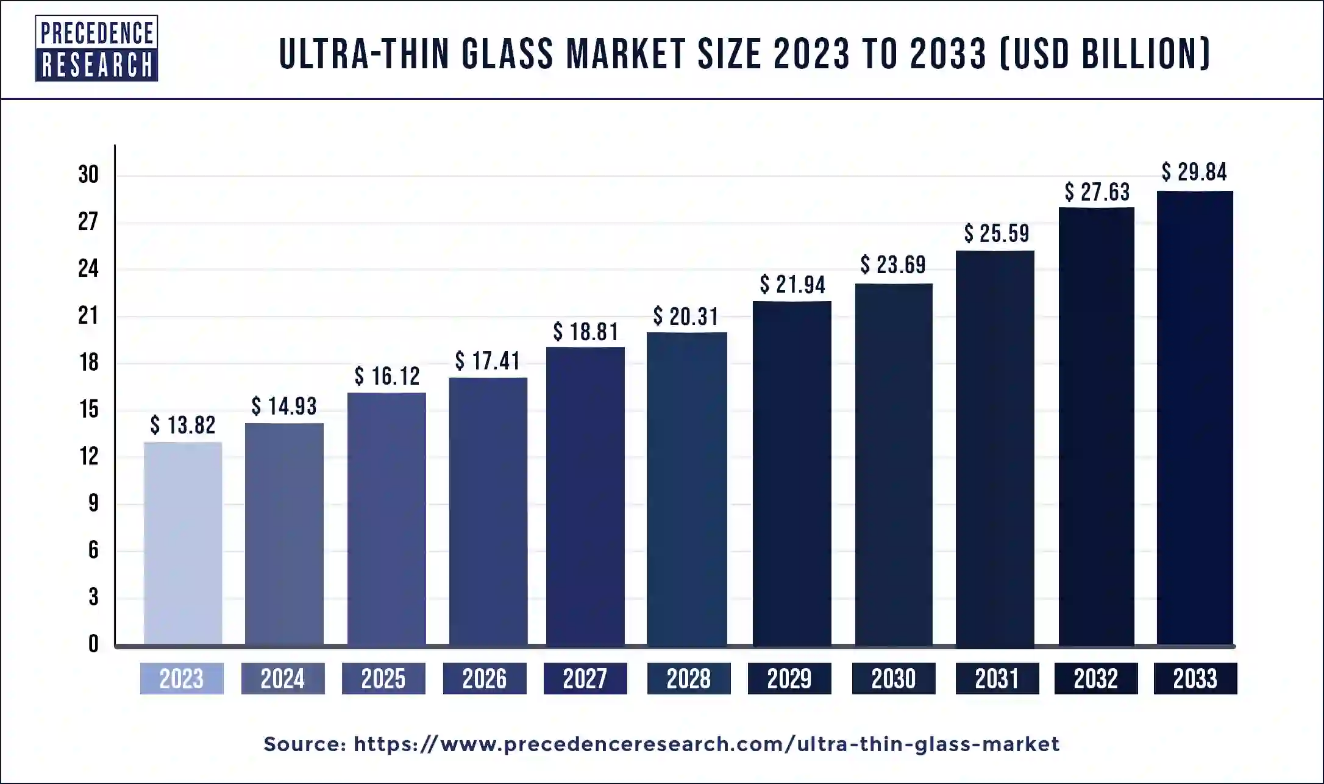

Ottawa, June 06, 2024 (GLOBE NEWSWIRE) -- According to Precedence Research, the global ultra-thin glass market size is predicted to increase from USD 13.82 billion in 2023 to USD 29.84 billion by 2033. The Ultra-thin glass market is driven by increasing demand for scratch-resistance displays and technological advancement.

The ultra-thin glass market refers to the global industry involved in the production, distribution, and application of glass that is exceptionally thin, typically defined as having a thickness of 2 millimeters or less. This type of glass offers a unique combination of flexibility, lightness, and strength, making it suitable for a variety of high-tech and advanced applications.

Ultra-thin glass has the same thermal expansion coefficient as silicon, resulting in great dimensional stability, high transparency, minimal electric loss, and an even, smooth surface. It can be used as a platform for IC packaging, increasing dependability and lowering warpage. It also provides improved electrical insulation in the high-frequency band, enabling data transfer via metallic "through glass vias" with reduced power dissipation and faster speeds.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1149

Ultra-thin glass may also be used for touch panels, touch sensors, smartphone screens, and diagnostic instruments. Engineers can turn ordinary items into thinner, smaller, and more efficient technologies by thinking at the micron level. Ultra-thin glass, known for its thinness, lightness, and transparency, finds applications in various industries such as touchscreens, displays, eyewear, construction, automotive, photovoltaic, medical devices, home products, and lighting fixtures. Its specialized use is determined by its physical qualities.

Ultra-thin Glass Market Key Insights

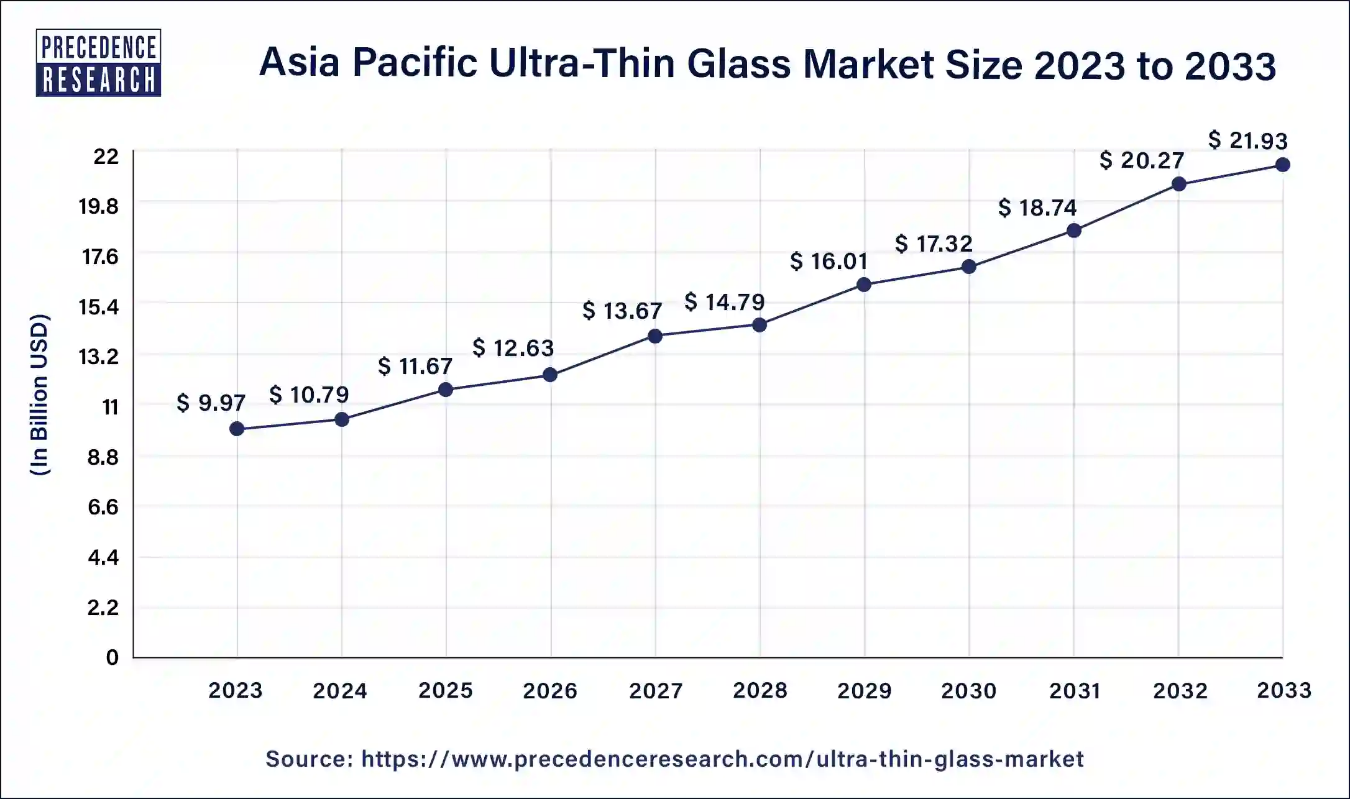

- Asia Pacific dominated the ultra-thin glass market with the largest revenue share of 72.14% in 2023.

- By region, Europe is expected to witness growth at a prominent rate during the forecast period.

- By application, the flat panel displays segment has held a major revenue share of 40% in 2023.

Asia Pacific Ultra-Thin Glass Market Size and Growth 2024 to 2033

The Asia Pacific ultra-thin glass market size was USD 9.97 billion in 2023, accounted for USD 10.79 billion in 2024 and is expected to hit around USD 21.93 billion by 2033, growing at a CAGR of 8.2% from 2024 to 2033.

Asia-Pacific dominated the ultra-thin glass market in 2023. Demand for LED and OLED televisions is driving market expansion in Asia-Pacific, with Chinese, South Korean, and Taiwanese manufacturers leading the industry. These displays are utilized in automobiles, industrial machinery, personal computers, and cell phones. The most common form of LCD is liquid crystal displays; however, smartphones employ organic light-emitting diodes (OLEDs) and quantum dot displays instead. The large concentration of flat panel display producers, as well as automotive manufacturers' usage of ultra-thin glass in China, India, and South Korea, are projected to propel the industry even further.

- In September 2023, Corning was to invest $1.5 billion in South Korea to increase the supply of flexible glass used by Samsung for its foldable phones, which uses ultra-thin glass. The move expands on the two businesses' 50-year alliance, which began with Corning establishing its first facility in the nation in a joint venture with Samsung.

Europe is expected to witness growth in the ultra-thin glass market at a prominent rate during the forecast period. Ultra-thin glass is becoming increasingly popular in consumer electronics, automotive, and medical applications, with major producers such as Schott AG and Corning GmbH providing a varied spectrum. Consumer electronics businesses are also utilizing ultra-thin technology for touch panels and sensors, resulting in market growth. The increased popularity of LCD TVs, smartphones, and laptop computers is pushing the need for ultra-thin glass, which is suitable for interior and solar glass panels in vehicles.

- In April 2023, Schott collaborated with Vivo to cover the exterior screens of its foldable phones using ultra-thin, drop-resistant glasses. The vivo X Flip and X Fold 2 phones use Schott's ultra-thin glass (UTG), which is smaller than human hair and has exceptional bending strength. Both versions have drop-resistant cover glass, Xensation α (Alpha).

- In December 2022, Samsung's next Galaxy Fold 2 may have an ultra-thin glass display instead of plastic. The South Korean tech behemoth has registered for European trademarks for Samsung Ultra-Thin Glass (UTG), which is expected to be utilized in the foldable phone. Ice Universe unveiled photographs of the clamshell foldable phone, which was released alongside the Galaxy S11 next year.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Ultra-Thin Glass Market Coverage

| Report Attribute | Key Statistics |

| Ultra-Thin Glass Market Size by 2033 | USD 29.84 Billion |

| Ultra-Thin Glass Market Size in 2023 | USD 13.82 Billion |

| Ultra-Thin Glass Market Size in 2024 | USD 14.93 Billion |

| Growth Rate from 2024 to 2033 | 8% CAGR |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Historical Year | 2021-2022 |

| Forecast Period | 2024 to 2033 |

Ultra-Thin Glass Report Highlights

Application Insights

The flat panel displays segment dominated the ultra-thin market in 2023. Ultra-thin LED displays have various advantages, including lower energy usage, more adaptability, and cheaper prices. They do not require a backlit screen and may light up when a current is supplied through them, resulting in up to 85% less power usage than LCDs. They are extremely adaptable and may be used with a wide range of devices, including mobile phones, computers, tablets, and transportable gaming consoles.

Furthermore, they do not require cooling or heating systems, making them ideal for smaller rooms and lowering manufacturing costs. Paper-thin LEDs, such as OLED, provide deeper blacks and fuller colors, outperforming FullHD by up to 16 times. They also offer a rapid reaction time, reacting to touch within 50 milliseconds and reducing the trail effect, making them perfect for high-definition applications like gaming or home usage.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/1149

Ultra-thin Glass Market Dynamics

Driver: Increasing usage of ultra-thin glass in smartphones

Ultra-thin glass is used for various high-tech applications such as cover glasses, wearables, OLED display substrates, camera systems, micro-batteries, CPUs, fingerprints, and biosensors. The company employs novel materials and patented down-draw technique to create ultra-thin glass as thin as 25µm. This glass has benefits over other materials such as plastic or silicon, contributes to the miniaturization trend, and enables intriguing concepts in the development of smartphone technologies.

Hardened ultra-thin glass is scratch-proof, bendable, and fatigue-resistant, making it an excellent substrate for flexible smartphones and OLED displays. It also has a high dielectric constant, which makes it ideal for smartphone cameras. Ultra-thin glass is also more heat-resistant than the polymers used in chip packing, giving it an intriguing option for silicon data transmission.

Restraint: Caution while handling

To properly handle ultra-thin glass, it must be coated and treated to retain its look and safety. It is critical to adhere to manufacturer specifications during assembly and select the proper coating or manufacturing technique for the project. Designers may employ a variety of methods to work with ultra-thin glass, but they must exercise caution and be aware of the hazards.

Different types and sizes of ultra-thin glass are accessible at reasonable rates, and knowing their production and use is critical. Some pieces are more likely to break, so use caution while handling them. Some varieties of glass are stronger than others, and they should be handled carefully. Understanding the different kinds and shapes of ultra-thin glass is critical to ensuring a secure and long-lasting installation.

Browse More Insights:

- Semiconductor Market: The global semiconductor market size was valued at USD 544.78 billion in 2023 and is expected to reach around USD 1,137.57 billion by 2033, poised to grow at a CAGR of 7.64% from 2024 to 2033.

- Automation Components Market: The global automation components market size was estimated at USD 129.85 billion in 2023 and is projected to hit around USD 301.19 billion by 2032, registering a CAGR of 9.80% from 2023 to 2032.

- GaN Semiconductor Devices Market: The global GaN semiconductor devices market size was valued at USD 2.67 billion in 2022, and is projected to surpass around USD 26.83 billion by 2032, poised to grow at a projected CAGR of 26% from 2023 to 2032.

- Commercial Display Market: The global commercial display market size was valued at USD 54 billion in 2022 and is expected to reach USD 99.94 billion by 2032, poised to grow at a CAGR of 6.40% from 2023 to 2032.

- Smart Wearables Market: The global smart wearables market size was valued at USD 60.04 billion in 2023 and is anticipated to reach around USD 375.80 billion by 2033, growing at a CAGR of 20.13% from 2024 to 2033.

- Medical Imaging Displays Market: The global medical imaging displays market size was valued at USD 5.24 billion in 2022 and it is expected to hit around USD 9.14 billion by 2032, expanding at a CAGR of 5.72% from 2023 to 2032.

- Liquid Electronics Market: The global liquid electronics market size was estimated at USD 82.5 billion in 2022 and is projected to hit around USD 174.02 billion by 2032 growing at a CAGR of 7.80% from 2023 to 2032.

- Flexible Electronics Market: The global flexible electronics market size was estimated at USD 29 billion in 2022 and is projected to surpass around USD 71.54 billion by 2032, poised to grow at a CAGR of 9.50% from 2023 to 2032.

- Photonics Market: The global photonics market size accounted for USD 0.77 trillion in 2022 and is expected to reach USD 1.39 trillion by 2032 and rising at the CAGR of 6.2% from 2023 to 2032.

Opportunity: Novel processing technology

Ultrafast Laser Application Laboratory (ULAL) has created a novel technique for Ultra-Thin Glass (UTG) processing. The study, led by Bogusz Stępak, R&D Director of Laser Microprocessing at ULAL, will be discussed at the ICALEO conference on October 17.

Femtosecond processing considerably reduces edge roughness in 100 μm glass, resulting in a fivefold decrease compared to picoseconds. This edge accuracy is critical for fragile materials like UTG used in foldable displays since poor processing conditions can cause tiny fractures and shorten screen life. The use of a glossy-cut edge improves the quality of the final displays.

Recent Developments:

- In May 2024, Samsung's Galaxy Z Flip6 will be released in July, with the Fold6 model. The Flip6 will have a thicker ultra-thin glass (UTG) than its predecessor, leading to a less noticeable seam in the middle of the folding screen. This is a major improvement over rivals who have fewer wrinkles. The UTG's thickness is projected to be roughly 50μm, compared to 30μm for the Flip5. The following year's Galaxy Z Flip7 is likely to include a redesigned hinge.

- In October 2023, OnePlus launched its first foldable phone, the OnePlus Open, which boasts a thin profile and a quality metallic finish. The phone comes in two colors, Emerald Dusk and Voyager Black, and features a 6.31-inch 2K AMOLED LTPO screen with Corning's Ceramic Guard. It sports a 7.82-inch 2K flexi-fluid AMOLED LPTO 3.0 screen with a refresh rate of 120Hz and a maximum brightness of 2,800 nits. The phone is secured by a triple-layered cover that includes an ultra-thin glass protector. The phone is anticipated to be released later this year.

Ultra-Thin Glass Market Top Companies

- CSG Holding Co., Ltd.

- Corning Incorporated

- SCHOTT AG

- Changzhou Almaden

- Nippon Electric Glass

- AGC Inc.

- Emerge Glass

- Luoyang Glass Company

- Xinyi Glass

- Nippon Sheet Glass Co., Ltd

Market Segmentation

By Application

- Automotive Glazing

- Semiconductors

- Flat Panel Displays

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Rest of the World

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1149

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

For Latest Update Follow Us: