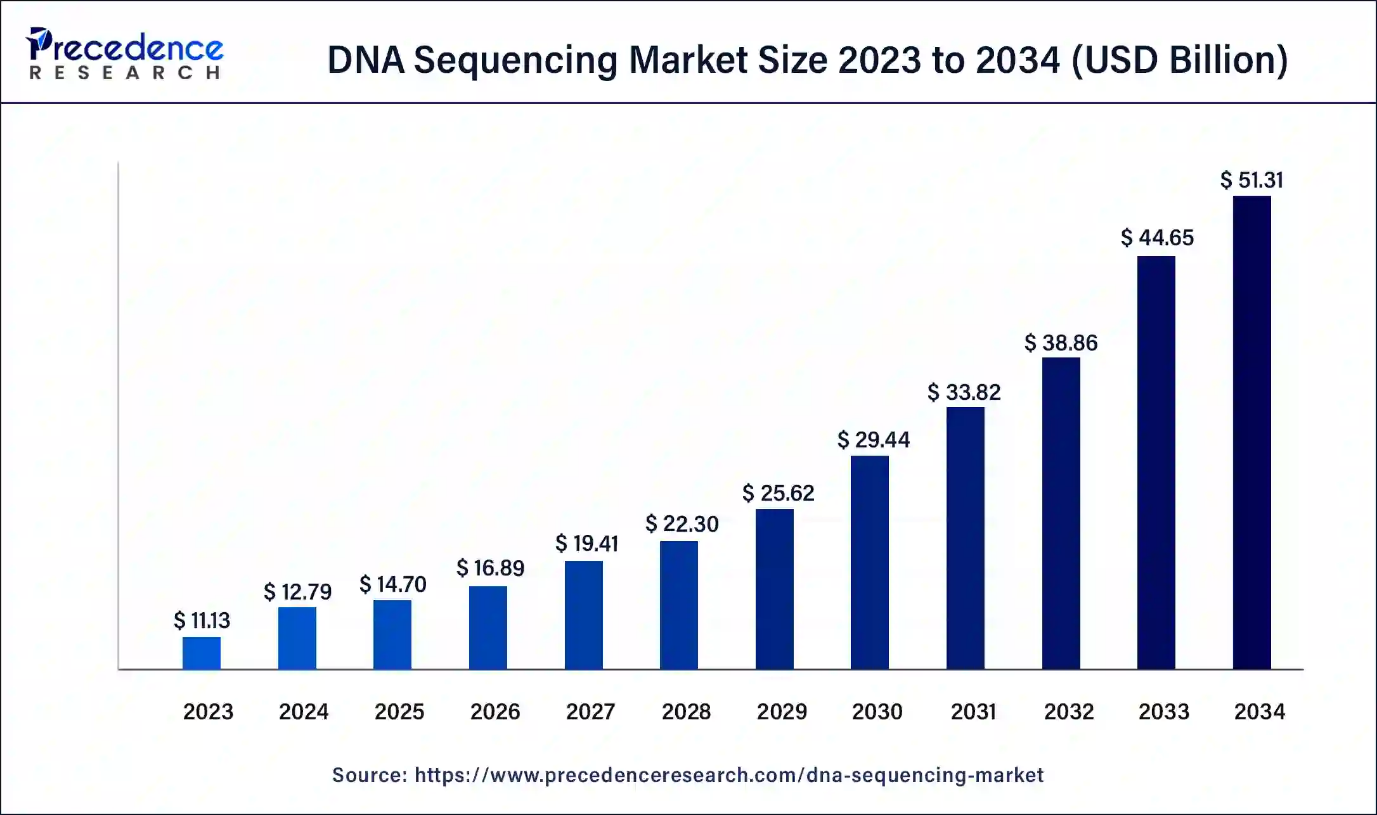

Ottawa, Aug. 29, 2024 (GLOBE NEWSWIRE) -- The global DNA sequencing market size is predicted to increase from USD 11.13 billion in 2023 to approximately USD 51.31 billion by 2034, According to Precedence Research. The market is poised to grow at a solid CAGR of 14.9% from 2024 to 2034. The DNA sequencing market is driven by the rising prevalence of genetic disorders and the need for early diagnosis.

DNA Sequencing Market Overview:

Advancements in sequencing technology have enabled researchers to provide high-volume data on genetic variation and gene expression. Next-generation sequencing (NGS), which has become increasingly popular, offers several advantages in terms of high throughput, lower cost, speed, data resolution, versatility, accuracy, and the ability to detect rare genetic variants.

