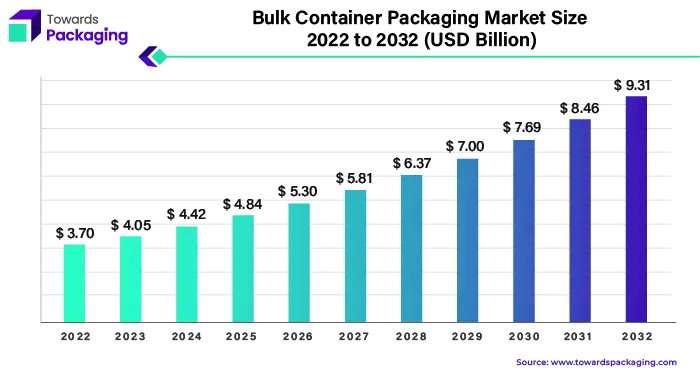

Ottawa, Aug. 06, 2024 (GLOBE NEWSWIRE) -- The global bulk container packaging market size was valued at USD 4.05 billion in 2023 and is predicted to hit around USD 9.31 billion by 2032, according to a study published by Towards Packaging a sister firm of Precedence Statistics.

Get a comprehensive Bulk Container Packaging Market Size, Companies, Share free sample: https://www.towardspackaging.com/personalized-scope/5166

The bulk container packaging market is experiencing substantial growth due to increasing international trade, rising demand for efficient and sustainable packaging solutions, and advancements in packaging technologies.

Bulk Container Packaging Key Takeaways:

- Factors driving growth in the bulk container packaging industry in the Asia-Pacific region.

- North America's contribution to innovation in bulk container packaging.

- Exploring the versatility of plastic bulk containers.

- Applications of flexible intermediate bulk containers in industrial environments.

- Increasing demand for bulk containers within the chemical sector.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Bulk container packaging refers to large-scale containers used for transporting and storing goods in significant quantities. These containers are designed to handle a wide range of materials, including liquids, powders, and granules, making them essential for industries such as agriculture, chemicals, and food and beverages. Examples of bulk container packaging include intermediate bulk containers (IBCs), bulk bags, and drums.

Bulk Container Packaging Market at a Glance

The bulk container packaging market is seeing impressive growth. This growth is driven by increasing demand across various industries for efficient and cost-effective packaging solutions. Bulk container packaging is essential for safely storing and transporting large quantities of goods, offering significant advantages over smaller packaging formats.

The bulk container packaging market involves the production, distribution, and sale of these large containers. This market is growing due to the increasing need for efficient and cost-effective ways to transport large quantities of products across various industries. The demand for sustainable packaging solutions, advancements in packaging technology, and the expansion of global trade are all driving factors contributing to the market's growth.

The bulk container packaging market is set for significant growth, driven by the increasing need for efficient, cost-effective, and sustainable packaging solutions across various industries. With advancements in manufacturing technologies and a strong focus on sustainability, the market is poised to expand further in the coming years, meeting the evolving demands of global trade and industrialization.

Get a customized Bulk Container Packaging Market report designed according to your preferences: https://www.towardspackaging.com/customization/5166

Increasing Global Trade, A Driver

The demand for efficient transportation has significantly risen, driving the growth of the bulk container packaging market. Bulk containers provide cost-effective and efficient solutions for transporting large quantities of goods, making them indispensable in today's global trade environment. These containers are designed to maximize space utilization, reduce shipping costs, and enhance the safety of transported goods.

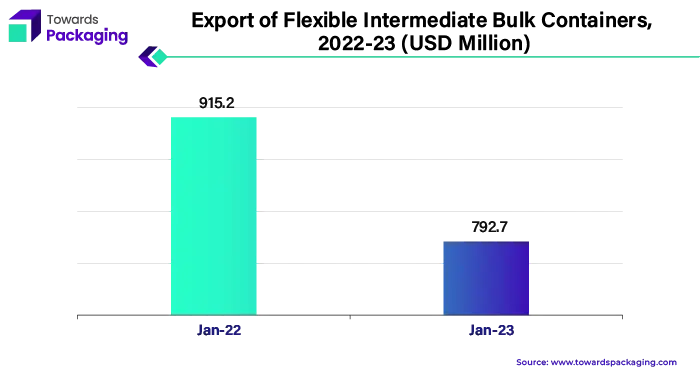

The expansion of international trade routes has further fueled this demand. As global trade continues to grow, there is an increased need for reliable and secure packaging for various products. Bulk containers, including Intermediate Bulk Containers (IBCs) and flexible intermediate bulk containers (FIBCs), offer robust solutions that meet these needs. For example, IBCs are widely used for transporting liquids and powders, providing a durable and reusable option that supports the efficient flow of goods.

- In February 2024, Lawgix International was acquired by Rapid Packaging Inc., aiming to strengthen the national supply chain for their FIBC and industrial bags. This acquisition underscores the strategic importance of bulk containers in enhancing supply chain efficiency and meeting the growing demand for bulk packaging solutions.

Growth in End-Use Industries to Promote the Market’s Expansion

The growth of end-use industries is a significant driver for the bulk container packaging market. Various sectors, including food and beverage, chemicals and petrochemicals, and pharmaceuticals, increasingly rely on bulk containers to meet their packaging and transportation needs.

The food and beverage industry is witnessing a surge in demand for processed foods and beverages. This increase drives the need for bulk container packaging to ensure product safety and freshness during transportation and storage. Bulk containers like Intermediate Bulk Containers (IBCs) and bulk bags are essential for transporting large quantities of ingredients and finished products.

Recent developments in this sector highlight the importance of bulk containers. In early 2024, a major food processing company in the United States invested in advanced bulk container solutions to enhance the efficiency of its supply chain. This investment includes the adoption of reusable bulk containers, which not only reduce waste but also ensure the consistent quality and safety of food products during transit.

The chemical and petrochemical industry heavily relies on bulk containers for storing and transporting hazardous materials. Bulk containers are designed to withstand the rigors of transporting chemicals, ensuring safety and compliance with regulatory standards.

A recent example illustrating this trend is the collaboration between a leading chemical manufacturer and a bulk container supplier to develop specialized containers for transporting high-purity chemicals. This collaboration, announced in March 2024, aims to enhance the safety and efficiency of chemical transportation, reflecting the industry's commitment to innovation and safety.

Restraint, High Initial Investment to Create Hurdle for the Market

Adopting bulk container packaging involves a significant initial investment, which can be a major restraint for many businesses. Companies need to purchase specialized handling equipment, set up adequate storage facilities, and establish proper cleaning infrastructure. These requirements can be particularly challenging for smaller businesses with limited capital.

For example, a small manufacturing company might find it difficult to justify the upfront costs of acquiring bulk containers and the necessary equipment for handling them. This is compounded by the need for dedicated storage space that meets safety standards, especially when dealing with hazardous materials. The expense of setting up such infrastructure can be prohibitive, leading smaller firms to continue using more conventional, less efficient packaging solutions.

- In 2023, a survey conducted by the Industrial Packaging Alliance revealed that 45% of small to medium-sized enterprises (SMEs) cited high initial investment costs as a primary barrier to adopting bulk container packaging. This has led to a slower adoption rate among SMEs compared to larger corporations, which can more easily absorb the costs due to their larger scale of operations.

Upcoming Opportunity, Sustainability Focus to Supplement the Market’s Growth

The growing emphasis on sustainability and circular economy principles is creating significant opportunities for the bulk container packaging market. With an increased focus on reducing waste and promoting recycling, reusable and recyclable bulk containers are gaining traction.

One of the promising developments in this area is the use of sustainable materials like bio-based plastics and recycled content in manufacturing bulk containers. Bio-based plastics, derived from renewable sources such as corn starch or sugarcane, offer a more environmentally friendly alternative to traditional plastics. Similarly, containers made from recycled materials help reduce the demand for virgin resources and lower the overall environmental footprint.

For instance, in 2022, the packaging company EcoBULK introduced a line of bulk containers made entirely from recycled ocean plastics. This initiative not only addresses the issue of plastic waste in oceans but also provides a sustainable packaging solution for various industries. By leveraging recycled materials, companies can enhance their sustainability credentials and appeal to environmentally conscious consumers.

Asia-Pacific Dominated the Bulk Container Packaging Market

The Asia-Pacific region stands out as a dominant force in the bulk container packaging market, driven by rapid industrialization and robust economic development. Countries like China, India, and Japan are at the forefront, with significant investments in sectors such as chemicals, food and beverages, and pharmaceuticals. The rising demand for efficient and cost-effective packaging solutions is propelling the market forward. In India, the government's push for infrastructure development and the growth of the manufacturing sector are key contributors to the increasing demand for bulk container packaging. Recent initiatives such as the "Make in India" campaign have further accelerated industrial growth, leading to a higher need for bulk packaging solutions.

- For instance, in March 2024, the South Korean government launched a new containership, catalyzing advancements in autonomous shipping efforts, highlighting the region's commitment to innovation in logistics and packaging.

North America is on to Grow at a Significant Growth Rate

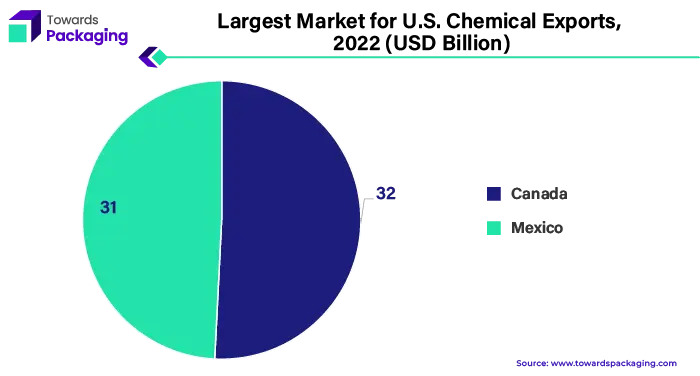

North America plays a crucial role in driving innovation in the bulk container packaging market. The region's well-established manufacturing sector, particularly in chemicals, pharmaceuticals, and food and beverages, fuels the demand for effective packaging solutions. The United States, with its mature and affluent consumer base, sees a high consumption of packaged goods, driving the need for reliable bulk container packaging. Additionally, the region's emphasis on sustainability and environmental awareness is leading to the adoption of eco-friendly packaging materials.

- In April 2023, Greif, Inc., a leading provider of industrial packaging products and services, acquired an 80% stake in Centurion Container LLC, showcasing North America's focus on expanding its packaging capabilities and sustainability efforts.

Europe to Hold a Considerable Share of the Market

Europe's bulk container packaging market is characterized by its strong regulatory framework and emphasis on sustainability. The region is home to numerous industries that require bulk packaging solutions, including chemicals, pharmaceuticals, and food and beverages. European companies are increasingly adopting sustainable practices, such as using recyclable and reusable packaging materials. The market is also driven by the region's advanced manufacturing capabilities and technological innovations.

- For example, in December 2023, Novvia Group, a global distributor of life sciences packaging, acquired JWJ Packaging, underscoring Europe's commitment to enhancing its packaging solutions through strategic acquisitions and partnerships.

The Plastic Segment Led the Market

In the bulk container packaging market, plastic is the leading material due to its durability, lightweight nature, and versatility. It’s widely used because it offers excellent protection against contamination and can be easily molded into various shapes and sizes, making it ideal for transporting a wide range of products.

The Flexible Container Segment to Create a Significant Share

Flexible containers dominate this segment due to their adaptability and efficiency. These containers can be easily folded when not in use, saving storage space, and they are also known for their ability to carry large volumes, which makes them popular in industries like chemicals and food and beverages.

The Chemical Industry Segment Dominated the Market

The chemical industry is the largest end user of bulk container packaging. This sector requires robust and reliable packaging solutions to transport hazardous and non-hazardous chemicals safely. Bulk containers provide the necessary strength and resistance to chemicals, ensuring safe and efficient transport.

More Insight in Towards Packaging

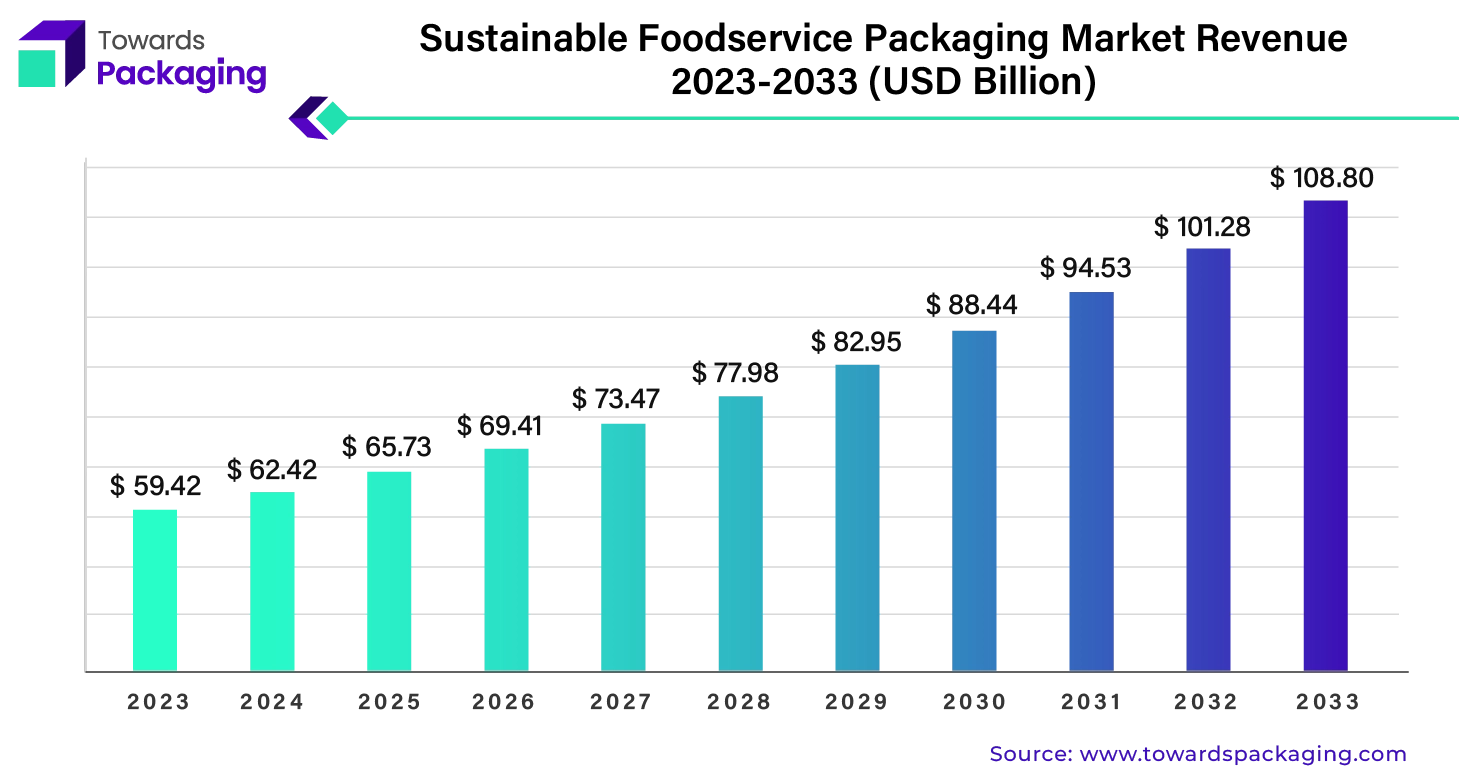

Sustainable Foodservice Packaging Market Size and Forecast 2023-2033

The global sustainable foodservice packaging market size is estimated to reach USD 108.80 billion by 2033, up from USD 59.42 billion in 2023, at a compound annual growth rate (CAGR) of 6.37% from 2024 to 2033.

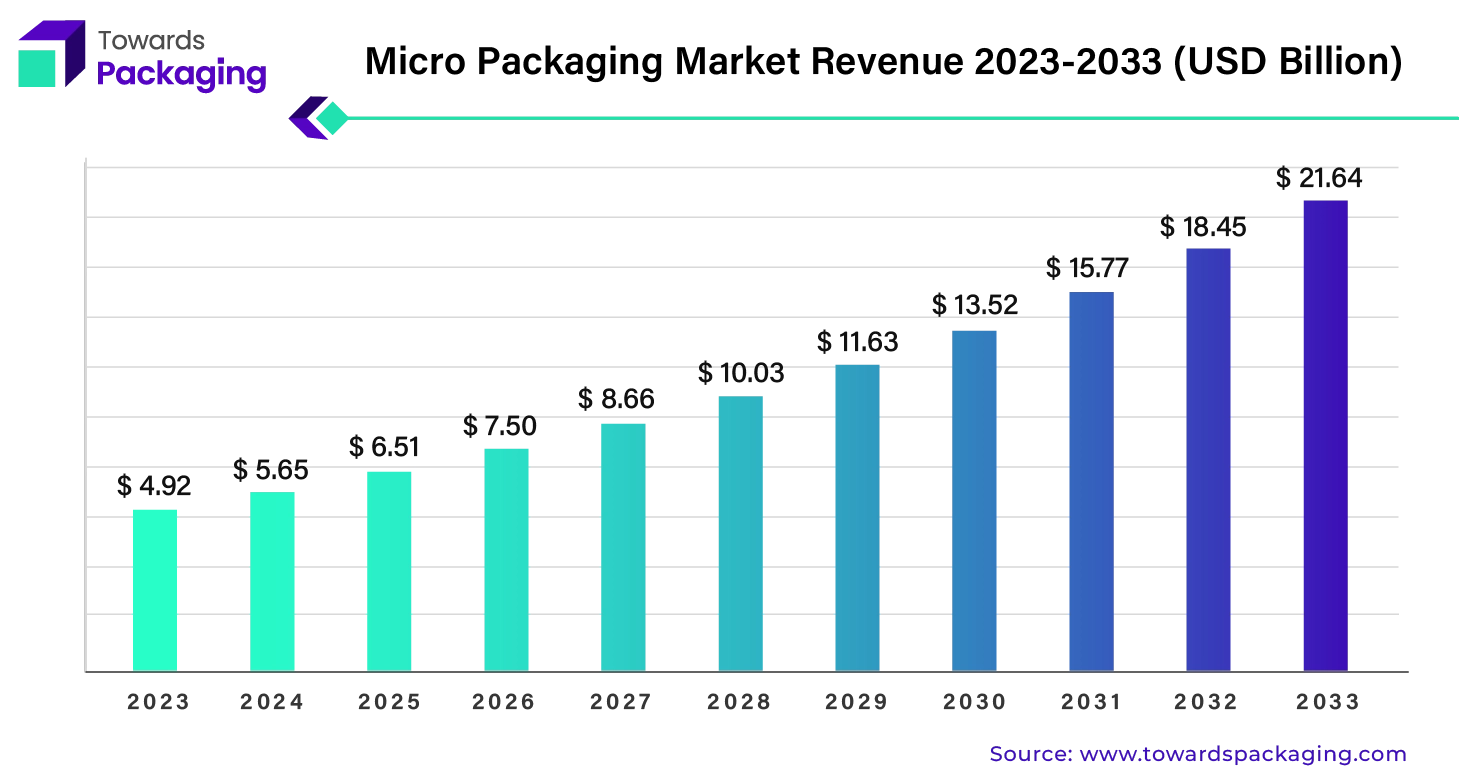

Micro Packaging Market Size, Trends, Forecast 2023-2033

The global micro packaging market size is estimated to reach USD 21.64 billion by 2033, up from USD 4.92 billion in 2023, at a compound annual growth rate (CAGR) of 16.09% from 2024 to 2033.

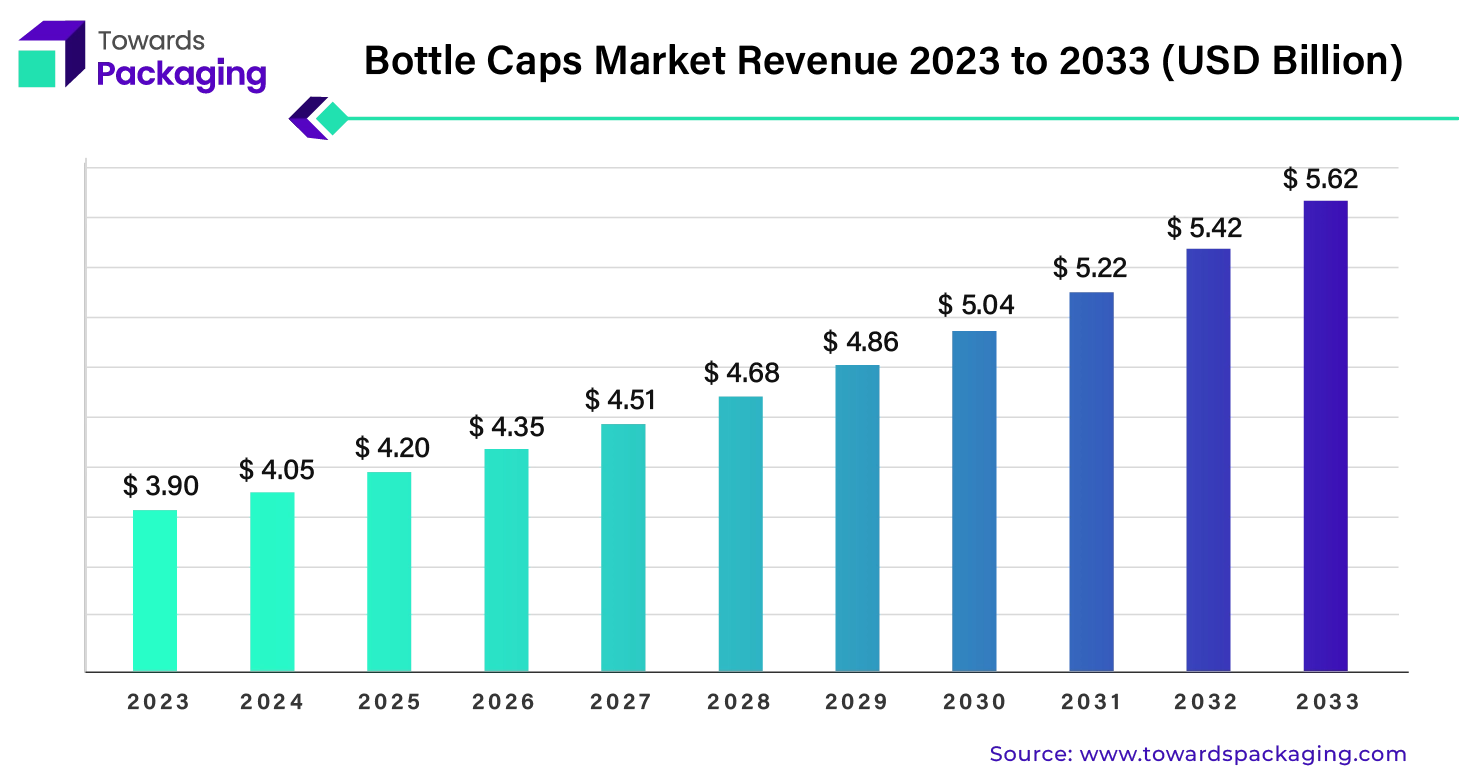

Bottle Caps Market Size, Trends, Forecast 2023-2032

The global bottle caps market size reached USD 3.9 billion in 2023 and is projected to hit around USD 5.62 billion by 2032, expanding at a CAGR of 3.72% during the forecast period from 2024 to 2033.

- The global highly visible packaging market size is estimated to reach USD 88.64 billion by 2033, up from USD 42.75 billion in 2023, at a compound annual growth rate (CAGR) of 7.71% from 2024 to 2033.

- The global cosmetic packaging machinery market size reached USD 4.66 billion in 2023 and is projected to hit USD 8.21 billion by 2033, expanding at a CAGR of 5.83% from 2024 to 2033.

- The global returnable packaging market size reached USD 116.02 billion in 2023 and is projected to hit around USD 208.56 billion by 2033, expanding at a CAGR of 6.04% during the forecast period from 2024 to 2033.

- The global beer cans market size reached USD 12.77 billion in 2023 and is projected to hit around USD 19.14 billion by 2033, expanding at a CAGR of 4.13% during the forecast period from 2024 to 2033.

- The global tube packaging market size is estimated to reach USD 18.68 billion by 2033, up from USD 10.73 billion in 2023, at a compound annual growth rate (CAGR) of 5.82% from 2024 to 2033.

- The global shrink and stretch sleeve labels market size is estimated to reach USD 25.33 billion by 2033, up from USD 13.51 billion in 2023, at a compound annual growth rate (CAGR) of 6.63% from 2024 to 2033.

- The global barrier films packaging market size is estimated to reach USD 57.74 billion by 2033, up from USD 32.67 billion in 2023, at a compound annual growth rate (CAGR) of 5.99% from 2024 to 2033.

Recent Developments

- In September 2023, Grief Inc., a leading provider of packaging solutions, opened a new manufacturing facility for intermediate bulk containers in Dilovasi, Turkey. This expansion signifies the growing demand for bulk container packaging in the region.

- In May 2023, Mauser Packaging Solutions enhanced the production capabilities of its plant in Gliwice, Poland, indicating a focus on meeting increasing market demands.

- In September 2023, industry giant Grief Inc. inaugurated a new intermediate bulk container manufacturing facility in Dilovasi, Turkey. This strategic move aims to enhance their production capabilities and cater to the growing demand in the region.

- In May 2023, TPL Plastech Limited announced its entry into the intermediate bulk container market by opening a manufacturing facility in Dahej, India. This expansion is expected to strengthen their market presence and meet the increasing needs of their customers.

Key Market Players

- Greif Inc.

- Mondi Group

- Berry Global Inc.

- Braid Logistics

- SIA Flexitanks Ltd.

- RRP Container

- Pyramid Technoplast

- Cleveland Steel Container

- Schütz Werke

- MAUSER Group

- Meyer Industries Limited

- SCHÜTZ GmbH & Co. KGaA

- Trans Ocean Bulk Logistics Ltd.

- BLT Flexitank Industrial Co. Ltd.

