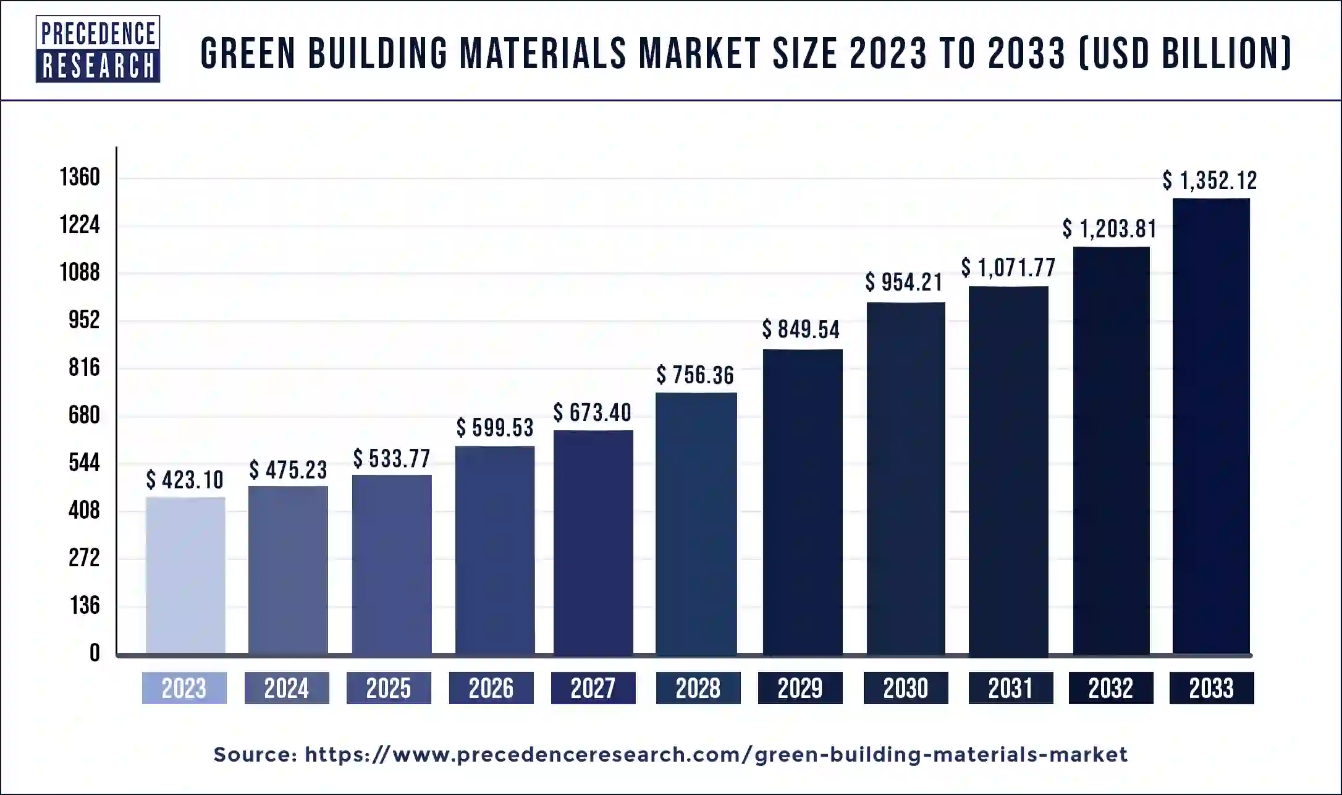

Ottawa, May 27, 2024 (GLOBE NEWSWIRE) -- According to Precedence Research, the global green building materials market size was estimated at USD 423.10 billion in 2023 and is projected to surpass around USD 1,203.81 billion by 2032. The green building materials market is driven by a shift towards using sustainable materials, rising environmental concerns, and novel technologies

The green building materials market encompasses construction materials that are environmentally responsible and resource-efficient throughout their life cycle, from extraction or harvesting to manufacturing, transportation, installation, use, and disposal or recycling. Environmentally friendly materials, commonly referred to as green building materials, are long-lasting, reusable, and recyclable materials derived from local sources. Cold, heat, or humidity cannot ruin these materials.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4296

Sustainable technology products and materials are extremely durable and can include technologies such as energy capture and pollutant removal. Timber is the most extensively utilized green building material due to its minimal environmental effect. Other green materials include isolated renewable materials like cellulose, which are fully recyclable and biodegradable, as well as wood treatments and natural paints that do not affect the ozone layer and do not include solvents or other chemical compounds.

Key Insights

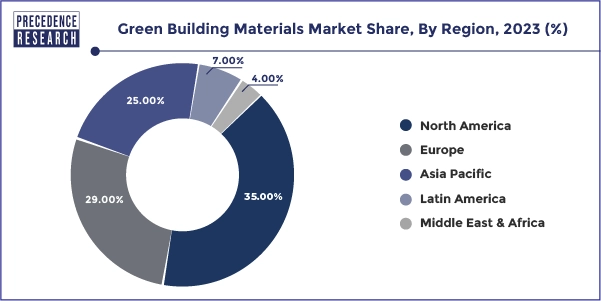

- North America dominated the market with the highest revenue share of 35% in 2023.

- Asia Pacific is observed to expand at a rapid pace during the forecast period.

- By application, the insulation segment has held the largest revenue share in 2023.

- By application, the roofing segment is expected to witness a significant share during the forecast period.

- By end-use industry, the residential segment has held the major revenue share in 2023.

- By end-use industry, the commercial segment is expected to grow significantly during the forecast period.

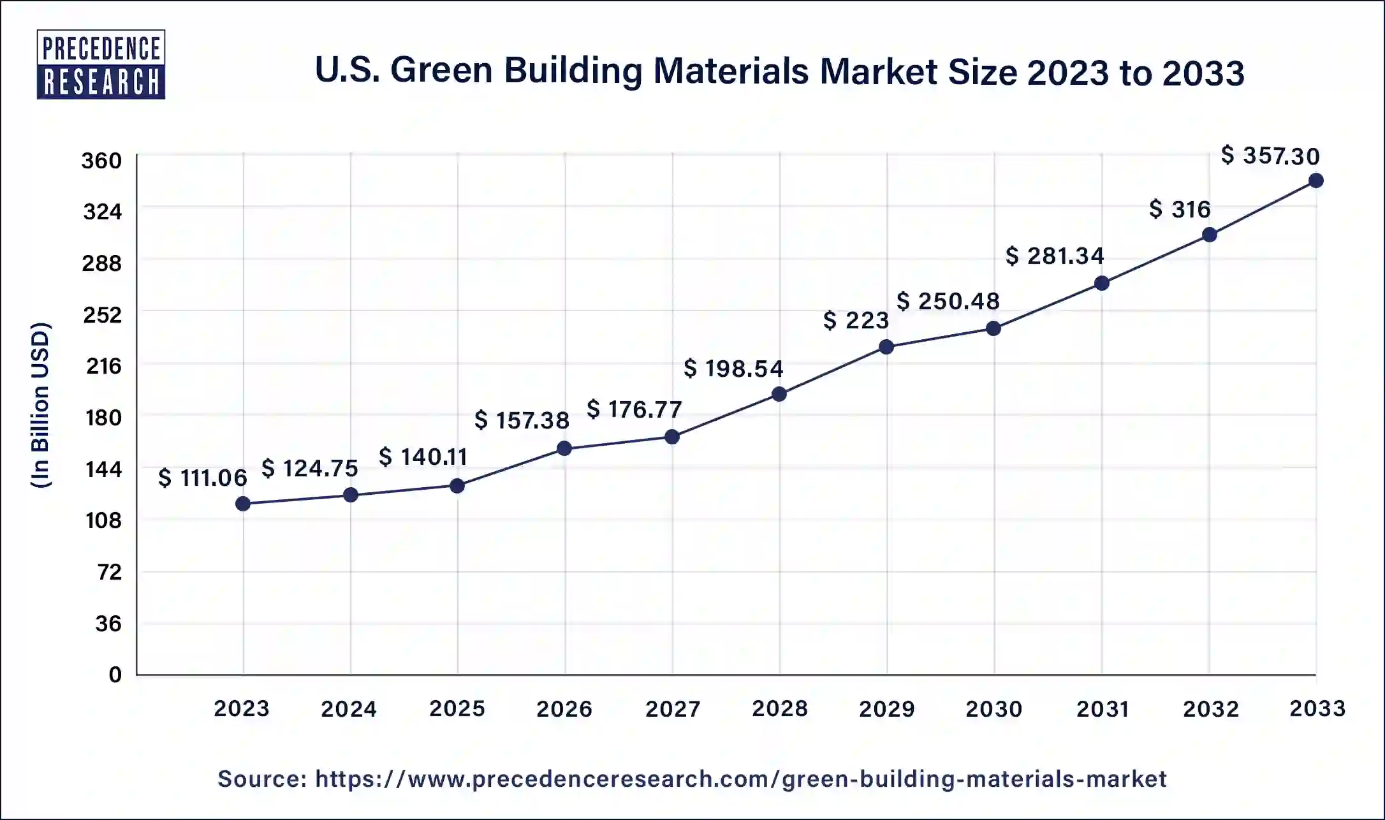

U.S. Green Building Materials Market Size and Growth 2024 to 2033

The U.S. green building materials market size was valued at USD 111.06 billion in 2023 and is poised to grow from USD 124.75 billion to USD 357.30 billion by 2033, expanding at a solid CAGR of 12.39% from 2024 to 2033.

North America dominated the green building materials market in 2023. While the industry is likely to expand significantly, considerable changes are required to make high-performance buildings the standard. Green building elements can help to save energy, reduce carbon emissions, use less water, and minimize waste. Economic forces are accelerating the uptake of green buildings in the U.S. and Canada as the cost of delivering sustainable structures decreases.

However, firms incur expenditures for gaining knowledge, and the large long-term financial benefits of green design surpass the early costs. Governments are overcoming barriers via construction laws, zoning regulations, tax breaks, and preferential treatment for green builders. Mexico's National Housing Commission is recording green practices and establishing standards for green dwellings, while Infonavit, a significant housing fund, has launched a "green mortgage" scheme.

Asia-Pacific is expected to grow at the fastest rate during the forecast period. India is concentrating on green buildings to combat pollution and promote environmentally friendly construction methods. According to a recent Anarock analysis, green buildings may save 20-30% on energy and 30-50% on water, lowering the demand for lighting and air conditioning. Furthermore, they have a reduced carbon footprint compared to traditional constructions. Although green homes may cost at least 15% more than traditional structures and 3-5% more than conventional buildings, increased demand for green buildings in India has resulted in cost reductions due to the greater availability of green materials, products, and technology.

- In April 2024, Navrattan Group, an Indian construction business, plans to offer eco-friendly "Green Cement" to the market to meet the rising demand for sustainable building materials that do not sacrifice performance or durability. Green cement is an alternative to traditional Portland cement that reduces carbon emissions and environmental effects. Himansh Verma, the founder of the Navrattan Group, thinks that green cement will address the urgent demand for environmentally responsible solutions in India's fast-developing building industry.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Scope of Green Building Material Market

| Report Attribute | Key Statistics |

| Green Building Material Market Size in 2023 | USD 423.10 Billion |

| Green Building Material Market Size in 2024 | USD 475.23 Billion |

| Green Building Material Market Size by 2033 | USD 1,352.12 Billion |

| Green Building Material Market CAGR | 12.32% from 2024 to 2033 |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Historical Year | 2021-2022 |

| Segments Covered | Application, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Report Highlights

Application Insights

The insulation segment dominated the green building materials market in 2023. There is great significance of insulation in green building materials, emphasizing its role in energy efficiency, comfort, and environmental impact. Insulation is essential in green home building for saving energy, increasing comfort, and lowering greenhouse gas emissions. Well-insulated dwellings reduce heating and cooling costs, lowering dependency on nonrenewable energy sources. Prioritizing insulation during building or retrofitting helps to provide more sustainable living conditions and decreases a home's ecological footprint.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/4296

The roofing segment is expected to experience a significant share during the forecast period. Green roofs have several economic benefits, such as lower energy costs, higher property value, and the establishment of new ecosystems for flora and wildlife. They help mitigate the effects of severe temperatures and heat islands in cities, absorb harmful radiation, and absorb hazardous contaminants. Green roofs help cut power use by collecting and storing heat, serving as insulators in the winter and conditioning in the summer. They help minimize air pollution and emissions of greenhouse gases by dry deposition, carbon sequestration, and storage. Green roofs can contribute to the slower production of ground-level ozone by lowering air temperature.

End-use Insights

The residential segment dominated the green building materials market in 2023. Green construction materials have several benefits, including energy savings, indoor air quality, durability, conserving water, comfort, and aesthetics. Green materials are selected based on Life Cycle Assessment (LCA), recycled content, resource efficiency, embodied energy, renewable resources, indoor air quality, and water efficiency. LCA assesses a construction material's environmental effect, whereas recycled content measures the quantity of materials utilized in manufacture. Renewable resources are viewed as more sustainable than nonrenewable ones. Indoor conditions and water efficiency are other important considerations when choosing sustainable construction materials.

The commercial segment is expected to witness significant growth during the forecast period. Sustainable materials are renewable, resilient, and long-lasting, decreasing waste while increasing energy efficiency. They are cost-effective, with greater upfront expenditures but long-term advantages. They also provide health and safety benefits, such as improved indoor air quality and comfort. Furthermore, sustainable materials may improve the reputation of a business and marketing efforts, enticing both customers and investors.

Browse More Insights:

- Technical Insulation Market: The global technical insulation market size was valued at USD 7.79 billion in 2022 and expected to reach USD 10.51 billion by 2032, with a CAGR of 3.10% from 2023 to 2032.

- Building Automation Systems Market: The global building automation systems market size is expected to hit around USD 204.97 billion by 2032 from USD 92.83 billion in 2023 and is poised to grow at a CAGR of 9.20% from 2023 to 2032.

