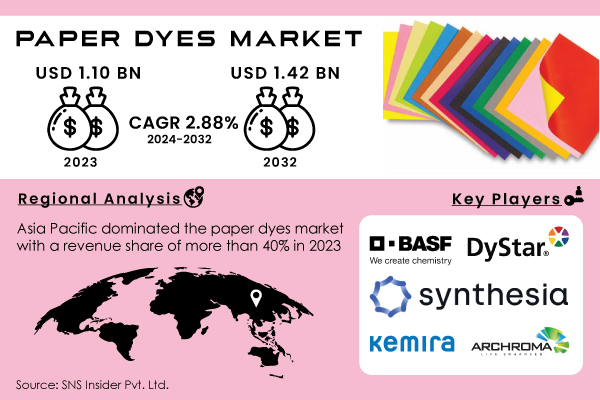

Austin, Sept. 02, 2024 (GLOBE NEWSWIRE) -- According to the SNS Insider report, The Paper Dyes Market size is projected to reach USD 1.42 billion by 2032 and grow at a CAGR of 2.88% over the forecast period of 2024-2032.

Rising Use of Specialty Papers Drive Market Growth.

Specialty papers, especially in applications such as printing, labels, and stationery, are increasingly used and drive the demand for high-quality paper dyes that guarantee vibrant heavy colors. This trend seems to be immense globally, where the printing and publishing industries are thriving. For instance, in 2023, the production output in Japan’s printing industry increased by 4% as there was a growing need for vibrantly colored printed materials.

Key players in the paper dye market responded to the demand. In June 2022, BASF introduced the eco-friendly range of paper dyes to meet the highest standards of the Asia-Pacific region, which revealed the evolving sustainably secure approach of the market.

Request Sample Report of Paper Dyes Market 2024 @ https://www.snsinsider.com/sample-request/3930

In February 2023, Archroma invested in the expansion of the dye production of the company in India and, thus, intensified the tempo of specialty paper production.

Many governments adopt policies that promote local production, which is likely to increase the demand for high-quality dyes even more. In 2022, the Indian Ministry of Commerce increased the production of specialty papers in the country. All these tendencies point to the critical importance of the high performance of dyes in the process of satisfying the market demands of changes in the specialty paper market.

The demand for paper dye has been majorly driven by the increased use of dyed paper within the packaging industry. The packaging industry is a major consumer of dyed paper and there has been a growing demand for paper dyes within this sector. The packaging industry has shifted towards customized product packaging and the use of premium product packaging as part of marketing. This growing market has spurred the use of premium paper dyes, which offer a broader range of vibrant colors and a better-quality finish. A broader popularity of personalized, one-of-a-kind product packaging solutions has subsequently emerged among product manufacturers.

In Jane 2023, Amcor, a global leader in the packaging industry, launched a new range of premium paper-based packaging solutions, which utilizes innovative dyeing methods to ensure better preservation of the products’ colors and appearance.

Paper Dyes Market Report Scope

| Report Attributes | Details |

| Market Size in 2023 | US$ 1.1 Bn |

| Market Size by 2032 | US$ 1.42 Bn |

| CAGR | CAGR of 2.88% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Sulphur Dyes, Acid Dyes, Basic Dyes, and Direct Dyes) • By Form (Liquid Form and Powder Form) • By Application (Packaging & Board, Writing & Printing, Tissues, Coated Paper, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF, dystar, Synthesia, KEMIRA OYJ, Archroma, Keystone Aniline, Atul Ltd, Vipul Organics, Standard Colors, Axyntis Group |

| Key Drivers | • Increasing adoption of paper products in various industries. • Increasing adoption of paper and boards from E-commerce industries |

If You Need Any Customization on Paper Dyes Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/3930

Segmentation Analysis

By Type

The direct dye type held the largest market share around 38.23%. A viscosity index is a type of an additive created to elevate a lubricant’s viscosity’s stability. This capability is essential for modern engines and machinery, which operate under varied and often extreme temperature environments. By preventing the lubricant from becoming too thick in cold conditions or too thin in high temperatures, VI improvers contribute significantly to engine efficiency, fuel economy, and overall longevity. Their ability to provide consistent performance regardless of temperature fluctuations has made them indispensable in high-performance and industrial applications, driving their dominance in the market. Thus, the demand for this type of Viscosity Index Improver only grows, and the market trends show it.

By Application

The packaging and board segment held the largest market share around 42.23% in 2023. due to its extensive use in a variety of applications and the growing demand for high-quality packaging solutions. This segment encompasses a broad range of paper products, including corrugated boxes, folding cartons, and paperboards, which are critical for both consumer and industrial packaging. The surge in e-commerce and retail sectors has heightened the need for visually appealing and durable packaging materials, leading to increased adoption of dyed paper for branding and product differentiation. The segment's dominance is also supported by advancements in dye technologies that enhance color vibrancy and printability, meeting the rising expectations of both manufacturers and consumers. This strong market presence reflects the pivotal role that packaging and board products play in the paper dyeing industry.

Regional Landscape:

Asia Pacific held the largest market share around 40% in 2023. The Asia Pacific market is leading in the world, primarily due to its large manufacturing base and growing demand for paper of various types: packaging, printing, specialty, etc. The region’s share is substantial because the developed e-commerce sector offers a large amount of paper in different applications, and there is a need for the material to be attractive and consistent with customers’ identities, be it logos, slogans, etc. Also, in the case of large countries like China and India, urbanization and increasing wealth allow and encourage citizens to buy more paper of various types. Government support for industrial development is also a factor, taking into account investment in new dyeing technologies.

Buy Full Research Report on Paper Dyes Market 2024-2032 @ https://www.snsinsider.com/checkout/3930

Recent Developments

- In 2023, Archroma launched a new range of eco-friendly dyes specifically designed for the paper industry. These dyes are formulated to enhance color brightness and durability while adhering to stringent environmental regulations.

- In 2022, BASF expanded its product portfolio with the introduction of advanced dyeing technologies for specialty papers.

- In 2023, Dystar introduced a line of innovative dyes that focus on improving color vibrancy and environmental safety.

Key Takeaways:

- The packaging and board segment holds the largest market share due to high demand for visually appealing and durable packaging solutions.

- Direct dyes have the largest market share because of their ease of application, cost-effectiveness, and ability to produce vibrant colors with excellent color stability on paper products.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

7. Paper Dyes Market Segmentation, by Type

8. Paper Dyes Market Segmentation, by Application

9. Paper Dyes Market Segmentation, by Form

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Description of Paper Dyes Market Report 2024-2032 @ https://www.snsinsider.com/reports/paper-dyes-market-3930

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.