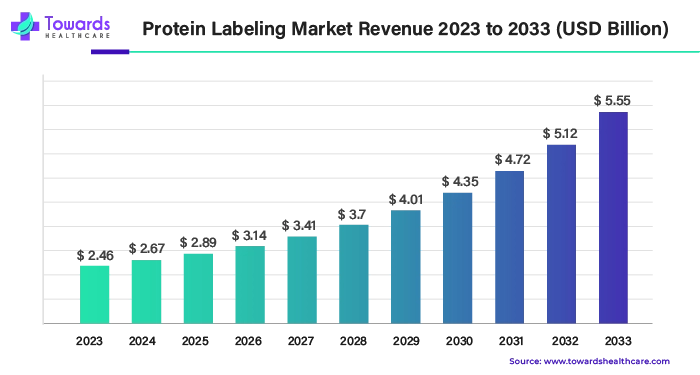

Ottawa, July 29, 2024 (GLOBE NEWSWIRE) -- The global protein labeling market size is predicted to increase from USD 2.46 billion in 2023 to approximately USD 5.12 billion by 2032, a study published by Towards Healthcare a sister firm of Precedence Statistics.

Download a short version of this report @ https://www.towardshealthcare.com/personalized-scope/5171

Key Takeaways

- North America led the market with the largest revenue share of 42% in 2023.

- By product, the reagents segment has held a major revenue share of 64% in 2023.

- By method, the in-vitro segment has contributed more than 71% of revenue share in 2023.

- By application, the immunological techniques segment accounted for the largest revenue share of 41% in 2023.

- By application, the fluorescence microscopy segment is anticipated to grow at a solid CAGR of 9.78% during the forecast period.

Protein Labeling Market at a Glance

The protein labeling market utilizes several reagents or molecules to monitor biological processes, quantify compounds and detect protein modifications. The ability to label a target protein provides researchers with a multitude of opportunities to engage with a protein and gain insight into the various intricate functions that proteins carry out within the body. The proteins are generally labeled using three types of tags: biotin, radioactive enzymes, or fluorescent substances. These labels are attached covalently to the protein’s active site. The labeling can be done either in vitro or in vivo. Protein labeling is widely used in different fields like biotechnology, medicine, genetics, forensics, cell biology, drug discovery, etc.

Evolving Research and Development as a Driver for Protein Labeling Market

The current biological research is a driver in the protein labeling market. Proteomics, genomics, metabolomics, ELISA, Western blotting, etc. are some of the ongoing research topics. Proteomics involves the detection and quantitation of proteins. ELISA and Western blotting are immunological-based assays for the detection of proteins. Fluorescence imaging microscopy is commonly utilized for the live-cell detection of proteins. Such advancements in current biological research can boost the market's growth potential.

Restraint

High Cost of Labeling Kits

The exorbitant cost of protein labeling kits is a restraint of protein labeling market. The cost of recombinase reagents is also high. This restricts the affordability of advanced research and development for some organizations and also hampers throughput and versatility. Additionally, the labeling of a protein results in a complete or partial loss of protein function.

Advanced Imaging Techniques as an Opportunity for Protein Labeling Market

The current most common techniques for imaging protein labeling include fluorescence microscopes, plate readers, flow cytometers, and cell sorters. Although these techniques are widely used, the limited resolution of the images from these techniques is insufficient for a detailed understanding of the proteins. Hence, there is a need for high-resolution imaging techniques and tools. Scientists are investigating novel approaches utilizing advanced techniques like artificial intelligence and machine learning. The utilization of these techniques can improve the resolution of imaging techniques.

- In April 2024, researchers at CeMM developed a novel approach, vpCells, for simultaneously labeling multiple proteins using five distinct fluorescent colors. This approach combines high-throughput microscopy, computer vision, and machine learning.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Top Companies in the Protein Labeling Market:

- Thermo Fischer Scientific, Inc.

- Sigma Aldrich

- Shiru

- Jena Bioscience

- Promega Corporation

- Agilent Technologies, Inc.

- LGC Ltd.

- New England Biolabs

- AnaSpec

Regional Insights

North America dominated the protein labeling market globally in 2023. The region is observed to grow at the fastest rate during the forecast period. Countries like the U.S. and Canada are at the forefront of accelerating the market's growth potential. Cutting-edge research and development and advanced healthcare systems boost the protein labeling market. The latest research on proteomics and metabolomics, as well as advancements in mass spectrometry, demonstrates the positive potential for the market.

- In June 2021, Thermo Fisher Scientific and Advanced Electrophoresis Solutions Ltd. announced an agreement to use cutting-edge protein analysis to accelerate the development of therapeutics. The agreement was signed to showcase the benefits of combining their technology for protein analysis and to give their laboratories access to cutting-edge biopharmaceutical tools that will allow them to better understand the outcomes of protein separation.

Asia Pacific region is estimated to grow faster in the protein labeling market. Countries like China, India, and Japan are emerging in protein labeling research and applications. Advanced research and development, like novel drug discovery, multi-omics studies, etc., potentiates market growth. Also, the government’s policies encouraging such research enhance the market’s growth.

- In February 2024, researchers at IISER Bhopal developed Baylis Hillman orchestrated Protein Aminothiol Labeling (BHoPAL) technology. This novel technology resolves the long-standing problem of maintaining protein function when treated with chemicals by allowing the attachment of certain chemical components to particular sites on proteins.

Customize this study as per your requirement @ https://www.towardshealthcare.com/customization/5171

Recent Developments

- In April 2022, a German company, Nanotemper Technologies, in collaboration with PharmAI, announced the launch of Proto, a free AI-based web tool for measuring molecular interactions efficiently to discover novel drugs.

- In November 2022, researchers at the Francis Crick Institute and Imperial College of London developed a novel method, Bio-Orthogonal Cell line-specific Tagging of Glycoproteins (BOCTAG), for the identification of proteins released by a specific type of cell. The chemical tags attached to a sugar molecule bind to the genetically modified cell, which can be identified using chemical tags.

- In October 2023, biomedical engineers at UC Davis developed a novel light-activated tool, BioID, for detecting protein-protein interactions. The enzyme TurboID that carries out biotin labeling was divided into halves and attached to the proteins. The halves were activated upon exposure to light and deactivated upon removal of the light source. The method was developed to reduce false positives by labeling proteins that interact with a target within a brief time window.

- In March 2024, researchers at Boston College developed a novel method, the electrochemical protein labeling reaction, eCLIC, to modify proteins. The researchers used a mild charge of electricity to incorporate 5-hydroxytryptophan at the active site of various proteins. The administration of this conjugate into the cells kills cancer cells, specifically with reduced cytotoxicity.

Segmental Insights

By Product

The reagents segment dominated the protein labeling market with a major revenue share of 64% in 2023. The reagents are classified as classic dyes that bind to a particular functional group on a target biomolecule, enabling further detection or purification of the biomolecule. The reactive dyes used for protein labeling include amine labeling, thiol labeling, and carbonyl labeling. Another type of reagent includes fluorescent dyes, which are small, natural, or organic fluorescent molecules that are employed in in vitro experiments for the labeling of biologically relevant molecules. Examples of fluorescent dyes are cyanine, fluorescein, and ethidium bromide.

By Method

The in vitro labeling segment dominated the protein labeling market with a revenue share of 71% in 2023. The most widely used in vitro labeling methods include chemical and enzymatic methods. The chemical method of protein labeling involves covalently attaching a label conjugated to chemical groups that react with particular amino acids. Whereas, the enzymatic method requires polymerases, ATP, and labeled amino acids or nucleotides.

By Application

The immunological techniques segment dominated the protein labeling market, with the largest revenue share of 41% in 2023. Immunological techniques describe the identification and characterization of viral infections and target cells through the use of antibodies, to detect viral proteins or cellular markers. Since protein labeling can observe cellular processes, like protein synthesis and transport, it is a crucial component of immunological experiments. The different immunological techniques include ELISA, RIA, immunoprecipitation, and western blotting.

The fluorescence microscopy segment also holds a rising growth potential for the protein labeling market, with an anticipated CAGR growth of 9.78% during the forecast period. The fluorescent dyes used for protein labeling are observed using a fluorescence microscope. This technique is widely used to determine the impact of a particular gene, by quantifying the levels of proteins expressed in a certain tissue. Another application is monitoring the processes of the cells by observing a protein under a microscope.

Browse More Insights of Towards Healthcare:

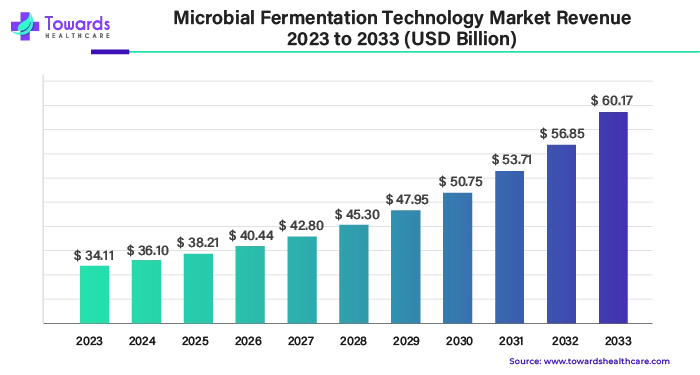

1. Microbial Fermentation Technology Market Size and Trends Report

The global microbial fermentation technology market size was estimated at US$ 34.11 billion in 2023 and is projected to grow US$ 60.17 billion by 2033, rising at a compound annual growth rate (CAGR) of 5.84% from 2024 to 2033.

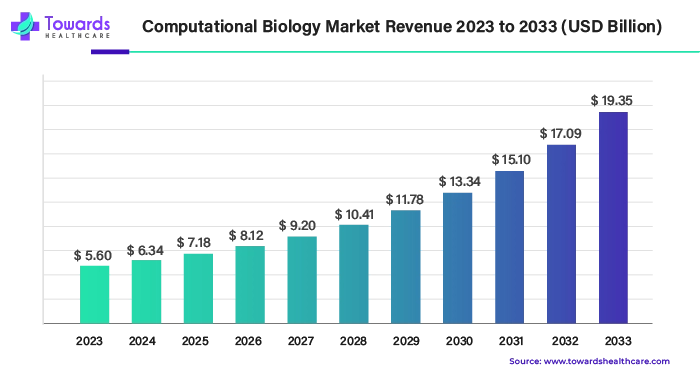

2. Computational Biology Market Size, Growth and Trends Report

The global computational biology market size was estimated at US$ 5.60 billion in 2023 and is projected to grow US$ 19.35 billion by 2033, rising at a compound annual growth rate (CAGR) of 13.20% from 2024 to 2033.

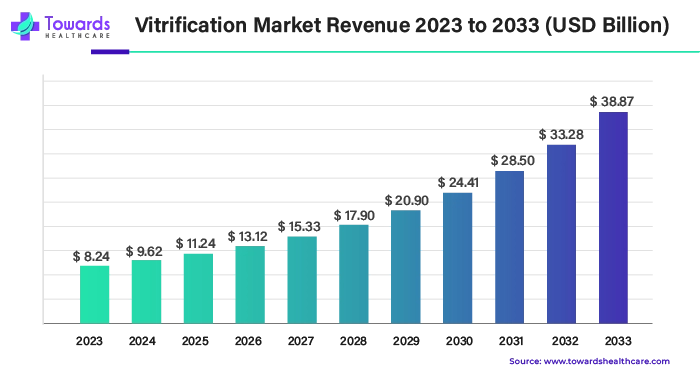

3. Vitrification Market Size, Shares and Regional Growth Report

The global vitrification market size was estimated at US$ 8.24 billion in 2023 and is projected to grow US$ 38.87 billion by 2033, rising at a compound annual growth rate (CAGR) of 16.78% from 2024 to 2033.

4. The global 503B compounding pharmacies market size was estimated at US$ 1.08 billion in 2023 and is projected to grow US$ 2.25 billion by 2033, rising at a compound annual growth rate (CAGR) of 7.63% from 2024 to 2033.

5. The global biotechnology instruments market size was estimated at US$ 90.06 billion in 2023 and is projected to grow US$ 132.8 billion by 2033, rising at a compound annual growth rate (CAGR) of 3.96% from 2024 to 2033.

6. The global biomaterials market size was estimated at US$ 178.16 billion in 2023 and is projected to grow US$ 761.23 billion by 2033, rising at a compound annual growth rate (CAGR) of 15.63% from 2024 to 2033.

7. The global circulating tumor cells market size was estimated at US$ 11.49 billion in 2023 and is projected to grow US$ 41.27 billion by 2033, rising at a compound annual growth rate (CAGR) of 13.64% from 2024 to 2033.

8. The global gene synthesis market size was estimated at US$ 2.1 billion in 2023 and is projected to grow US$ 9.38 billion by 2033, rising at a compound annual growth rate (CAGR) of 16.14% from 2024 to 2033.

9. The global clinical microbiology market size was valued at US$ 4.61 billion in 2023 is expected to reach US$ 7.78 billion by 2033. It is poised to grow at a compound annual growth rate (CAGR) of 5.37% from 2024 to 2033.

10. The global lipid nanoparticle raw materials market size was estimated at US$ 269.31 million in 2023 is to reach around US$ 467.49 million by 2033. Projected to grow at a compounded annual growth rate (CAGR) of 5.67% from 2024 to 2033.

Protein Labeling Market TOC

Introduction

- Definition and Scope of the Market

- Objectives of the Study

- Market Segmentation

- Research Methodology

- Data Sources

Executive Summary

- Market Overview

- Key Findings

- Market Trends

- Competitive Landscape

- Market Dynamics

Market Dynamics

- Drivers

- Increasing Research and Development Activities

- Growing Demand for Protein Labeling in Proteomics Research

- Technological Advancements in Labeling Techniques

- Restraints

- High Cost of Reagents and Kits

- Regulatory Challenges

- Opportunities

- Emerging Markets

- Advancements in Label-Free Techniques

- Challenges

- Complexities in Protein Labeling

Market Analysis

- Market Size and Forecast

- Market Share Analysis

- Growth Rate Analysis

- Market Trends

Market Segments

- By Product

- Reagents

- Proteins

- Enzymes

- Probes/Tags

- Monoclonal Antibodies

- Other Reagents

- Kits

- Services

- Reagents

- By Method

- In-vitro Labeling Methods

- Enzymatic Labeling

- Dye-based Labeling

- Co-translational Labeling

- Site-specific Labeling

- Nanoparticle Labeling

- Others

- In-vivo Labeling Methods

- Photoreactive Labeling

- Radioactive Labeling

- Others

- In-vitro Labeling Methods

- By Application

- Immunological Techniques

- Cell-based Arrays

- Fluorescence Microscopy

- Protein Microarray

- Mass Spectrometry

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- MEA

Cross Segmental Analysis

By Product

- Reagents

- Proteins

- Market Value and Volume in Different Labeling Methods

- Application in Immunological Techniques vs. Mass Spectrometry

- Enzymes

- Market Value and Volume by Application (e.g., Cell-based Arrays vs. Fluorescence Microscopy)

- Probes/Tags

- Market Value and Volume by Method (e.g., Dye-based vs. Nanoparticle Labeling)

- Monoclonal Antibodies

- Market Value and Volume by Application (e.g., Protein Microarray vs. Mass Spectrometry)

- Other Reagents

- Market Value and Volume in Various Methods and Applications

- Proteins

- Kits

- Market Value and Volume by Method

- In-vitro vs. In-vivo Labeling Methods

- Market Value and Volume by Application

- Immunological Techniques vs. Protein Microarray

- Market Value and Volume by Method

- Services

- Market Value and Volume by Application

- Custom Labeling Services for Cell-based Arrays vs. Mass Spectrometry

- Market Value and Volume by Region

- North America vs. Asia-Pacific

- Market Value and Volume by Application

By Method

- In-vitro Labeling Methods

- Enzymatic Labeling

- Market Value and Volume by Product (e.g., Enzymes vs. Probes/Tags)

- Dye-based Labeling

- Market Value and Volume by Application (e.g., Fluorescence Microscopy vs. Protein Microarray)

- Co-translational Labeling

- Market Value and Volume by Product and Region

- Site-specific Labeling

- Market Value and Volume by Application and Region

- Nanoparticle Labeling

- Market Value and Volume by Application and Product

- Others

- Market Value and Volume across Various Applications

- Enzymatic Labeling

- In-vivo Labeling Methods

- Photoreactive Labeling

- Market Value and Volume by Application (e.g., Immunological Techniques vs. Cell-based Arrays)

- Radioactive Labeling

- Market Value and Volume by Product and Region

- Others

- Market Value and Volume by Method and Application

- Photoreactive Labeling

By Application

- Immunological Techniques

- Market Value and Volume by Product

- Reagents vs. Kits

- Market Value and Volume by Method

- In-vitro vs. In-vivo Labeling

- Market Value and Volume by Product

- Cell-based Arrays

- Market Value and Volume by Product

- Proteins vs. Enzymes

- Market Value and Volume by Method

- Enzymatic vs. Dye-based Labeling

- Market Value and Volume by Product

- Fluorescence Microscopy

- Market Value and Volume by Product

- Probes/Tags vs. Kits

- Market Value and Volume by Method

- Dye-based vs. Nanoparticle Labeling

- Market Value and Volume by Product

- Protein Microarray

- Market Value and Volume by Product

- Monoclonal Antibodies vs. Other Reagents

- Market Value and Volume by Method

- Co-translational vs. Site-specific Labeling

- Market Value and Volume by Product

- Mass Spectrometry

- Market Value and Volume by Product

- Enzymes vs. Probes/Tags

- Market Value and Volume by Method

- Nanoparticle vs. Enzymatic Labeling

- Nanoparticle vs. Enzymatic Labeling

- Market Value and Volume by Product

By Region

- North America

- Market Value and Volume by Product

- Reagents vs. Kits

- Market Value and Volume by Method

- In-vitro vs. In-vivo Labeling

- Market Value and Volume by Application

- Immunological Techniques vs. Cell-based Arrays

- Market Value and Volume by Product

- Europe

- Market Value and Volume by Product

- Proteins vs. Monoclonal Antibodies

- Market Value and Volume by Method

- Dye-based vs. Photoreactive Labeling

- Market Value and Volume by Application

- Fluorescence Microscopy vs. Mass Spectrometry

- Market Value and Volume by Product

- Asia-Pacific

- Market Value and Volume by Product

- Enzymes vs. Kits

- Market Value and Volume by Method

- Site-specific vs. Radioactive Labeling

- Market Value and Volume by Application

- Protein Microarray vs. Immunological Techniques

- Market Value and Volume by Product

- Latin America

- Market Value and Volume by Product

- Probes/Tags vs. Other Reagents

- Market Value and Volume by Method

- Nanoparticle vs. Enzymatic Labeling

- Market Value and Volume by Application

- Cell-based Arrays vs. Mass Spectrometry

- Market Value and Volume by Product

- Middle East and Africa

- Market Value and Volume by Product

- Monoclonal Antibodies vs. Services

- Market Value and Volume by Method

- Photoreactive vs. Co-translational Labeling

- Market Value and Volume by Application

- Immunological Techniques vs. Fluorescence Microscopy

- Immunological Techniques vs. Fluorescence Microscopy

- Market Value and Volume by Product

Go-to-Market Strategies for Protein Labeling Market (Selective Region)

- Market Segmentation and Targeting

- Identify key market segments

- Develop targeted marketing strategies

- Focus on high-growth regions and applications

- Product Differentiation and Positioning

- Highlight unique features and benefits

- Position products by application

- Develop a strong value proposition

- Pricing Strategy

- Competitive pricing analysis

- Value-based pricing for premium products

- Discount strategies for bulk purchases

- Distribution Channels

- Establish partnerships with key distributors

- Leverage online sales platforms

- Develop direct sales channels

- Sales and Marketing

- Invest in a skilled sales force

- Utilize digital marketing strategies

- Participate in industry conferences and trade shows

- Customer Relationship Management

- Develop relationships with key opinion leaders

- Provide excellent customer support

- Implement loyalty programs

- Regulatory and Compliance

- Ensure compliance with regulatory standards

- Obtain necessary certifications

- Monitor regulatory changes

- Research and Development

- Invest in continuous R&D

- Collaborate with research institutions

- Focus on developing new labeling techniques

- Strategic Partnerships and Alliances

- Form strategic alliances for co-development

- Partner with academic institutions

- Establish relationships with CROs

- Market Entry and Expansion

- Develop a phased market entry strategy

- Focus on entering high-growth markets

- Plan for gradual expansion

- Risk Management

- Identify potential risks

- Monitor market trends and competitor activities

- Adapt strategies based on market feedback

- Performance Metrics and Monitoring

- Set clear performance metrics

- Regularly monitor sales performance and customer feedback

- Adjust strategies based on performance data

Integration of AI in Protein Labeling Market

- Enhanced Data Analysis

- Use AI algorithms to analyze large datasets for identifying patterns and insights.

- Improve accuracy and efficiency in protein identification and quantification.

- Automation of Labeling Processes

- Implement AI-driven automation for labeling processes to increase throughput.

- Reduce human error and enhance reproducibility in experimental procedures.

- Predictive Modeling

- Develop AI models to predict labeling outcomes based on protein structure and function.

- Optimize labeling protocols by simulating different conditions and parameters.

- Advanced Imaging and Detection

- Utilize AI for image analysis in fluorescence microscopy and other imaging techniques.

- Enhance detection sensitivity and specificity through AI-powered image processing.

- Custom Labeling Solutions

- Offer AI-based custom labeling solutions tailored to specific research needs.

- Use machine learning to design novel probes and tags for specialized applications.

- Market and Trend Analysis

- Employ AI to analyze market trends and predict future demands.

- Identify emerging opportunities and potential market shifts.

- Personalized Customer Support

- Implement AI-driven chatbots and virtual assistants for customer support.

- Provide personalized recommendations and troubleshooting based on customer queries.

- Research and Development Acceleration

- Leverage AI to accelerate R&D efforts in developing new labeling techniques.

- Use AI to streamline experimental design and hypothesis testing.

- Integration with Existing Technologies

- Combine AI with existing technologies like mass spectrometry and immunological techniques.

- Enhance the overall workflow and performance of protein labeling applications.

Key Strategic Areas in Protein Labeling Market

- Opportunity Assessment

- Identifying Market Gaps

- Analyzing Emerging Trends

- Competitive Landscape Evaluation

- New Product Development

- Innovation in Labeling Techniques

- Prototyping and Testing

- Product Launch Strategy

- Plan Finances/ROI Analysis

- Cost-Benefit Analysis

- Investment Strategies

- ROI Forecasting and Management

- Supply Chain Intelligence/Streamline Operations

- Supply Chain Optimization

- Vendor and Partner Management

- Logistics and Distribution Efficiency

- Cross Border Intelligence

- International Market Analysis

- Regulatory and Compliance Insights

- Global Expansion Strategies

- Business Model Innovation

- Developing Flexible Business Models

- Exploring New Revenue Streams

- Adapting to Market Changes

- Blue Ocean vs. Red Ocean Strategies

- Identifying Untapped Markets (Blue Ocean)

- Competitive Strategies in Saturated Markets (Red Ocean)

- Strategic Positioning and Differentiation

Competitive Landscape

- Overview

- Market Share Analysis

- Key Developments and Strategies

- Company Profiles

- Thermo Fisher Scientific, Inc.

- Market Value and Volume

- Key Products and Services

- Recent Developments

- LI-COR, Inc.

- Shiru

- F. Hoffmann-La Roche Ltd

- Jena Bioscience GmbH

- Merck KGaA

- New England Biolabs

- Promega Corporation

- Revvity Inc.

- LGC Ltd

- Agilent Technologies Inc.

- Danaher (Cytiva)

- EvolutionaryScale

- Other Key Players

- Thermo Fisher Scientific, Inc.

Future Outlook

- Market Forecast

- Emerging Trends

- Strategic Recommendations

Appendix

- List of Abbreviations

- Methodology

- Primary Research

- Secondary Research

- Assumptions

- Disclaimer

Acquire our comprehensive analysis today @ https://www.towardshealthcare.com/price/5171

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardsautomotive.com

https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

Get Our Freshly Printed Chronicle: https://www.healthcarewebwire.com