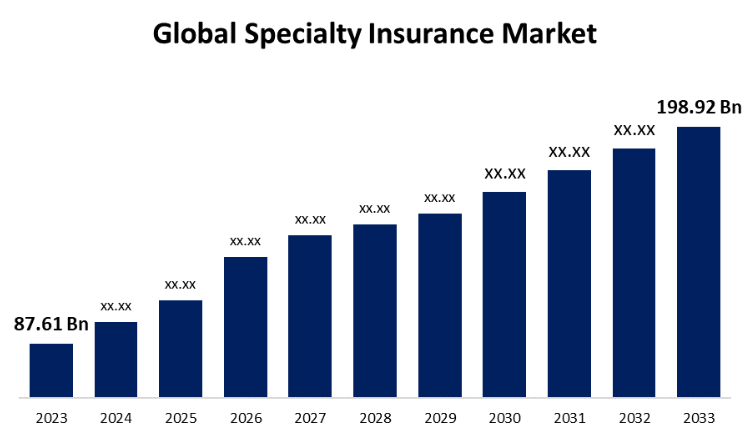

New York, United States , July 11, 2024 (GLOBE NEWSWIRE) -- The Global Specialty Insurance Market Size is to Grow from USD 87.61 Billion in 2023 to USD 198.92 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 8.10% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/4943

The specialty insurance market is a thriving and specialized subdivision of the wider insurance business, serving unique and unusual risks that often fall beyond the scope of standard insurance policies. This industry has become more well-known as businesses and people search for tailored coverage solutions for risks that are becoming more complex and specialized. Regular insurance, on the other hand, mostly focuses on common risks like property damage or liability. Specialty insurance, on the other hand, covers specific, often high-risk, and uncommon scenarios. These might include hazards related to cyber liability, aviation, maritime, fine art, terrorism, and other peculiar risks. Specialty insurers fill in the gaps left by standard insurance offers by applying their expertise to underwrite and construct policies that provide total protection against these particular risks. Furthermore, the specialized insurance market can now accurately evaluate present and future risks due to the use of technologies like blockchain and the internet of things (IoT). The wide number of coverage alternatives that specialty insurance offers, along with a great degree of flexibility with regard to the policy term, policy duration, and coverages, is another important reason propelling the specialty insurance market's expansion. Furthermore, governments everywhere are imposing ever-tougher regulations and compliance standards on industries. Specialty insurance helps businesses navigate these complex legal settings while ensuring compliance. The need for new insurance policies for cross-border operations is rising along with the number of trade agreements. However, the catastrophic physical damage caused by significant weather disasters, the professional indemnity and liability industry is experiencing a rise in claims and subpar financial underwriting performance.

Browse key industry insights spread across 230 pages with 110 Market data tables and figures & charts from the report on the "Global Specialty Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Marine, Aviation & Transport (MAT), Marine Insurance, and Inland Marine Insurance), By Distribution Channel (Brokers and Non-Brokers), By End User (Business and Individuals), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/4943

The aviation & transport (MAT) segment is anticipated to hold the greatest share of the global specialty insurance market during the projected timeframe.

Based on the type, the global specialty insurance market is divided into marine, aviation & transport (MAT), marine insurance and inland marine insurance. Among these, the marine, aviation & transport (MAT) segment is anticipated to hold the greatest share of the global specialty insurance market during the projected timeframe. The growth in international trade, which is essential for the efficient delivery of goods, the movement of people, and the continuous exchange of ideas, is driving the demand for robust MAT services. Furthermore, MAT's implementation of cutting-edge technologies is enhancing efficiency, safety, and environmental compliance. The demand for these services is rising as a result of technology improvements that have made transportation more appealing and accessible. In addition, the growth in global tourism is driving up demand for air and marine transportation. Governments and international organizations are also offering a positive market viewpoint by stressing the importance of sustainable and eco-friendly transportation systems.

The brokers segment is expected to grow at the fastest CAGR growth through the estimated period.

Based on the distribution channel, the global specialty insurance market is divided into brokers and non-brokers. Among these, the brokers segment is expected to grow at the fastest CAGR growth through the estimated period. Due to their expertise in evaluating complex and unusual risks as well as their proficiency in risk management, brokers are able to tailor solutions to fit specific needs. With their extensive network of insurers at their disposal, they can also find the best specialty insurance coverage. Close, one-on-one relationships with clients also enable brokers to better understand their particular specialty insurance needs.

The business segment is predicted to grow at the fastest CAGR in the global speciality insurance market during the estimated period.

Based on the end user, the global speciality insurance market is divided into business and individuals. Among these, the business segment is predicted to grow at the fastest CAGR in the global specialty insurance market during the estimated period. Specialty insurance allows businesses to handle a range of risks and specific challenges specific to their industry that may not be covered by standard insurance policies. A variety of industries, including manufacturing, construction, healthcare, and technology, might be covered by these specialty insurance plans. By acquiring specialist insurance, businesses can lower the risks related to product liability, cybersecurity, intellectual property, and environmental concerns.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/4943

Europe is expected to hold the largest share of the global specialty insurance market over the forecast period.

Europe is expected to hold the largest share of the global specialty insurance market over the forecast period. Europe has the biggest market share, largely because of its robust regulatory framework, particularly in the financial services industry, which supports reliable and transparent specialized insurance activities. Significant global financial hubs such as London also offer an atmosphere conducive to the expansion of specialty insurance companies. The talent and experience that these centers attract from around the globe foster innovation and expansion in the specialty insurance product industry.

Asia Pacific is predicted to grow at the fastest pace in the global specialty insurance market during the projected timeframe. The region's fast economic growth, expanding middle class, and increasing risk management awareness are driving the need for specialty insurance solutions in this area. Specialty insurance in Asia Pacific is expanding quickly as more businesses and individuals seek to safeguard themselves against certain risks such as environmental liability and cyber threats. Because insurers are increasingly tailoring their policies to meet the diverse needs of this ever-evolving market, specialty insurance is expanding quickly in this region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Specialty Insurance Market are AXA, AIG, Allianz, ASSICURAZIONI GENERALI S.P.A., Berkshire Hathaway Inc., Chubb, Munich Reinsurance Company,, PICC, Tokio Marine HCC, Zurich, Hiscox Ltd., Manulife Financial Corporation, MAPFRE S.A. Other Key Vendors.

Get Discount At @ https://www.sphericalinsights.com/request-discount/4943

Recent Developments

- In January 2024, AXA XL unveiled a new endorsement to assist publicly traded companies with the financial implications of the SEC's cyber incident reporting requirements.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Specialty Insurance Market based on the below-mentioned segments:

Global Specialty Insurance Market, By Type

- Marine, Aviation & Transport (MAT)

- Marine Insurance

- Inland Marine Insurance

Global Specialty Insurance Market, By Distribution Channel

- Brokers

- Non-Brokers

Global Specialty Insurance Market, By End User

- Business

- Individuals

Global Specialty Insurance Market, Regional Analysis

-

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Browse Related Reports:

Global Trade Surveillance Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Deployment (On-Premise, Cloud), By Enterprise Size (Large Enterprises, SMEs), By End User (Banks, Institutional Brokers, Retail Brokers, Market Centers & Regulators, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments, and Cross-Border Payments), By Payment Method (Bank Transfer, Card, and Online Payments), By Verticle Type (BFSI, IT and ITES, Retail and E-commerce, Travel and Hospitality, Healthcare, Media and Entertainment, Transportation and Logistics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Regtech Market Size, Share, and COVID-19 Impact Analysis, By Component (Solutions and Services), By Application (Anti-Money Laundering (AML) & Fraud Management, Regulatory Intelligence, Risk & Compliance Management, and Regulatory Reporting), By Deployment Mode (On-Premises and Cloud-Based), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Crypto Asset Management Market Size, Share, and COVID-19 Impact Analysis, By Solution (Custodian Solutions and Wallet Management), By Application (Web-Based and Mobile), By Deployment Mode (Cloud and On-Premises), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter