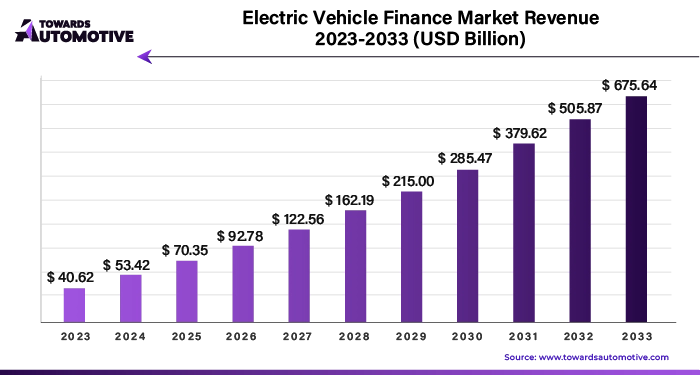

Ottawa, July 10, 2024 (GLOBE NEWSWIRE) -- The global electric vehicle finance market size was valued at USD 40.62 billion in 2023 and is predicted to hit around USD 675.64 billion by 2033, according to a study published by Towards Automotive a sister firm of Precedence Statistics.

Maximize your time with our condensed report insights! Access Here: https://www.towardsautomotive.com/insight-sample/1295

The electric vehicle (EV) finance market is a rapidly evolving segment of the automotive industry, closely tied to the growing adoption of electric vehicles worldwide. This market encompasses various financial products and services tailored specifically for consumers and businesses looking to purchase or lease electric vehicles.

The increasing supportive government policies and incentives worldwide such as tax credits, rebates, and subsidies, are encouraging consumers to adopt electric vehicles, thus expanding the potential customer base for EV financing. Furthermore, technological advancements in battery technology and charging infrastructure are enhancing the performance and range of electric vehicles, reducing range anxiety and increasing consumer confidence in EV ownership. Additionally, heightened environmental awareness and the growing urgency to combat climate change are driving a shift towards cleaner transportation options, with electric vehicles positioned as a key solution.

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Key Trends and Findings

- With the rising demand for EVs, an expanding array of models will become accessible in the market. The initial category of vehicles expected to witness the most substantial surge will be crossover SUVs and SUVs, given their present status as the preferred choice among consumers. This is increasing the demand for EV financing options.

- The EV finance market is witnessing an expansion of financing options tailored to meet the diverse needs of consumers and businesses. In addition to traditional auto loans and lease agreements, innovative financing models such as subscription-based services, battery leasing programs, and peer-to-peer lending platforms are gaining traction.

- Collaboration between automakers, financial institutions, charging infrastructure providers, and other stakeholders is becoming increasingly prevalent in the EV finance market.

- Europe is witnessing rapid expansion in the EV finance market, propelled by stringent emissions regulations, ambitious electrification targets, and strong consumer demand for sustainable transportation options.

- The Asia Pacific region is emerging as a key growth market for electric vehicle financing, driven by government initiatives, technological advancements, and increasing urbanization. Countries such as China, Japan, and South Korea are investing heavily in electric mobility, with ambitious targets for EV adoption and the development of charging infrastructure.

Get exactly what you need with a bespoke report! Request Now: https://www.towardsautomotive.com/contact-us

Market Drivers

Government Incentives and Policies

Government incentives and policies play a pivotal role in driving the growth of the electric vehicle (EV) finance sector. Supportive measures, including tax credits, rebates, grants, and subsidies, serve as powerful incentives for consumers and businesses to transition towards electric vehicles. These financial incentives effectively reduce the upfront costs associated with purchasing or leasing an EV, making them more affordable and appealing to a wider audience.

The United Kingdom (UK) operates an Electric Vehicle Home Charge Scheme, allowing EV owners to receive a grant for installing a charging point at their residence. Individuals who have purchased an eligible electric vehicle, hold registration, are lessees, or primarily utilize the vehicle, can avail themselves of this incentive. The scheme provides coverage for up to 75% (capped at GBP 500, including VAT) of the total capital expenses for one charge point and its associated installation costs.

In the United States (US), certain all-electric and plug-in hybrid vehicles qualify for a federal tax credit ranging from $3,700 to $7,500. Additionally, many states offer supplementary incentives to encourage the purchase of new EVs

By incentivizing EV adoption, governments stimulate market demand, which, in turn, drives growth in the EV finance sector. Furthermore, these incentives not only encourage individual consumers to invest in electric vehicles but also incentivize fleet operators and businesses to electrify their vehicle fleets. The cumulative effect of government incentives and policies is a significant boost to the EV finance market, fostering a favorable environment for the transition towards sustainable transportation and the proliferation of electric vehicles on roads globally.

Market Restraints

Initial Cost and Depreciation

The higher initial cost of electric vehicles (EVs) relative to traditional gasoline-powered vehicles, largely attributed to the expense of battery technology, presents a significant restraint on EV adoption. This upfront cost differential can deter potential consumers from opting for EVs despite their long-term benefits. Moreover, apprehensions regarding the resale value and depreciation of EVs further compound this restraint.

Consumers may hesitate to invest in electric vehicles due to uncertainties surrounding future resale prices, which could affect their financial considerations and overall confidence in EV ownership. These concerns not only influence individual purchasing decisions but also have implications for the availability and terms of financing options for EVs. Addressing these challenges through cost reduction measures, enhanced battery technology, and effective communication about the long-term benefits of EV ownership is essential for mitigating this restraint and promoting wider adoption of electric vehicles.

Market Opportunities

Emerging Markets and Urbanization

Emerging markets offer substantial opportunities for the widespread adoption of electric vehicles (EVs), buoyed by rapid urbanization, rising disposable incomes, and government initiatives. As urban populations swell and cities grapple with pollution and congestion, the demand for clean transportation solutions intensifies. In regions like Asia Pacific, Latin America, and Africa, burgeoning economies and expanding middle-class populations create fertile ground for EV penetration.

As per International Energy Agency, once again, China led the EV market, representing approximately 60% of global electric car sales. With over half of the world's electric vehicles now traversing Chinese roads, the nation has already surpassed its 2025 target for new energy vehicle sales. This impressive growth can be attributed to over a decade of consistent policy backing for early adopters, which includes the extension of purchase incentives.

Moreover, supportive government policies, including incentives, tax breaks, and infrastructure investments, further catalyse market growth. By capitalizing on these favorable conditions, stakeholders in the EV finance market can tap into untapped market segments, diversify their portfolios, and drive revenue growth. However, to fully leverage the opportunities presented by emerging markets, it is imperative to address infrastructure challenges, enhance consumer awareness, and tailor financing solutions to meet the unique needs and preferences of consumers in these regions.

Key Segment Analysis

Financial Institution Segment Analysis Preview

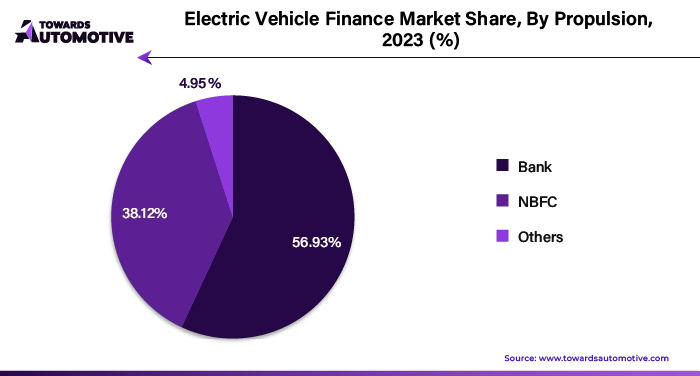

The bank segment captured a substantial market share of 56.93% in 2023. The banks possess extensive financial resources and established infrastructure, enabling them to offer a wide array of financing options tailored to meet the diverse needs of EV buyers. Additionally, banks often have existing relationships with consumers and businesses, providing them with a competitive advantage in capturing market share within the EV finance sector. Moreover, the growing consumer demand for electric vehicles further propels the Bank segment's growth in EV financing. Furthermore, strategic partnerships and collaborations between banks, automakers, and charging infrastructure providers bolster the Bank segment's position in the EV finance industry, facilitating the development of innovative financing solutions and enhancing customer engagement.

Vehicle Type Segment Analysis Preview

The passenger cars segment held largest market share of 41.83% in 2023. The increasing consumer demand for electric passenger cars, driven by environmental consciousness, government incentives, and technological advancements, significantly contributed to the segment's market share. Consumers are increasingly opting for electric passenger cars due to their lower operating costs, reduced environmental impact, and enhanced driving experience. Additionally, automakers' focus on expanding their electric passenger car portfolios, coupled with aggressive marketing strategies and competitive pricing, further bolstered the segment's growth.

Regional Insights

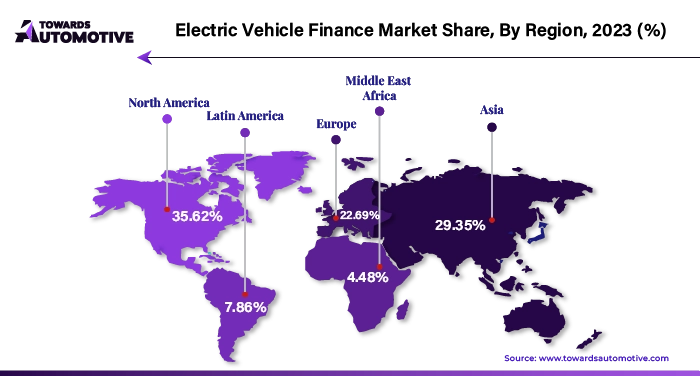

Asia Pacific dominated the market and stood at USD 17.26 billion in the global electric vehicle finance market. Many countries in the region have implemented supportive policies and incentives to promote EV adoption. These measures include tax incentives, subsidies, and grants for purchasing EVs, as well as incentives for investing in charging infrastructure. Government support stimulates demand for EVs and encourages financial institutions to offer attractive financing options.

As per the data by Federation of Automobile Dealers Association (FADA), the sale of Electric Vehicles in India has registered a growth of 49.25 percent during the last calendar year i.e. 2023. The Indian government has set a target to achieve 30 percent electrification of the country's vehicle fleet by 2030, and has introduced several incentives and policies to support the growth of the EV industry.

Furthermore, consumer awareness of environmental issues and the benefits of electric vehicles are increasing in the Asia Pacific region. As consumers become more educated about the advantages of EVs, they are more likely to consider purchasing or leasing an electric vehicle. Financial institutions are responding to this growing demand by offering competitive financing options tailored to the needs of EV buyers.

Europe is expected to grow at a considerable CAGR of 32.40% during the forecast period. Europe has some of the most stringent emissions regulations in the world, with targets aimed at reducing greenhouse gas emissions and improving air quality. As a result, there is a growing emphasis on electric mobility as a means to achieve these targets. Financial institutions recognize the importance of supporting EV adoption to comply with regulatory requirements and are thus expanding their financing offerings for electric vehicles. Furthermore, Europe has a well-established network of charging infrastructure, including public charging stations, fast chargers, and home charging solutions. The availability of charging infrastructure is essential for boosting consumer confidence in EV ownership and driving market demand.

Electric Vehicle Finance Market Leaders

- Tenet Energy

- Bank of America Corporation

- Tesla Finance (Tesla, Inc.)

- Capital One Financial Corporation

- Ally Financial Inc.

- BMW Financial Services (BMW Group)

- Chase Auto Finance (JPMorgan Chase & Co.)

- Wells Fargo & Company

- Nissan Motor Acceptance Corporation (Nissan Motor Co., Ltd.)

- Toyota Financial Services (Toyota Motor Corporation)

- Volkswagen Financial Services AG

Recent Developments:

- January, 2024: Greaves Finance Limited announced collaboration with ElectricPe, strategically aligning itself with the latter to enhance customer experience. This partnership joins two industry leaders committed to simplifying and improving the overall electric vehicle (EV) ownership journey for customers.

- December, 2023: Origence and Tesla have entered into a partnership to offer credit union financing to EV buyers directly through the Tesla website. This collaboration aims to provide Tesla buyers seeking affordable monthly payments with more options through credit union financing. By integrating credit union financing at the point of purchase, EV buyers will have convenient access to competitive rates and extended financing terms, both crucial factors in offering consumers options to reduce their monthly payments.

- June, 2022: Tenet introduced a new financial solution designed to reduce the cost of owning EVs, marking the beginning of a new era that brings carbon-free emissions within reach for nearly every new car owner. With the launch of its innovative EV financing platform, which rejects traditional car depreciation models and values EVs as clean collateral, Tenet also plans to expand its offerings to include zero-emission home upgrades, assisting consumers in achieving their financial and sustainability objectives more effectively.

More Insight of Towards Automotive

- The global terminal tractor market size is estimated to reach USD 2.69 billion by 2033, up from USD 1.37 billion in 2023, at a compound annual growth rate (CAGR) of 7.09% from 2024 to 2033.

- The global sailboats market size is estimated to reach USD 4.76 billion by 2033, up from USD 3.18 billion in 2023, at a compound annual growth rate (CAGR) of 4.21% from 2024 to 2033.

- The global remote operated vehicle market size is estimated to reach USD 4.97 billion by 2033, up from USD 1.86 billion in 2023, at a compound annual growth rate (CAGR) of 10.47% from 2024 to 2033.

- The global heavy-duty vehicle rental market size is estimated to reach USD 203.77 billion by 2033, up from USD 103.61 billion in 2023, at a CAGR of 7.10% from 2024 to 2033.

- The global collision avoidance system market size is estimated to reach USD 140.46 billion by 2033, up from USD 61.26 billion in 2023, at a compound annual growth rate (CAGR) of 8.81% from 2024 to 2033.

- The global car leasing market size is estimated to reach USD 1373.96 million by 2033, up from USD 724.67 million in 2023, at a compound annual growth rate (CAGR) of 6.71% from 2024 to 2033.

- The global automotive ignition system market size is estimated to reach USD 18.15 billion by 2033, up from USD 10.12 billion in 2023, at a compound annual growth rate (CAGR) of 6.11% from 2024 to 2033.

- The global hybrid bicycles market size is estimated to reach USD 19.28 billion by 2033, up from USD 10.08 billion in 2023, at a compound annual growth rate (CAGR) of 6.79%.

- The global connected trucks market size is estimated to reach USD 103.24 billion by 2033, up from USD 29.08 billion in 2023, at a compound annual growth rate (CAGR) of 13.59%.

- The global car sharing telematics market size is estimated to reach USD 767.34 million by 2033, up from USD 285.61 million in 2023, at a compound annual growth rate (CAGR) of 10.47%.

Electric Vehicle Finance Market Segmentation

By Financial Institution

- Bank

- NBFC

- Others

By Vehicle Type

- Passenger Car Personal

- Commercial

- Commercial vehicle

- Bus

- Truck

- Two-wheeler

- Personal

- Commercial

- Three-wheeler

- Passenger

- Cargo

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Acquire our comprehensive analysis today @ https://www.towardsautomotive.com/price/1295

You can place an order or ask any questions, please feel free to contact us at sales@towardsautomotive.com

Subscribe to our Annual Membership and gain access to the latest insights and statistics in the automotive industry. Stay updated on automotive industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the competition with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of automotive: Get a Subscription

About Us

Towards Automotive is a premier research firm specializing in the automotive industry. Our experienced team provides comprehensive reports on market trends, technology, and consumer behaviour. We offer tailored research services for global corporations and start-ups, helping them navigate the complex automotive landscape. With a focus on accuracy and integrity, we empower clients with data-driven insights to make informed decisions and stay competitive. Join us on this revolutionary journey as we work together as a strategic partner to reinvent your success in this ever-changing packaging world.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardshealthcare.com

https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-automotive