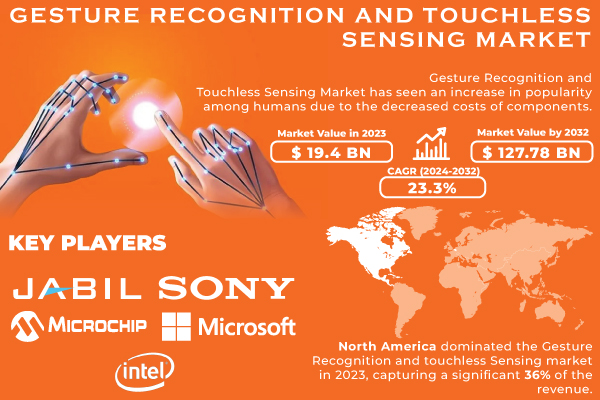

Pune, Sept. 10, 2024 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “The Gesture Recognition and Touchless Sensing Market Size was valued at USD 19.4 billion in 2023 and is expected to reach USD 127.78 billion by 2032 and grow at a CAGR of 23.3% over the forecast period 2024-2032.”

Increasing Opportunities in Gesture Recognition and Touchless Sensing Innovation

Advancements in technology and the desire for user-friendly interfaces are driving significant growth in the Gesture Recognition and Touchless Sensing Market. Gesture recognition allows devices to understand human movements using algorithms, while touchless sensing identifies commands without the need for physical contact. This technology is becoming more and more incorporated into devices such as smartphones and smart TVs, improving user engagement. In the automotive sector, it enables hands-free management of vehicle functions, enhancing safety. In the field of healthcare, touchless sensing decreases the chances of contamination by allowing hygienic interaction with devices. The gaming sector gains advantages from increased immersion with motion-controlled platforms. AI and machine learning continue to enhance these systems, leading to the growth of the market.

Download PDF Sample of Gesture Recognition and Touchless Sensing Market @ https://www.snsinsider.com/sample-request/2054?utm_source=Kajal

Key Companies:

- Intel Corporation

- Jabil Inc.

- Microchip Technology Inc.

- Sony Corporation

- Elliptic Laboratories ASA

- GestureTek

- Microsoft Corporation

- Google LLC

- Cipia Vision Ltd.

- Ultraleap

- Apple Inc.

Gesture Recognition and Touchless Sensing Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 19.4 Billion |

| Market Size by 2032 | USD 127.8 Billion |

| CAGR | CAGR of 23.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technologies (Touch-based, Touchless) • By Touchless Sensing Product (Touchless sanitary equipment, Touchless biometric equipment, Others) • By Gesture Recognition Type (Offline, Online) • By Touchless Sensing Industry (Consumer electronics, Healthcare, Government, Automotive, Finance & banking, Others) • By Gesture Recognition Industry(Automotive, Consumer electronics, Healthcare, Advertisement and Communication, Defense, Others) |

| Key Drivers | • Transforming user interaction with the emergence of gesture recognition and touchless sensing in smartphones. • Increase in Gesture Detection and touchless Sensing Technologies Boosts Market Expansion across Industries. |

If You Need Any Customization on Gesture Recognition and Touchless Sensing Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/2054?utm_source=Kajal

Improving Car Safety with Gesture Recognition and Touchless Sensing

The growth in the Gesture Recognition and Touchless Sensing Market is being greatly influenced by the increasing prevalence of advanced driver assistance systems (ADAS) in the automotive sector. Luxury car manufacturers are adding gesture recognition technology to their vehicles so that drivers can control entertainment, climate, and navigation systems with hand movements, decreasing the need for hands-on interaction and improving safety while driving. The Gesture Control feature in BMW's 7 Series showcases this development, allowing for tasks such as adjusting volume and managing calls without needing to touch the steering wheel, in line with the safety initiatives of the NHTSA. With the progression of automation, having dependable gesture recognition is essential for natural and safe interactions in vehicles, increasing the need for advanced safety-oriented interfaces in the market.

Dominance of Touch-Based and Touchless Biometric Technologies

In 2023, Touch-based technology led the Gesture Recognition and Touchless Sensing Market with a 71% revenue share, thanks to its wide usage in consumer electronics, automotive, and healthcare industries, dominated by Technologies. Touch screens present in smartphones, tablets, and interactive displays utilize capacitive, resistive, or optical sensors to enable easy user interactions. Advancements in touch-based technologies, such as capacitive touchscreens and AMOLED displays introduced by Apple and Samsung, along with touch-based controls in cars by Continental AG, highlight the continued evolution and expansion of touch-based technologies.

In 2023, touchless biometric devices were the top choice in the Gesture Recognition and Touchless Sensing Market, generating 46% of revenue because of a growing need for secure, non-invasive authentication according to Touchless Sensing Product. The increasing significance of facial recognition, iris scanning, and palm vein technology is underscored by the advancements made by companies such as Face++, NEC Corporation, and Fujitsu. The widespread use of their accuracy and user-friendly nature is fueling market growth in various industries.

The fastest growth rates for the gesture recognition and touchless sensing markets are in North America, followed by Asia-Pacific.

North America held a significant market share in the Gesture Recognition and Touchless Sensing industry in 2023, capturing 36% of the total revenue. This leadership is fueled by the advanced technological infrastructure in the region, widespread use of cutting-edge consumer electronics, and substantial investments in R&D. The United States and Canada are leading the way, with prominent technology companies such as Microsoft and Apple driving advancements. Microsoft's HoloLens and Apple's touchless features in iPhones and iPads represent their progress in user engagement. The Motion Sense technology from Google in Pixel 4 and the Canadian contributions by Research In Motion highlight North America's significant role in advancing touchless technologies.

In 2023, Asia-Pacific saw rapid growth in the Gesture Recognition and Touchless Sensing market to become the second fastest-growing region, fueled by substantial investments and technological progress. The area is quickly integrating these technologies, especially in the healthcare sector for remote monitoring and virtual rehabilitation, as well as in security using touchless biometric solutions. The expanding gaming sector and increasing consumer device adoption in China are driving market growth, highlighting the Asia-Pacific region's importance in worldwide expansion.

Buy Full Research Report on Gesture Recognition and Touchless Sensing Market 2024-2032 @ https://www.snsinsider.com/checkout/2054?utm_source=Kajal

Recent Development

- In December 2023, NXP Semiconductors released the Trimension NCJ29D6, a car UWB system that combines real-time location tracking, radar, gesture recognition, and security elements.

- In September 2023, Meta and EssilorLuxottica introduced the Ray-Ban Meta smart glasses featuring advanced cameras, audio capabilities, and AI interaction based on gestures.

- In May 2023, SAP and Accenture employed AR and AI technologies, such as gesture recognition, with the goal of reaching a $1 trillion revenue opportunity by 2025.

- In May 2023, Infineon Technologies purchased Imagibob in order to enhance TinyML edge AI for purposes such as voice command and gesture identification.

- April 2023 saw the release of IMOU SENSE by IMOU, boasting cutting-edge gesture recognition for intelligent IoT solutions.

- In April 2023, Elmos demonstrated sensor IC solutions featuring advanced gesture control for automotive and industrial uses at Sensor+Test.

- In January 2023, PreAct Technologies purchased Gestos with the aim of incorporating sophisticated computer vision and gesture recognition technology into its LIDAR systems.

Key Takeaways for Gesture Recognition and Touchless Sensing Market

- Learn more about market trends, growth opportunities, and risks that could affect your business ·

- Some of the competitors are quite good and some need to be assisted by proficient business plans.

- Research the market trends and discover emerging markets.

- Automatically track innovative technologies and trends to create meaningful, high-potential solutions.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Technology Adoption Rates and Growth, 2020-2032, by Region

5.2 Regulatory Compliance and Standards for Gesture Recognition Systems, by Region

5.3 Market Penetration and Integration of Touchless Sensing Technologies, by Region

5.4 Consumer Adoption Trends and Preferences for Gesture and Touchless Interfaces, by Region

5.5 Innovation Trends and Technological Developments (Data on advancements, new products, and services in the market)

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Gesture Recognition and Touchless Sensing Market Segmentation, by Technologies

7.1 Chapter Overview

7.2 Touch-based

7.3 Touchless

8. Gesture Recognition and Touchless Sensing Market Segmentation, By Touchless Sensing Product

8.1 Chapter Overview

8.2 Touchless sanitary equipment

8.3 Touchless biometric equipment

8.4 Others

9. Gesture Recognition and Touchless Sensing Market Segmentation, By Gesture Recognition Type

9.1 Chapter Overview

9.2 Offline

9.3 Online

10. Gesture Recognition and Touchless Sensing Market Segmentation, By Touchless Sensing Industry

10.1 Chapter Overview

10.2 Consumer electronics

10.3 Healthcare

10.4 Government

10.5 Automotive

10.6 Finance & banking

10.7 Others

11. Gesture Recognition and Touchless Sensing Market Segmentation, By Gesture Recognition Industry

11.1 Chapter Overview

11.2 Automotive

11.3 Consumer electronics

11.4 Healthcare

11.5 Advertisement and communication

11.6 Defense

11.7 Others

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Access Complete Report Description of Gesture Recognition and Touchless Sensing Market Report 2024-2032 @ https://www.snsinsider.com/reports/gesture-recognition-and-touchless-sensing-market-2054?utm_source=Kajal

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.