Fast turnaround time, high-resolution data, versatility, and accuracy make next-generation sequencing appropriate for various applications. Its ability to detect rare genetic variations is vital in understanding disease mechanisms, treatment tailoring, and prognosis. The adoption of NGS is projected to increase rapidly, with continuous improvement in sequencing accuracy, read length, miniaturization, and portability.

The Complete Study is Immediately Accessible | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/sample/1189

DNA Sequencing Market Highlights:

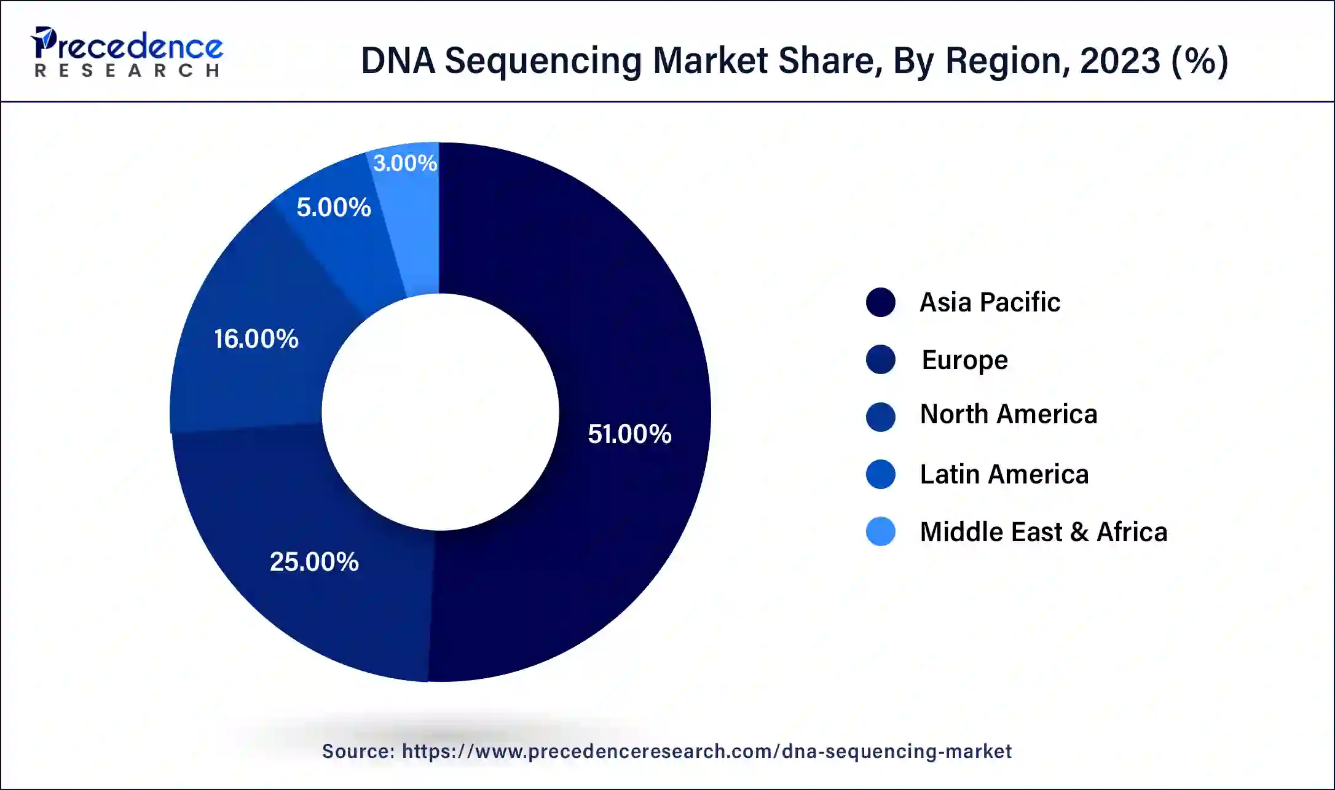

- North America dominated the DNA sequencing market with the largest market share of 51% in 2023.

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By product, the consumable segment led the market in 2023.

- By technology, the next-generation sequencing segment dominated the market in 2023.

- By application, the oncology segment contributed the largest market share in 2023.

- By end-use, the academic research segment dominated the market in 2023.

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

DNA Sequencing Market Analysis by Regions:

The U.S. oncology market size is estimated to grow from USD 65.11 billion in 2023 to USD 220.21 billion by 2034, expanding at a double-digit CAGR of 11.7% from 2024 to 2034.

