Pune, Sept. 19, 2024 (GLOBE NEWSWIRE) -- Market Size and Overview:

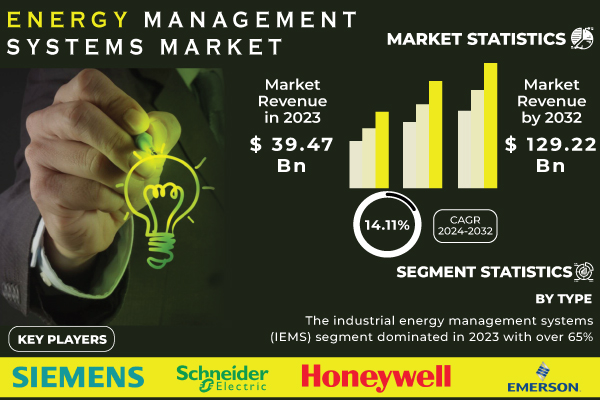

The Energy Management Systems (EMS) Market size was valued at USD 39.47 Billion in 2023 and is projected to expand to USD 129.22 Billion by 2032, reflecting a robust CAGR of 14.11% during the forecast period from 2024 to 2032.

The energy management systems market is experiencing elevated expansion as businesses strive to effectively manage and optimize their energy use. These systems give real-time data on energy consumption, identify areas of inefficiency, and offer reliable data to enable an informed choice on energy consumption. Essentially, the market for EMS systems has been driven by the growing awareness concerning environmental sustainability and the significance of enterprises reducing their carbon footprint. Governments and legislative bodies around the world are putting in place more stringent regulations concerning energy efficiency to foster the uptake of EMS solutions. The U.S. government has significantly funded and invested in the development of EMS systems. At the federal level, the Department of Energy has been a major investor in the construction of EMS, with the Office of Energy Efficiency and Renewable Energy providing about USD 4 billion per year to energy efficiency, including EMS implementation. The American Recovery and Reinvestment Act of 2009 funded the smart grid technologies with a total of USD 4.5 billion under the smart grid investment grant program, and the state energy program was supported by a further USD 3.1 billion. The trend has been observed with the Infrastructure Investment and Jobs Act in 2023, with hefty funding for energy use efficiency and conservation projects. Companies across all industries are using these systems to comply with the regulations, meet environmental or sustainability goals, and optimize costs by enhancing energy utilization.

Get a Sample Report of Energy Management System (EMS) Market (With Graphs and TOC) @ https://www.snsinsider.com/sample-request/3494

Dominant Industry Players Listed in this Research Report are:

- Siemens (Desigo CC, Sentron Power Manager)

- Schneider Electric (EcoStruxure Power, PowerLogic ION9000)

- General Electric (GE) (GE Digital Energy, GE Grid Solutions)

- Honeywell (Honeywell Forge, Energy Manager)

- Johnson Controls (Metasys, BCPro)

- ABB (ABB Ability Energy Manager, OPTIMAX)

- Emerson (DeltaV, Ovation)

- Rockwell Automation (FactoryTalk EnergyMetrix, PowerFlex Drives)

- Eaton (Power Xpert, Foreseer)

- IBM (TRIRIGA, Maximo Asset Management)

- Siemens Gamesa (SgREg, EnergyThru)

- Delta Electronics (DeltaGrid EMS, Delta Energy Online)

- Honeywell International (Building Management Solutions, Tridium)

- Mitsubishi Electric (EneScope, EcoWebServer III)

- Enel X (JuiceNet, EMS Virtual Power Plant)

- GridPoint (GridPoint Energy Manager, Advanced Energy Storage)

- Panasonic (Smart Energy Gateway, RESU Home Battery)

- Cisco (EnergyWise, Connected Grid)

- Huawei (FusionSolar Smart PV, eM3000 Smart Meter)

- Legrand (Energy Intelligence, WattStopper)

"Segment Analysis: Uncovering Critical Growth Areas in the Competitive Market Landscape"

By Type: The industrial energy management systems segment was the dominant one in 2023, with an over 65% market share. This is because manufacturing, oil and gas, and other industries have by far the highest energy needs and potential cost savings. IEMS solutions enable industrial facilities to maximize energy efficiency, reduce operational costs, and meet rigorous environmental requirements.

By Component: The hardware segment, which had a 60% market share in 2023, was the dominant market segment. This is because energy management systems cannot be used if the appropriate hardware components are not present; these include sensors, meters, controllers, and smart devices. They facilitate real-time data collection, monitoring, and control of energy use, which is valuable in a wide range of uses, from industrial and commercial to residential.

By Deployment: In 2023, the on-premises segment had a substantial share of over 55%, as it is assumed that business use of energy data and energy tools is more stringent. The on-demand manufacturing industry and the utilities industry need direct control of their energy systems, so they use on-premises EMS.

Do you Have any Specific Queries or Need any Customize Research on Energy Management System (EMS) Market, Enquiry Now @ https://www.snsinsider.com/enquiry/3494

Key Market Segmentation:

By Type

- Industrial energy management systems (IEMS)

- Building energy management systems (BEMS)

- Home energy management systems (HEMS)

By Component

- Hardware

- Software

- Services

By Deployment

- Cloud

- On-premises

By End User

- Residential

- Energy & Power

- Telecom & IT

- Manufacturing

- Retail

- Healthcare

- Others

"Regional Dynamics and Growth Trends in the Global Market: A Comprehensive Analysis"

In 2023, North America held the leading position in the energy management systems market with a 37% market share. This can be explained by the adoption of advanced energy management technology and the region’s supportive regulatory framework for energy efficiency. Moreover, both the US and Canada encourage and require their companies in various industries to install energy-efficient systems taking into account the relatively high volume of energy consumption in the industrial and commercial sectors. Thus, American companies from diverse industries, such as manufacturing, retail, and data centers, require various types of energy management systems.

APAC is the region with the fastest growth rate anticipated within 2024-2032 due to rapid urbanization and industrialization and the associated growth of energy consumption. Additionally, China, India, and other APAC countries are investing heavily in smart grids and renewable energy installations to meet the increasing demand for energy supply and respond to environmental regulation constraints. Therefore, in 2032, APAC will hold an estimated market share of 45%. From the above, one can infer that North America leads the energy management systems market, whereas APAC is the most quickly growing region.

Recent Developments

- April 2024: Siemens launched the new "Siemens Desigo CC," a comprehensive building management system that integrates with advanced energy management capabilities, enhancing efficiency across commercial and industrial buildings.

- July 2024: Honeywell introduced the "Honeywell Energy Manager 3.0," a cloud-based solution designed to provide real-time energy analytics and optimization for large enterprises, improving operational efficiency and reducing costs.

- September 2024: Schneider Electric announced its partnership with Google Cloud to develop "EcoStruxure Energy Hub," a cloud-based platform aimed at delivering advanced energy management and sustainability solutions for global clients.

Buy Enterprise User PDF of Global Energy Management System (EMS) Market Report at USD 5350 (40% Discount) @ https://www.snsinsider.com/checkout/3494

Key Takeaways

- Currently, the energy management systems market is growing rapidly due to technological innovation and high demand for energy-efficient solutions.

- The BEMS and cloud-based solutions are triggering market growth, which points to a tendency toward more advanced, integrated approaches to energy management.

- The biggest market in the world is in APAC, followed by the North America market, which is growing due to its advanced technology market and the supportive regulatory environment.

- Cloud-based energy management systems with advanced data analysis and real-time management options are among the main trends observed in the industry today.

Key Points from Table Of Contents

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Energy Management Systems Wafer Production Volumes, by Region (2023)

5.2 Energy Management Systems Design Trends (Historical and Future)

5.3 Energy Management Systems Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

7. Energy Management System (EMS) Market Segmentation, by Type

8. Energy Management System (EMS) Market Segmentation, by Component

9. Energy Management System (EMS) Market Segmentation, by Deployment

10. Energy Management System (EMS) Market Segmentation, By End User

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Insights of Energy Management System Market Growth & Outlook 2024-2032@ https://www.snsinsider.com/reports/energy-management-systems-market-3494

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.