LIVONIA, Mich., June 18, 2024 (GLOBE NEWSWIRE) -- With a staggering $90 trillion in assets projected to change hands over the next two decades in what's deemed the largest intergenerational wealth transfer in history, financial institutions are sprinting to position themselves to support clients. Expected inheritors have varying investment plans and communication preferences, according to Cogent Syndicated's report, Trajectory of Intergenerational Wealth Transfer™, by Escalent. The report delves into inheritance trends and expectations, offering invaluable insights for advisors and asset managers as they prepare for the historic shift.

In the next decade, 28% of affluent investors anticipate inheriting wealth, with 44% representing Gen X, 25% Millennials, and 22% comprised of those in early retirement (second-wave Baby Boomers). Interest in investing inherited assets decreases with age, as Millennials are significantly more likely to invest these funds—70% of Millennials versus 46% of Gen Xers and 48% of early retiree Baby Boomers.

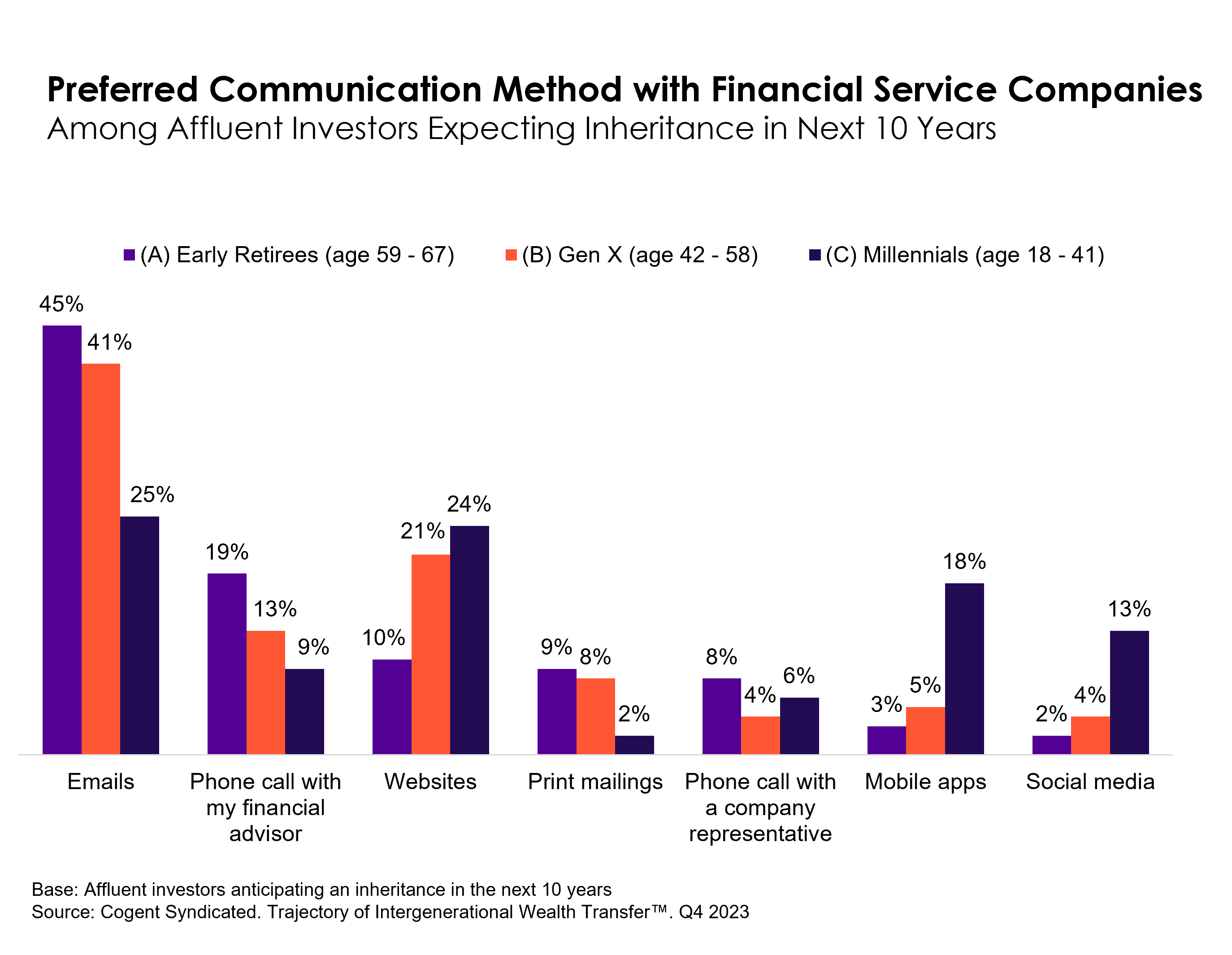

While over sixty percent of the expected inheritors work with advisors in some capacity (with no significant differences between generations), their communication preferences with financial service companies vary greatly among generations. This presents an opportunity for asset managers and other financial service providers to better tailor their communication strategies.

“Millennials’ aptitude for and interest in technology is clear. While they are just as likely as older generations to leverage financial advisors and other types of advice, Millennials are significantly less likely to use emails. Instead, they tend to favor digital communication platforms like mobile apps and social media,” said Steven Ethridge, Senior Director at Cogent Syndicated. “In contrast, the most effective methods for reaching Gen Xers and early retiree Boomers are emails, websites and phone calls.”

“As these generations come into their inheritance, it's crucial for financial service providers and wealth managers to steer them toward optimal financial decision-making,” continued Ethridge. “Millennials recognize the importance of saving and investing but lean towards high-tech platforms, while older generations prefer in-person interactions and email communication. To capture these inheritance dollars, firms must employ targeted messaging and innovative strategies to connect with affluent investors."

Join Steven Ethridge and Kristin Hall, investor experts at Escalent, for a live webinar at 12 PM EST on June 25 as they share insights and a first look at the Trajectory of Intergenerational Wealth Transfer report.

About Trajectory of Intergenerational Wealth Transfer™

Cogent Syndicated conducted an online survey from October 25, 2023 to January 8, 2024 of a representative sample of 5,571 affluent investors. In order to qualify for this study, survey participants were required to be 18 years or older, sole or shared household financial decision-makers, and have at least $100,000 in investable assets including DC plan and IRA assets but excluding the value of primary real estate. In determining the sampling frame for this study, targets are set during fieldwork for respondent gender, region, age, education and household income using Cogent’s market-sizing incidence survey results, which are weighted to US census data. Weights are applied where necessary to ensure a representative sample of the US affluent investor population. Minimal weighting was applied to adjust for any deviations from the actual marketplace distribution. The data have a margin of error of ±1.31% at the 95% confidence level. Cogent Syndicated will supply the exact wording of any survey questions upon request.

About Escalent

Escalent is an award-winning data analytics and advisory firm specializing in industries facing disruption and business transformation. As catalysts of progress for more than 40 years, we accelerate growth by creating a seamless flow between primary, secondary, syndicated, and internal business data, providing consulting and advisory services from insights through implementation. We are 2,000 team members strong, following the acquisition of C Space and Hall & Partners in April 2023. Escalent is headquartered in Livonia, Michigan, with locations across the US and in Australia, Canada, China, India, Ireland, the Philippines, Singapore, South Africa, UAE, and the UK. Visit escalent.co to see how we are helping shape the brands that are reshaping the world.

CONTACT: Kim Eberhardt

248.417.2460

keberhardt@identitypr.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/155def6e-f757-4e37-99d0-71730b492033