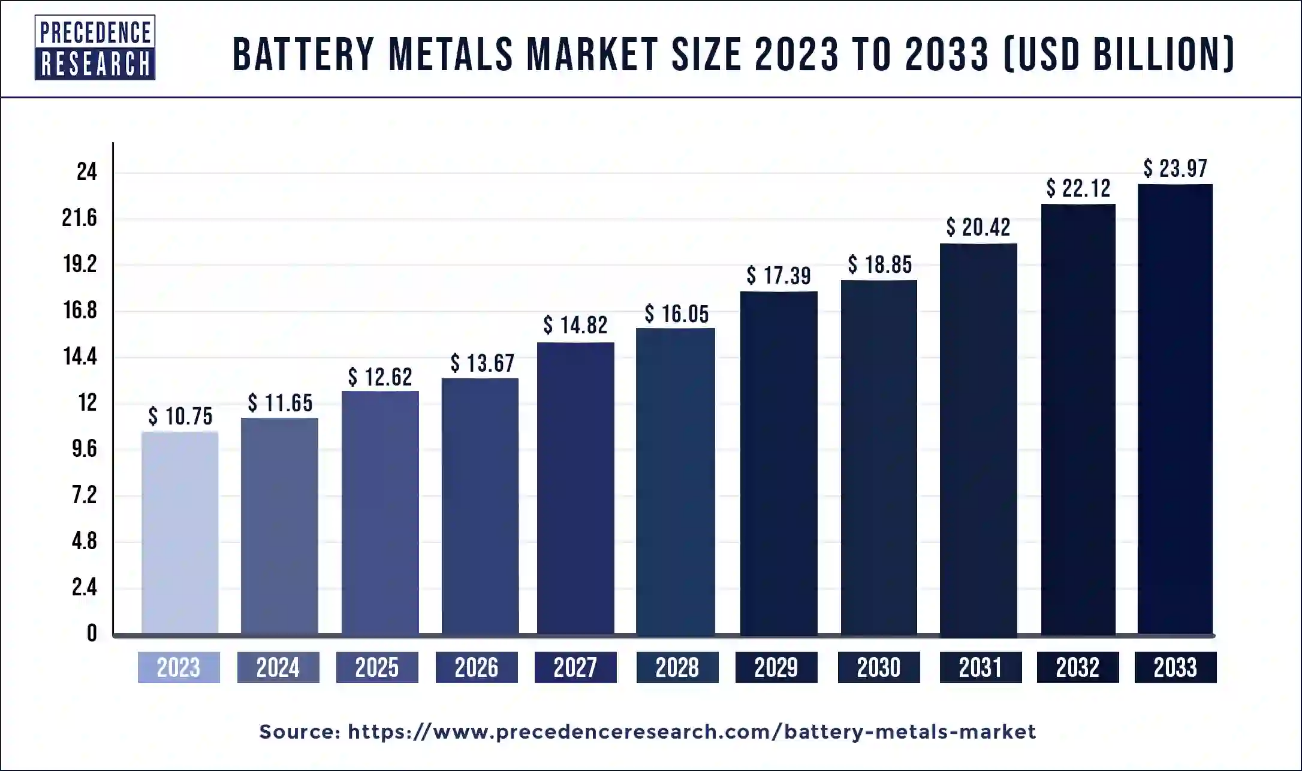

Ottawa, June 05, 2024 (GLOBE NEWSWIRE) -- The global battery metals market size is estimated to increase from USD 10.75 billion in 2023 to USD 23.97 billion by 2033. The market is projected to show solid growth from 2024 to 2033, with a CAGR of 8.35%. The battery metals market is driven by the increasing adoption of electric vehicles, increasing government initiatives, and the latest technologies.

The battery metals market refers to the industry involved in the extraction, processing, and supply of metals used in the production of batteries, particularly those used in electric vehicles (EVs), consumer electronics, and energy storage systems. Rechargeable batteries require battery materials such as lithium, graphite, nickel, manganese, cobalt, alumina, tantalum, magnesium, tin, and vanadium.

The global demand for electric cars and battery-based systems for storing energy is prompting manufacturers to safeguard their resources. Lithium, a lightweight and low-density substance with high energy density, is a common choice for batteries.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4350

Battery Metals Market Key Insights:

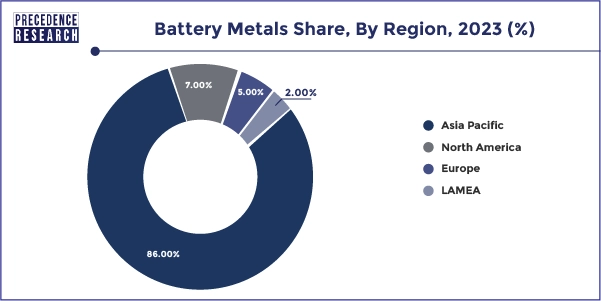

- Asia Pacific has held a major revenue share of 86% in 2023.

- North America is expected to expand at a notable in the market during the forecast period.

- By metal, the cobalt segment has held the largest revenue share in 2023.

- By metal, the lithium segment is projected to grow at the fastest CAGR during the forecast period.

- By application, the starter, lighting, and ignition (SLI) segment has contributed the biggest revenue share in 2023.

- By application, the electric vehicles segment is expected to grow rapidly during the forecast period.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

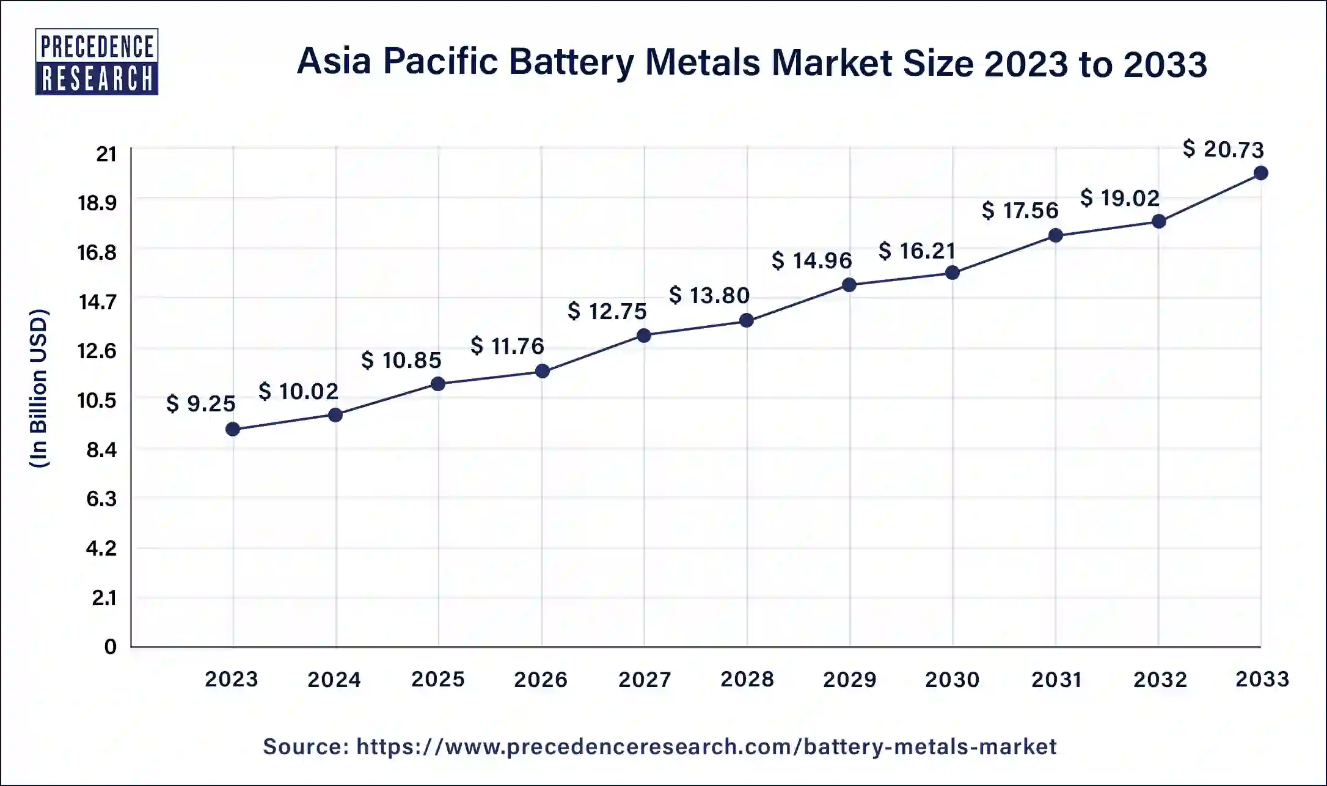

Asia Pacific Battery Metals Market Size and Growth Rate Analysis 2024 to 2033

The Asia Pacific battery metals market size was USD 9.25 billion in 2023, calculated at USD 10.02 billion in 2024 and is anticipated to reach around USD 20.73 billion by 2033, registering a solid CAGR of 8.40% from 2024 to 2033.

Asia-Pacific dominated the battery metals market in 2023. The market is a critical worldwide commodity due to rising demand for batteries in the electric car and renewable energy industries. These metals are critical components of rechargeable battery packs, which power gadgets such as smartphones and electric vehicles. The industry is active and developing, owing to increased electrification of transportation and the need for renewable energy storage solutions. As technology progresses and environmental concerns gain prominence, the industry is projected to experience major changes.

- For instance, in 2023, China's electric car industry saw a 35% growth in registrations, reaching 8.1 million, despite an 8% decrease in conventional car sales. The New Energy Vehicle (NEV)3 sector saw its first year without national subsidies, while tax breaks and non-financial assistance remained. Province-led assistance and investments also play an important role. China shipped more than 4 million automobiles in 2023, including 1.2 million EVs, a 65% increase over 2022.

North America is expected to grow at the fastest rate during the forecast period. Electric cars are critical for decreasing air pollution in highly populated places, diversifying energy sources, and lowering greenhouse gas emissions. They provide benefits like zero tailpipe emissions and greater fuel economy than combustion-powered automobiles. As technology progresses, the demand for electric cars rises, necessitating a significant supply of lithium-ion batteries. The demand for rechargeable batteries and their inputs, such as cobalt, lithium, copper, nickel, and manganese, is rising. This has resulted in a significant growth in demand for electric, hybrid, and plug-in hybrid cars, hence propelling the battery metals industry.

- For instance, in 2023, new electric vehicle registrations in the United States increased by 40% to 1.4 million. Despite a reduced yearly increase, demand for electric vehicles has remained high. The updated Clean Vehicle Tax Credit standards and price decreases make certain popular EV vehicles, like the Tesla Model Y, eligible for credit. Despite worries related to potential bottlenecks or manufacturing delays, the new requirements under the Inflation Reduction Act boosted sales. Sales of the Tesla Model Y grew by 50% compared to 2022.

Scope of Battery Metals Market

| Report Attribute | Key Statistics |

| Battery Metals Market Growth Rate | 8.35% from 2024 to 2033 |

| Battery Metals Market Size by 2033 | USD 23.97 Billion |

| Battery Metals Market Size in 2023 | USD 10.75 Billion |

| Battery Metals Market Size in 2024 | USD 11.65 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Historical Year | 2021-2022 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Metal, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Unlock the potential for future growth by requesting your personalized custom report Now! https://www.precedenceresearch.com/customization/4350

Battery Metals Market Highlights

Metal Outlook

The cobalt segment dominated the battery metals market in 2023. Cobalt is essential for increasing the density of energy and stability in lithium-ion batteries that rely on lithium ions moving between the anode of a battery and the cobalt-containing cathode. When coupled with nickel, cobalt enhances energy density, resulting in longer driving ranges and better performance in electric cars. Cobalt-based cathodes are recognized for their stability and extended cycle life, allowing EV batteries to go through several cycles before capacity degrades. Furthermore, cobalt-containing batteries retain a constant voltage output, resulting in consistent performance. Because of their capacity to tolerate high charging rates, they also allow for fast charging.

The lithium segment is expected to grow at the fastest rate during the forecast period. Lithium-ion batteries have several benefits, including high energy density, little memory effect, minimal self-discharge, and environmental friendliness. They have an elevated density of energy, which means they can hold more energy for a given size than other varieties. They also have a lesser self-discharge rate than conventional rechargeable batteries and produce less trash than disposable batteries. Furthermore, they are free of hazardous elements such as lead and cadmium. Overall, lithium-ion batteries are a preferred option for a variety of uses.

Application Outlook

The starter, lighting, and ignition (SLI) segment dominated the battery metals market in 2023. The starting, lighting, and ignition (SLI) battery is an essential component in automobile engineering, supplying power to start the engine, illuminate the road, and power critical electrical components. SLI batteries are generally lead-acid, with lead plates immersed in sulfuric acid electrolyte. They are grouped in cells, each producing 2.1 volts. During the charging and discharging phases, chemical processes occur within every cell, converting lead sulfate to lead dioxide and lead. This procedure guarantees that the vehicle's systems perform smoothly, which contributes to road safety and convenience.

The electric vehicle industry is predicted to expand fast due to developments in battery technology, concerns about the environment, and greater investment in infrastructure for charging, making electric automobiles more convenient and eco-friendly. Lithium, cobalt, nickel, graphite, and manganese are all necessary components in electric car batteries. Lithium drives current gadgets and renewable energy systems, whereas nickel is essential for batteries. Cobalt is utilized in high-temperature alloys, and manganese enhances battery performance and safety. Graphite, typically used in pencils, accounts for approximately half of battery materials.

Browse More Reports:

- Electric Powertrain Market: The global electric powertrain market size was valued at USD 109.23 billion in 2023 and is anticipated to reach around USD 438.08 billion by 2033, growing at a CAGR of 14.91% from 2024 to 2033.

- Battery Power Tools Market: The global battery power tools market size was valued at USD 25.43 billion in 2023 and is anticipated to reach around USD 49.70 billion by 2033, growing at a CAGR of 6.93% from 2024 to 2033.

- Battery Management System Market: The global battery management system market size was estimated at USD 9.78 billion in 2023 and it is expected to hit around USD 62.84 billion by 2033, poised to grow at a CAGR of 20.42% from 2024 to 2033.

- Battery Technology Market: The global battery technology market size was valued at USD 105 billion in 2022 and it is expected to hit around USD 223.55 billion by 2032 with a CAGR of 7.90% from 2023 to 2032.

- Sustainable Battery Materials Market: The global sustainable battery materials market size was valued at US$ 45 billion in 2022 and it is expected to surpass around US$ 82.51 billion by 2032 with a registered CAGR of 6.30% from 2023 to 2032.

- Battery Materials Market: The global battery materials market size was valued at US$ 50.28 billion in 2021 and it is expected to hit US$ 82.3 billion by 2030 with a registered CAGR of 5.63% during the forecast period.

- Electric Vehicle Battery Recycling Market: The global electric vehicle battery recycling market size was valued at USD 2.8 billion in 2022 and is expected to reach around USD 42.48 billion by 2032, growing at a high CAGR of 31.3% during the forecast period 2023 to 2032.

Battery Metals Market Dynamics

Driver: Adoption of electric vehicles

Increasing adoption of electric vehicles is a major driving factor for the battery metals market. In 2023, approximately 14 million new electric vehicles were registered worldwide, raising the total amount of them on the road to 40 million. Electric vehicle sales in 2023 were 3.5 million greater than in 2022, representing a 35% year-on-year rise and accounting for around 18% of all vehicles sold. In 2023, battery electric cars accounted for 70% of the total electric vehicle stock.

However, sales remain concentrated in a few key areas, with China accounting for slightly less than 60% of new registrations, Europe for 25%, and the United States for 10%. This concentration has a considerable impact on worldwide trends, as does the shift to electric vehicles in these areas.

Restraint: Recycling difficulties

Recycling lead-acid batteries has historically been successful owing to its 100% lead recycling, but recent developments favor lithium-ion batteries because of their better technology, longer battery life, and higher power density. However, large-scale recycling of batteries has several problems, including safe transportation, optimizing the economic worth of recovered components, and the intricacies of battery design diversity.

Lithium batteries differ in chemistry and composition, making it hard for recycling facilities to filter and separate them by composition, increasing costs and slowing recycling. These batteries' structures are not standardized; therefore, dismantling is unsystematic and requires human effort. This presents substantial hurdles to recycling operations.

Opportunity: New technology for battery production

Novel technology for battery production has a great opportunity for the battery metals market. Lithium-ion (Li-ion) batteries retain and discharge energy by transferring lithium ions from the positive to negative electrodes via the electrolyte. These batteries offer the best energy density, charge quickly, and last a long time.

Lithium-sulfur (Li-S) batteries employ light active materials and have a potential energy density four times that of lithium-ion. Saft picked the most potential Li-S technology based on a solid-state electrolyte, which provides high energy density, extended life, and higher gravimetric energy density. Solid-state batteries offer a technological paradigm change by replacing the liquid electrolyte with a solid compound, which improves safety, allows for high-voltage, high-capacity materials, and is suitable for electric cars because of their high power-to-weight ratio.

Recent Developments:

- In May 2024, Wyloo, a Canadian nickel miner, intends to construct a battery materials processing plant in Sudbury, Ontario, to address a crucial gap in Canada's electric car battery supply chain. The plant will create low-carbon sulfate nickel and nickel-dominant pCAM, which are important elements in EV batteries, therefore improving Canada's domestic EV battery supply chain.

- In May 2024, The Fair Cobalt Alliance, a multi-stakeholder organization formed in 2020, seeks to generate riches for the DRC by building an African battery metals industrial value chain. It encourages investment in child labor remediation, humane working conditions, and increased household incomes for local mining communities. The alliance intends to work with small-scale and artisanal miners to solve the various issues related to artisanal exploitation.

- In May 2024, Patriot Battery Metals dissolved its exclusive lithium relationship with Albemarle, which began in August 2023. The MOU, which was a private transaction worth around C$109 million, sought to investigate mine manufacturing collaboration and connect to downstream chemical processing facilities in North America. Albemarle's investment permitted essential capital works, but Patriot thinks the termination opens new cooperation prospects in the lithium business.

Battery Metals Market Top Companies

- Glencore

- Tinaqi Lithium

- Albemarle Corporation

- SQM S.A.

- Umicore

- LG Chem

- Norilsk Nickel

- Bolt Metals

- Ganfeng Lithium Co., Ltd.

- Sumitomo Metal Mining Co. Ltd.

- Vale

- CMOC

- MITSUBISHI MATERIALS

- Eramet

- Anglo-American PLC

Segment Covered in the Report

By Metal

- Lithium

- Cobalt

- Nickel

- Others

By Application

- Starter, Lighting, and Ignition

- Electric Vehicles

- Electronic Devices

- Stationary Battery Energy Storage

- Other

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4350

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us: