Anchorage, Alaska, July 31, 2024 (GLOBE NEWSWIRE) -- Nova Minerals Limited (“Nova” or the “Company”) (NASDAQ: NVA, NVAWW) (ASX: NVA) (OTC: NVAAF) (FSE: QM3) is pleased to announce the commencement of resource definition drilling and exploration field programs on its over 200mi2 flagship Estelle Gold Project, located in the prolific Tintina Gold Belt in Alaska.

The Company is focused on Feasibility Study (FS) stage drilling at the high-grade RPM deposit to continue to increase and prove-up resources to the higher confidence Measured and Indicated categories. With a total defined 5.2 Moz Au in-pit constrained S-K 1300 compliant resource (Table 1) across 4 deposits, the Estelle Gold Project has development optionality in terms of initial project size and scale, which is subject to market conditions and strategic partners to meet our objective of ultimately growing the Estelle Gold Project into a tier 1 gold producer. The Feasibility Study currently underway is considering a strategy to achieve production with a scalable operation, by:

| 1. | Establishing an initial low capex smaller scale operation at the high-grade RPM deposit requiring less infrastructure for expected early cashflow and high margins to potentially self-fund expansion plans; and/or |

| 2. | Develop the higher capex larger mining operation for increased gold production, cash flow, and mine life that potential future large gold company strategic partners have expressed an interest. |

Work Plan and PFS Highlights:

| ● | Resource Drilling. Program focused at RPM to increase and prove-up resources as part of the Feasibility Study utilizing the company owned drill rig to achieve a cost efficient program (Figures 1 to 5). |

| ● | Mineral Resource Estimate (MRE). Update to include the 2023 and 2024 drilling data and to incorporate the higher gold price for an updated resource. |

| ● | LIDAR. Detailed survey across the property to enable detailed infrastructure design, mineral reserve classification, exploration, etc. |

| ● | Heap Leach. Metallurgical test work is currently underway with METS Engineering to include a low-cost gold recovery method option in the flow sheet for processing lower grade ores to potentially substantially reduce capex and increase the gold production profile. |

| ● | Geotechnical. Detailed studies are underway to potentially increase pit slope angles further. Early indications show very competent geology, with the study results expected to have a significant positive impact on the project economics. |

| ● | Ore Sorting. FS level test work to commence to investigate the additional benefit of using Steinart multiple sensor technologies and further improve on previous exceptional results from utilizing XRT density sorting. Ore sorting results to date have shown the potential to significantly improve resource extraction providing processing optionality, which is expected to reduce overall processing costs, increase total gold production, and increase the life of mine. In addition, planning is underway to complete a future 200kt bulk pit pilot test program to further de-risk ore sorting and optimize material handling and flow. The expected benefits of ore sorting to improve project economics include: |

| ○ | Pre-concentration of mill feed by separating it into high-grade, low-grade and waste fractions | |

| ○ | Selective high grading of lower grade ores and existing waste dumps | |

| ○ | Reduction of environmental risks and costs – smaller tailings dam footprint | |

| ○ | Optimization of multiple process streams, for example, sending appropriate ore to the mill and heap leach | |

| ○ | Pre-concentration of ore in order to reduce transportation costs | |

| ○ | Lowering operating costs | |

| ○ | Improving ore grade |

| ● | Critical Elements. In addition to copper and silver, highly elevated concentrations of Antimony and other critical elements have been discovered at numerous prospects across the Estelle Project. These elements have the potential to provide significant by-product credits to the project. The Company continues to include multi-element analysis for all samples to define these resources for potential future extraction from the gold processing waste stream, and/or as a stand-alone small-scale operation for near term cash flow, i.e. for antimony production which is found in prospects outside of the existing gold deposits. The Company continues to pursue this opportunity as well as federal and state grants for critical minerals development studies and extraction/refining plant capital requirements. The US Government is engaged in providing grant funding and support through the Defense Production Act (DPA) and other legislation to establish and fully secure US domestic critical minerals supply chains which are currently controlled by foreign adversaries. The Estelle Gold Project with its potential of contained critical mineral resources and other key project aspects could contribute to achieving these US national security objectives. |

Nova CEO, Mr Christopher Gerteisen commented: “In less than 5 years we have taken the project from green fields to a total 5.2 Moz Au in-pit constrained S-K 1300 compliant resource with a FS now in progress. We have focused defining high confidence resources for conversion to reserves at 2 deposits, RPM and Korbel, from the over 20 prospects across the Estelle Gold Project on our path towards production. Now in the FS stage, the asset is progressing towards development with our strategy reflecting the flexibility of the project to current market conditions and our commitment to balance sheet management, with a low-capex, expected high margin, scalable start-up operation with potential self-funded expansion and/or a strategic partner to advance the full-scale production scenario to ultimately realize our goal of becoming a tier 1 gold producer with the Estelle Gold Project.”

This strategy provides a defined path to production designed to provide free cashflow, while potentially allowing us to continue to unlock the district organically and to deliver on our prior track record of resource growth, new discoveries, at a low-cost per discovery ounce.”

2024 RPM Drill Plan

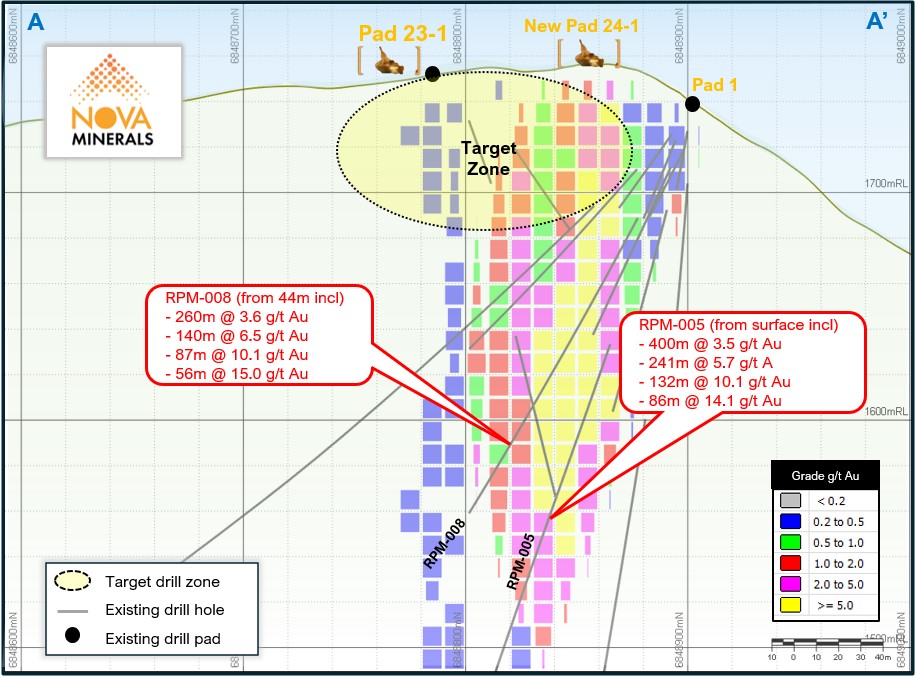

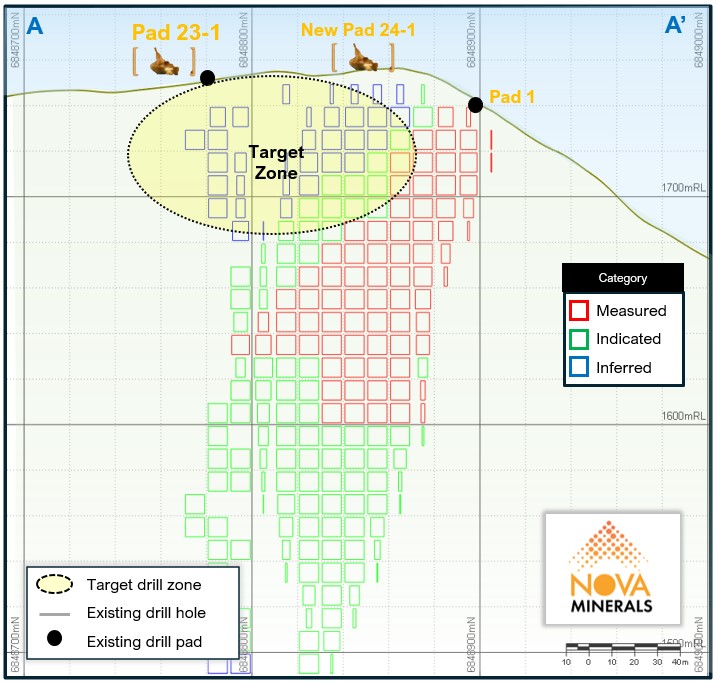

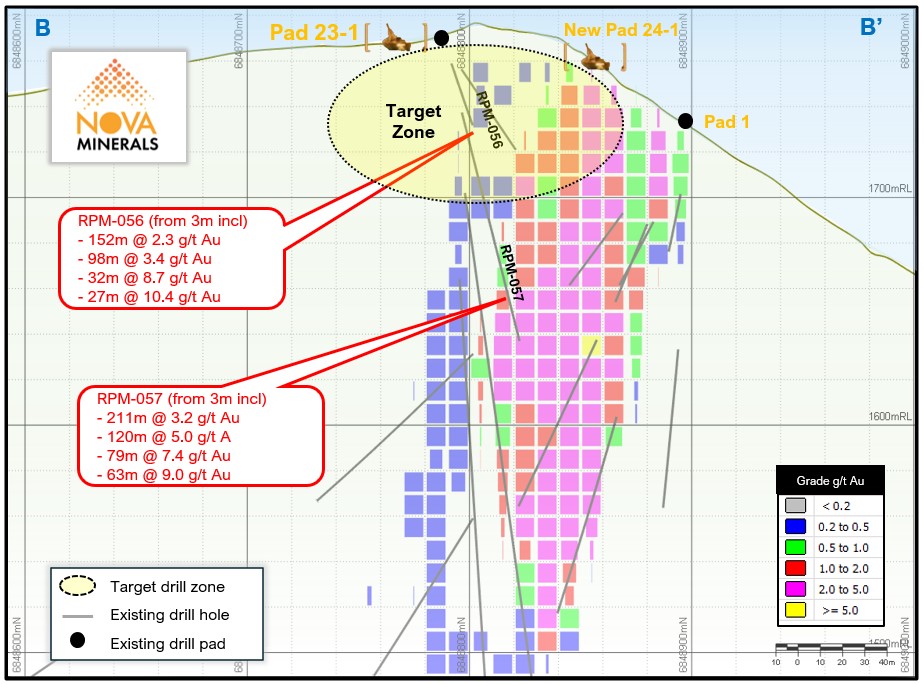

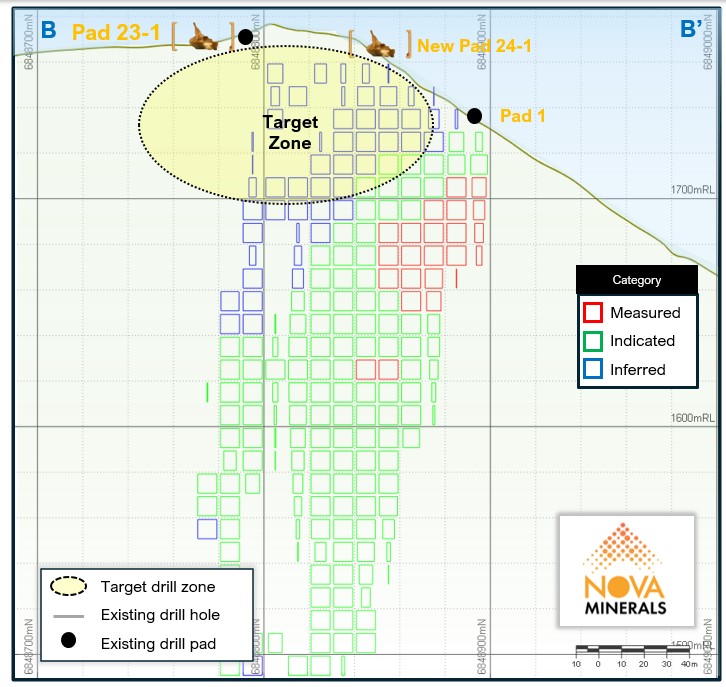

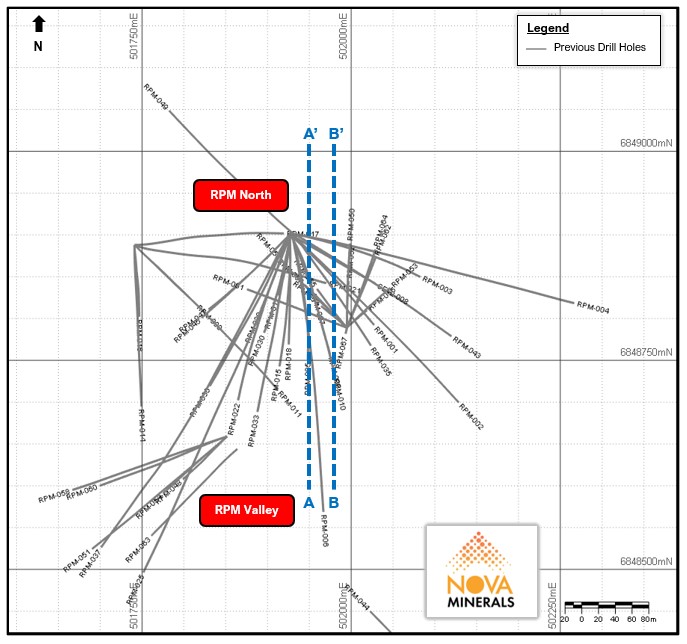

Highly targeted and strategic drilling at the RPM deposit continues, with the Company owned Reverse Circulation (RC) rig working to upgrade and expand the current resource. Of the drilling planned for 2024, the majority will be allocated to advance the RPM high grade starter pit area and to further delineate the at-surface, high-grade (1 g/t Au to > 5 g/t Au) zone encountered there during 2022-2023 drilling, while upgrading inferred resources and testing for potential near surface extensions of the high-grade gold system to the south and west (Figures 1 to 5). Drilling at RPM will be complemented by ongoing metallurgical work and environmental surveys as outlined in this announcement along with studies as necessary to inform economic assessment of the discovery to gain a head start for a potential initial low capex smaller scale operation at the high-grade RPM deposit requiring less infrastructure for early cashflow and high margins to self-fund expansion plans.

Due to the speed, efficiency and lower costs of running the Company owned RC rig on labor hire only, when compared to diamond drilling, this drill program is designed to be conducted at a lower cost, while providing the necessary data density to meet our objectives of expanding and proving up a significant amount of the existing RPM resource into the Measured and Indicated categories to allow conversion into economic reserves for the upcoming FS.

The Company looks forward to announcing the assay results from the drill campaign as they come in to assess the significance of the observations in Figures 1-4.

|  | |

| Figure 1. RPM North Section A-A’ 1950mE looking West showing existing drill traces and selected results, and the 2024 drill target zone – Block model (Au Grade) | Figure 2. RPM North Section A-A’ 1950mE looking West showing the 2024 drill target zone – Block model (Resource classification) |

|  | |

| Figure 3. RPM North Section B-B’ 1975mE looking West showing existing drill traces and selected results, and the 2024 drill target zone – Block model (Au Grade) | Figure 4. RPM North Section B-B’ 1975mE looking West showing the 2024 drill target zone – Block model (Resource classification) |

Figure 5. RPM North and RPM Valley plan view, with all drill holes to date

Table 1. Estelle Gold Project in-pit constrained S-K 1300 compliant Mineral Resource Estimate (MRE) – January 31, 2024. ~ 6,600m of drilling performed in late 2023 is not included in this MRE.

| Measured | Indicated | Inferred | Total | |||||||||||||||||||||||

| Deposit | Cut-off Grade | Tonnes Mt | Grade Au g/t | Au Moz | Tonnes Mt | Grade Au g/t | Au Moz | Tonnes Mt | Grade Au g/t | Au Moz | Tonnes Mt | Grade Au g/t | Au Moz | |||||||||||||

| RPM North | 0.20 | 1.4 | 4.1 | 0.18 | 3.0 | 1.6 | 0.15 | 23 | 0.60 | 0.45 | 28 | 0.88 | 0.78 | |||||||||||||

| RPM South | 0.20 | - | - | - | - | - | - | 23 | 0.47 | 0.35 | 23 | 0.47 | 0.35 | |||||||||||||

| Total RPM | 1.4 | 4.1 | 0.18 | 3.0 | 1.6 | 0.15 | 46 | 0.54 | 0.80 | 51 | 0.70 | 1.13 | ||||||||||||||

| Korbel Main | 0.15 | - | - | - | 240 | 0.31 | 2.39 | 35 | 0.27 | 0.30 | 275 | 0.30 | 2.70 | |||||||||||||

| Cathedral | 0.15 | - | - | - | - | - | - | 150 | 0.28 | 1.35 | 150 | 0.28 | 1.35 | |||||||||||||

| Total Korbel | - | - | - | 240 | 0.31 | 2.39 | 185 | 0.28 | 1.65 | 425 | 0.30 | 4.05 | ||||||||||||||

| Total Estelle Gold Project | 1.4 | 4.1 | 0.18 | 243 | 0.33 | 2.54 | 231 | 0.33 | 2.45 | 476 | 0.3 | 5.17 | ||||||||||||||

Notes to Table 1

| 1. | A Mineral Resource is defined as a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity, that there are reasonable prospects for economic extraction. |

| 2. | The mineral resource applies a reasonable prospect of economic extraction with the following assumptions: |

| ● | Resources are constrained within optimized pit shells that reflect a conventional large-scale truck and shovel open pit operation with cost and revenue parameters as follows: |

| ○ | Gold price of US$2,000/oz | |

| ○ | 5% royalty on recovered ounces | |

| ○ | Pit slope angles of 50o | |

| ○ | Mining cost of US$1.65/t | |

| ○ | Processing cost for RPM US$9.80/t and for Korbel US$5.23/t (inclusive of ore sorting for Korbel). | |

| ○ | Combined processing recoveries of 88.20% for RPM and 75.94%. | |

| ○ | General and Administrative Cost of US$1.30/t | |

| ○ | Tonnages and grades are rounded to two significant figures. Ounces are rounded to 1000 ounces. Rounding errors are apparent. | |

Please refer to the “S-K 1300 Technical Report Summary Initial Assessment for the Estelle Gold Project, Alaska, USA” with an effective date of January 31, 2024, available under the Company’s website at www.novaminerals.com.au

Christopher Gerteisen, P.Geo., Chief Executive Officer of Nova Minerals, has supervised the preparation of this news release and has reviewed and approved the scientific and technical information contained herein. Mr. Gerteisen is a “qualified person” for the purposes of SEC Regulation S-K 1300.

About Nova Minerals Limited

Nova Minerals Limited is a gold and critical minerals exploration and development company focused on advancing the Estelle Gold Project, comprised of 513 km2 of State of Alaska mining claims, which contains multiple mining complexes across a 35 km long mineralized corridor of over 20 identified gold prospects, including two already defined multi-million ounce resources across four deposits. The 85% owned project is located 150 km northwest of Anchorage, Alaska, USA, in the prolific Tintina Gold Belt, a province which hosts a 220 million ounce (Moz) documented gold endowment and some of the world’s largest gold mines and discoveries including, Victoria Gold’s Eagle Mine, and Kinross Gold Corporation’s Fort Knox Gold Mine.

Further discussion and analysis of the Estelle Gold Project is available through the interactive Vrify 3D animations, presentations, and videos, all available on the Company’s website. www.novaminerals.com.au

Forward Looking Statements

This press release contains “forward-looking statements” that are subject to substantial risks and uncertainties. All statements, other than statements of historical fact, contained in this press release are forward-looking statements. Forward-looking statements contained in this press release may be identified by the use of words such as “anticipate,” “believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “target,” “aim,” “should,” “will” “would,” or the negative of these words or other similar expressions, although not all forward-looking statements contain these words. Forward-looking statements are based on Nova Minerals Limited’s current expectations and are subject to inherent uncertainties, risks and assumptions that are difficult to predict. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. These and other risks and uncertainties are described more fully in the section titled “Risk Factors” in the final prospectus related to the public offering filed with the Securities and Exchange Commission. Forward-looking statements contained in this announcement are made as of this date, and Nova Minerals Limited undertakes no duty to update such information except as required under applicable law.

For Additional Information Please Contact

Craig Bentley

Director of Finance & Compliance & Investor Relations

E: craig@novaminerals.com.au

M: +61 414 714 19