Singapore , July 26, 2024 (GLOBE NEWSWIRE) --

Established in 1956, PT SUCOFINDO is a joint venture company between the Government of the Republic of Indonesia and SGS, Geneve, Switzerland. As the first inspection in Indonesia, the company currently works closely with the Indonesian policymakers, CFPP asset owners, power purchasers and financial institutions to accelerate clean energy transitions across Indonesia.

Sustainability Economics, an international entity headquartered in Singapore and US, with a big development center in Bangalore providing end-to-end net-zero solutions across high emitting sectors for global businesses. Sustainability Economics brings CLEM (Clean Energy Mechanism), a first-of-its-kind end-to-end solution to accelerate clean energy transitions globally.

Kasu Venkata Reddy, Co-Founder/CEO of Sustainability Economics: “We are excited to partner with PT SUCOFINDO in our shared mission to accelerate the clean energy transition across Indonesia. This collaboration highlights our strong commitment towards achieving net zero goals globally.”

Budi Utomo, Director of Industrial Services of SUCOFINDO: “Partnership with Sustainability Economics will equip our competence and end-to-end service with an international presence that bring values to the Independence Power Producers’ agenda of energy transition towards net zero emissions with the principles of just and affordability.

CLEM – Practical & Crafted Approach

Coal-fired power generation remains a significant contributor to global carbon emissions, Particularly in Asia, where a concentration of young CFPPs exists, averaging less than 15 years old. To address this pressing issue, CLEM, a first-of-its-kind clean energy transition tailor-made solution, takes a practical data-driven approach working with CFPP asset owners, power purchasers and policymakers by connecting the dots to automate, simplify and scale the clean energy transitions.

CLEM VISION: MAKING ENERGY TRANSITIONS PROFITABLE

CLEM's vision is to make energy transition not just practical but profitable for CFPP asset owners and financiers. Leveraging a cutting-edge, data-driven approach, CLEM's tailor-made solutions provide the most effective and strategic clean energy transition planning while ensuring profitability with a make-it-happen approach.

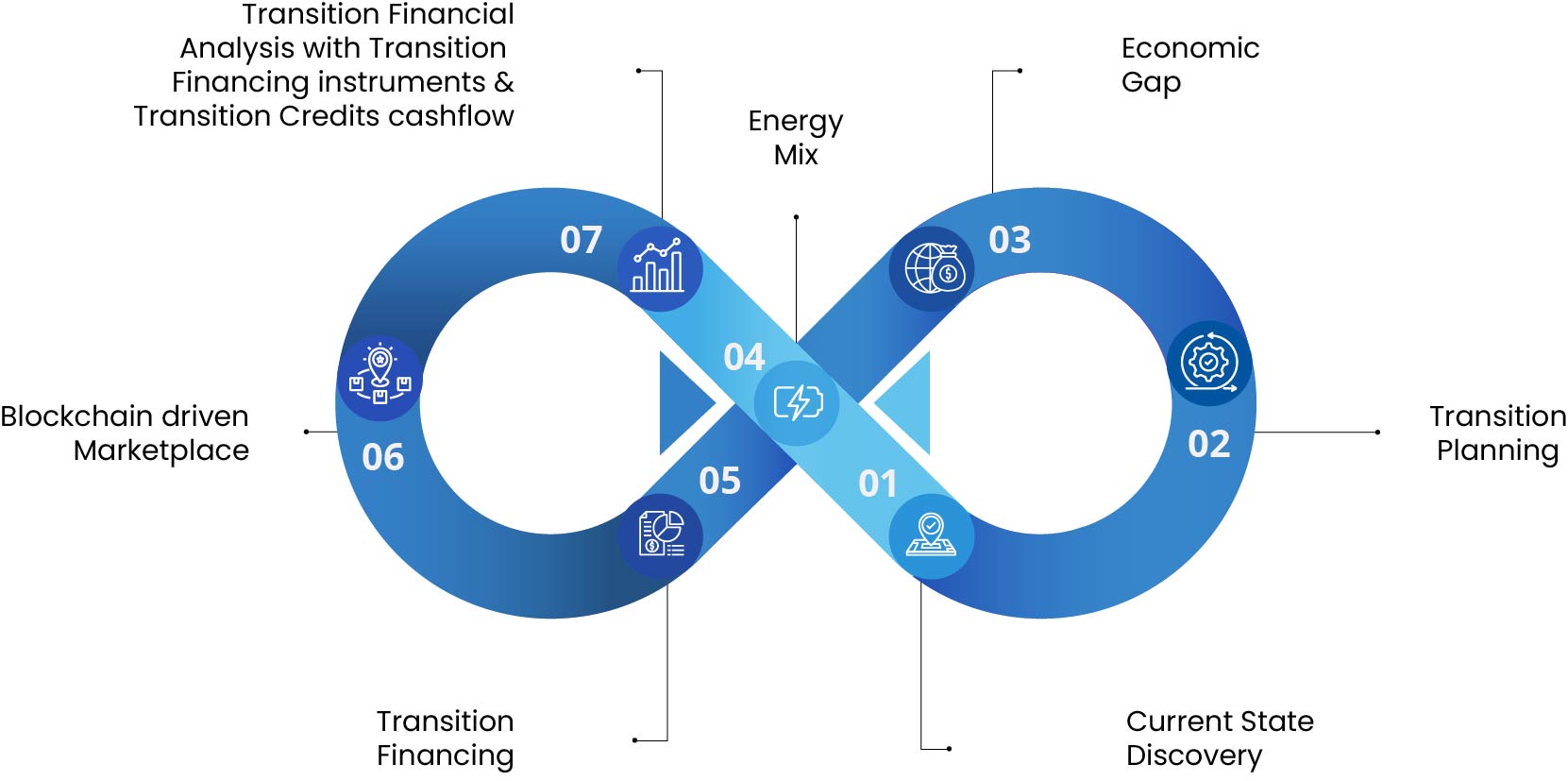

CLEM STRATEGY:

Key outcomes:

Current state discovery – Data-driven extraction of technical and financials of current state of CFPP

Transition planning – Practical location/country-specific transition plan (phased approach) by collaborating with CFPP owners, power purchasers, financial institutions and policymakers.

Economic gap – Practical data-driven mechanism to nail down exact dollars CFPP owners have to forego as part of the transition.

Energy mix – Model-driven approaches covering region/country-specific policies to identify the potential clean energy source technologies and the cost associated along with financial analysis. Build clean energy source technologies working with region/country specific partners.

Transition finance – Data-driven, practical approach to identify transition financing requirements mapping with clear timelines covering different business models. Constructing transition financing requirements by using innovative global financial instruments to make transition profitable and working with our equity, debt global financial partners to raise funds.

Blockchain-driven Marketplace – Source the right clean energy source technology by working with clean energy source developers to fasten the transition.

Financial analysis – Provide detailed financial analysis with innovative transition financing instruments and transition credit cash flows for both equity and debt players.

Summary – Demonstrate profitability with transitions by comparing different options for CFPP owners and financial institutions.

Attachment