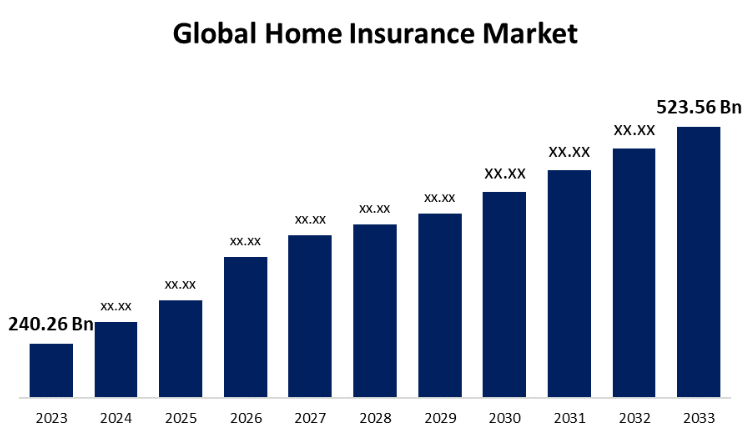

New York, United States , July 11, 2024 (GLOBE NEWSWIRE) -- The Global Home Insurance Market Size is to Grow from USD 240.26 Billion in 2023 to USD 523.56 Billion by 2033, at a Compound Annual Growth Rate (CAGR) of 8.10% during the projected period.

Get a Sample PDF Brochure: https://www.sphericalinsights.com/request-sample/4899

An insurance policy that pays for costs and damage to a home or other insured property is known as home insurance. It is one of the various categories of general insurance products and a type of property insurance. Homeowner's insurance is another term for house insurance. It protects against possible threats to built homes, owned homes, rented apartments, bungalows, and apartments. It covers the costs of losses resulting from unfavorable events. Another aspect of home insurance is liability for injuries and property damage to policyholders. This covers things like theft, vandalism, fire, and harm from household pets. Furthermore, military requirements drive the majority of the artillery systems industry. Countries with large military forces, particularly those involved in conflicts or with security concerns, are the principal users of howitzers. Furthermore, many insurance firms throughout the world are using novel strategies to increase their market value, improve customer satisfaction, and make more revenue. Consequently, several home insurance firms provided their customers with apps and other innovative products to ensure their safety throughout this global epidemic. Furthermore, incidents including fire, theft, exterior or interior property damage, accident, and asset loss are making home insurance more and more necessary. This is forcing insurance companies to create and finance the development of less popular policies that provide high coverage, monetary security in the event of an accident or other damages, and less proliferation. However, a significant obstacle to the growth of the house insurance sector is the general lack of understanding and awareness of the coverage that home insurance offers.

Browse key industry insights spread across 230 pages with 110 Market data tables and figures & charts from the report on the "Global Home Insurance Market Size, Share, and COVID-19 Impact Analysis, By Coverage (Dwelling Coverage, Content Coverage, and Liability Coverage), By End User (Landlords and Tenants), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033."

Buy Now Full Report: https://www.sphericalinsights.com/checkout/4899

The dwelling segment is anticipated to hold the greatest share of the global home insurance market during the projected timeframe.

Based on the coverage, the global home insurance market is divided into dwelling coverage, content coverage, and liability coverage. Among these, the dwelling segment is anticipated to hold the greatest share of the global home insurance market during the projected timeframe. The rise in building activities and the increasing value of properties can be attributed to the increase in demand for residential coverage. This kind of coverage provides homeowners with vital financial security in the event of property damage or loss due to natural disasters like fires, hurricanes, vandalism, or theft. In this market, insurance providers who offer customizable plans and methods for enhancing residential building coverage are well-positioned to cater to a variety of needs.

The landlords segment is expected for the largest revenue share in the global home insurance market during the projected timeframe.

Based on the end user, the global home insurance market is divided into landlords and tenants. Among these, the landlords segment is expected for the largest revenue share in the global home insurance market during the projected timeframe. In addition to contents and building insurance, it usually includes landlord-specific coverages including loss of rent, tenant default insurance, and property owners' liability insurance. Renting is a reasonable option because it provides clients with adequate financial protection against their medical costs, accidents, and other expenses. It also gets the usage rights to the land without having to pay a costly upfront charge.

Inquire Before Buying This Research Report: https://www.sphericalinsights.com/inquiry-before-buying/4899

North America is expected to hold the largest share of the global home insurance market over the forecast period.

North America is expected to hold the largest share of the global home insurance market over the forecast period. The majority of the growth in the regional market is attributable to the primary house insurance market in the United States. The homeownership rate in the United States is among the highest globally. There is a great need for home insurance due to many individuals owning homes. North America, which is made up of the US and Canada, has a substantial population as well as a developing real estate market. The house insurance industry has been growing due to a sizable population and a healthy real estate market.

Asia Pacific is predicted to grow at the fastest pace in the global home insurance market during the projected timeframe. The Asia-Pacific home insurance market will have to gain from the increased economic development and rising per capita income in Asia-Pacific nations including China, India, Vietnam, and others, which have raised living standards and raised demand for better housing services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Major vendors in the Global Home Insurance Market include AXA, American International Group, Inc., Allianz, Admiral, Allstate Insurance Company, Auto-Owners Insurance Group, Assurant, Inc., Chubb, CNA Financial Corporation, Erie Insurance Group, Farmers Insurance, Hanover Insurance Group, HCI Group, and Others.

Get Discount At @ https://www.sphericalinsights.com/request-discount/4899

Recent Developments

- In October 2022, As part of its global expansion into financial services, Amazon.com Inc. signed up three major insurers and established a home insurance platform in the UK. Ageas UK (AGES.BR), Co-op, and LV General Insurance, a branch of German insurer Allianz (ALVG.DE), will initially supply third-party services.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Home Insurance Market based on the below-mentioned segments:

Global Home Insurance Market, By Coverage

- Dwelling Coverage

- Content Coverage

- Liability Coverage

Global Home Insurance Market, By End User

- Landlords

- Tenants

Global Home Insurance Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Browse Related Reports

Global Trade Surveillance Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Deployment (On-Premise, Cloud), By Enterprise Size (Large Enterprises, SMEs), By End User (Banks, Institutional Brokers, Retail Brokers, Market Centers & Regulators, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global B2B Payments Market Size, Share, and COVID-19 Impact Analysis, By Payment Type (Domestic Payments, and Cross-Border Payments), By Payment Method (Bank Transfer, Card, and Online Payments), By Verticle Type (BFSI, IT and ITES, Retail and E-commerce, Travel and Hospitality, Healthcare, Media and Entertainment, Transportation and Logistics, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

Global Neobanking Market Size, Share, and COVID-19 Impact Analysis, By Account Type (Business account, Savings account), By Services (Mobile-banking, Payments, money transfers, savings, Loans, Others), By Application Type (Personal, Enterprises, Other applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 – 2032

Global Revenue Management Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution, Services), By Solution (Billing & Payment, Price Management, Revenue Assurance & Fraud Management, Channel Management, Others), By Deployment Mode (On-premises, Cloud), By Organization Size (Large Enterprises, Small & Medium Enterprises), By Vertical (Telecom, Hospitality, Transportation, Healthcare, Retail & eCommerce, BFSI, Utilities, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter