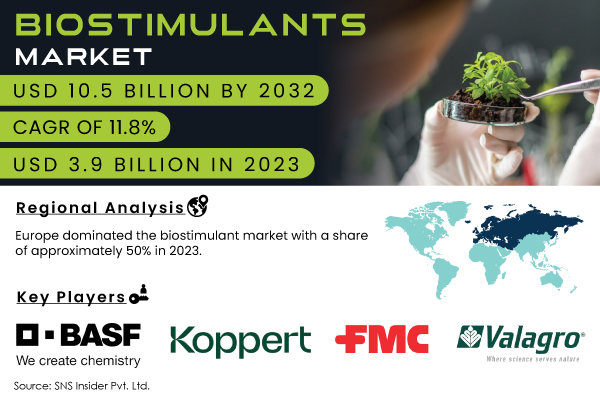

Austin, Aug. 20, 2024 (GLOBE NEWSWIRE) -- The Biostimulants Market Size was valued at USD 3.9 billion in 2023, and is expected to reach USD 10.5 billion by 2032, and grow at a CAGR of 11.8% over the forecast period 2024-2032.

The biostimulants market has been developing progressively with product innovation, more so in the last couple of years, driven by increasing demand for sustainable agriculture and rising awareness of the benefits which biostimulants deliver to crop yield and resilience. One noteworthy development in the industry took place in February 2024 when UPL Limited, a global provider for sustainable agriculture products, introduced its new biostimulant product, Zeba, into the European market. The product enhances the water retention capacity of the soil, reducing the consumption of water by up to 20%, which became a pretty vital discovery in regions where the climate is prone to drought. In October 2023, Bayer AG expanded its line of biostimulants by acquiring the majority stake of the Biotech company Kimitec, well known for its solutions in biostimulants. Therefore, Bayer will be integrated with additional key markets and new geographies with this acquisition.

Download PDF Sample of Biostimulants Market @ https://www.snsinsider.com/sample-request/3497

Key Players

- BASF SE

- Koppert B.V.

- Sapec Agro S.A.

- FMC Corporation

- Isagro Group

- Biolchim S.P.A.

- Novozymes A/S

- Platform Specialty Products Corporation

- Valagro SpA

- Italpollina SAP

- Biostadt India Limited

- UPL Limited

- Koppert

The growth of the Biostimulants Market is prompted by increased adoption of organic farming practices, coupled with rising needs to increase agricultural productivity without the use of harmful chemicals. A few factors mould market dynamics: government regulations, increased consumer demand for organic food products, and more robust crops against climate change. The firms are more willing to spend on research and development that creates novel biostimulant products imparting additional benefits such as advanced nutrient uptake, stress tolerance, better soil health, among others. This is causing a rush of new product launches and some strategic collaborations. For instance, BASF SE launched a new biostimulant product called Nodulator Duo in July 2023 for enhancing nitrogen fixation in legume crops for better growth and yield.

Biostimulants Market Report Scope:

| Market Size in 2023 | US$ 3.9 Bn |

| Market Size by 2032 | US$ 10.5 Bn |

| CAGR | CAGR of 11.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Active Ingredients (Seaweed Extract, Acid Based, Humic Substances, Microbial, and Others) • By Crop Type (Fruits & Vegetables, Row Crops & Cereals, Oilseeds & Pulses, Turf & Ornamentals, and Others) • By Formulation (Dry and Liquid) • By Mode of Application (Foliar Treatment, Seed Treatment, and Soil Treatment) |

| Key Drivers | • Increasing demand for sustainable agricultural practices • Growing awareness among farmers about the environmental impact of conventional farming practices |

If You Need Any Customization on Biostimulants Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/3497

Segment Analysis

The foliar treatment segment dominated the biostimulants market and was estimated to hold a share of approximately 45%. The dominance of this segment is due to the high efficiency of the foliar application, since the biostimulant gets directly delivered on the leaves of plants; hence, it gets rapidly absorbed and instantly assures benefits. In particular, foliar treatments are so popular among farmers of high-value crops such as fruits, vegetables, and ornamentals; well-timed application of biostimulants can radically improve the quality and productivity of crops. For example, in the citrus industry, foliar biostimulants have been greatly adopted to fight abiotic stress factors like drought and high temperatures, which because of climate change have become more frequent.

Trends Analysis: Biostimulants Market

The biostimulants market currently undergoes development and adoption of microbial-based biostimulants that involve beneficial microbes such as bacteria and fungi to aid in improving plant growth and resilience. These have been quite popular, for they make nutrients more available to plants, facilitate better root development, and enhance inherent defense mechanisms of a plant against pests and diseases. For instance, one of the biggest companies within the realm of microbial biostimulants—Indigo Agriculture—has recently developed its product line using that symbiosis between plants and microbes to further enhance crop performance. Another factor responsible for such increased interest in microbial biostimulants is the rising demand for sustainable and environment-friendly ag solutions, since these are naturally derived and non-toxic to the environment.

Recent Developments

May 2023: Yara International announced its intention to set up a global production plant for Specialty Crop Nutrition Products and Biostimulants in order to increase yield and quality.

January 2023: Sumitomo Chemical acquired the US-based biostimulant player FBSciences Holdings, Inc., strengthening its position in the market.

Regional Analysis

Europe dominated and accounted for 38% of the market share for biostimulants market, driven by Europe's stringent regulations on allowing any chemical inputs into agriculture and the high focus on organic farming practices. Countries like Spain, Italy, and France are leading the way forward in the utilization of biostimulants, with farmers increasingly leaning on biostimulants to augment added quality and higher yields in crops. Similarly, the high-level government of Spain for organic farming through many subsidies and incentives has registered a high-rate biostimulant use in the country. According to the Spanish Ministry of Agriculture, Fisheries, and Food, this level of uptake concerning biostimulants by organic farmers has grown at a clipworm pace of 15% per annum, mainly in the horticulture and viticulture sectors. The trend is expected to increase with more and more European consumers demanding organic and sustainably produced foodstuffs.

Buy Full Research Report on Biostimulants Market 2024-2032 @ https://www.snsinsider.com/checkout/3497

Key Takeaways:

- The Biostimulants Market is dominated by the foliar treatment segment with approximately 45% market share.

- Europe accounts for a lion's share of approximately 38%, driven by stringent regulations and a strong emphasis on organic farming.

- The market has witnessed new product launches and facility expansions by major players such as Syngenta, Valagro, and Arysta LifeScience.

- The microbial-based biostimulants are gaining trend with the growing demand for sustainable agricultural solutions.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization Analysis by Region

5.2 Feedstock Prices Analysis by Region

5.3 Regulatory Impact: Effects of regulations on production and usage.

5.4 Environmental Metrics Analysis by Region

5.5 Innovation and R&D

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Biostimulants Market Segmentation, by Active Ingredients

- Seaweed Extract

- Acid Based

- Microbial

- Others

8. Biostimulants Market Segmentation, by Crop Type

- Fruits & Vegetables

- Row Crops & Cereals

- Oilseeds & Pulses

- Turf & Ornamentals

- Others

9. Biostimulants Market Segmentation, by Formulation

- Dry

- Liquid

10. Biostimulants Market Segmentation, by Mode of Application

10.1 Chapter Overview

10.2 Foliar Treatment

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Description of Biostimulants Market Report 2024-2032 @ https://www.snsinsider.com/reports/biostimulants-market-3497

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.