US & Canada, Aug. 27, 2024 (GLOBE NEWSWIRE) -- North America is the second-largest contributor to the global Contactless Payments Market. Contactless payment is a secure and convenient way of paying for goods and services with a smartphone, debit card, or credit card that uses radio frequency identification (RFID) technology and near-field communication (NFC). Contactless payment works by tapping or waving the payment device over a point-of-sale terminal. It reduces transaction time with a single tap rather than entering the PIN or handling cash. It improves user experience and trust, as contactless payment is safe and encrypted to prevent any fraudulent purchases. It offers flexibility for using NFC-enabled smartphones, wearable devices, or contactless cards. It also provides loyalty benefits, as some contactless payment systems are integrated with loyalty programs offering discounts and rewards.

Download PDF Brochure: https://www.theinsightpartners.com/sample/TIPTE100000406/

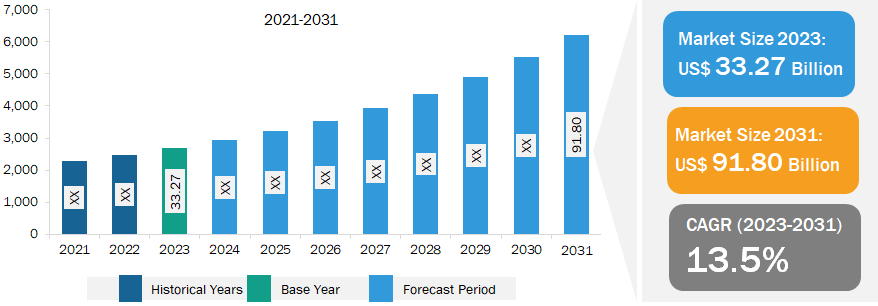

Contactless Payments Market Overview:

Source: The Insight Partners’ Analysis

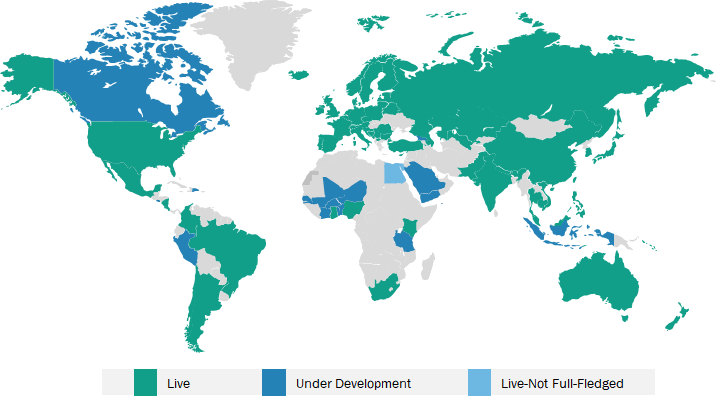

Global Contactless Payments Market Landscape - 2022:

Source: World Bank Group

Identify The Key Trends Affecting This Market - Download PDF

Key Contactless Payments Market Findings:

- Asia Pacific dominated the contactless payments market in 2023 and is expected to register the highest CAGR during the projected period. Increasing demand for digital transactions, rising penetration of smartphones and wearables, growing e-commerce activities, and surging trend of digitization across the region drive the contactless payments market growth. Payment providers, financial institutions, and IT companies in the region have formed strategic partnerships and collaborations to enhance the adoption of contactless payments. For instance, in October 2023, Aurionpro Transit (a transportation fintech company based in Singapore) partnered with Mastercard to introduce a cutting-edge contactless payment solution for public transportation, providing commuters with a contemporary and convenient mode of payment.

- The contactless payments market in North America is driven by the speed, convenience, and security benefits. This market is expected to expand in the coming years, owing to increasing government initiatives, growing financial institutions, and rising consumer awareness. Moreover, market players across North America are partnering to provide contactless payment. For instance, in October 2022, Visa Inc. partnered with PayPal Holdings Inc. to enable contactless payments at more than 8 million retail locations in the US. The partnership allows PayPal and Venmo users to pay with QR codes at any merchant accepting Visa contactless payments. The partnership also enables Visa Direct, a real-time push payment solution for instant money transfers.

- By payment mode, the contactless payments market is segmented into smartphones, smart cards, PoS terminals, and others. In 2023, the smartphones segment held the largest share of the market. Smartphones are among the most convenient devices to store credit and debit card information securely. As smartphones are equipped with contactless payment technology, users can seamlessly perform transactions utilizing RFID and NFC to connect with payment terminals.

- Based on component, the market is segmented into hardware, solutions, and services. The hardware segment held the largest share of the contactless payments market in 2023. Further, the solutions segment is expected to register the highest CAGR during 2023–2031. Contactless payment hardware encompasses the physical devices and technology to facilitate secure transactions without any physical contact between payment devices and point- of-sale (POS) terminals. 3-in-1 Reader, Terminal, Mini, Keypad, PINPad Pro, Flex, and POS+ are some of the contactless payment hardware.

Key Contactless Payments Market Dynamics:

Source: The Insight Partners’ Analysis

Source: The Insight Partners’ Analysis

Efficiency and Cost-Effectiveness of Contactless Payments:

Contactless payment technologies enable transactions through chips embedded in payment cards, tags, wearables, and mobile phones. Contactless payment offers quick bank approvals and instant money transfers, reducing the waiting time and improving efficiency. The contactless payment also allows the monthly auto-pay method to save time and earn rewards. Moreover, the contactless payment option has lower processing fees than manually keyed-in payments. Furthermore, contactless payment speeds up transactions, helping a huge crowd with instant payment. For example, Barclaycard provides contactless credit cards; through the card, the transactions take half a second to process, which is seven times faster than requiring guests to pay with a chip card and enter a PIN.

Technological Advancements in Contactless Payments Market:

Contactless payment enables faster transactions and increased customer satisfaction and loyalty, as well as the adoption of new payment technologies, such as NFC and others, which facilitate machine-to-machine communication and IoT integration. Customers can directly tap or wave their mobile device near an NFC-equipped card reader. The process of holding a chipped card or smartphone against the reader provides an extra layer of security, making contactless payments safe and secure. Also, the EMV (i.e., Europay, Mastercard, and Visa) chip is the physical "antennae" necessary for RFID/NFC contactless payments using credit cards. While all EMV chips are capable of NFC contactless payments, the ability to do such a transaction relies on the payee. If the PoS or farebox cannot process NFC payments, the chip is then used by inserting the card into the reader.

Directly Purchase a Copy of this Report at: https://www.theinsightpartners.com/buy/TIPTE100000406/

Contactless Payments Market Competitive Landscape:

Source: The Insight Partners’ Analysis

Recent Contactless Payments Market Developments:

- In November 2023, the SECORA pay security solution from Infineon Technologies AG supported card inlays with LEDs. The Visa- and Mastercard-certified product family enables banks to design new and distinctive payment cards. Embedded LEDs provide visual feedback when the card is held up to the point-of-service (POS) terminal for a payment transaction.

- In May 2024, the Worldpay PayFac suite of services enabled Tap to Pay on iPhone. Two PayFac partners, Fullsteam and Autobooks, launched this new service from Worldpay, which securely accepts contactless payments via iPhone with no additional hardware needed.

Key Company Offerings:

| Sr. No | Companies | Products/Solutions/Services |

| 1 | Visa |

|

| 2 | Mastercard |

|

| 3 | Giesecke+Devrient GmbH |

|

| 4 | Ingenico |

|

| 5 | IDEMIA |

|

In addition to the above companies, several other market players, including Thales, Infineon Technologies AG, On Track Innovations LTD, Identiv, Inc., CPI Card Group Inc., PAX Technology, mypinpad, SumUp Payments Pty Limited, PayCore Inc., Castles Technology, Stripe, Inc., Block, Inc., American Express, PayPal, Inc., and Apple, were analyzed to get a holistic view of the global contactless payments market and its ecosystem.

Fast Payment Systems Around the World:

| Sr. No. | Country | Fast Payment System | Description |

| 1 | Australia | New Payments Platform (NPP) | NPP (introduced in 2018) is a payment system that allows consumers, corporations, and government agencies to conduct instant transactions with participating financial institutions. It provides features, including PayID, to link bank accounts to phone numbers or email addresses. |

| 2 | China | IBPS | IBPS (introduced in 2010) supports multiple use cases/services, such as P2P payments, bill payments, and recurring payments (credit card repayment and loan repayment). |

| 3 | India | Unified Payments Interface (UPI) | UPI (introduced in 2016) is a real-time payment system that connects various bank accounts to a single mobile app and promotes smooth financial transfers across banks. |

| 4 | European Union | SCT Inst | SCT Inst (introduced in 2017) supports multiple use cases, such as merchant and bill payments and bulk and future-dated payments. |

| 5 | Netherlands | iDEAL | iDEAL (introduced in 2005) allows secure and real-time payments for online transactions using bank accounts. In addition to iDEAL, the Netherlands established the Instant Payments Initiative, which became operational in 2019. Customers of partner banks use this to make rapid payments at any time. |

| 6 | Brazil | Pix | The Central Bank of Brazil launched Pix in 2020. It allows for frictionless fund transfers between all forms of bank accounts in the Brazilian market, resulting in a payment service ecosystem with minimal acceptance costs and great usability. The platform also actively uses QR codes as an access route. |

Want More Information about Competitors and Market Players? Get PDF

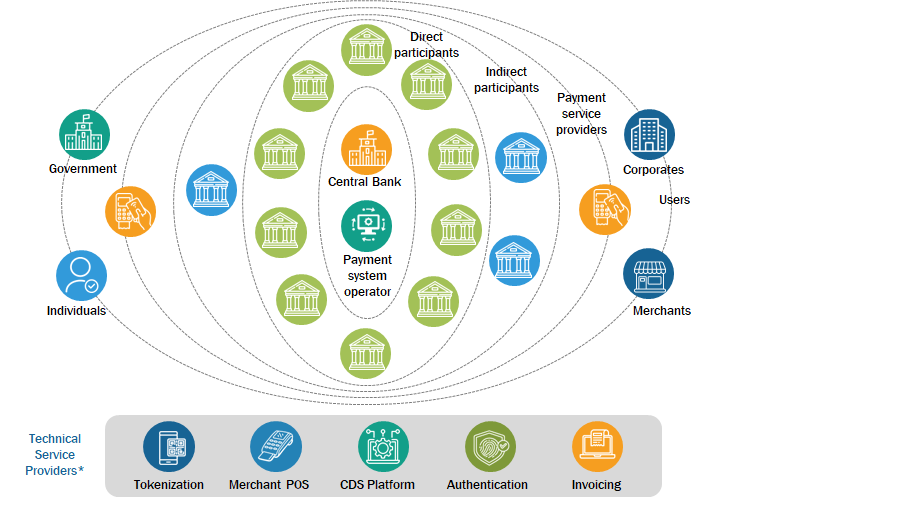

Contactless Payment Ecosystem:

Source: The Insight Partners’ Analysis

Source: The Insight Partners’ Analysis

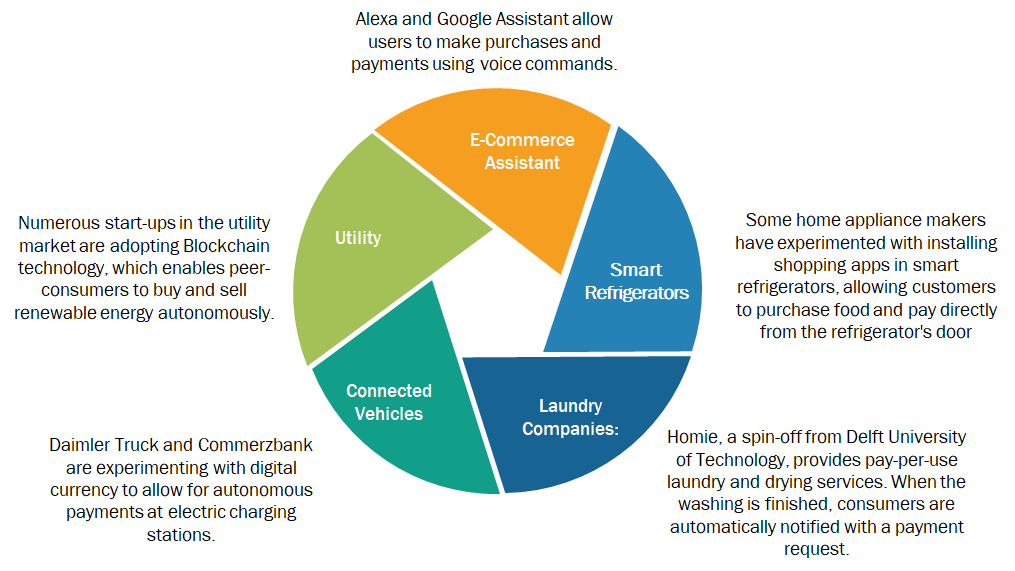

How is IoT Changing Payment Systems?

The IoT contains a vast network of interconnected devices, each embedded with sensors and software. These help in collecting and exchanging data over the Internet. Wearable devices embedded with IoT technology allow payments with a simple tap or hold their device near a point-of-sale (PoS) terminal. Apart from wearable devices, various other IoT devices that help in contactless payment are given below:

Source: The Insight Partners’ Analysis

Source: The Insight Partners’ Analysis

Benefits of Contactless Payments:

Several benefits have encouraged people to use contactless payment methods such as credit cards with NFC technology or mobile payment apps. The following are a few benefits of contactless payments for consumers:

- Convenience: Faster transactions can be enabled with a single tap or wave of a card or smartphone without using cards or cash.

- Speed: Owing to quick transactions, wait time is drastically reduced for both customers and companies. This is especially helpful in crowded retail contexts for quick payments to boost customer satisfaction and overall efficiency.

- Enhanced Security: Tokenization is a procedure that replaces sensitive card information with a unique identifier or token, which improves security for contactless cards and mobile payment apps. This implies that even if a transaction is intercepted, the token retains no value and cannot be utilized fraudulently. Furthermore, no physical contact lower the risk of card skimming or identity theft.

- Hygiene and Health Concerns: The recent global pandemic has raised awareness for hygiene and the spread of viruses through physical contact. Contactless payments address these problems by reducing physical contact at payment terminals, lowering the danger of contagious diseases.

Require A Diverse Region or Sector? Customize Research to Suit Your Requirement

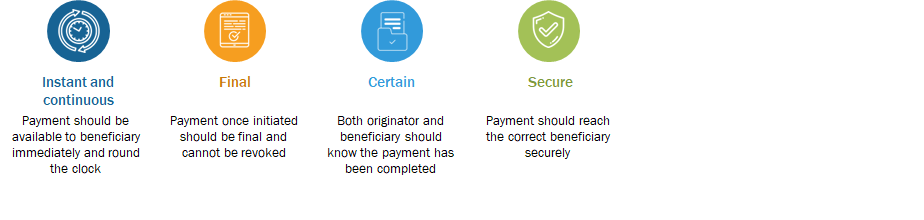

Key Characteristics of Contactless Payments:

Source: The Insight Partners’ Analysis

Source: The Insight Partners’ Analysis

Related Report Titles:

- E-commerce Payment Market

- Digital Payment Market

- Payment Gateway Market

- Europe and MEA Payment Gateway Market

- Indian Payment Gateway Market

- Real Time Payments Market

- Payment Processing Solutions Market

- Mobile Payments Market

- Retail Point-of-Sale Terminals Market

- Recurring Payments Market

- Wearable Payments Devices Market

- Cards and Payments Market

- NFC Payments Market

- Voice-based Payments Market

- Virtual Payment (POS) Market

- Payment as a Service Market

- Payment HSMs Market

- Banking and Payment Smart Card Market

- Mobile Wallet and Payment Market

- Europe and South America Mobile Wallet and Payment Market

- Payment Terminal Market

- In-Vehicle Payment Services Market

- Biometric Payment Cards Market

- 3D Secure Payment Authentication Market

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Ankit Mathur

E-mail: ankit.mathur@theinsightpartners.com

Phone: +1-646-491-9876

Press Release: https://www.theinsightpartners.com/pr/contactless-payments-market