.5 billion in 2024 and is projected to reach around USD 136.99 billion by 2033. The market is expected to expand at the fastest compound annual growth rate (CAGR) of 6.94% from 2024 to 2033.

Asia-Pacific dominated the hydrogen generation market in 2023 and is expected to grow at the fastest rate during the forecast period. The Asia Pacific region is expected to experience a significant increase in hydrogen demand and production due to rapid industrialization, economic growth, and advancements in renewable energy technologies. Governments are implementing policies to support hydrogen economy growth, while international collaborations are fostering a robust global hydrogen generation market, positioning the region as a key player in the hydrogen industry.

In Asia-Pacific, China is a major shareholder in hydrogen production due to energy security, climate change, urban air pollution, and competitiveness. With an emphasis on clean energy and renewable energy sources, Japan is one of the major players in the Asian energy market. $10 billion has been committed by the Japanese government to facilitate this transition; of that, $2.7 billion will go toward extensive hydrogen supply lines, and $700 million will go toward hydrogen-producing projects.

A consortium headed by Mitsubishi UFJ Bank and Japan Bank for International Cooperation is financing projects and low-carbon technology with net zero objectives. India, another up-and-coming force, is tackling the problem of finding a reliable energy supply to support its expanding population without compromising its green transition objectives. To reduce emissions and emerge as Asia's first significant exporter of hydrogen, India announced in 2022 a $2 billion incentive scheme for the green hydrogen industry.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Scope of Hydrogen Generation Market

| Report Attribute | Key Statistics |

| Hydrogen Generation Market Size in 2023 | USD 148 Billion |

| Hydrogen Generation Market Size in 2024 | USD 155.3 Billion |

| Hydrogen Generation Market Size by 2033 | USD 259 Billion |

| Hydrogen Generation Market CAGR | 5.75% from 2024 to 2033 |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Historic Data | 2021-2022 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, System Type, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Hydrogen Generation Market Highlights:

Technology Outlook:

- Coal Gasification

- Steam Methane Reforming

- Partial Oxidation (POX)

- Electrolysis

- Others

The steam methane reforming segment dominated the market in 2023

The steam methane reforming segment dominated the market in 2023. The common and cost-effective method for hydrogen production is methane steam reforming (MSR), which contributes a major share of the world's hydrogen production. The global demand for low-carbon and renewable energy sources is increasing, with SMR-produced hydrogen playing a crucial role. Advancements in SMR technology, including carbon capture and storage technologies, have improved efficiency and reduced costs, making it more competitive in the decarbonization process. Due to the unique properties of hydrogen, it is used in multiple industries, hence making steam methane reforming more popular to overcome the demands of consumers.

The coal gasification segment is expected to grow at the fastest rate as it improves electric power generation, produces hydrogen-rich syngas, and reduces CO2 emissions. It can be used in combined cycle technology (IGCC) to improve electricity efficiency while enriching CO2 and H2 in the product gas via steam shift reactions, which promotes CO2 capture with low energy demand and high-quality hydrogen generation.

Unlock the potential for future growth by requesting your personalized custom report Now! https://www.precedenceresearch.com/customization/1316

Application Outlook:

- Methanol Production

- Ammonia Production

- Petroleum Refinery

- Transportation

- Power Generation

- Others

The petroleum refinery segment dominated the hydrogen generation market in 2023

Pure hydrogen, with its high chemical activity and ease of reaction, is commonly employed in industrial operations and oil refineries to purify products and fuels. Refineries utilize significant amounts of hydrogen for de-sulfurizing crude oil to produce petrol, diesel, and other chemicals, which boosted the demand for hydrogen in recent times.

The ammonia production segment is the fastest-growing segment during the forecast period. Ammonia production is predicted to increase by 40% over the next 30 years, with hydrogen playing an important role in this growth. The ammonia sector now accounts for 1.8% of total carbon dioxide emissions, presenting an opportunity to reduce emissions.

Type Outlook

- Blue Hydrogen

- Gray Hydrogen

- Green Hydrogen

In the upcoming years, the green hydrogen segment is observed to grow at a significant rate in the hydrogen generation market. As companies, manufacturers and industries switch to clean hydrogen based operations, the demand for green hydrogen is observed to grow in the upcoming period. Green hydrogen is observed to be a clean energy source which emits no residues in the air. The rising environmental concerns across the globe are observed to promote the expansion of the segment in the market. For instance, in January 2024, Reliance Industries Ltd., announced its plans to switch to green hydrogen production by 2025.

System Outlook

- Merchant

- Captive

The merchant generation segment dominated the hydrogen generation market in 2023. Hydrogen produced on-site or in a central facility is sold to consumers via pipeline, bulk tank, or cylinder truck delivery as merchant generation. The increasing number of pipelines in different regions is the main reason for the growth of this segment. Ease of availability and reduced setup cost for hydrogen production boost the merchant hydrogen generation segment.

The captive generation segment is expected to be the fastest growing. Captive generation means hydrogen production on site for internal use. Captive segment offers improved control over energy prices, lower transmission and distribution losses, and increased dependability. They provide a consistent and reliable power source for businesses.

Browse More Insights of Precedence Research

- Hydrogen Energy Storage Market: The global hydrogen energy storage market size was estimated at USD 16.56 billion in 2023 and it is expected to surpass around USD 32.65 billion by 2033 with a registered CAGR of 7.1% from 2024 to 2033.

- Energy Storage Market: The global energy storage market size reached USD 44.7 billion in 2022 and is projected to hit around USD 167.90 billion by 2032, growing at a CAGR of 14.20% from 2023 to 2032.

- Bioenergy Market: The global bioenergy market size was estimated at US$ 125 billion in 2022 and is expected to surpass around US$ 256.42 billion by 2032, growing at a CAGR of 7.50% from 2023 to 2032.

- Energy Storage Systems Market: The global energy storage systems market size was valued at USD 246.54 billion in 2023 and is expected to hit USD 535.53 billion by 2033 and is poised to grow at a CAGR of 8.05% from 2024 to 2033.

- Thermal Energy Storage Market: The global thermal energy storage market size was estimated at USD 21.66 billion in 2022 and is projected to surpass around USD 50.57 billion by the year 2032, growing at a notable CAGR of 8.9% from 2023 to 2032.

- Energy Storage as a Service Market: The global energy storage as a service market size was valued at US$ 62 billion in 2022 and it is expected to hit over US$ 138.25 billion by 2032 with a registered CAGR of 8.40% from 2023 to 2032.

- Green Power Market: The global green power market size was estimated at US$ 54 in 2022 and it is expected to surpass around US$ 162.54 billion by 2032, poised to grow at a CAGR of 11.7% from 2023 to 2032.

Hydrogen Generation Market Dynamics

Driver: Growing industrial application

The rapidly growing industrial application of hydrogen has boosted the growth of the hydrogen generation market. Hydrogen is largely employed as an element or catalyst in ammonia, oil refining, and methanol production. Clean hydrogen can be substituted in industrial processes employing carbon capture, utilization, and storage (CCUS) and renewable energy, resulting in considerable emissions reductions and the long-term expansion of the petrochemical industry.

Ammonia might also be used as a hydrogen storage media, making it easier to transport than liquid or gas-based hydrogen. Methanol manufacturing employs hydrogen to reduce emissions in the hydrogenation process, resulting in increased fuel economy and fewer emissions.

Steelmakers are also testing hydrogen to cut emissions in the steelmaking process, which involves high temperatures and chemical reactions. Steel is a crucial building block of contemporary buildings and industrial operations; therefore, using clean hydrogen has the potential to significantly cut emissions. Concrete production is now undergoing experimental testing because hydrogen cannot be directly substituted as a component or reaction in current processes. Oil refining is another sector where clean hydrogen helps reduce carbon emissions, as oil is crucial to the global economy.

Restraint: Limited specialized workforce and high operational costs

The green hydrogen production market, despite its potential job growth, faces challenges due to a limited specialized workforce and high operational costs. The industry's maturity will be hindered by a shortage of skilled workers, as well as the high costs of storage and transport due to its flammable nature and low volumetric density. Hydrogen production needs highly skilled professionals, as hydrogen is highly flammable. And it needs to be handled very carefully.

Opportunities

Hydrogen as a future fuel

Hydrogen energy has sparked widespread interest as a potential future fuel due to its unique qualities, which include quick burn time and minimal toxicity or ozone-forming capabilities. It is derived from a combination of clean coal and fossil fuels, nuclear power, and large-scale renewables, enhancing its chances of being the main future fuel. Large-scale hydrogen manufacturing is a viable option for future fuel cell production.

Studies have found that hydrogen-powered spark-ignition engines beat gasoline-powered counterparts in terms of thermal efficiency. Hydrogen engines outperform gasoline engines in terms of thermal efficiency. Adding hydrogen to diesel fuel improves thermal efficiency while increasing nitrogen oxide emissions. All the unique properties of hydrogen, along with technological advancement, have boosted the opportunities for market players to invest in the hydrogen generation market.

Improving the methods used for hydrogen generation

The current methods used in hydrogen generation are not environmentally friendly, and this creates a great opportunity for the market to develop new methods that will be sustainable, more efficient, and will produce less carbon footprint. New technologies are being tested, which include incorporating a catalyst with PEMFC (Proton Exchange Membrane Fuel Cell Technology), hiring a Gas Diffusion Attorney with PEMFC, and combining polymer with PEMFC. The first step is to incorporate a catalyst to create hydrogen with optimum purity at 4500 degrees Celsius, hence improving energy density and photochemical activity. The second technique employs a Gas Diffusion Attorney to renew hydrogen with high specific energy, minimal hazardous emissions, rapid startup, low corrosion risk, high current density, and high operating pressure.

The third strategy employs polymer and PEMFC for hydrogen regeneration with low voltage loss and high photochemical activity. The role of nuclear power in the energy system, advancements in battery technology (e.g., higher energy density at lower cost), and numerous other novel and inventive technologies (e.g., flexible repurposing of RES electricity surpluses and alternative large-scale storage technologies) will all have an impact on green hydrogen's contribution to the decarbonization of the energy system. The government is also taking initiatives to advance the hydrogen generation method. R&D is regularly conducted by different research institutes and industries.

Recent Developments:

- In March 2024, Chinese scientists developed a strategy to produce "green" hydrogen using seawater and freshwater energy. The technology, developed by Fudan University, uses a high-performance ion exchange membrane and electrodes to collect osmotic energy in river mouths, aiming to reduce carbon dioxide emissions in the energy sector and accelerate hydrogen production.

- In March 2024, Sterling Generators Private Ltd, part of Sterling and Wilson Private Limited, signed an agreement with Tecnicas Reunidas, a world leader in energy engineering and construction, for the joint development of a 1 MWe hydrogen electrolyzer. The agreement, signed at the Embassy of Spain in India, is expected to be commissioned in the last quarter of 2024 and scaled up to 10MW.

- In February 2024, China International Marine Containers Group Co., the world's largest shipping container manufacturer, reported a significant increase in revenues from its hydrogen business, indicating the commercial traction of clean fuel. The company produced electrolyzers and gas storage containers, generating $139 million in sales last year.

Hydrogen Generation Market Top Companies

- Linde plc

- Praxair, Inc.

- Hydrogenics

- Inox

- Messer Group GmbH

- Weldstar, Inc.

- Air Products and Chemicals, Inc.

- McPhy

- Air Liquide International S.A.

- LNI Swissgas

Hydrogen Generation Market Segmentation

By Technology

- Coal Gasification

- Steam Methane Reforming

- Partial Oxidation (POX)

- Electrolysis

- Others

By Application

- Methanol Production

- Ammonia Production

- Petroleum Refinery

- Transportation

- Power Generation

- Others

By Type

- Blue Hydrogen

- Gray Hydrogen

- Green Hydrogen

By System Type

- Merchant

- Captive

By Source

- Natural Gas

- Coal

- Biomass

- Water

By Regional

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1316

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us: