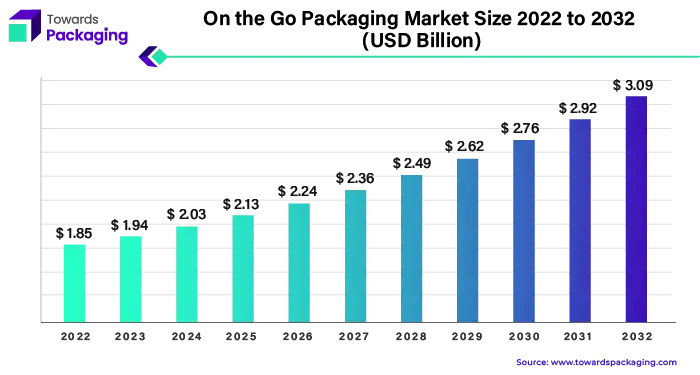

Ottawa, July 30, 2024 (GLOBE NEWSWIRE) -- The global on-the-go packaging market size is predicted to increase from USD 1.94 billion in 2023 to approximately USD 3.09 billion by 2032, according to a study published by Towards Packaging a sister firm of Precedence Statistics.

The on-the-go packaging market is experiencing significant growth due to the increasing demand for convenience food, rising urbanization, and the growing trend of snacking between meals.

Get a comprehensive On-the-Go Packaging Market Size, Companies, Share free sample: https://www.towardspackaging.com/personalized-scope/5175

On-the-go packaging refers to packaging solutions designed for convenience, allowing consumers to easily carry and consume products while they are away from home. This type of packaging is especially popular for food and beverages, providing features like resealable tops, easy-open lids, and single-serving portions. It aims to cater to the busy lifestyles of modern consumers who need quick and hassle-free options for meals and snacks.

The on-the-go packaging market encompasses the production and distribution of these convenient packaging solutions. This market has been growing rapidly, driven by the increasing demand for ready-to-eat food and beverages, rising urbanization, and changing consumer habits. People today are more likely to eat on the move due to their hectic schedules, and on-the-go packaging meets this need perfectly. The market includes a wide range of packaging types such as bottles, pouches, trays, and boxes, each designed to make it easier for consumers to enjoy their products anywhere, anytime.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

On-the-Go Packaging Market at a Glance

The on-the-go packaging market has been gaining significant traction over recent years, driven by the fast-paced lifestyles of modern consumers. This type of packaging is designed for convenience, allowing individuals to easily carry and consume products while they are away from home. It has become particularly popular in the food and beverage sector, where single-serving portions, resealable tops, and easily open lids are highly valued.

The increasing demand for ready-to-eat and drink products is a primary driver of the market growth. Consumers are looking for convenient, portable options that fit their busy schedules, and on-the-go packaging meets this need perfectly.

The on-the-go packaging market is set for sustained growth as it adapts to the dynamic needs of modern consumers across the globe. The focus on convenience, portability, and sustainability will continue to drive innovation and expansion in this sector.

Get a customized On-the-Go Packaging Market report designed according to your preferences: https://www.towardspackaging.com/customization/5175

Busy Lifestyles, Driver for On-the-Go Packaging Market

In today's fast-paced world, many people find themselves juggling work, family, and social commitments, which leaves them with little time to prepare meals at home. This shift in lifestyle has led to a growing demand for convenient and portable food and beverage options. On-the-go packaging is crucial in meeting this demand by providing solutions that keep these products fresh, safe, and easy to consume.

For example, single-serve snack packs, resealable pouches, and portable bottles have become essential for consumers who need quick and easy meal options. These packaging formats are designed to be lightweight and durable, making them ideal for busy individuals who are constantly on the move. Whether it's a quick breakfast on the way to work, a midday snack between meetings, or a portable dinner for a family outing, on-the-go packaging ensures that food remains fresh and ready to eat.

- In December 2023, Kellanova reduced the amount of plastic used in its packaging for some of its top snack items, ensuring the same amount of food is preserved while using less material. This not only caters to the convenience of busy consumers but also addresses environmental concerns, making the packaging more sustainable.

Companies are increasingly incorporating smart packaging technologies to enhance consumer experience. Features like temperature monitoring, freshness indicators, and interactive packaging are becoming more common, allowing consumers to trust the quality and safety of their food even when they are on the go.

Growing Urbanization, Driver for On-the-Go Packaging Market

Urbanization is a key factor driving the on-the-go packaging market. As more people move to cities, they often find themselves with limited access to full kitchens or the time to prepare elaborate meals. This shift is reshaping the way people eat and increasing the demand for convenient, portable food options.

In urban environments, the pace of life is fast, and the need for quick meal solutions is high. For instance, many city dwellers rely on single-serve packages, ready-to-eat meals, and snacks that they can easily carry and consume on the way to work or during their lunch breaks. Products like pre-packaged salads, fruit cups, and snack bars have become staples for those navigating the hustle and bustle of city life.

- In November 2023, Nestlé introduced a new line of ready-to-drink smoothies packaged in recyclable materials. This product caters directly to urban consumers who need nutritious options that fit into their busy schedules and align with their growing environmental consciousness.

The rise of food delivery services in urban areas also underscores the importance of on-the-go packaging. Companies like Swiggy and Zomato have seen exponential growth in cities across India, where young professionals often prefer ordering in rather than cooking at home. These services rely heavily on efficient, secure packaging that keeps food fresh and intact during transit.

Balancing Functionality and Sustainability, Restraint for On-the-Go Packaging Market

Consumers today are increasingly demanding packaging that is both convenient and eco-friendly. However, developing packaging that meets both criteria can be quite challenging. Often, sustainable materials don't perform as well as traditional ones in crucial aspects like keeping food fresh or preventing leaks.

One example of this challenge is the use of biodegradable plastics. While these materials are better for the environment, they sometimes fail to provide the same level of protection as conventional plastics. This can lead to issues such as shorter shelf life for products or packaging that is more prone to damage during transportation.

A recent development highlighting this challenge is the shift towards paper-based packaging. Companies are exploring paper alternatives to plastic for items like straws and food containers. However, paper can be less durable and less effective in preserving food quality.

- In November 2023, a major food company had to recall a batch of its new paper-packaged snacks because the packaging failed to keep the contents fresh, resulting in customer complaints and financial losses.

There is also the issue of consumer acceptance. While there is a strong desire for sustainable packaging, consumers still expect the same level of convenience and product protection they are used to. If sustainable packaging doesn't meet these expectations, it can lead to dissatisfaction and reduced sales. For example, in mid-2023, a popular beverage company faced backlash after switching to a compostable bottle that leaked when not stored upright, causing inconvenience for users.

Reusable and Refillable Packaging Systems, Opportunity for On-the-Go Packaging Market

The rise of reusable and refillable packaging systems presents a significant opportunity for the on-the-go packaging market. As environmental concerns continue to grow, consumers are becoming more conscientious about the waste generated from single-use packaging. Reusable and refillable solutions not only address these concerns but also appeal to eco-friendly consumers who prioritize sustainability in their purchasing decisions.

A prime example of this opportunity is the development of refillable beverage containers. These containers can be designed for both hot and cold drinks and are made from durable materials that can withstand multiple uses. Consumers can purchase these containers once and then refill them at home, at coffee shops, or at designated refill stations.

- In 2023, a leading coffee chain introduced a program that allows customers to bring their own reusable cups, offering discounts as an incentive. This initiative not only reduces waste but also fosters customer loyalty by promoting a sustainable lifestyle.

North America Holds the Largest Share Market in On-to-Grow Packaging

North America leads the on-the-go packaging market, driven by the fast-paced lifestyle prevalent across the region. The United States and Canada are significant contributors to this trend due to high consumer demand for convenient food and beverage options. The region’s culture of frequent snacking and busy work schedules propels the need for portable packaging solutions.

Recent developments underscore this trend. For instance, PepsiCo has recently introduced a new line of flexible snack packaging that incorporates more sustainable practices. Similarly, Mondelez's innovative packaging for snack items reflects the growing emphasis on convenience while aiming for environmental friendliness. North American companies are at the forefront of integrating eco-friendly materials and advanced packaging technologies to meet the evolving consumer needs.

Europe to Grow at a Notable Rate

Europe’s on-the-go packaging market is characterized by a strong emphasis on sustainability and innovation. European consumers are highly conscious of environmental issues, which influences their preference for eco-friendly packaging solutions. The market is seeing a shift towards packaging that not only offers convenience but also minimizes environmental impact.

Recent innovations in Europe include Amcor’s development of an all-polyethylene spouted pouch in collaboration with Stonyfield Organic and Cheer Pack North America. This packaging solution represents a significant step towards more sustainable packaging options. Additionally, European companies are actively pursuing advanced technologies such as smart packaging and reusable solutions to meet consumer demands.

Asia Pacific on to Grow at a Rapid Rate

In Asia Pacific, the on-the-go packaging market is expanding rapidly, particularly in urban centers like Seoul, Tokyo, Bangkok, Jakarta, and Singapore. The region's booming urbanization and lifestyle changes are driving the demand for convenient and portable packaging solutions. Consumers in these cities are increasingly favoring quick and easy food options, which is reflected in the growing popularity of on-the-go packaging formats.

For example, Nutifood from Vietnam recently introduced a new carton bottle format for its premium nutrition milk, eliminating plastic usage. This move aligns with the rising consumer preference for sustainable packaging solutions. The market in India is also growing robustly, with significant players like Nestlé and Hindustan Unilever investing in on-the-go packaging to cater to the burgeoning demand. The Indian market for snacks is projected to grow significantly, reflecting the increasing preference for convenient, ready-to-eat food options.

- In April 2024, Vietnam's Nutifood introduced the SIG DomeMini carton bottle, providing a convenient and eco-friendly packaging solution for its premium milk products. This development underscores the region's shift towards sustainable and user-friendly packaging formats.

In India, the on-the-go packaging market is experiencing substantial growth. The rapid urbanization and changing lifestyles in cities like Mumbai, Delhi, and Bangalore are driving the demand for convenient food and beverage options. Major FMCG companies, such as Nestlé and Hindustan Unilever, are actively expanding their portfolios to include on-the-go packaging formats that cater to the increasing need for portability and convenience.

- For instance, in February 2024, RIND Snacks acquired Small Batch Organics to enhance its product offerings with convenient, on-the-go packaging options. The Indian market is set to grow significantly, with forecasts indicating a rise in the demand for packaged snacks and beverages, supported by evolving consumer preferences and increasing urbanization.

The Plastic Segment to Grow as a Leading Segment

Plastic remains the leading material in on-the-go packaging due to its versatility, durability, and cost-effectiveness. Its ability to be molded into various shapes and sizes makes it ideal for packaging a wide range of products, from snacks to beverages. The convenience of resealable features and lightweight properties further enhances its popularity among consumers and manufacturers alike.

The Pouches is Observed to Sustain as a Leader

Pouches have emerged as the dominant packaging type in the on-the-go segment. Their flexibility, compactness, and ease of use make them highly suitable for portable food and beverage products. Pouches can be customized with features like resealable closures and tear notches, which add to their functionality and appeal to busy consumers.

The Food & Beverage Segment to Sustain as a Leader in the Market

The food and beverage sector is the largest end user of on-the-go packaging. This segment drives significant demand for convenient and portable packaging solutions that cater to busy lifestyles. From single-serve snack packs to drink bottles, the food and beverage industry’s need for practical, on-the-go packaging is a major factor in the market’s growth.

More Insights in Towards Packaging

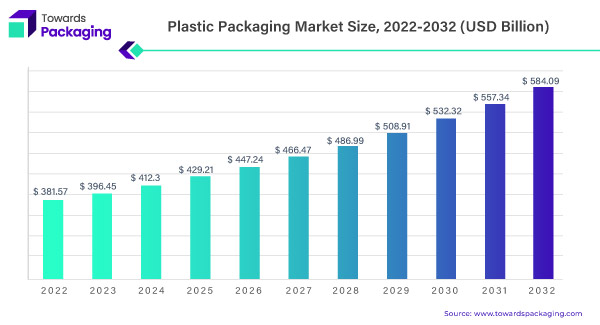

Plastic Packaging Market Size, Companies and Growth Rate

The global plastic packaging market size reached USD 381.57 billion in 2022 and is projected to hit around USD 584.09 billion by 2032, growing at a CAGR of 4.4% from 2023 to 2032.

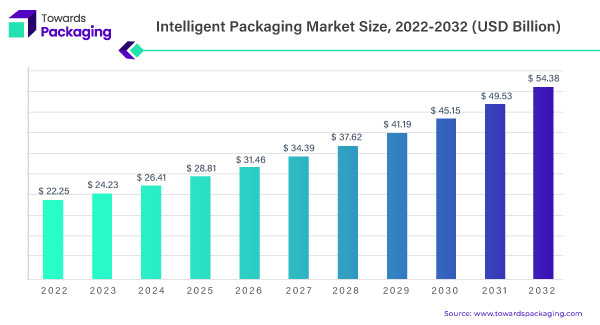

Intelligent Packaging Market Size, Share and Companies

The global intelligent packaging market size accounted for USD 24.23 billion in the year 2023 and it is predicted to hit around USD 54.38 billion by 2032, registering at a CAGR of 9.4% from 2023 to 2032.

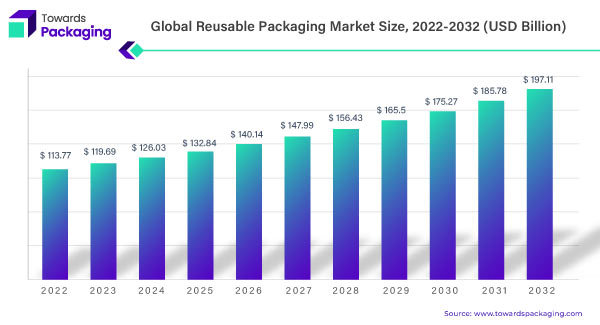

Reusable Packaging Market Size and Overview

The global reusable packaging market size was estimated at USD 113.77 billion in 2022 and is projected to reach a revised size of USD 197.11 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032.

- The global recyclable packaging market size accounted for USD 28.7 billion in 2022 and it is predicted to hit around USD 46.15 billion by 2032, growing at a CAGR of 4.9% from 2023 to 2032.

- The global pharmaceutical packaging market size is estimated to grow from USD 117.23 billion to reach an estimated USD 322.50 billion by 2032, growing at a CAGR of 10.7% from 2023-2032.

- The e-commerce packaging market size is estimated to grow from USD 51,248 million in 2022 to reach an estimated USD 2,42,061 million by 2032, at a growing CAGR 16.8% from 2023 to 2032.

- The global pharmaceutical temperature-controlled packaging solutions market size was valued at USD 578.9 million in 2022 and is predicted to reach around USD 945.2 million by 2030, growing at a 6.30% CAGR from 2022 to 2030.

- The global protective packaging market size has reached USD 30,904.05 million in 2023 is expected to reach USD 46,243.03 million by 2032, at CAGR of 4.6% from 2023 to 2032.

- The global rigid plastic packaging market size estimated was valued at USD 310.65 billion in 2023 and is estimated to reach around USD 542.91 billion by 2032, exhibiting a CAGR of 6.4% between 2023 and 2032.

- The global artificial intelligence in packaging market size was at USD 2,021.3 million in 2022 to expected to hit USD 5,375.28 million by 2032, at 10.28% CAGR from 2023 to 2032.

Major Breakthroughs in the On-the-go Packaging Market:

- In December 2023, Kellanova, a food packaging company, announced a significant reduction in plastic used in their on-the-go snack packaging while maintaining the same product volume. This highlights the ongoing focus on sustainable solutions in the industry.

- In April 2024, Dairy company Nutifood from Vietnam takes the SIG DomeMini carton bottle for consumer convenience in a handy format. Nutifood will bring Varna brand premium adult nutrition milk from its shelf which is a carton pack containing no plastic.

- In March 2024, an initiative by PepsiCo and its snack flexible package supply chain partners already certified the recycled plastic content in the new premium snack packaging to be 50%.

- In March 2024, PepsiCo as food and beverage business has introduce you to a new paper outer bag for all the Snack A Jacks multipack. The novel outside paper bag is believed to be extensively recyclable through your domestic waste bins and kerbside collection.

On-the-Go Packaging Market TOC

Introduction

- Research Objective

- Scope of the Study

- Definition and Taxonomy

Research Methodology

- Research Approach

- Data Sources

- Assumptions

Executive Summary

- Synopsis

- Analyst Recommendations

Market Overview

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Value chain analysis

- Raw Material Sourcing

- Manufacturing Process

- Logistics & Transportation

- Buyer Preferences

- Trends

- Market Trends

- Technological Trends

- Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitute

- Threat of New Entrants

- Degree of Competition

- PESTLE Analysis for 5 Leading Countries

- Regulatory Framework for Leading Countries/Regions

- Supply Demand Analysis

- Production & Consumption Statistics

- Export Import Statistics

- Price Trend Analysis

Global On-the-Go Packaging Market Assessment

- Overview

- Global On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By Material (2021 – 2033)

- Paper & Paperboard

- Plastic

- Glass

- Aluminium

- Metal

- Global On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By Packaging Type (2021 – 2033)

- Bags

- Pouches

- Bottles

- Boxes

- Cans

- Cartons

- Jars

- Clamshells

- Global On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By End User (2021 – 2033)

- Food & Beverage

- Pharmaceuticals

- Personal Care

- Healthcare

- Others

- Global On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By Region (2021 – 2033)

- North America

- Asia Pacific

- Europe

- LAMEA

North America On-the-Go Packaging Market Assessment

- Overview

- North America On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By Material (2021 – 2033)

- Paper & Paperboard

- Plastic

- Glass

- Aluminium

- Metal

- North America On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By Packaging Type (2021 – 2033)

- Bags

- Pouches

- Bottles

- Boxes

- Cans

- Cartons

- Jars

- Clamshells

- North America On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By End User (2021 – 2033)

- Food & Beverage

- Pharmaceuticals

- Personal Care

- Healthcare

- Others

Asia Pacific On-the-Go Packaging Market Assessment

- Overview

- Asia Pacific On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By Material (2021 – 2033)

- Paper & Paperboard

- Plastic

- Glass

- Aluminium

- Metal

- Asia Pacific On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By Packaging Type (2021 – 2033)

- Bags

- Pouches

- Bottles

- Boxes

- Cans

- Cartons

- Jars

- Clamshells

- Asia Pacific On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By End User (2021 – 2033)

- Food & Beverage

- Pharmaceuticals

- Personal Care

- Healthcare

- Others

Europe On-the-Go Packaging Market Assessment

- Overview

- Europe On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By Material (2021 – 2033)

- Paper & Paperboard

- Plastic

- Glass

- Aluminium

- Metal

- Europe On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By Packaging Type (2021 – 2033)

- Bags

- Pouches

- Bottles

- Boxes

- Cans

- Cartons

- Jars

- Clamshells

- Europe On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By End User (2021 – 2033)

- Food & Beverage

- Pharmaceuticals

- Personal Care

- Healthcare

- Others

LAMEA On-the-Go Packaging Market Assessment

- Overview

- LAMEA On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By Material (2021 – 2033)

- Paper & Paperboard

- Plastic

- Glass

- Aluminium

- Metal

- LAMEA On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By Packaging Type (2021 – 2033)

- Bags

- Pouches

- Bottles

- Boxes

- Cans

- Cartons

- Jars

- Clamshells

- LAMEA On-the-Go Packaging Market Size Value (US$) and Volume (Billion Tons), By End User (2021 – 2033)

- Food & Beverage

- Pharmaceuticals

- Personal Care

- Healthcare

- Others

Company Profile

- Nestlé

- Company Overview

- Geographic Footprints

- Financial Performance

- Product Portfolio

- SWOT Analysis

- R&D Efforts

- Recent Developments & Strategic Collaborations

- Product Launch/M&A/Technical Collaboration

- Procter & Gamble (P&G)

- Unilever

- Amcor plc

- Mondi Group

- Sonoco Products Company

- Berry Global Group

- Smurfit Kappa Group

- Sealed Air Corporation

- WestRock Company

- Georgia-Pacific LLC

- Huhtamaki Oyj

- Tetra Pak

- Constantia Flexibles Group GmbH

- Winpak Ltd.

- ProAmpac LLC

- Pactiv LLC

- Glenroy Inc.

- Stora Enso Oyj

Conclusion & Recommendations

Act Now and Get Your On-the-Go Packaging Market Size, Companies and Insight 2032 @ https://www.towardspackaging.com/price/5175

Get the latest insights on packaging industry segmentation with our Annual Membership. Subscribe now for access to detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead in the dynamic packaging sector with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/