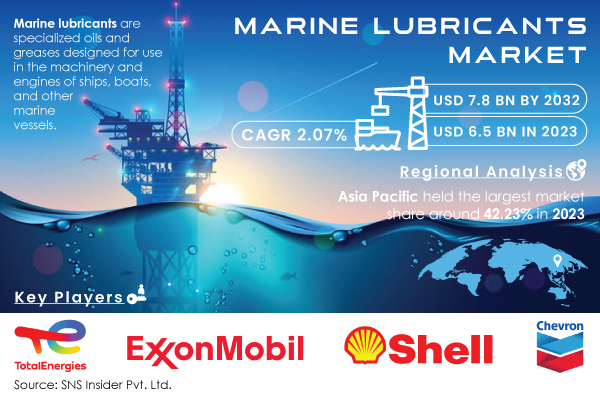

Austin, Sept. 16, 2024 (GLOBE NEWSWIRE) -- The SNS Insider report reveals that The Marine Lubricants Market size is projected to reach USD 7.8 billion by 2032 and grow at a CAGR of 2.07% over the forecast period of 2024-2032.

Growth in Shipping Industry Drive Market Growth.

The global shipping industry’s growth is one of the major factors that significantly impact the marine lubricants market. As international trade keeps increasing and the global shipping fleet experiences expansion, the call for increased performance demands high-quality products to ensure the effective work of marine engines and tools. Some of the recent innovations confirm the tendency.

For instance, in 2023, such market leaders as ExxonMobil and Chevron released a range of new sophisticated marine lubricants that have been specifically designed to work best with low-sulfur fuels featured with the highest performance Kaplan turbine. As expected by major players in the market, these new solutions satisfy the market needs to the full extent. It is proved by the data provided by IMO due to which the overall demand for marine lubricants within the next five years will expand by around 4.5%.

Request Sample Report of Marine Lubricants Market 2024 @ https://www.snsinsider.com/sample-request/1813

Key Players:

- Castrol, Lubmarine (Total Group)

- Sinopec Corporation

- Lukoil Marine Lubricants.

- Gulf Marine and Industrial Supplies Inc.

- Quepet Lubricants

- Chevron

- ExxonMobil Corporation

- BP Marine

- Royal Dutch Shell Plc

- JX Nippon Oil & Energy Corporation

- Other

The progress of technologies in the sphere of marine lubricants is one of the ultimate engines of market growth. As modern engines and equipment demand liquid lubricants to meet the toughest requirements, a few new releases in the sector became possible. it is possible to mention high-performance lubricants released in 2024 by Shell Marine. The new lubricants are synthetic, which provides premier protection for the engines. In addition to that, the new products are more fuel-efficient and more stable in terms of service life.

Lastly, they offer fewer wear problems to the engines of the latest generation while providing other essential advantages. TotalEnergies is also on the market with its bio-based lubricants which make it possible for the equipment to meet all modern environmental requirements without compromising the efficiency or durability of the lubricant.

The marine lubricants market is being greatly affected by severe environmental regulations, resulting in the interest in products that satisfy new standards. The most notable one is IMO 2020, which imposes a cap of 0.5% sulfur content for naval fuels. It has already caused higher demand for low-sulfur marine lubes able to operate effectively with the new conditions. In most cases, lube-producing companies have to come up with entirely new products that would comply with the lower sulfur content of the fuel, offering optimal engine protection and performance.

Furthermore, future regulations for cutting Green House Gas emissions from the ship sector are expected under the IMO artifice, which includes some goals for lessening carbon intensity. This is likely to have a similar impact, meaning that the products of the lube-producing sector are set to become considerably more advanced and environmentally friendly. All in all, the combination of these regulatory instruments is promoting a more innovative marine lubes sector that is more capable of complying with the latest and ever more severe environmental standards.

