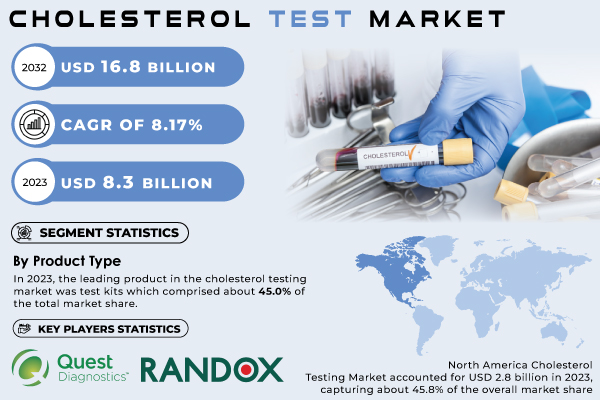

Austin, Oct. 21, 2024 (GLOBE NEWSWIRE) -- The S&S Insider report indicates that, “The Cholesterol Test Market was evaluated at USD 8.3 billion in 2023 and is expected to reach USD 16.8 billion by 2032, growing at a CAGR of 8.17% from 2024 to 2032.” The market growth is mainly influenced by increasing cardiovascular diseases, high obesity rates, and a rising focus on preventive care. Apart from these, improvements in testing technologies and increased access to diagnostic services are increasingly enhancing the demand for cholesterol testing in the world.

Market Overview

High cholesterol levels are a fast-emerging and growing health-related problem in recent times, not only among the elderly but also among people of younger ages. Cardiovascular diseases also account for a majority of fatalities around the world. The immense demand for cholesterol testing can thus be derived from the increasing need for improving standards of health education that promotes raising awareness about the dangers of high cholesterol levels. Millions of people across the globe are suffering from conditions such as heart attacks, diabetes, and kidney failure; therefore, there is an immediate need for efficient monitoring solutions. Advanced healthcare structures, especially in emerging nations, will add more pressure on cholesterol tests through enhanced capabilities of diagnosis. Due to the growing adoption of cutting-edge technologies, such as telemedicine and home testing, cholesterol testing has become more accessible to patients than ever before. Health departments around the globe also promote annual cholesterol screenings across various age brackets, ensuring that a constant demand and supply for testing devices will persist.

Download PDF Sample of Cholesterol Test Market @ https://www.snsinsider.com/sample-request/2861

Key Players:

- Quest Diagnostics Incorporated

- Clinical Reference Laboratory Inc.

- Randox Laboratories Ltd.

- PTS Diagnostics

- Hoffmann-La Roche AG

- Cell Biolabs Inc.

- Laboratory Corporation of America Holdings (LabCorp)

- Thermo Fisher Scientific

- Eurofins Scientific

Cholesterol Test Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 8.3 Billion |

| Market Size by 2032 | USD 16.8 Billion |

| CAGR | CAGR of 8.17% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Test Kits, Test Strips, Others) • By Test Type (Total Cholesterol Test, High-density lipoprotein (HDL) Cholesterol, Low-density lipoprotein (LDL) Cholesterol, Triglycerides/VLDL Cholesterol Test) • By End User (Hospitals, Diagnostic Laboratories, Others) |

| Key Drivers | • Rising Cardiovascular Diseases and Obesity Rates Propel Demand for Regular Cholesterol Screening |

If You Need Any Customization on Cholesterol Test Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/2861

Segment Analysis

By Product Type

In 2023, test kits accounted for the largest share of 45.0% in the cholesterol testing market. They are well-accepted among professionals and patients because they are convenient and friendly. Test kits provide an opportunity to be screened entirely for cholesterol, meeting all healthcare needs. On the other hand, the test strip segment is expected to grow the highest at 8% year-over-year from 2023 to 2028. This growth is fueled by an increasing desire for at-home testing solutions, through which patients are progressively wanting more control over monitoring their health.

By Test Type

Total cholesterol test was dominant in 2023, with 40.0% capturing the entire market share. The fact that this type of test can provide full information about the cholesterol levels of a patient together with the amount of HDL, LDL, and triglycerides makes it the most preferred test type for such check-ups. Alternatively, the market for tests for LDL cholesterol is poised to be the fastest growing segment, estimated at a 7% CAGR, attributed to heightened health awareness concerning the dangers attributed to high levels of LDL in contexts of cardiovascular diseases.

By End User

Hospitals held a market share of approximately 60.0% of the cholesterol testing market in 2023. They remain the primary care site as they are well-equipped with sophisticated diagnostic facilities and professionally qualified manpower, ensuring proper testing and follow-up. Diagnostic centers would be the highest growth player in the market with a CAGR of 9% during the review period due to the increasing trend for specialized testing and outpatient services, hence forming a primary interface in the healthcare delivery process.

Regional Analysis

North America

In 2023, North America held the largest share in the cholesterol testing market because it has a very advanced healthcare infrastructure and a high prevalence of cardiovascular diseases. The region has some major players, including Abbott and Quest Diagnostics, which are continuously advancing their product lines. Such is the case with Abbott's Proclaim DRG neurostimulation system and Quest's MelaNodal Predict Test, demonstrating an intense desire to upgrade health services in this region. With increased importance being laid on preventive healthcare, North America would continue dominating the market.

Asia Pacific

The Asia Pacific region is likely to emerge as the most rapidly growing market for cholesterol testing, aided by large numbers of people and people with a consistent growth in numbers. China and India are witnessing heavy investments in healthcare infrastructure, enabling the opening up of more diagnosis centers and laboratories. Growing health consciousness in the consumer population and the introduction of testing products that are easy to use drive the market. Randox Laboratories and Thermo Fisher Scientific are making high investments in development to expand their market in this region and can also pick up increasing demand for cholesterol testing.

Buy Full Research Report on Cholesterol Test Market 2024-2032 @ https://www.snsinsider.com/checkout/2861

Cholesterol Test Market Recent Developments

- January 2024: Abbott expanded MRI access for its Proclaim DRG neurostimulation system for chronic pain management.

- January 2024 Abbott initiated global proceedings for its volt-pulsed field ablation system in a clinical trial to use for treatments on abnormal heart rhythms.

- February 2024 Quest Diagnostics released MelaNodal Predict Test, a patient-specific melanoma risk prediction tool, which can help its clients avoid unwarranted invasive surgeries.

- November 2023 Randox Laboratories launched a kit for cholesterol that it improved as being more accurate and easier to use from a clinical perspective.

- December 2023: Laboratory Corporation of America Holdings (LabCorp) released a home cholesterol testing kit, representing an innovation whose time had come to meet the convenience needs of patients.

- October 2023: Clinical Reference Laboratory Inc. unveils a new and broader lipid profile testing service that will further monitor and outcomes of the patient.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients.

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Cholesterol Test Market Segmentation, by Product Type

7.1 Chapter Overview

7.2 Test Kits

7.3 Test Strips

7.4 Others

8. Cholesterol Test Market Segmentation, by Test Type

8.1 Chapter Overview

8.2 Total Cholesterol Test

8.3 High-density lipoprotein (HDL) Cholesterol

8.4 Low-density lipoprotein (LDL) Cholesterol

8.5 Triglycerides/VLDL Cholesterol Test

9. Cholesterol Test Market Segmentation, by End User

9.1 Chapter Overview

9.2 Hospitals

9.3 Diagnostic Laboratories

9.4 Others

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Description of Cholesterol Test Market Report 2024-2032 @ https://www.snsinsider.com/reports/cholesterol-test-market-2861

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.