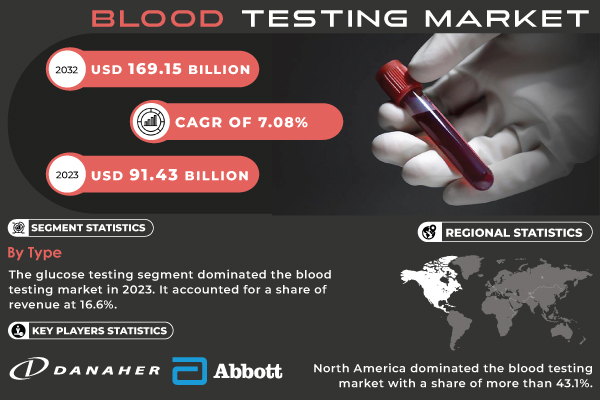

Pune, Oct. 04, 2024 (GLOBE NEWSWIRE) -- The Blood Testing Market was valued at USD 91.43 billion in 2023 and is expected to reach USD 169.15 billion by 2032, growing at a CAGR of 7.08% over the forecast period 2024-2032. This growth is due to the increasing prevalence of chronic diseases, growing health awareness, and innovation in testing technologies such as point-of-care and home testing solutions.

Market Summary

The blood testing market is witnessing a high rise in demand currently. This is because the need for correct and timely diagnostic testing is on the rise. Included in this market are several blood tests such as glucose testing, lipid panels, and infectious disease screenings. A high rise in the prevalence of chronic conditions such as diabetes and cardiovascular diseases has created a massive demand for blood testing services across the globe. Also, there are advanced technologies like automated laboratory systems and mobile health applications that enhance the efficiency of blood testing for better patient outcomes. Supply chains have also changed to meet this increased demand with many companies ready to offer full testing solutions that ensure minimal turnaround times. This will increase the rate at which blood testing is done, hence the uptick in the sale of serology tests and COVID-19 antibody tests, and of course, the market will be strong.

Download PDF Sample of Blood Testing Market @ https://www.snsinsider.com/sample-request/1014

Key Players:

- Danaher Corporation (DxH 520 Hematology Analyzer)

- Trinity Biotech Plc (Uni-Gold HIV Test, Hemoglobin A1c Testing Systems)

- Roche Diagnostics (Cobas 8000 Analyzer)

- bioMerieux SA (VITEK 2)

- Quest Diagnostics (Quest Diabetes Panel)

- Abbott (Abbott Alinity, FreeStyle Libre)

- F. Hoffmann-La Roche AG (Elecsys)

- Bio-Rad Laboratories, Inc. (BioPlex 2200)

- Biomerica, Inc. (Hemoglobin A1c Test, Rapid Test Kits)

- Becton, Dickinson and Company (BD Vacutainer, BD FACS)

- Siemens Healthineers (Atellica, ADVIA)

- Thermo Fisher Scientific (Orion Star A Series, Cell & Gene Therapy Kits)

- Others

Blood Testing Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 91.43 Billion |

| Market Size by 2032 | USD 169.15 Billion |

| CAGR | CAGR of 7.08% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test Type (Glucose Testing, A1C Testing, Direct LDL Testing, Lipid Panel Testing, Prostate-specific Antigen Testing, COVID-19 Testing, BUN Testing, Vitamin D Testing, Thyroid-stimulating Hormone (TSH), Serum Nicotine/Cotinine, High-sensitivity CRP Testing, Testosterone Testing, ALT Testing, Cortisol Testing, Creatinine Testing, AST Testing, Other Blood Tests) |

| Key Drivers | • The Surge of Chronic Diseases and Technological Innovations Fueling Growth in the Global Blood Testing Market |

If You Need Any Customization on Blood Testing Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/1014

Segment Analysis

By Type:

Glucose testing held the largest market share in the year 2023, accounting for a revenue share of 16.6%. This is because the rate at which the cases of diabetes in the population rise is very fast. The International Diabetes Federation has estimated that around 537 million adults aged 20-79 years will be living with diabetes in 2021, which is expected to rise to 783 million by 2045. This calls for a great need for glucose testing, through technology afforded by devices like glucometers, especially those based on Bluetooth and wireless characteristics. Prominent ones include Dario Health Smart Meter, iHealth Align, and Glooko through consumables test strips and syringes. Another area of growth expected for this period is A1C testing, largely by being convenient in diabetes management.

Fastest Growing Segment

The glucose testing market provides the highest market share, but the A1C testing segment is expected to grow fastest in the forecast period. Increasing demand for effective long-term management solutions for diabetes is further boosting this segment. A1C tests provide critical information about average blood glucose levels over extended periods; hence, they are crucial for diagnosis as well as continued treatment evaluation. The increasing availability of point-of-care A1C testing devices makes the technology more accessible to healthcare providers and patients alike, and this adds to the fast-growing nature of the segment.

Regional Analysis

North America:

As of 2023, the Blood Testing Market was dominated by North America, accounting for about 40%. Such dominance was a result of the region's well-developed healthcare infrastructure and the high prevalence of chronic diseases as well as significant investments made by major companies in R&D. The region consists of major players like Abbott Laboratories, Quest Diagnostics, and LabCorp, which are continuously making efforts to find solutions to meet the ever-growing demands for blood testing solutions. Besides, the increased government efforts to improve access and patient health outcomes provide further strength to market growth in the region.

Asia-Pacific:

Asia-Pacific is expected to be the fastest-growing in the Blood Testing Market during the forecast period. The growth has been driven by a healthy population growing health awareness and increased adoption of more advanced biomedical technologies. Countries like China and India are mainly driving this growth by shelling in more healthcare and diagnostic infrastructures. For example, Bio-Rad Laboratories and Beckman Coulter have increased their operations in this region to keep up with the increasing demand for blood testing services. In addition, government efforts in the countryside that improve accessibility of healthcare boost the market opportunity of the region.

Buy Full Research Report on Blood Testing Market 2024-2032 @ https://www.snsinsider.com/checkout/1014

New Products and Innovations in Recent Times

- Abbott Laboratories released the Alinity System for blood testing on February 15, 2024. The system enhanced the velocity and sensitivity of the tests.

- Roche Diagnostics released Cobas 8100 automated workflow solutions on March 10, 2024. The solutions made laboratory workflows easier to manage while also improving test turnaround times.

- Siemens Healthineers launched Atellica Solution, where the company brings laboratory automation together with state-of-the-art blood testing capabilities on April 5, 2024.

- Thermo Fisher Scientific launched its commercial version of the Ion Proton System for cutting-edge genetic testing capacity on June 20, 2024. This catapulted further into the blood testing space.

- Bio-Rad Laboratories released new A1C testing kits on July 30, 2024, with improved diabetes management options for healthcare providers.

- Beckman Coulter introduced the Access 2 Immunoassay System on August 15, 2024, which happens to be an integrated system that provides a combined solution for multiple blood tests.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Blood Testing Market Segmentation, by Test Type

7.1 Chapter Overview

7.2 Glucose Testing

7.3 A1C Testing

7.4 Direct LDL Testing

7.5 Lipid Panel Testing

7.6 Prostate-specific Antigen Testing

7.7 COVID-19 Testing

7.8 BUN Testing

7.9 Vitamin D Testing

7.10 Thyroid-stimulating Hormone (TSH)

7.11 Serum Nicotine/Cotinine

7.12 High-sensitivity CRP Testing

7.13 Testosterone Testing

7.14 ALT Testing

7.15 Cortisol Testing

7.16 Creatinine Testing

7.17 AST Testing

7.18 Other Blood Tests

8. Regional Analysis

9. Company Profiles

10. Use Cases and Best Practices

11. Conclusion

Request An Analyst Call@ https://www.snsinsider.com/request-analyst/1014

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.