Pune, Aug. 28, 2024 (GLOBE NEWSWIRE) -- Coiled Tubing Market Size & Growth Analysis:

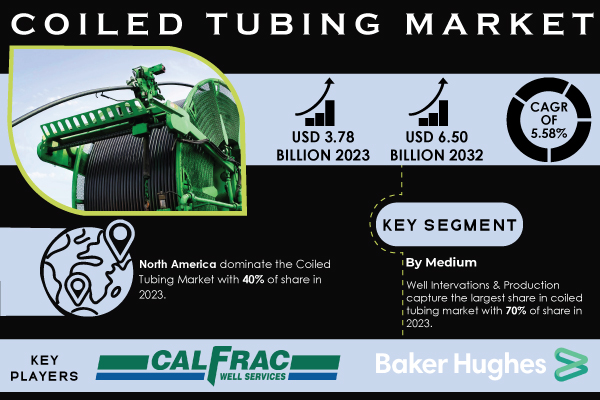

“According to SNS Insider Research, The Coiled Tubing Market size was valued at US$ 3.78 Billion in 2023 & is estimated to reach US$ 6.50 billion by 2032 and grow at a CAGR of 5.58% over the forecast period of 2024-2032.”

A combination of technological improvements has created the industry's demand curve for coiled tubing market.

Increased focus on well maintenance, and the rising adoption of enhanced oil recovery (EOR) techniques. As of 2023, around 65% of all well intervention operations worldwide rely on coiled tubing due to its efficiency in performing tasks such as cleanouts, scale removal, and zonal isolation, which helps maintain production levels. With over 80,000 active wells globally, about 40% require regular maintenance and stimulation services, which coiled tubing facilitates due to its cost-effective and versatile nature.

Additionally, the market is poised for growth in unconventional applications. For instance, the use of coiled tubing in geothermal energy extraction, which currently constitutes less than 5% of the total application market, is expected to increase as interest in renewable energy solutions expands.

CEO Insights: "Driving Innovation in Coiled Tubing for a Sustainable Future" - Olivier Le Peuch (Schlumberger)

The coiled tubing market exhibits strong attractiveness due to its crucial role in enhancing oil and gas extraction efficiency. With over 60% of the market demand driven by well intervention and stimulation services, coiled tubing systems have become indispensable in optimizing production.

Get a Sample Report of Coiled Tubing Market@ https://www.snsinsider.com/sample-request/1196

Major Players Analysis Listed in this Report are:

- Altus Intervention

- Calfrac Well Services Ltd.

- Baker Hughes Company

- Halliburton

- Step Energy Services

- Key Energy Services, LLC.

- Oceaneering International, Inc.

- Schlumberger Limited

- Trican

- Weatherford International Plc.

- Other Players

Coiled Tubing Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 3.78 Billion |

| Market Size by 2032 | USD 6.50 Billion |

| CAGR | CAGR 5.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Growth Drivers |

|

Key Segment Analysis:

By type, standard coiled tubing dominates the market, accounting for approximately 70% of total demand due to its widespread use in conventional applications such as well interventions and routine drilling operations.

However, the specialty coiled tubing segment, which includes advanced materials and designs tailored for deepwater, high-temperature, and high-pressure environments, is growing at a faster rate, projected to expand by 6.8% CAGR over the next eight years, driven by the increasing complexity of extraction methods and challenging well conditions.

Do you have any specific queries or need any customization research on Coiled Tubing Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/1196

Coiled Tubing Market Key Segmentation

By Service:

- Well Intervations & Production

- Drilling

- Others

By Operation:

- Circulation

- Pumping

- Logging

- Perforation

- Others

By Application:

- Onshore

- Offshore

North America held the largest regional share at over 40% of the coiled tubing market.

The United States, contributing approximately 70% of this regional demand, remains a significant driver due to its substantial oil and gas production activities. As of 2023, around 60% of U.S. oil wells require regular intervention, with coiled tubing playing a critical role in enhancing extraction efficiency. The adoption of advanced technologies, like hydraulic fracturing, has surged, with 65% of U.S. new wells utilizing these techniques, underscoring the reliance on coiled tubing for well stimulation and intervention services.

Recent innovations, such as Halliburton's high-temperature coiled tubing systems and Schlumberger's real-time monitoring technologies, have further cemented the U.S.'s leadership in this market.

Regional Coverage:

- North America (US, Canada, Mexico)

- Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe])

- Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific)

- Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa])

- Latin America (Brazil, Argentina, Colombia Rest of Latin America)

SNS Insider analysis of Political trends in U.S. marketplace and its impact on the coiled tubing market.

In 2023, federal policies aimed at increasing energy independence resulted in a 12% increase in approvals for new drilling projects, bolstering demand for coiled tubing in well intervention and stimulation. The U.S. Energy Information Administration (EIA) reported a 7% rise in unconventional resource extraction, driven by supportive state-level incentives for hydraulic fracturing and other enhanced oil recovery techniques.

Additionally, the Inflation Reduction Act's clean energy provisions are encouraging investment in advanced materials and technologies that improve coiled tubing efficiency, enhancing market competitiveness. Recent geopolitical tensions and trade restrictions have led to a 10% increase in sourcing local coiled tubing services and materials, reflecting a shift towards reducing foreign dependency.

Recent Development:

- In 2024, Schlumberger introduced its innovative coiled tubing technology with enhanced durability and real-time monitoring, which is projected to increase operational efficiency by 20%.

- Halliburton’s new systems, designed for extreme environments, are expected to reduce well intervention costs by 15%.

- Baker Hughes’ specialty coiled tubing for deepwater applications, launched in 2023, integrates corrosion-resistant materials, promising to extend service life by up to 30%.

Buy an Enterprise-User PDF of Coiled Tubing Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/1196

Key Takeaways:

- Advances in coiled tubing technology, such as real-time monitoring and improved materials, are enhancing efficiency and reducing operational costs, significantly boosting market attractiveness.

- Over 60% of market demand is driven by well intervention and stimulation services, reflecting the essential role of coiled tubing in maintaining and optimizing oil and gas production.

- The surge in unconventional oil and gas extraction, with U.S. shale oil accounting for 11.25% of global production, underscores the increasing reliance on coiled tubing for efficient resource extraction.

- North America leads the market with over 45% share due to extensive oil and gas production and unconventional resource exploitation, while Asia-Pacific and the Middle East and Africa are also significant contributors to market growth.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Coiled Tubing Market Segmentation, by Service

8. Coiled Tubing Market Segmentation, by Operation

9. Coiled Tubing Market Segmentation, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Details of Coiled Tubing Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/coiled-tubing-market-1196

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.