Bulk Container Packaging Market TOC

Introduction

- Research Objective

- Scope of the Study

- Definition and Taxonomy

Research Methodology

- Research Approach

- Data Sources

- Assumptions

Executive Summary

- Synopsis

- Analyst Recommendations

Market Overview

- Market Dynamics

- Market Drivers

- Market Restraints

- Market Opportunities

- Value chain analysis

- Raw Material Sourcing

- Manufacturing Process

- Logistics & Transportation

- Buyer Preferences

- Trends

- Market Trends

- Technological Trends

- Porter’s Five Forces Analysis

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitute

- Threat of New Entrants

- Degree of Competition

- PESTLE Analysis for 5 Leading Countries

- Regulatory Framework for Leading Countries/Regions

- Supply Demand Analysis

- Production & Consumption Statistics

- Export Import Statistics

- Price Trend Analysis

Global Bulk Container Packaging Market Assessment

- Overview

- Global Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Plastic

- Metal

- Fiber

- Paper & Paperboard

- Wood

- Global Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Flexible Container

- Rigid Container

- Global Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By End User Type (2021 – 2033)

- Chemical Industry

- Pharmaceutical

- Industrial

- Petroleum & Lubricants

- Food and Beverage

- Personal Care

- Others

- Global Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By Region Type (2021 – 2033)

- Asia Pacific

- North America

- Europe

- LAMEA

Asia Pacific Bulk Container Packaging Market Assessment

- Overview

- Asia Pacific Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Plastic

- Metal

- Fiber

- Paper & Paperboard

- Wood

- Asia Pacific Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Flexible Container

- Rigid Container

- Asia Pacific Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By End User Type (2021 – 2033)

- Chemical Industry

- Pharmaceutical

- Industrial

- Petroleum & Lubricants

- Food and Beverage

- Personal Care

- Others

North America Bulk Container Packaging Market Assessment

- Overview

- North America Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Plastic

- Metal

- Fiber

- Paper & Paperboard

- Wood

- North America Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Flexible Container

- Rigid Container

- North America Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By End User Type (2021 – 2033)

- Chemical Industry

- Pharmaceutical

- Industrial

- Petroleum & Lubricants

- Food and Beverage

- Personal Care

- Others

Europe Bulk Container Packaging Market Assessment

- Overview

- Europe Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Plastic

- Metal

- Fiber

- Paper & Paperboard

- Wood

- Europe Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Flexible Container

- Rigid Container

- Europe Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By End User Type (2021 – 2033)

- Chemical Industry

- Pharmaceutical

- Industrial

- Petroleum & Lubricants

- Food and Beverage

- Personal Care

- Others

LAMEA Bulk Container Packaging Market Assessment

- Overview

- LAMEA Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By Material Type (2021 – 2033)

- Plastic

- Metal

- Fiber

- Paper & Paperboard

- Wood

- LAMEA Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By Product Type (2021 – 2033)

- Flexible Container

- Rigid Container

- LAMEA Bulk Container Packaging Market Size Value (US$) and Volume (Billion Tons), By End User Type (2021 – 2033)

- Chemical Industry

- Pharmaceutical

- Industrial

- Petroleum & Lubricants

- Food and Beverage

- Personal Care

- Others

Company Profile

- Greif Inc.

- RRP Container

- Pyramid Technoplast

- Cleveland Steel Container

- Schütz Werke

- Mondi

- MAUSER Group

- SIA Flexitanks

- Braid Logistics

- Meyer Industries Limited

- SCHÜTZ GmbH & Co. KGaA

- Trans Ocean Bulk Logistics Ltd.

Conclusion & Recommendations

Act Now and Get Your Bulk Container Packaging Market Size, Companies and Insight 2032 @ https://www.towardspackaging.com/price/5166

Get the latest insights on packaging industry segmentation with our Annual Membership. Subscribe now for access to detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead in the dynamic packaging sector with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities: Subscribe to Annual Membership

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Browse our Brand-New Journal:

https://www.towardshealthcare.com/

https://www.towardsautomotive.com/

https://www.precedenceresearch.com/

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Get Our Freshly Printed Chronicle: https://www.packagingwebwire.com/