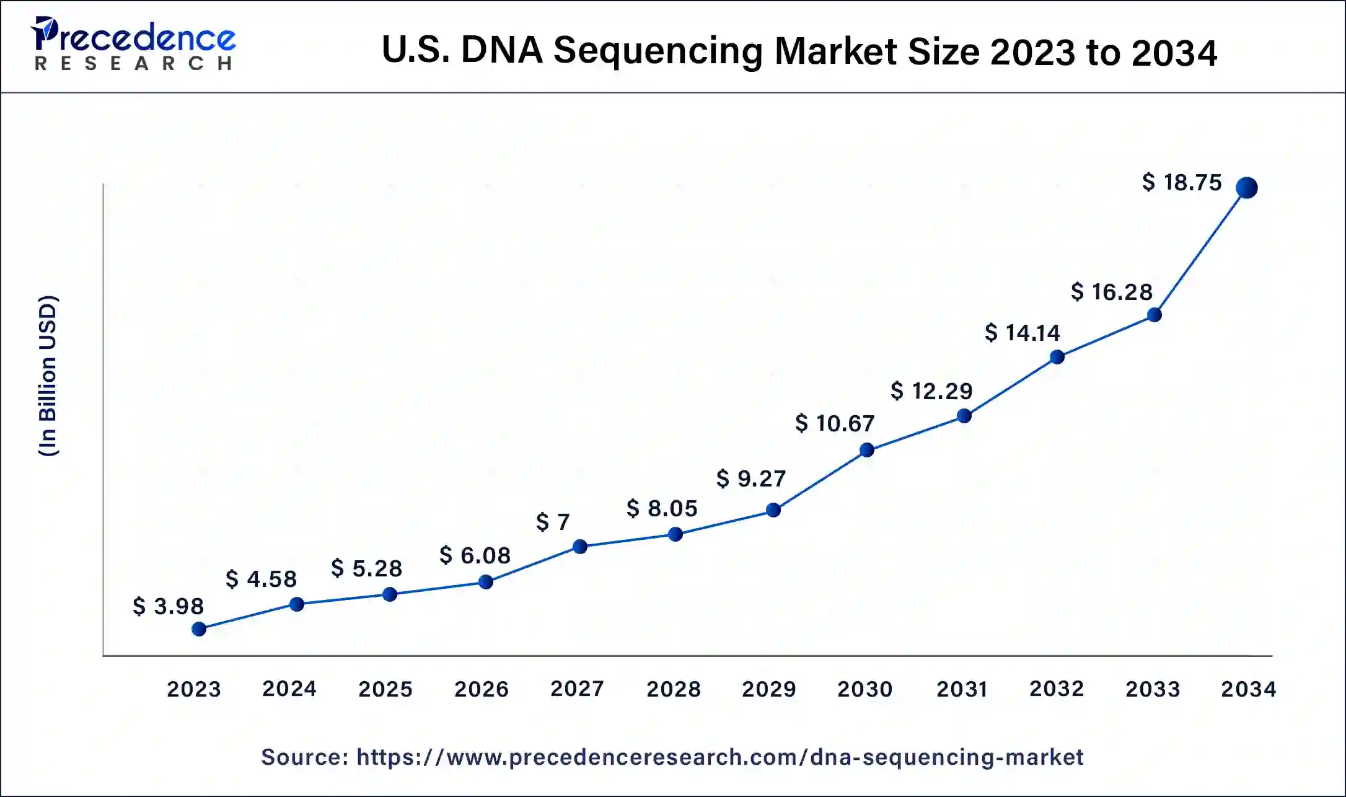

North America dominated the market in 2023 owing to the presence of well-established healthcare infrastructure. Moreover, the presence of a large number of market players fuels the growth of the market in the region. These players are making efforts to boost their market presence. The rising genomics, oncology, and whole-genome-based research further propel the market. Other factors such as increasing research programs, funding, availability of skilled personnel, and companies thrusting for better research methods to identify new technologies for diagnosis and therapies fuel the market.

The market in Asia Pacific is expected to grow at the fastest rate during the forecast period.

The growth of the Asia Pacific market is primarily driven by developments in prenatal NGS testing. NGS testing enable early diagnosis of rare diseases and pathogen monitoring, thereby improving outcomes for cancer patients. Moreover, the increasing developments in genomics boost the market.

- In August 2024, the government of Kerala decided to use advanced DNA sequencing technology to identify victims of Wayanad landslides. This technology will be used to identify 32 decomposed samples recovered from landslide-hit areas in Mundakkai-Chooralmala.

DNA Sequencing Market Scope:

| Report Attribute | Key Statistics |

| Market Size in 2024 | USD 12.79 billion |

| Market Size by 2034 | USD 51.31 billion |

| Growth Rate from 2024 to 2034 | CAGR of 14.9% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, technology, Application, and End Use |

| By Product | Instruments, Consumables, and Services |

| By Technology | Third Generation DNA Sequencing, Next-Generation Sequencing, Sanger Sequencing |

| By Application | Clinical Investigation, Oncology, Forensics & Agrigenomics, Reproductive Health HLA Typing, and Others |

| By End-Use | Clinical Research, Academic Research, Biotechnology & Pharmaceutical Companies, Hospitals & Clinics, and Others |

| By Geography | North America, Europe, Asia Pacific, Latin America and Middle East & Africa (MEA) |

| Countries Covered | U.S., Canada, UK, Germany, France, Italy, Spain, Norway, Sweden, Denmark, Japan, China, India, Australia, South Korea, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

DNA Sequencing Market Segment Analysis:

Analysis by Product:

The consumable segment accounted for the largest market share in 2023.

The sequencing consumables form the intrinsic part of DNA sequencing processes through reagents, kits, and other associated products. The genomic advancements and broad adoption of next-generation sequencing technologies in research, clinical diagnostics, and personalized medicine applications raise the demand for sequencing consumables.

The sequencing consumables segment is likely to continue expanding due to the increasing integration of genomics into biomedical research, rising technological advancements, and a global push toward more personalized genomic approaches.

- For instance, in February 2023, Oxford Nanopore Technologies extended its partnership with UPS Healthcare to speed up the delivery of DNA/RNA sequencing products and consumables throughout the Asia Pacific, increasing supply while enabling more time for research in genomics.

Analysis by Technology

The next-generation sequencing segment led the DNA sequencing market in 2023.

Next-generation sequencing technology is important for studying DNA and other genetic material, requiring the quick and accurate sequencing of large stretches of DNA. Laboratory automation is essential for increasing the efficiency and accuracy of the sequencing process.

Next-generation sequencing accelerates the process, saving considerable time and resources while sequencing large stretches of DNA. This allows researchers to process more samples within a short period, ensuring that the results are accurate and consistent.

- In March 2024, NGeneBio and Genolution signed a memorandum of understanding to develop and launch an automated next-generation sequencing system.

Analysis by Application

The oncology segment held a major share of the market in 2023.

Next-generation sequencing is revolutionizing cancer treatments by providing exact and detailed data on individual tumors. NGS-driven diagnostics is driving treatment selection to optimize patient outcomes.

Next-generation sequencing brings improved accuracy and speed in diagnosis, which holds substantial implications for oncology by allowing the assessment of multiple genes within a single assay and obviates the need for running multiple tests in search of causative mutations. This multigene approach reduces the time to answer, provides a more economical solution, and allows for high sensitivity, enabling mutation detection at as low as 5% of DNA isolated from a tumor sample.

Analysis by End-use

The academic research segment dominated the market in 2023 due to the heightened adoption of Sanger technology and NGS in research projects. Funding and investment programs have increased the demand for DNA sequencing products and services.

Additionally, the increasing research activities on disease and personalized therapies are likely to boost the segment.

Browse More Insights Precedence Research:

- Target Sequencing and Resequencing Market: The global target sequencing and resequencing market size reached USD 5.74 billion in 2022 and is projected to hit around USD 45.72 billion by 2032, poised to grow at a CAGR of 23.06% from 2023 to 2032.

- Viral Vectors & Plasmid DNA Manufacturing Market: The global viral vectors & plasmid DNA manufacturing market size calculated at USD 6.26 billion in 2024 and is projected to grow around USD 23.7 billion by 2033, growing at a CAGR of 15.94% from 2024 to 2033.

- Plasmid DNA Manufacturing Market: The global plasmid DNA manufacturing market size was valued at USD 1.8 billion in 2023 and is anticipated to reach around USD 10.22 billion by 2033, growing at a CAGR of 18.73% from 2024 to 2033.

- Biotechnology Market: The global biotechnology market size accounted for USD 1.55 trillion in 2024 and is expected to reach around USD 4.61 trillion by 2034, expanding at a CAGR of 11.5% from 2024 to 2034.

- Metagenomic Sequencing Market: The global metagenomic sequencing market size was USD 2.58 billion in 2023, accounted for USD 3.07 billion in 2024, and is expected to reach around USD 14.71 billion by 2033, expanding at a CAGR of 19% from 2024 to 2033.

- Recombinant DNA Technology Market: The global recombinant DNA technology market size accounted for USD 856.81 billion in 2024 and is expected to reach around USD 1,623.52 billion by 2034, expanding at a CAGR of 6.6% from 2024 to 2034.

DNA Sequencing Market Dynamics

Driver

The advent of next-generation sequencing (NGS)

In the last decade, scientific research and clinical genomics applications have been significantly revolutionized by NGS due to its high throughput multiplexing, coupled with smart bioinformatic tools. Various population genome sequencing projects such as 1000 G, ExAC, ESP6500, UK 100 K, Indigenome, and gnomAD generated huge data on NGS, leading to the development of knowledge bases and large and small sequencing panels for major applications in clinical research and diagnostics.

NGS is heavily used in microbiome research, human disease research, and diagnostics. NGS further assists in transcriptomic pathogen analysis, metastatic biomarkers, therapeutic resistance, immune microenvironment and immunotherapy, and cancer neoantigen research. NGS is also useful in diagnostics for precisely identifying the etiological agent in microbial infections and finding a correlation among many genes in multifactorial disorders.

- In May 2024, Ambry Genetics and PacBio announced that they are conducting a large, rare disease genome sequencing project in collaboration with the University of California, Irvine (UCI) and the GREGoR Consortium (Genomics Research to Elucidate the Genetics of Rare diseases).

- In November 2023, Johnson & Johnson collaborated with the world's biggest human genome sequencing project to increase understanding of genetic diseases among scientists and develop new healthcare interventions.

Restraint

Low quality of outsourcing services

Outsourcing becomes imperative for developing countries where genome sequencing facilities are limited. The outsourcing companies that become the local representatives for some foreign companies supply low-quality services. They send samples to be sequenced and send results back.

Improper handling and transport and long service timing lead to low-quality service. It consumes a lot of money and time, sometimes running into months, and may fail at any stage. Thus, outsourcing is the only option for accessing Balize genomic technologies in such countries.

Opportunity

Development of personalized therapy

The genome analysis and sequencing technology is likely to spread to all other research areas as it improves diagnostic procedures, thus permitting the establishment of personalized therapies. DNA sequencing methods have been applied in diagnosing complex neuro-developmental disorders and tumors, thus helping pregnant women avoid invasive methods, such as amniocenteses.

The wide availability of cheap and high-performance sequencing techniques is expected to increase the diversity of genomic research and applications. Scientists are focusing on enhancing the sequencing technique with more efficiency, accuracy, and less processing time.

DNA Sequencing Market Key Companies

- Agilent Technologies

- Perkin Elmer

- Illumina, Inc.

- QIAGEN

- Hoffmann-La Roche Ltd.

- Oxford Nanopore Technologies Ltd.

- Macrogen, Inc.

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific

- Myriad Genetics

Recent Developments

- In August 2024, Zymo Research, a global frontrunner in epigenetics, microbiomics, and transcriptomics, introduced the Zymo-Seq SPLAT DNA Library Kit for DNA sequencing with precision and flexibility for researchers and laboratories everywhere. |

- In August 2024, Ambry Genetics, a subsidiary of REALM IDx, launched the ExomeReveal test. This new multiomic exome sequencing test accelerates the detection of rare diseases.

- In May 2024, SOPHiA GENETICS partnered with Microsoft and NVIDIA to provide healthcare institutions with scalable whole genome sequencing (WGS) analytical solutions.

Market Segments Covered:

By Product

- Instruments

- Consumables

- Services

By Technology

- Third Generation DNA Sequencing

- Next-Generation Sequencing

- Sanger Sequencing

By Application

- Clinical Investigation

- Oncology

- Forensics & Agrigenomics

- Reproductive Health

- HLA Typing

- Others

By End-Use

- Clinical Research

- Academic Research

- Biotechnology & Pharmaceutical Companies

- Hospitals & Clinics

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research Report@ https://www.precedenceresearch.com/checkout/1189

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

Unlocking Market Insights through Data Excellence

The "Precedence Statistics" flexible dashboard is a powerful tool that offers real-time news updates, economic and market forecasts, and customizable reports. It can be configured to support a wide range of analysis styles and strategic planning needs. This tool empowers users to stay informed and make data-driven decisions in various scenarios, making it a valuable asset for businesses and professionals looking to stay ahead in today's dynamic and data-driven world.

To Access our Premium Real-Time Data Intelligence Tool, Visit: http://www.precedencestatistics.com

About Us

Precedence Research is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Precedence Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defense, among different ventures present globally.

Web: https://www.precedenceresearch.com

Our Blogs:

https://www.towardshealthcare.com

https://www.towardspackaging.com

https://www.towardsautomotive.com

For Latest Update Follow Us: