Not for dissemination in the United States or for distribution to U.S. wire services

VANCOUVER, British Columbia , Aug. 20, 2024 (GLOBE NEWSWIRE) -- Norden Crown Metals Corporation (“Norden Crown” or the “Company”) (TSXV:NOCR, OTC:NOCRF, Frankfurt:03E) is pleased to announce that it has entered into a binding letter of intent dated August 19, 2024 (the “Letter Agreement”) with Domestic Copper Corporation (“Domestic Copper”), a privately held British Columbia company, providing for the acquisition by Norden Crown, of 100% of the issued and outstanding securities of Domestic Copper (the “Transaction”), being 3,000,000 common shares (the “Domestic Copper Shares”), in exchange for 8,000,000 common shares of Norden Crown (the “Norden Crown Shares”). The acquisition of Domestic Copper will result in the acquisition of the right to acquire an up to 60% interest (subject to certain back-in rights) in the Smart Creek copper-gold porphyry project, located approximately 16 kilometers north of Philipsburg, Montana (the “Property” or the “Project”). The Property is under option from Rio Tinto Group (through its subsidiary, Kennecott Exploration Company (“Kennecott”)) and consists of 570 unpatented federal mining claims (4,072 Ha) and 45 patented claims (312 Ha) in Granite County, Montana (see Figures 1 and 2 below).

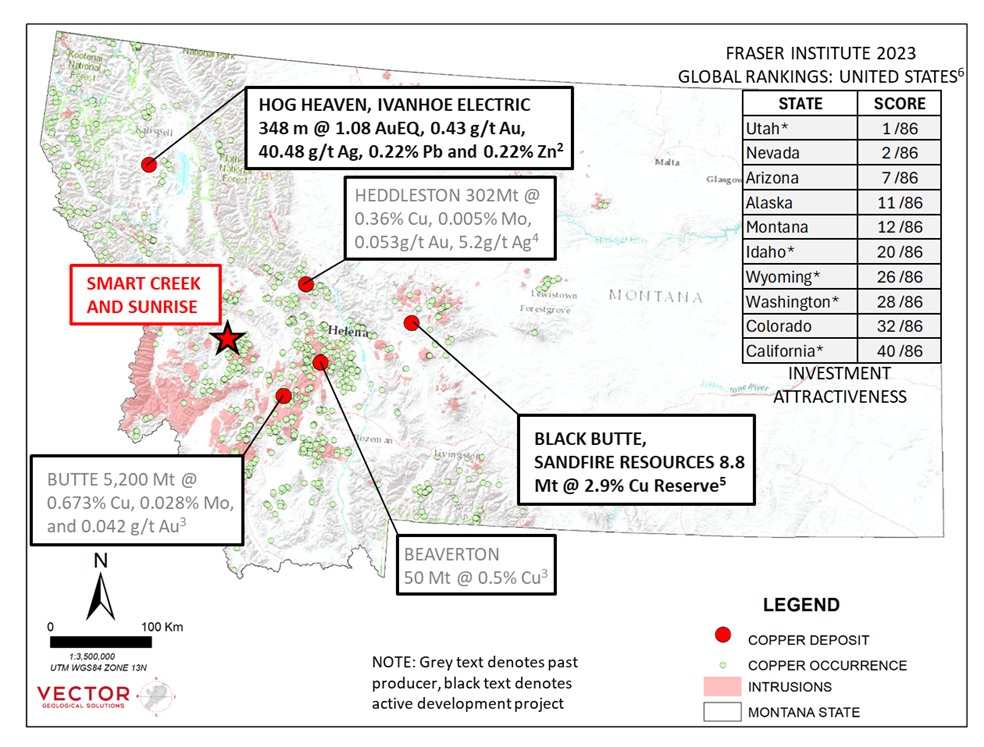

Patricio Varas, Chairman and CEO of Norden Crown, stated: “The acquisition of the Smart Creek property marks the beginning of Norden Crown’s transition to copper and precious metal exploration in the Americas, allowing the Company and its shareholders to leverage the evolving EV and precious metals markets.” Mr. Varas further stated: “The State of Montana is among the highest ranked mining jurisdictions globally by the Fraser Institute and the Smart Creek project has key explorable characteristics, including reactive host rocks, a large copper and gold endowed footprint, and previous drilling data, including an intercept of 109 meters of 0.75% copper, which together support the project’s potential to host a major bulk minable orebody that warrants commensurate exploration expenditures.”

SMART CREEK – SUNRISE, Project Overview

The Project consists of 570 unpatented federal mining claims (4,072 Ha) and 45 patented claims (312 Ha) in Granite County, Montana. The Property is located approximately 16 km north of Philipsburg, Montana and is road accessible year-round (see Figures 1 and 2 below).

Figure 1. The location and proximity to past producers and active development projects of the Property and the distribution of copper occurrences in the State of Montana1.

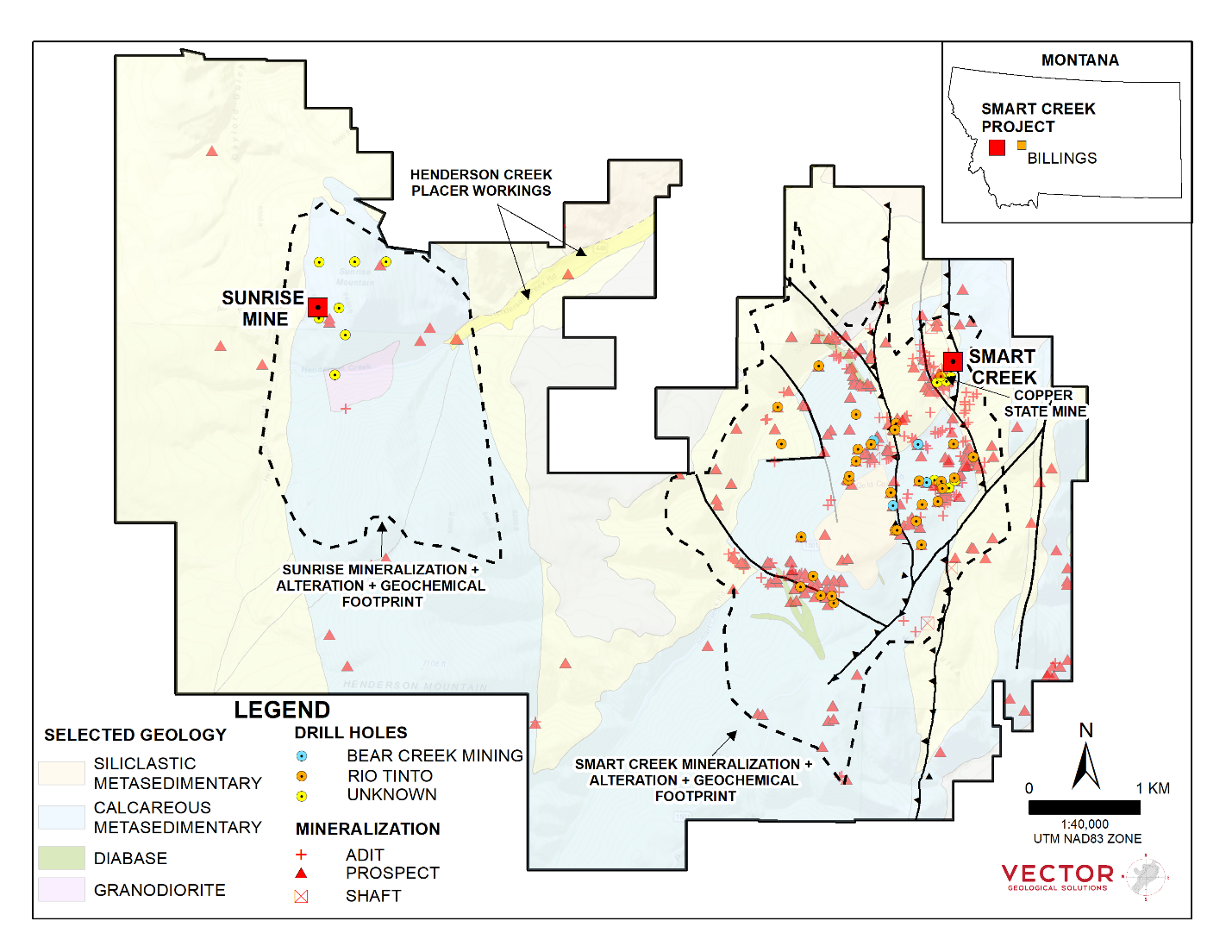

Porphyry-related copper, gold, silver and molybdenum mineralization is hosted in sedimentary rocks of the Proterozoic Belt Supergroup and includes the reactive Helena Formation (argillaceous carbonate sedimentary rocks), the main host to mineralization at the Property. At the Property, the Helena Formation contains significant mineralization, including copper-gold-silver-lead-zinc replacement style mineralization and porphyry copper-gold-molybdenum mineralization. The Project contains two drill ready, high priority targets known as the “Smart Creek” porphyry target and the “Sunrise” replacement target that are separated by 1.5 kilometers (Figure 2). At Smart Creek, porphyry related alteration and mineralization, as evidenced by surface showings (adits, pits and shafts) and surface geochemistry, define an anomalous footprint measuring 5 by 3 kilometers (Figure 2). The past producing Sunrise Mine target consists of replacement style lenses of high-grade copper, gold and silver that have potential for expansion through exploration drilling with potential for an associated porphyry “root zone”. The Sunrise target has an anomalous footprint defined by surface alteration, surface mineralization and surface geochemistry measuring 3 by 2 kilometers (Figure 2).

Previous Diamond Drilling and Trenching at SMART CREEK – SUNRISE

A total of 40 historical diamond drill holes and 5 surface trenches are available for Smart Creek and the most significant results are summarized in Table 1 below7,8. These holes cut significant copper oxide and sulphide mineralization and alteration and collectively are consistent with a distal copper-gold-molybdenite porphyry environment. Using 3.5 meter minimum composite lengths, minimum grades of 0.1% copper and up to 3.5 meters of internal dilution, there are 105 significant copper intercepts in 26 drill holes and 4 trenches ranging from 3.5 meters of 0.14% copper to 109.73 meters at 0.75%. The abundance of historical exploration information contained in these holes will be used to identify prospective drill targets at Smart Creek.

| HOLE OR | FROM | TO | LENGTH | COPPER | GOLD | SILVER |

| TRENCH ID | (m) | (m) | (m) | (%) | (gpt) | (gpt) |

| SMCR0022 | 0.00 | 109.73 | 109.73 | 0.75 | 0.05 | 18.74 |

| SMCR0014 | 0.00 | 35.05 | 35.05 | 0.62 | 0.04 | 11.40 |

| SMCR0008 | 60.96 | 129.54 | 68.58 | 0.27 | 0.01 | 5.97 |

| SC-02 | 82.30 | 179.83 | 97.54 | 0.17 | n/a | n/a |

| M-3 | 3.40 | 45.70 | 42.30 | 0.39 | n/a | 7.92 |

| SMCR0002 | 1018.50 | 1078.00 | 59.50 | 0.27 | 0.01 | 3.34 |

| Trench_C | 36.00 | 58.00 | 22.00 | 0.71 | 0.01 | 8.78 |

| SC-01 | 71.63 | 100.58 | 28.96 | 0.47 | 0.07 | 6.51 |

| Trench_A | 0.00 | 38.00 | 38.00 | 0.32 | 0.03 | 6.81 |

| Trench_C | 0.00 | 30.00 | 30.00 | 0.39 | 0.01 | 10.34 |

| SMCR0023 | 57.00 | 103.50 | 46.50 | 0.25 | 0.01 | 5.88 |

| SMCR0026 | 181.50 | 225.35 | 43.85 | 0.24 | 0.07 | 3.64 |

| SMCR0004 | 193.00 | 219.00 | 26.00 | 0.40 | 0.03 | 8.67 |

| M-1 | 0.00 | 10.70 | 10.70 | 0.96 | n/a | 6.35 |

Table 1. Significant historical drill and trench intercepts at Smart Creek7,8.

Figure 2. The economic geology of Smart Creek including surface geology, historical drilling, surface mineralization (adits, prospects and shafts) and anomalous footprints for the drill ready Smart Creek and Sunrise targets8.

SMART CREEK – SUNRISE, Historic Exploration and Mining

Historic mining activity from the Project area included high-grade copper-silver ore (several thousand tonnes) taken from the Copper State Mine prior to 1930 (Smart Creek area), placer gold dredging in the late 1800s and early 1900s (northeastern margin of the Property), and production of ~12,500 oz of gold from thin manto-style beds and fissures averaging 0.2 opt Au, 1 opt Ag and 1.5% Cu at Sunrise9,10 (Figure 1). Placer mining between 1943 and 1947 concentrated scheelite for the war effort which resulted in ~215,000lbs of 63% WO39. Previous exploration on the Property includes drilling conducted in the late 1960s by Bear Creek Mining (5 holes) and Melissa Syndicate (8 holes), targeting near surface copper-silver (+/- lead, zinc) mineralization in search of sediment-hosted copper at Smart Creek9,10 (Figure 1). Smart Creek Resources completed 12 lines of IP from 2010-2012 and attempted to drill 2 exploratory holes which did not reach target depth9. The United States Bureau of Mines, Exxon, Utah International, Noranda and Pegasus have all conducted exploration drilling programs at Sunrise targeting tungsten, copper and gold. Rio Tinto (Kennecott) acquired the property in 2016 after recognizing the porphyry potential suggested by extensive calcsilicate and skarn alteration within the hornfelsed Helena Formation sedimentary rocks and extensive copper oxide and sulphide mineralization exposed at surface across the Property9. Rio Tinto identified a large zoned geochemical (soil and rock sample geochemistry) footprint consistent with a porphyry copper-gold-molybdenum hydrothermal system9. Rio Tinto completed a total of 32 drill holes between 2018 and 2020 testing the bulk tonnage potential of Smart Creek (Figure 1) 9.

The Transaction and About Domestic Copper

The Transaction is to be effected by way of a share purchase or other similar form of transaction, such that Domestic Copper will become a wholly owned subsidiary of Norden Crown. The outstanding Domestic Copper Shares will be exchanged for the Norden Crown Shares on the basis of a share exchange ratio of one (1) Domestic Copper Share for two and two-thirds (2 ⅔) Norden Crown Shares. The Norden Crown Shares issuable under the Transaction to Domestic Copper shareholders will be issued at a deemed price per share of C$0.05.

Domestic Copper is a company incorporated under the British Columbia Business Corporations Act and is privately held. Domestic Copper currently has 3,000,000 Domestic Copper Shares outstanding and has one wholly owned subsidiary, being Domestic Copper US Corporation (“Domestic Copper US”), a Nevada incorporated entity. Domestic Copper has no other shares, warrants or any other right to acquire Domestic Copper securities outstanding.

Domestic Copper US is a party to an Option to Joint Venture Agreement with Kennecott dated June 20, 2024 (the “Kennecott Agreement”), whereby Domestic Copper US has the option to acquire an undivided interest of up to 60% in the Property from Kennecott pursuant to the terms of the Kennecott Agreement (and subject to certain back-in rights in favour of Kennecott) and to enter into a joint venture with Kennecott with respect to the Property.

Concurrent Private Placement Financing

Concurrently with the Transaction, the Company will conduct a non-brokered private placement (the “Concurrent Financing”) of at least 15 million Norden Crown Shares at a price of C$0.05 per share for gross proceeds of at least C$750,000.

Pursuant to the Letter Agreement, not less than C$400,000 from the proceeds of the Concurrent Financing will be allocated to expenditures related to the Property following closing of the Transaction. The Concurrent Financing is integral to the proposed Transaction and therefore the Company expects to rely on the “part and parcel pricing exception” provided for in the policies of the TSX Venture Exchange (the “Exchange”).

Completion of the Transaction and the Concurrent Financing is expected to occur in Q3 2024, is subject to satisfaction of a number of customary conditions precedent, and will be effected pursuant to Exchange policies.

Subject to Exchange acceptance, the Company may pay finders’ fees of cash and/or securities in connection with the Concurrent Financing, on terms to be determined by the Company and disclosed in a subsequent news release.

All securities issued under the Concurrent Financing will be subject to a hold period of four months and a day from the date of issuance under applicable securities laws.

This news release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”), or any state securities laws and may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the 1933 Act) absent such registration or an applicable exemption from such registration requirements.

Notes

1 Past producing deposits and development projects shown outside of the Smart Creek land position provide geologic context for the Property, but this is not necessarily indicative that the Property hosts similar grades or tonnages of mineralization.

3 Singer, Donald & Berger, V.I. & Moring, B.C. (2008). Porphyry copper deposits of the world: Database and grade and tonnage models. Open File Report.

4 Singer, D.A., Berger, V.I., and Moring, B.C., 2005. Porphyry copper deposits of the world: Database, map, and grade and tonnage models: U.S. Geological Survey Open-File Report 1060, 9 p.

6 https://www.fraserinstitute.org/resource-file?nid=16008&fid=22124

7 Composite intervals are calculated using length weighted averages based on a combination of lithological breaks and copper, gold, and silver geochemical assay. All intervals reported are core lengths, and true thicknesses are yet to be determined. Mineral resource modeling is required before true thicknesses can be reliably estimated. Composite drill intercepts are reported at minimum copper grades of 0.1% copper to a minimum of 3.5 meters and include up to 3.5 meters of internal dilution.

8 Data disclosed in this news release includes historical drilling results and information derived from historic drill results compiled previously by Rio Tinto. Neither the Qualified Person (described below) nor Norden Crown has undertaken any independent investigation of the sampling, nor have they independently analyzed the results of the historical exploration work in order to verify the results. Norden Crown only considers these historical data relevant as the Company is using this data as a guide to develop future exploration programs. The Company’s future exploration work on the Project will include verification of the exploration data by its Qualified Person.

9 Smart Creek-Sunrise Project, Granite County, Montana. Rio Tinto Internal Summary of the Economic Geology of the Smart Creek Project. November 2016.

10 Emmons, W.H., and Calkins, F.C., 1913. Geology and Ore Deposits of the Philipsburg Quadrangle, Montana. United States Geological Survey Professional Paper #78.

About Norden Crown Metals Corporation

Norden Crown is a mineral exploration company focused on the discovery of large scale copper, and gold deposits in exceptional, historical mining project areas, in the Americas. The Company aims to discover new economic mineral deposits in historical mining districts that have seen exploration where economically favorable grades have been indicated by historic drilling and outcrop sampling. The Company is led by an experienced management team and an accomplished technical team, with successful track records in mineral discovery, mining development and financing.

Qualified Person

Daniel MacNeil, P.Geo, a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has read and approved all technical and scientific information contained in this news release. Mr. MacNeil is a technical advisor for Norden Crown. He has not verified the data presented in this news release and as part of future exploration on the Project, new drilling will be conducted in order to verify exploration data.

On behalf of Norden Crown Metals Corporation

Patricio Varas, Chairman and CEO

(604) 831-9306

For more information on Norden Crown, please visit the Company website at www.nordencrownmetals.com or contact us at info@nordencm.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains certain statements that may be deemed “forward‐looking statements”. Forward‐looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects”, “plans”, “anticipates”, “believes”, “intends”, “estimates”, “projects”, “potential” and similar expressions, or that events or conditions “will”, “would”, “may”, “could” or “should” occur. Forward-looking statements may include, without limitation, statements relating to completion of the Transaction and the Concurrent Financing on the terms described herein or at all. Although Norden Crown believes the expectations expressed in such forward‐looking statements are based on reasonable assumptions, such statements are not guarantees of future performance, are subject to risks and uncertainties, and actual results or realities may differ materially from those in the forward‐looking statements. Such material risks and uncertainties include, but are not limited to: the risk that the Company cannot complete the Transaction or the Concurrent Financing on the terms described herein, on the timing described herein or at all; competition within the industry; actual results of current exploration activities; environmental risks; changes in project parameters as plans continue to be refined; future price of commodities; failure of equipment or processes to operate as anticipated; accidents, and other risks of the mining industry; delays in obtaining approvals or financing; risks related to indebtedness and the service of such indebtedness; as well as those factors, risks and uncertainties identified and reported in the Company’s public filings under Norden Crown’s SEDAR+ profile at www.sedarplus.ca. Although Norden Crown has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are made as of the date hereof and, accordingly, are subject to change after such date. Norden Crown disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise unless required by law.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/8163defd-b725-441f-ad21-22ca719f337f

https://www.globenewswire.com/NewsRoom/AttachmentNg/00696dc3-0478-45a0-91d5-2988dd9b70ba