- Insulation Materials Market: The global insulation materials market size was estimated at USD 67 billion in 2022 and it is projected to surpass around USD 110.7 billion by 2032, growing at a CAGR of 5.20% from 2023 to 2032.

- Building Integrated Photovoltaics Market: The global building integrated photovoltaics market size was estimated at USD 19 billion in 2022 and it is expected to expand around USD 143.99 billion by 2032, expanding at a CAGR of 22.5% from 2023 to 2032.

- OEM Insulation Market: The global OEM insulation market size was valued at USD 32 billion in 2022 and is expected to reach around USD 53.89 billion by 2032 and expected to grow at a CAGR of 5.4% from 2023 to 2032.

- Building and Construction Sealants Market: The global building and construction sealants market size was valued at USD 10.29 billion in 2023 and is anticipated to reach around USD 18.65 billion by 2033, growing at a CAGR of 6.13% from 2024 to 2033.

Market Dynamics

Drivers

Environmental concerns

Shift towards green materials due to environmental concerns is a driving factor for the growth of the green building materials market. Buildings with a Green grade are frequently chosen for their reduced environmental effect, greenhouse gas emissions, and healthier working conditions. These structures make effective use of resources, including land, energy, water, materials, natural lighting, and enhanced interior air quality. This improves the general health, comfort, and productivity of inhabitants.

Increasing renovation and construction

The housing and construction sectors are very volatile, with housing patterns and land prices influencing corporate performance. A spike in rehabilitation projects has created both possibilities and problems for builders. To fulfill rising demand and ensure effective project execution, construction workers may look for powerful construction takeoff software that combines forces with artificial intelligence. For the first time in 2022, reconstruction billings outpaced new building projects.

The reasons for this tendency include an existing housing scarcity, inflation, a pandemic, aged infrastructure and buildings, and shifting tastes. Home contractors may observe an increase in demand for open floor designs, collaborative workspaces, green structures, and aging-in-place options. Businesses may better satisfy the requirements of their clientele by staying up to date with current trends and technical developments.

Restraint

High cost

The green building materials market is hampered by the high cost of technologies and materials like rainwater collection systems, energy-efficient windows, and solar panels, which make sustainable construction difficult. These costs might raise the cost of developing and maintaining sustainable buildings, which would be prohibitive for developers and residents. Furthermore, developers may find it more difficult to defend the first investment in sustainable architecture due to the lack of evident advantages.

Opportunity

Long-term benefits

Green building materials may save AEC professionals money in both the long and medium term since they are more energy efficient, last longer, and are durable. They also lessen the need for regular replacements or repairs. Lifecycle expenses, including maintenance and disposal, can help to reduce costs. Furthermore, employing sustainable materials complies with green construction requirements and laws, perhaps leading to tax breaks or refunds. This is consistent with the increased demand for environmentally responsible buildings, making it an economically sound alternative.

Recent Developments

- In May 2024, Feldballe Friskole, a private school in Djursland, Denmark, is building a 250-square-meter addition using straw walls, a wooden roof, and non-toxic materials. The 250-square-meter expansion features a new physics and chemistry lab, as well as an older students' classroom. The design makes use of compacted straw in wooden cassettes for quick disassembly, which adheres to the Design for Disassembly concept. The extension is composed of locally available clay and wood, which are fast renewable and have a substantially lower carbon impact than standard building materials.

- In January 2024, the forthcoming budget must highlight environmental responsibility and Nationally Determined Contributions (NDCs) to reduce emissions intensity, notably in the construction and operation of buildings, which account for 40% of global carbon emissions. Key expectations include incentives for green construction materials and increased R&D spending to lower emissions intensity.

- In September 2023, Adani Group's ACC, a cement and building material firm, announced the establishment of India's first Green Building Centre, which will focus on sustainable construction solutions. The center introduced novel concrete products in many locations, such as Kerb Stones, RCC Saucer Drain Covers, Hollow and Solid Concrete Blocks, and Tactiles, considerably increasing ACC's impact in the construction business.

Green Building Materials Market Companies

- BASF SE

- Bauder Ltd.

- Interface Inc.

- Owens Corning Dupont

- Alumasc Group plc.

- Saint-Gobain

- Binderholz GmbH

- Homasote Company

- Sika AG

- Kingspan Limited

- CertainTeed Corporation

- Lafarge Company

- Soben International (Asia-Pacific) Ltd

- LG Hausys Ltd.

- RedBuilt LLC

- Binderholz GmbH

- Wienerberger AG

- PPG Industries, Inc.

- Holcim

Segments Covered in the Report

By Application

- Framing

- Insulation

- Roofing

- Exterior Siding

- Interior Finishing

- Other Applications

By End-use Industry

- Residential

- Commercial

- Industrial and Institutional

- Infrastructure

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4296

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us: