Pune, Sept. 18, 2024 (GLOBE NEWSWIRE) -- Cloud Content Delivery Network Market Size Analysis:

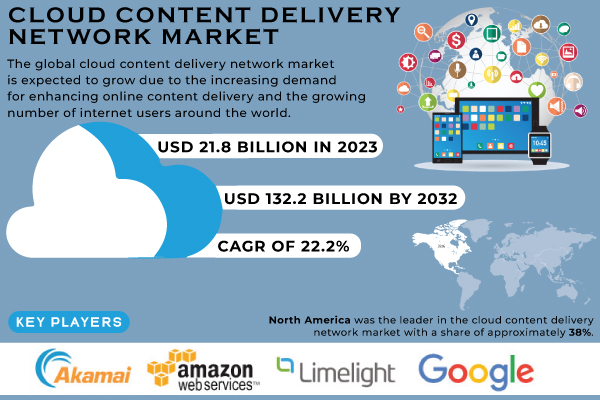

“In 2023, the Cloud Content Delivery Network Market was valued at USD 21.8 billion. By 2032, it is estimated to reach a value of USD 132.2 billion, reflecting a 22.2% CAGR for the 2024-2032 forecasted period. “

Increased Internet Penetration and Digital Infrastructure Expansion

The expansion of the global internet and digital infrastructure has served as a prolific driver for the cloud content delivery network market. Governments across the globe are investing heavily in internet infrastructure to support digital economies. The United States allocated USD 65 billion under the Infrastructure Investment and Jobs Act for the development of broadband infrastructure. The European Union’s Digital Decade policy targets achieving 5G coverage for all populated areas by 2030, further fueling demand for CDN services. The deepening accessibility of the internet is being complemented by a drop in network latency and an improvement in integrity, which play vital roles in the speedy dissemination of digital content by CDNs. The market is also benefitting from a growing number of businesses and users that demand uniformly seamless access to online content. The popularity of high-bandwidth applications, including e-commerce, social media, cloud applications, and others, also adds pressure on the content provider to provide fast access, drive CDN market growth.

Get a Sample Report of Cloud Content Delivery Network Market@ https://www.snsinsider.com/sample-request/1945

Major Players Analysis Listed in this Report are:

- Akamai Technologies (Akamai Intelligent Edge Platform, Kona Site Defender, Akamai Ion)

- Amazon Web Services (AWS) (Amazon CloudFront, AWS Global Accelerator)

- Cloudflare, Inc. (Cloudflare CDN, Cloudflare Argo)

- Google Cloud Platform (GCP) (Google Cloud CDN, Google Cloud Armor)

- Microsoft Azure (Azure CDN, Azure Traffic Manager)

- Fastly (Fastly CDN, Fastly Image Optimizer, Fastly Compute@Edge)

- Limelight Networks (now Edgio) (Limelight CDN, EdgeFunctions)

- Verizon Communications, Inc. (Edgecast) (Edgecast CDN, Edgecast Streaming)

- StackPath (StackPath CDN, Edge Computing)

- CDNetworks (CDNetworks Global CDN, Cloud Security Solutions)

- KeyCDN (KeyCDN Delivery, KeyCDN Real-time Logging)

- Alibaba Cloud (Alibaba Cloud CDN, DCDN (Dynamic Content Delivery Network))

- Tencent Cloud (Tencent Cloud CDN, Tencent Anti-DDoS, Tencent EdgeOne)

- Imperva (Imperva CDN, Imperva DDoS Protection)

- CacheFly (CacheFly Global CDN, CacheFly Ultra Low Latency Streaming)

- G-Core Labs (G-Core Labs CDN, G-Core Labs Cloud)

- Bunny.net (Bunny CDN, Bunny Optimizer)

- Leaseweb (Leaseweb CDN, Leaseweb Load Balancer)

- OnApp (OnApp CDN, OnApp Storage)

- Medianova (Medianova CDN, Medianova Cloud Encoding)

Cloud Content Delivery Network Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 21.8 Bn |

| Market Size by 2032 | USD 132.2 Bn |

| CAGR | CAGR of 22.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Key Regional Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Key Growth Drivers | • The growing popularity of streaming services for video, audio, and other multimedia content is driving the Market. • The people gaining access to high-speed internet globally, there is a growing in online content consumption, helps to increased demand for CLOUD CDN services. |

Do you have any specific queries or need any customization research on Cloud Content Delivery Network Market, Make an Enquiry Now@ https://www.snsinsider.com/enquiry/1945

Segment analysis

- On the basis of type, the video CDN dominated the market and held a revenue share of over 61%, video CDN is growing because of the increasing authorization and licensing demands of the content holders as well as the increasing demand for online video streaming. With government statistics highlighting a 30% annual increase in internet traffic, largely due to video consumption, the video CDN segment’s dominance becomes evident. As per the Federal Communications Commission Video streaming accounted for over 82% of all internet traffic in the U.S. in 2023. The introduction of streaming combined with other popular internet enabled devices has grown the market such that even social software provides support services for video streaming. The growing popularity of platforms such as Netflix, YouTube, and video content sharing on social media has made the use of video CDNs necessary to ensure buffer-free, high-quality streaming experiences. Furthermore, the global expansion of 4G and 5G networks has also contributed to the trend as the higher-definition video content can now be streamed across a range of personal devices more seamlessly than ever before. As consumer expectations for video quality continue to rise, content providers are leveraging CDNs in order to meet these requirements, resulting in growth in the market.

- Based on Organization Size, large organizations have accounted for more than 67% of market share in 2023 by organization size. Large organizations drive the market with increased demand for seamlessly distributing huge amounts of content across different geographical areas. According to the governments’ digital service data, the tendency for all the companies with more than 10,000 employees to apply CDN service is growing. The U.K. Department for Digital, Culture, Media and Sport for instance recorded a 25% growth among large enterprises that rely on the cloud and CDN because of large digital footprints and need to ensure constant and optimized user experience for their clients. In addition, large organizations that provide online services, e-commerce, financial, and media rely on CDNs to reduce latency, improve content delivery speeds, and secure their networks, enhancing their competitive advantage. These organizations also benefit from CDN providers’ security features, such as DDoS protection, essential for safeguarding their vast data flow.

Cloud Content Delivery Network Market Segmentation:

By Core Solution

- Web Performance Optimization

- Media Delivery

- Cloud Security

By Type

- Standard/Non-Video CDN

- Video CDN

By Adjacent Service

- Cloud Storage

- Analytics and Monitoring

- Application Program Interface (APIs)

- CDN Network Design

- Support and Maintenance

- Others

By Organization Size

- Small and Medium Businesses

- Large Enterprises

By Vertical

- Advertising

- Media & Entertainment

- Online gaming

- E-commerce

- Education

- Government

- Healthcare

- Others

Regional dominance

North America dominated the CDN market in 2023, accounted more than 38% share owing to significant investments in digital infrastructure, and early adoption of advanced technologies. The U.S. and Canada, in particular, have shown robust CDN market growth, supported by government initiatives like the IIJA, which is projected to bring high-speed internet access to various regions, thus, bolstering demand for CDN services. According to the U.S. Bureau of Economic Analysis, the digital economy contributed over $2 trillion to the U.S. GDP in 2023, with CDN services playing a critical role in supporting this growth. Due to the well-developed technology sector and the high rate of internet and mobile device use, North America has been fertile ground for the adoption of CDNs. Further, the rise of video-on-demand services and gaming and major tech players in the region will continue to place North America as a frontrunner in the adoption of CDN market in the coming years.

Buy an Enterprise-User PDF of Cloud Content Delivery Network Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/checkout/1945

Latest News

- In March 2024, Akamai Technologies partnered with Microsoft Azure to supplement its CDN with new cloud solution edge platforms to support more cloud-based video streaming and gaming.

- In July 2024, Cloudflare launched the new edge cloud new service, intended for reducing latency in video-streaming for enterprise clients through edge computing which will enhance dynamic spectrum sharing while improving performance of the server’s CDN, as reported by Cloudflare.

Key Takeaways

- Internet infrastructure expansion is driving CDN market growth globally.

- Video CDNs dominate due to rising demand for online streaming, holding over 61% market share.

- Large-scale organizations account for 67% of the market due to growing digital demands and security needs.

- North America leads the CDN market, driven by high digital economy contributions and government support.

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Cloud Content Delivery Network Market Segmentation, By Core Solution

8. Cloud Content Delivery Network Market Segmentation, By Type

9. Cloud Content Delivery Network Market Segmentation, By Adjacent Service

10. Cloud Content Delivery Network Market Segmentation, By Organization Size

11. Cloud Content Delivery Network Market Segmentation, By Vertical

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Access Complete Report Details of Cloud Content Delivery Network Market Analysis Report 2024-2032@ https://www.snsinsider.com/reports/cloud-content-delivery-network-market-1945

[For more information or need any customization research mail us at info@snsinsider.com]

SNS Insider Offering/ Consulting Services:

Go To Market Assessment Service

Total Addressable Market (TAM) Assessment

Competitive Benchmarking and Market Share Gain

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.