Marine Lubricants Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 6.5 Billion |

| Market Size by 2032 | US$ 7.8 Billion |

| CAGR | CAGR of 2.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| DRIVERS | • The shipping industry has grown and changed over time and drives the market growth. • New technologies to reduce emissions |

If You Need Any Customization on Marine Lubricants Market Report, Enquire Now @ https://www.snsinsider.com/enquiry/1813

Recent Developments

- In 2024, TotalEnergies introduced its "TotalEnergies Marine Lubricants EcoProtect" line, featuring bio-based components and high-performance additives. This line aims to offer sustainable lubrication solutions that comply with environmental regulations and enhance engine durability.

- In 2023, Chevron Marine expanded its portfolio with the introduction of "Chevron Marine Starplex 2200" which combines advanced additive technology to improve engine performance and fuel efficiency while meeting new environmental standards.

- In 2023, Shell Marine launched its new "Shell Alexia S4" marine lubricant designed to meet the demands of low-sulfur fuels while providing enhanced engine protection and fuel efficiency.

Segmentation Analysis

By Oil Type

In 2023, mineral oil held the largest market share around 42.95% in 2023. Mineral oils are widely used for lubricating ship engines and equipment as they offer stable lubrication, which prevents friction, wear, and corrosion. These oils are derived from processed petroleum and are significantly cheaper than other types of lubricants, including synthetic and bio-based options. Due to the wide availability of large fleets of ships and the growing demand to reduce the costs of operation, mineral oils are often one of the most preferred alternatives for marine units. Furthermore, they also offer the most predictable benefits as this lubricant is highly compatible with marine engines in general, and not just those that run on eco-friendly fuels. Overall, the balance of these qualities makes mineral oils one of the most popular lubricants in the marine market.

By Product Type

Engine oil is the lubricant with the largest Marine which has the largest market share in the market. This is due to the crucial function that it has in sustaining the performance and the durability of marine engines. It is essential for the reduction of friction, which results in the minimization of wear on the engines. High-quality engine oils are instrumental in protecting the engines of marine vessels from corrosion and deposits. As marine vessels continue to become increasingly sophisticated, and the wear to which engine oils are subjected rises, the volume of engine oil demanded in the market intensifies.

By Oil type

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

By Product Type

- Engine Oil

- Hydraulic Fluid

- Compressor Oil

- Others

By Ship type

- Bulk Carriers

- Tankers

- Container Ships

- Others

Buy Full Research Report on Marine Lubricants Market 2024-2032 @ https://www.snsinsider.com/checkout/1813

Regional Landscape:

Asia Pacific held the largest market share around 48.23% in 2023. This dominance is largely attributed to the region's robust maritime industry, which includes some of the world's busiest ports and largest shipping fleets. Countries like China, Japan, and South Korea are pivotal players, with extensive shipping operations that drive substantial demand for marine lubricants. Additionally, the region's rapid economic growth and expanding trade activities have led to increased shipping and, consequently, a higher requirement for effective marine lubrication solutions. The significant investments in port infrastructure and fleet expansion further bolster the demand for marine lubricants. Moreover, favorable regulatory environments and the growing adoption of advanced lubricants to comply with international environmental standards contribute to Asia-Pacific's leading market position. This dynamic growth reflects the region's strategic importance and its substantial influence on the global marine lubricants market.

Key Takeaways:

- Innovations in lubricant technology, including high-performance, synthetic, and bio-based lubricants, are enhancing engine protection, fuel efficiency, and service life.

- The increasing size of the global shipping fleet and expansion of international trade contribute to rising demand for marine lubricants.

- There is a growing emphasis on sustainable and eco-friendly lubricants, driven by regulatory pressures and environmental considerations.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Capacity and Utilization, by Country, by Type, 2023

5.2 Feedstock Prices, by Country, by Type, 2023

5.3 Regulatory Impact, by Country, by Type, 2023.

5.4 Environmental Metrics: Emissions Data, Waste Management Practices, and Sustainability Initiatives, by Region

5.5 Innovation and R&D, by Type, 2023

6. Competitive Landscape

7. Marine Lubricants Market Segmentation, by Oil Type

8. Marine Lubricants Market Segmentation, by Product Type

9. Marine Lubricants Market Segmentation, by Ship Type

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Description of Marine Lubricants Market Report 2024-2032 @ https://www.snsinsider.com/reports/marine-lubricants-market-1813

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain