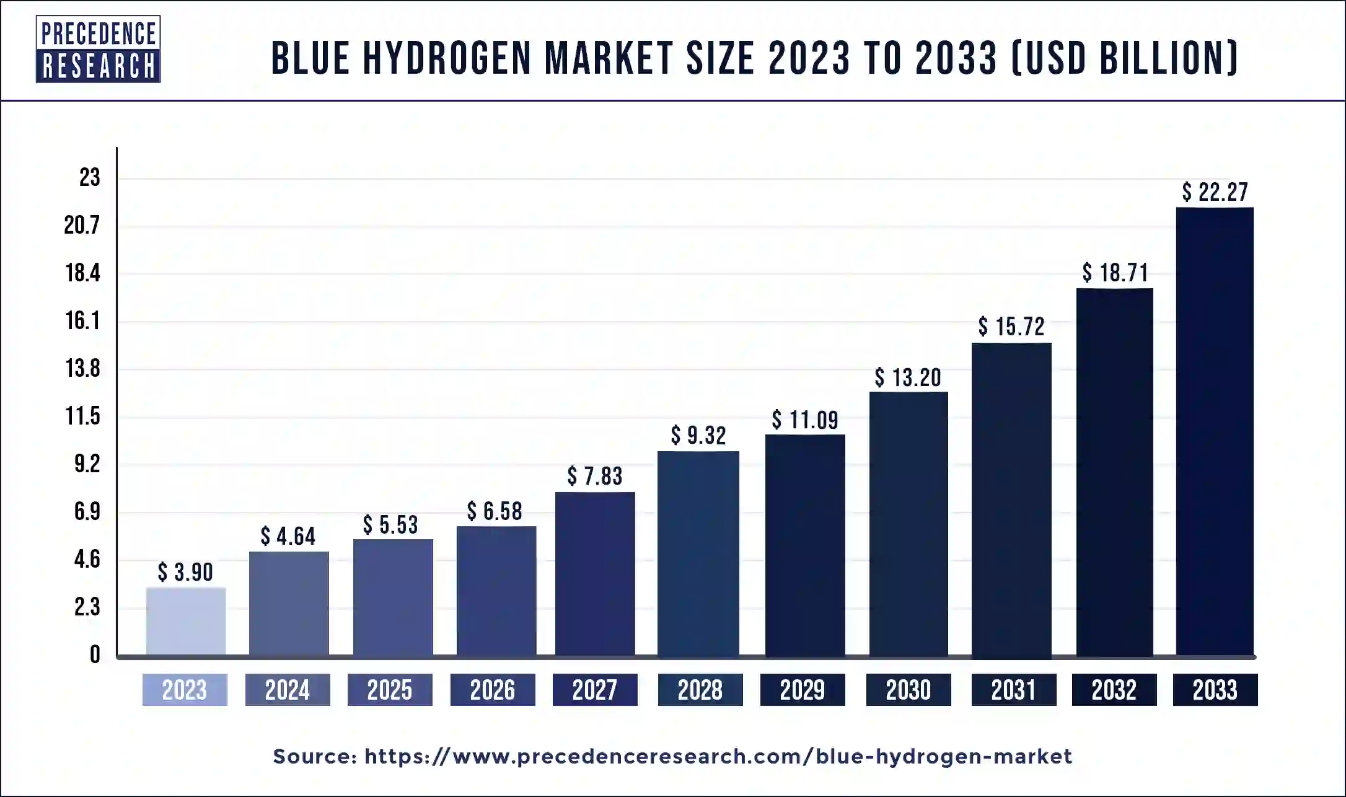

Ottawa, July 18, 2024 (GLOBE NEWSWIRE) -- The global blue hydrogen market size is predicted to increase from USD 3.90 billion in 2023 to approximately USD 22.27 billion by 2033, According to Precedence Research. The blue hydrogen market is driven by increasing need for electricity, shift towards sustainable options and evolving novel technologies.

The blue hydrogen market refers to the production, distribution, and commercialization of hydrogen produced from natural gas or methane through steam methane reforming or auto-thermal reforming. Blue hydrogen, obtained from natural gas, is a more environmentally friendly alternative to green hydrogen, which splits water using renewable electricity. It employs carbon capture to lower its carbon footprint, making it more affordable and eco-friendly.

Blue hydrogen is a big step towards a greener energy future science. It works with the current natural gas network and can be included in the energy strategy. However, the real climate effect is determined by parameters such as CO2 collection efficiency, methane emission, and global warming potential measures. As the energy environment changes, it is critical that decision-makers grasp the distinctions between blue and green hydrogen generation methods.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/4367

Blue Hydrogen Market Key Insight

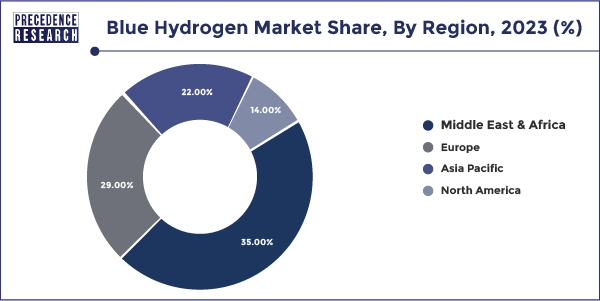

- Middle East & Africa dominated the Blue Hydrogen Market with the largest revenue share of 35 % in 2023.

- Europe is projected to expand at the quickest CAGR of 22.65% during the forecast period

- By technology, the steam methane reforming segment has generated more than 63% of revenue share in 2023.

- By technology, the auto thermal reforming segment is expected to grow at a remarkable rate in the market over the forecast period.

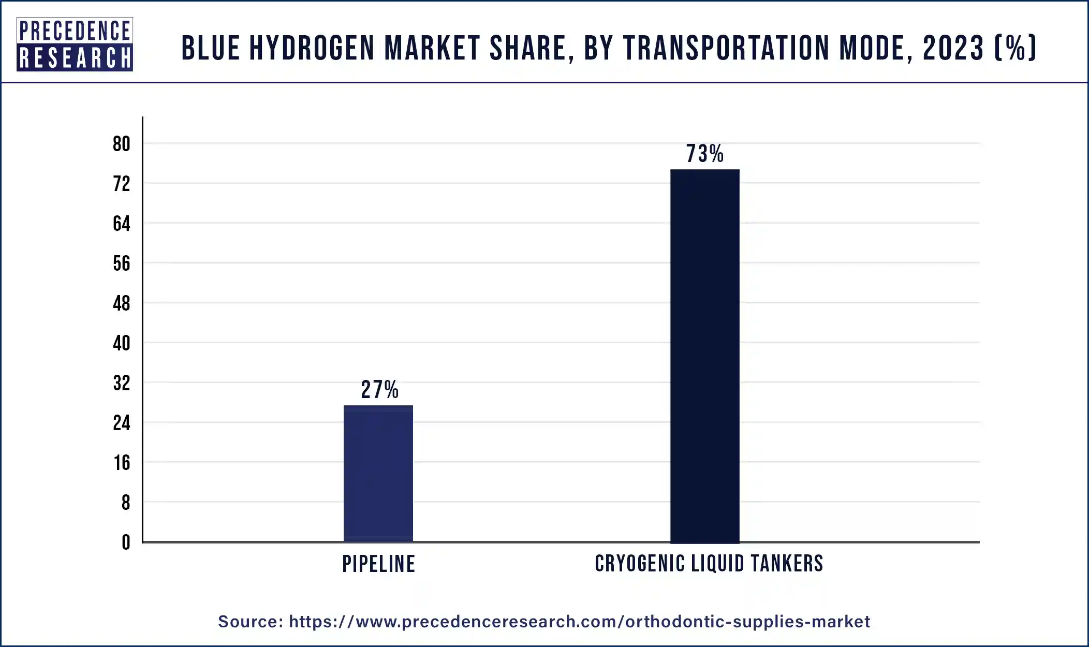

- By transportation mode, the pipeline segment has held the biggest revenue share of 73% in 2023.

- By transportation mode, the cryogenic liquid tankers segment is expected to witness growth at fastest rate during the forecast period.

- By application, the power generation segment has captured more than 39% of revenue share in 2023.

- By application, the refinery segment is expected to expand at a solid CAGR of 20.62% over the projected period.

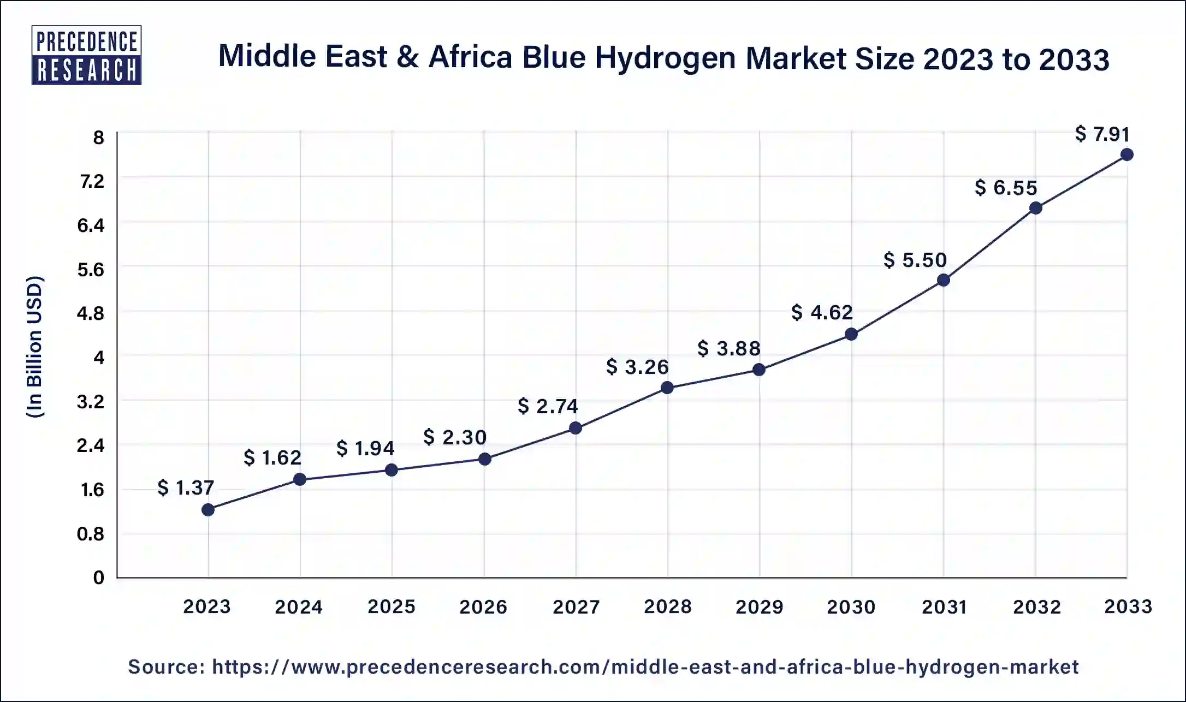

Middle East & Africa Blue Hydrogen Market Size and Forecast

The Middle East & Africa blue hydrogen market size was valued at USD 1.37 billion in 2023 and is expected to be worth around USD 7.91 billion by 2033 with a CAGR of 19.16% from 2024 to 2033.

Middle East and Africa dominated the blue hydrogen market in 2023. The Middle East (MEA) is gaining traction in the hydrogen sector, with large-scale low-carbon projects in the works. African countries such as South Africa, Egypt, Mauritania, and Morocco employ renewable resources to manufacture green hydrogen for local use and export to markets like Europe. Meanwhile, the Middle East is taking a balanced approach, investing in both blue and green hydrogen to strengthen its position in the global hydrogen market.

Europe is expected to grow at the fastest rate during the forecast period. As of 2022, 476 active hydrogen production facilities in Europe had a total hydrogen production capacity of 11.30 Mt, with important European nations accounting for 56%.

The total consumption was 8.23 Mt, with an average capacity utilization rate of 73%. Conventional hydrogen generation processes, such as reforming, byproduct production, and electrolysis, accounted for 99.9% of the total capacity. 97 water electrolysis-based hydrogen production plants were discovered, with 67 having a capacity of at least 0.5 MW.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Blue Hydrogen Market Coverage

| Report Attribute | Key Statistics |

| Blue Hydrogen Market Size by 2033 | USD 22.27 Billion |

| Blue Hydrogen Market Size in 2024 | USD 4.64 Billion |

| Blue Hydrogen Market Size in 2023 | USD 3.90 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 19.03% |

| Base Year | 2023 |

| Historical Year | 2021-2022 |

| Forecast Year | 2024-2033 |

| Segments Covered | Technology, Transportation Mode, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Blue Hydrogen Market Segments Outlook

Technology Outlook

The steam methane reforming segment dominated the blue hydrogen market in 2023. The majority of blue hydrogen generated now is via steam methane reforming, a mature manufacturing method that uses high-temperature steam to manufacture hydrogen from methane sources such as natural gas. This process generates carbon monoxide, hydrogen, and a small quantity of carbon dioxide. Partial oxidation is an exothermic process that yields less hydrogen per unit of input fuel. This route is being studied from hydrogen generation in fuel cell electric cars (FCEVs) and other applications since it minimizes greenhouse gas emissions and petroleum use compared to gasoline vehicles.

The auto thermal reforming segment is expected to grow at a significant rate in the blue hydrogen market over the forecast period. Autothermal steam reforming (ATR) transforms hydrocarbons such as natural gas into syngas by partial oxidation. The process runs under harsher circumstances than conventional steam methane (SMR), allowing for more waste heat recovery.

Customize this study as per your requirement@ https://www.precedenceresearch.com/customization/4367

ATR’s heating approach enables easier carbon collection and less pre-combustion capture equipment. However, large-scale blue hydrogen generation necessitates the use of numerous reactor trains as well as cryogenic air separation units (ASUs) to provide pure oxygen. These machines consume electricity in complicated operation and safety, needing stringer regulations and safer methods. Although not as economical as SMR, ATR’s combination with carbon capture makes it an attractive option for greenfield blue hydrogen projects.

Transportation Mode Outlook

The pipeline segment dominated the blue hydrogen market in 2023. Pipelines may transmit gaseous hydrogen, just like natural gas. Currently, commercial hydrogen producers possess 1,600 miles of hydrogen pipelines in the United States, which are positioned near significant hydrogen customers such as petroleum refineries and chemical factories. This low-cost approach is suitable for transporting big amounts of hydrogen.

The cryogenic liquid tankers segment is expected to witness growth at the fastest rate during the forecast period. Cryogenic gas storage is a low-cost method that enhances safety while requiring the fastest refill of the gas supply. It eliminates the need to handle and change cylinders, allowing deliveries to be completed unaccompanied outside of business hours. This eliminates the need for cylinder handling, which necessitates extra attention and safety equipment. Gas storage is safer since heavy cylinders are removed from the production floor, freeing up important space. Furthermore, cryogenic storage systems can assist in offsetting installation expenses by lowering labor expenditures per unit volume.

Application Outlook

The power generation segment dominated the blue hydrogen market in 2023. 96% of hydrogen is created globally by reforming and heating fossil fuels to 800°C. Hydrogen fuel cells mix hydrogen and oxygen to create water, electricity, and heat. They do not emit greenhouse gases, which increases demand for blue hydrogen in power generation and contributes to market revenue growth.

The refinery segment is anticipated to grow at a significant rate during the forecast period. Refineries are increasing their need for hydrogen to reduce the sulfur content of diesel fuel, which is being driven by increased demand and severe sulfur standards. However, much of this expansion is being met by the purchase of hydrogen from merchant providers, which has an influence on the refining industry's usage of natural gas as feedstock. There are two types of hydrogen generation: purpose-built hydrogen production utilizing steam methane reformers (SMR) and hydrogen production as a byproduct of other chemical processes. The SMR technique is 90% efficient in producing hydrogen.

Browse More Insights:

- Liquefied Petroleum Gas Market Size and Forecast: The global liquefied petroleum gas market size was USD 151.48 billion in 2023, accounted for USD 160.27 billion in 2024, and is expected to reach around USD 266.21 billion by 2033, expanding at a CAGR of 5.8% from 2024 to 2033.

- Precious Metal Catalysts Market Size and Forecast: The global precious metal catalysts market size was valued at USD 50.08 billion in 2023 and is anticipated to reach around USD 131.80 billion by 2033, expanding at a CAGR of 10.16% from 2024 to 2033.

- Steam Methane Reforming Market Size and Forecast: The global steam methane reforming market size was estimated at USD 750 million in 2022 and it is expected to hit around USD 1,299.39 million by 2032, growing at a CAGR of 5.7% during the forecast period 2023 to 2032.

- Hydrogen Infrastructure Market Size and Forecast: The global hydrogen infrastructure market is surging with an overall revenue growth expectation of hundreds of millions of dollars during the forecast period from 2023 to 2032.

- Low Carbon Hydrogen Market Size and Forecast: The global low carbon hydrogen market size was USD 22.75 billion in 2023, calculated at USD 26.39 billion in 2024 and is expected to reach around USD 100.53 billion by 2033. The market is expanding at a solid CAGR of 16.02% over the forecast period 2024 to 2033.

- Electric Vehicle Market Size and Forecast: The global electric vehicle market size reached USD 255.54 billion in 2023 and is projected to hit around USD 2,108.80 billion by 2033 with a notable CAGR of 23.42% from 2024 to 2033.

- Power Generation Market Size and Forecast: The global power generation market size was estimated at USD 1.8 trillion in 2022 and it is expected to hit around USD 3.9 trillion by 2032, growing at a CAGR of 8.04% during the forecast period from 2023 to 2032.

- Lithium-ion Battery Market Size and Forecast: The global lithium-ion battery market size was valued at USD 70 billion in 2022 and is expected to surpass around USD 387.05 billion by 2032 with a registered CAGR of 18.70% from 2023 to 2032.

- Catalyst Market Size and Forecast: The global catalyst market size was exhibited at USD 36.8 billion in 2022 and it is expected to hit around USD 59.66 billion by 2032 with a registered CAGR of 5% during the forecast period 2023 to 2032.

Blue Hydrogen Market Dynamics

Driver: Wide range of applications

Hydrogen is used in various applications, including transportation, power generation, building heating, and industrial. It is currently utilized to power buses, freight trucks, trains, planes, and ships. The widespread usage of hydrogen is contingent on the affordability of hydrogen fuel cells and the rising availability of hydrogen filling stations.

Hydrogen can also be utilized to transform renewable energy sources into fuel that can be stored and delivered for great distances. It can also help to cut emissions from gas turbines and coal-fired power plants. Hydrogen boilers and household hydrogen fuel cells are still in development, but they could have a large impact in the future.

Restraint: High investment cost

Hydrogen generation is critical for the worldwide shift to green and blue hydrogen, which will replace fossil fuels. This would necessitate considerable investments in electrolyzer capacity, industrial-scale CCUS installation, and new hydrogen transportation infrastructure. Stored hydrogen is also required to balance seasonal electricity demand.

Retrofitting existing gas-fired electricity generation capacity and coal-fired power plants will be required. By 2030, more end-use hydrogen equipment will be installed, including hydrogen fuel cell automobiles. However, the expensive expense of developing low-emission hydrogen manufacturing plants puts projects in danger.

Opportunity: Deployment and competitiveness

Blue hydrogen can increase its deployment and competitiveness by using the established infrastructure and supply chain of the natural gas and coal sectors. It can produce enormous amounts of hydrogen at low cost and with high dependability, as well as adjust production based on power and CO2 storage availability.

Blue hydrogen can also help to cut CO2 emissions in the short term, whereas green hydrogen scales up and becomes more economical in the long run. It can be combined with green hydrogen by utilizing renewable electricity for SMR or gasification.

Blue Hydrogen Market Top Companies

- Linde Plc

- Equinor ASA

- Exxon Mobil Corp.

- Shell Group of Companies

- Engie

- INOX Air Products Ltd.

- Air Liquide

- SOL Group

- Air Products and Chemicals, Inc.

- Iwatani Corp.

Recent Developments

- In January 2024, Researchers from LUT University in Finland investigated the effects of climate change on several types of hydrogen generation, including blue hydrogen (SMR-CCS), grey hydrogen (SMR), turquoise hydrogen (TDM), and green hydrogen (PEM electrolysis).

- In November 2023, Air Products is developing Europe's largest blue hydrogen production plant, while RAG Austria has opened the world's first 100% hydrogen storage facility in a porous subsurface reservoir.

Segments Covered in the Report

By Technology

- Steam Methane Reforming

- Gas Partial Oxidation

- Auto Thermal Reforming

By Transportation Mode

- Pipeline

- Cryogenic Liquid Tankers

By Application

- Chemicals

- Refinery

- Power Generation

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/4367

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

For Latest Update Follow Us: