Canada, Toronto , Oct. 22, 2024 (GLOBE NEWSWIRE) -- The Hot Dog and Sausage Market have been growing for several reasons, driven by changing consumer preferences, increasing demand for convenient and affordable food options, and evolving product innovations.

Industry Overview

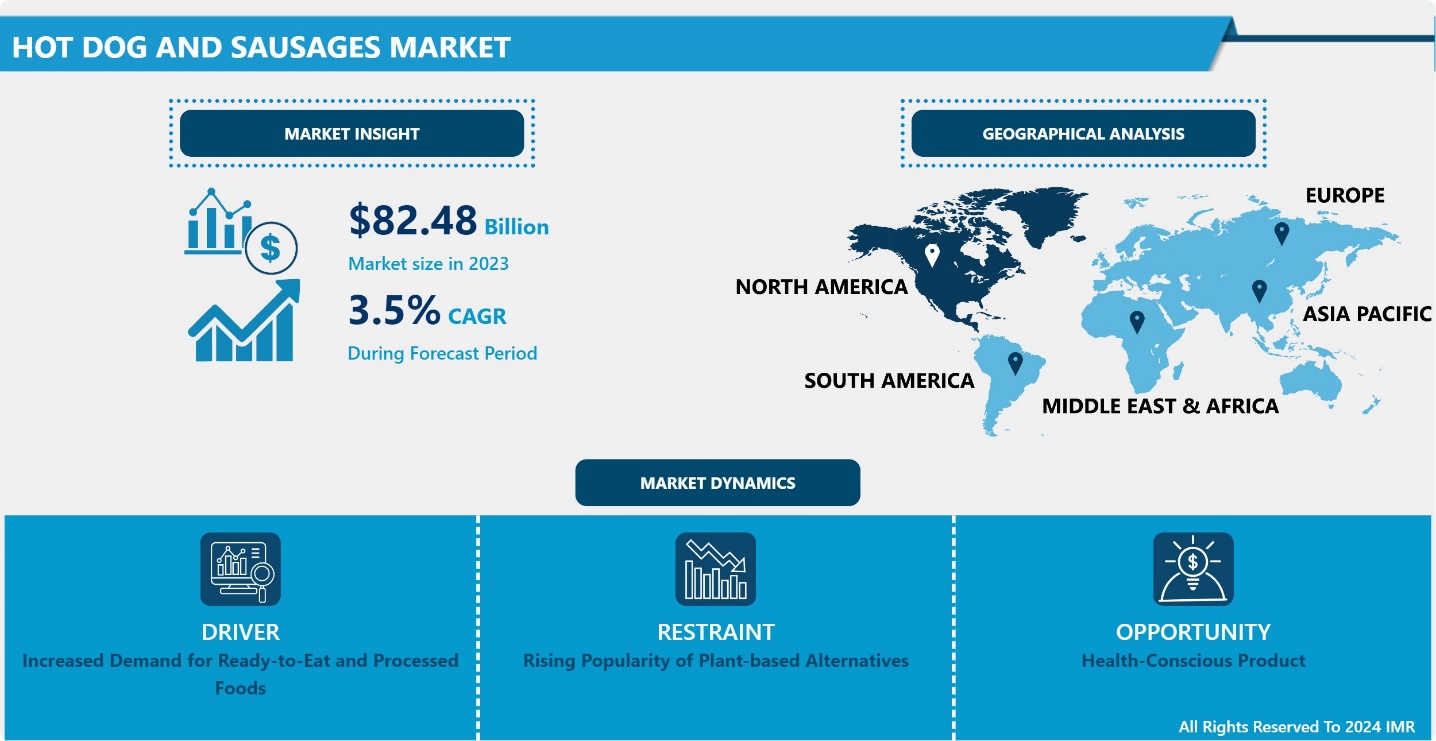

The global hot dog and sausages market has witnessed consistent growth, driven by evolving consumer preferences and increasing demand for convenient and ready-to-eat foods. Hot dogs and sausages are widely popular due to their easy preparation, availability, and affordability, making them staple items in fast-food menus and home-cooked meals alike. Key factors propelling the market include urbanization, rising disposable incomes, and the growing trend toward on-the-go meals.

Market segmentation is primarily based on product type, distribution channel, and geography. Hot dogs and sausages are generally classified into pork, beef, chicken, and plant-based options, with the latter gaining traction as more consumers opt for healthier or meat-alternative diets. In terms of distribution, supermarkets, hypermarkets, convenience stores, and online channels are the main retail avenues.

The rise of plant-based sausages has further expanded the market, driven by the increasing number of health-conscious consumers and the growing vegan and vegetarian movements. Companies are investing heavily in innovations, focusing on enhancing taste and texture to meet consumer demands for sustainable and nutritious options.

Download Sample 250 Pages of Hot Dog and Sausages Market Report@ https://introspectivemarketresearch.com/request/16649

Driving Factor

Increased Demand for Ready-to-Eat and Processed Foods

The hot dog and sausages market have witnessed substantial growth, primarily driven by the rising demand for ready-to-eat (RTE) and processed foods. Modern lifestyles, characterized by fast-paced routines and busy work schedules, have fueled the preference for convenient, quick-to-prepare meals. Hot dogs and sausages, with their minimal preparation time, fit perfectly into this trend, offering consumers an easy way to enjoy protein-rich meals without the hassle of extensive cooking.

One of the key factors behind this demand surge is the urbanization and increasing number of dual-income households. With both partners working, time available for meal preparation has decreased, prompting a shift towards easily accessible food products like hot dogs and sausages. These products are available in various forms, such as pre-cooked, frozen, and canned, catering to the need for diverse yet time-efficient meal options.

Moreover, the growing popularity of processed meat in fast-food chains and the retail sector further amplifies the demand. Hot dogs and sausages are staples in many fast-food outlets due to their cost-effectiveness and appeal across age groups. Alongside this, the expansion of supermarket chains and online grocery platforms has improved the accessibility of these products, boosting their sales.

Health-conscious consumers are also influencing the market, driving innovation in product offerings. Manufacturers are now introducing healthier alternatives like low-fat, organic, and gluten-free sausages, catering to the rising demand for nutritious yet convenient food options.

Opportunity

Health-Conscious Product

The hot dog and sausages market have traditionally been associated with indulgence rather than health. However, rising health consciousness among consumers presents a significant opportunity for innovation in this space. As people increasingly prioritize wellness, they seek healthier alternatives without sacrificing flavor. This shift allows brands to introduce products that align with modern dietary preferences, such as low-fat, low-sodium, or high-protein options.

One key trend is the demand for clean-label products. Consumers are now scrutinizing ingredient lists, preferring sausages and hot dogs made with natural ingredients, free from artificial additives, preservatives, and fillers. This aligns with the broader trend of "real food" and transparency in sourcing.

Another opportunity lies in plant-based and alternative proteins. With the rise of flexitarian diets, plant-based sausages and hot dogs made from ingredients like soy, pea protein, and mushrooms are becoming mainstream. These options appeal not only to vegetarians and vegans but also to health-conscious consumers looking to reduce their red meat consumption.

Additionally, there is a growing interest in functional foods that offer specific health benefits, such as sausages fortified with vitamins, minerals, or probiotics. Offering gluten-free or allergen-free variants can also capture niche markets catering to dietary restrictions.

Rising Popularity of Plant-based Alternatives

The rising popularity of plant-based alternatives is increasingly becoming a restraint for the traditional hot dog and sausage market. As consumers become more health-conscious and environmentally aware, the demand for plant-based products has surged. This shift is driven by various factors, including the growing perception that plant-based diets are healthier, concerns over the ethical treatment of animals, and the desire to reduce the environmental impact of meat production.

Health concerns related to the consumption of processed meats like hot dogs and sausages have been a significant motivator for this change. Studies linking processed meats to health issues such as heart disease, obesity, and certain cancers have led many consumers to seek healthier alternatives. Plant-based sausages and hot dogs, made from ingredients like soy, peas, or other legumes, are often perceived as a better option due to their lower fat content and absence of cholesterol.

Additionally, the environmental impact of meat production is a growing concern for consumers. Meat production is resource-intensive, requiring large amounts of water, land, and energy, and is a significant contributor to greenhouse gas emissions. In contrast, plant-based alternatives are seen as more sustainable, requiring fewer resources and generating lower emissions. This environmental awareness is particularly prominent among younger consumers, who are more likely to adopt plant-based diets and advocate for sustainable food choices.

The ethical concerns surrounding the treatment of animals in the meat industry have also led to a rise in vegetarianism and veganism. Many consumers are turning to plant-based products as a way to align their food choices with their values. This trend is further supported by the growing availability of plant-based alternatives, which are now widely available in supermarkets and restaurants, offering consumers more variety and accessibility than ever before.

Traditional hot dog and sausage producers are facing increasing pressure to innovate and offer plant-based options or risk losing market share. While the demand for traditional meat products remains strong in certain segments, the rapid growth of plant-based alternatives is undeniably reshaping the market.

Do you need any industry insights on Hot Dog and Sausages Market, Make an enquiry now >>? https://introspectivemarketresearch.com/inquiry/16649

Key Manufacturers

Market key players and organizations within a specific industry or market that significantly influence its dynamics. Identifying these key players is essential for understanding competitive positioning, market trends, and strategic opportunities.

- Tyson Foods Inc(U.S.)

- Goodman Fielder Ltd (Australia)

- Nippon Meat Packers Inc. (Japan)

- Robert Bosch (Germany)

- Fleury Michon (France)

- Hormel Foods Corp(U.S.)

- Nestlé (Switzerland)

- Animex Foods (Poland)

- Atria Plc (Finland)

- Johnsonville, LLC (U.S.)

- Bob Evans Farms (U.S.)

- Vienna Beef (U.S.)

- Kunzler & Company (U.S.)

Recent Industry Development

In January 2024, A new meat processing plant in Hokkaido was completed by the NH Foods Group company Nippon Food Packer, Inc. The plant added 40% capacity and strengthened the local production and distribution structure. Located in Yakumo, Futami District, Hokkaido Prefecture, the Donan Plant enhanced the Group's hog farming business and facilitated the expansion of export operations.

In May 2023, Tyson Foods, Inc. completed the previously announced acquisition of Williams Sausage Company, Inc. of Union City, Tenn., furthered the company’s strategy to increase its capacity and product portfolio. To ensure the continuity of business operations, Emily Billingsley, Roger Williams’ daughter, was responsible for the company’s operations. “This acquisition aligned with our strategy to win with customers, augmented our manufacturing capabilities, and expanded our product portfolio,” said Stewart Glendinning, group president, Prepared Foods for Tyson Foods. “Williams Sausage Company brought real strengths in its brand, facilities, and direct store delivery network that made this a logical and welcome addition to our Prepared Foods business.

Key Segments of Market Report

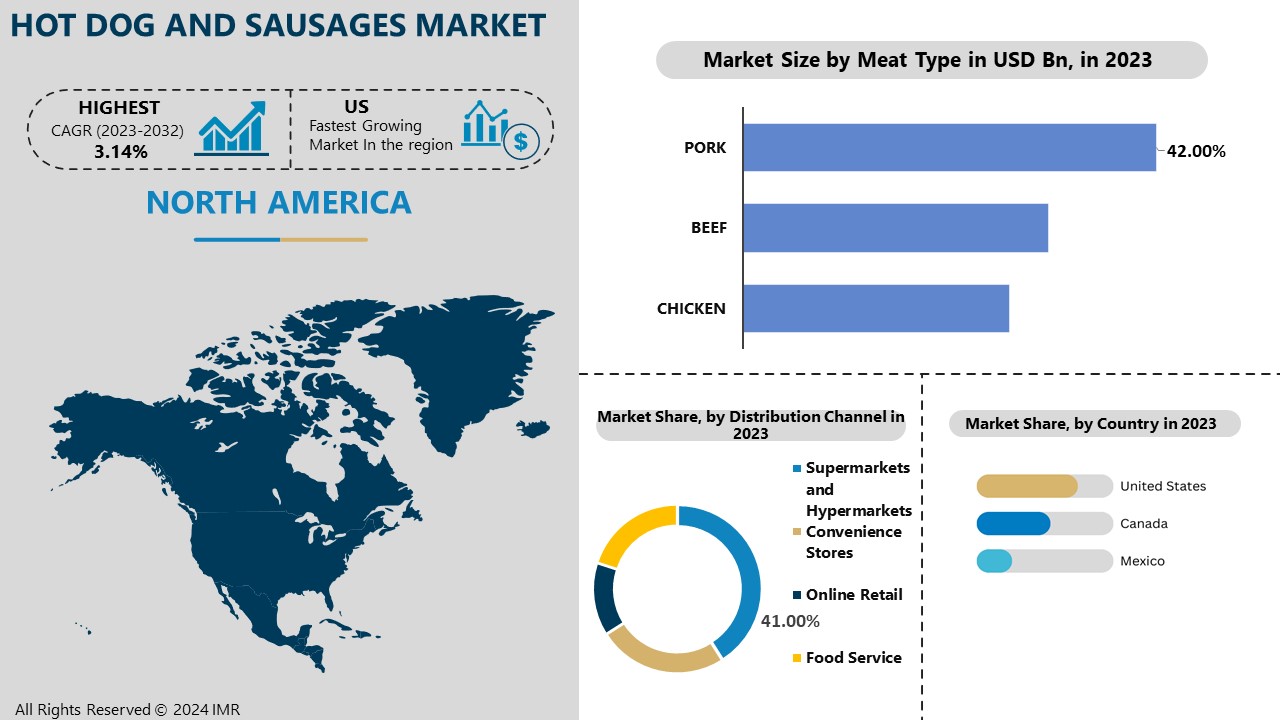

By type, Pork type segment is expected to dominate the Hot dog and Sausages market during the forecast period

The pork type segment is expected to dominate the hot dog and sausages market during the forecast period, driven by several factors, including its global popularity, affordability, and taste preferences. Pork has long been a staple in processed meat products, particularly in Western countries and Asia, where consumers have a strong preference for pork-based sausages and hot dogs. This segment's dominance can be attributed to the versatility of pork as a meat choice, its ability to retain flavor when processed, and its wide availability, making it a popular option among manufacturers and consumers alike.

One of the main reasons for the expected dominance of the pork segment is the historical and cultural significance of pork in many regions. In Europe, for example, pork sausages have a rich tradition, especially in countries like Germany, Poland, and Spain, where they are often consumed as part of everyday meals or festive occasions. In Asia, pork is also widely consumed, particularly in China, where it is an integral part of many local sausage varieties, contributing to a high demand for pork-based products. This cultural preference significantly boosts the demand for pork sausages and hot dogs globally.

Moreover, pork is generally more affordable compared to other meats like beef or lamb, which makes it an attractive option for mass production of hot dogs and sausages. Consumers looking for budget-friendly options are more likely to opt for pork products, especially in regions with lower disposable incomes. This affordability extends to both fresh and processed pork, further cementing its position in the hot dog and sausage market.

Health trends, despite favoring leaner meats such as poultry, have not significantly diminished the demand for pork in processed foods. While there is a growing preference for healthier alternatives, the indulgence factor associated with pork sausages—due to their rich flavor and juiciness—continues to appeal to consumers who prioritize taste over calorie-conscious choices. Additionally, the introduction of healthier pork processing techniques and lower-fat variants could help maintain the segment’s dominance in the market.

Innovations in product development and the introduction of diverse flavors within pork-based hot dogs and sausages are expected to sustain consumer interest. Manufacturers are exploring new flavor profiles, packaging options, and convenience-focused products, catering to a wider range of demographics, including younger consumers and those seeking premium offerings. These factors collectively contribute to the expected dominance of the pork segment in the hot dog and sausages market during the forecast period.

By Distribution Channel, Supermarket and Hypermarket segment held the largest share in 2023

The supermarket and Hypermarket segment emerged as the dominant distribution channel, capturing the largest market share across various industries. This is attributed to several key factors that have driven consumer preferences and business strategies toward these large-scale retail formats.

Supermarkets and hypermarkets offer unparalleled convenience. They are typically one-stop destinations where consumers can purchase a wide variety of products, from groceries to household items, under one roof. This diverse product assortment appeals to busy consumers looking to save time by consolidating their shopping trips. Additionally, these stores tend to have longer operating hours and are located in accessible areas, further enhancing their appeal.

Supermarkets and hypermarkets often benefit from economies of scale, allowing them to offer competitive pricing compared to smaller retailers. These cost savings are passed on to consumers, which is particularly appealing when customers seek value for money in times of economic uncertainty. Moreover, large retail chains frequently run promotions, discounts, and loyalty programs that incentivize repeat purchases, increasing customer retention.

Another contributing factor is the trust and familiarity that consumers have with established supermarket and hypermarket brands. Many of these chains have spent decades building strong reputations, which provides them with a loyal customer base. In contrast to online-only retailers, brick-and-mortar stores offer the advantage of physical interaction with products, allowing customers to inspect items before purchasing.

The expansion of product offerings beyond traditional groceries has also played a role in the dominance of this segment. Supermarkets and hypermarkets now frequently include electronics, apparel, beauty products, and even services such as pharmacies and banking, transforming them into comprehensive retail hubs.

Supermarket and Hypermarket segment's leading market share in 2023 is driven by convenience, competitive pricing, established trust, and the extensive variety of products and services offered. These factors have collectively reinforced the preference of consumers and businesses alike for this distribution channel over others, including smaller retailers and online platforms.

Download Sample 250 Pages of Hot Dog and Sausages Market Report@ https://introspectivemarketresearch.com/request/16649

Regional Analysis of the Hot Dog and Sausages Market

North America is Expected to Dominate the Market

Hot dogs and sausages are a part of North American cuisine and have been popular for over a century. They are often associated with outdoor events, such as sports games and barbecues, and are seen as a staple food in many households. Hot dogs and sausages are quick and easy to prepare, making them a popular choice for busy families and individuals.

Hot dogs and sausages are widely available in North America, with many different brands and varieties sold in supermarkets and convenience stores. The Hot Dog and Sausages market in North America is highly competitive, and companies have invested heavily in marketing and promotion to maintain their market share.

The North American market has seen a lot of innovation in the Hot Dog and Sausages market, with new flavors and varieties being introduced regularly to keep consumers interested. North America has a large population, which provides a large potential market for Hot dogs and sausage manufacturers.

Comprehensive Offerings:

- Historical Market Size and Competitive Analysis (2017–2023): Detailed assessment of market size and competitive landscape over the past years.

- Historical Pricing Trends and Regional Price Curve (2017–2023): Analysis of historical pricing data and price trends across different regions.

- Market Size, Share, and Forecast by Segment (2024–2032): Projections and detailed insights into market size, share, and future growth by segment.

- Market Dynamics: In-depth analysis of growth drivers, restraints, opportunities, and key trends, with a focus on regional variations.

- Market Trend Analysis: Evaluation of emerging trends that are shaping the market landscape.

- Import and Export Analysis: Examination of trade patterns and their impact on market dynamics.

- Market Segmentation: Comprehensive analysis of market segments and sub-segments, with a regional breakdown.

- Competitive Landscape: Strategic profiles of key players across regions, including competitive benchmarking.

- PESTLE Analysis: Evaluation of the market through Political, Economic, Social, Technological, Legal, and Environmental factors.

- PORTER’s Five Forces Analysis: Assessment of competitive forces influencing the market.

- Industry Value Chain Analysis: Examination of the value chain to identify key stages and contributors.

- Legal and Regulatory Environment by Region: Analysis of the legal landscape and its implications for business operations.

- Strategic Opportunities and SWOT Analysis: Identification of lucrative business opportunities, coupled with a SWOT analysis.

- Conclusion and Strategic Recommendations: Final insights and actionable recommendations for stakeholders.

Related Report Links:

Meat Extract Market: Meat Extract Market Size Was Valued at USD 1.85 Billion in 2023, and is Projected to Reach USD 3.1 Billion by 2032, Growing at a CAGR of 5.90% From 2024-2032.

Cultivated Meat Market: Cultivated Meat Market Size is Valued at USD 0.23 Billion in 2023, and is Projected to Reach USD 0.79 Billion by 2032, Growing at a CAGR of 16.50% From 2024-2032.

Homogenized Meat Market: Homogenized Meat Market Size Was Valued at USD 148.54 Million in 2023, and is Projected to Reach USD 239.68 Million by 2032, Growing at a CAGR of 5.46% From 2024-2032.

Artificial Meat Products Market: Artificial Meat Products Market Size Was Valued at USD 4.38 Billion in 2023, and is Projected to Reach USD 6.41 Billion by 2032, Growing at a CAGR of 4.32% From 2024-2032.

Clean Meat Market: The Global Clean Meat Market Size Was Valued at USD 19.99 Million in 2023 and is Projected to Reach USD 77.81 Million by 2032, Growing at a CAGR of 16.3% From 2024-2032.

Raw Meat Speciation Testing Market: The raw Meat Speciation Testing Market Size Was Valued at USD 2.6 Billion in 2023, and is Projected to Reach USD 5.28 Billion by 2032, Growing at a CAGR of 8.2% From 2024-2032.

Meat Snacks Market: The Global Meat Snacks Market size is expected to grow from USD 4.22 billion in 2023 to USD 8.87 billion by 2032, at a CAGR of 8.6% during the forecast period (2024-2032).

Plant-Based Meat Market: Global Plant-Based Meat Market was valued at USD 20.36 Billion in 2023 and is expected to reach USD 68.33 Billion by the year 2032, Growing at a CAGR of 14.4% From 2024-2032.

Meat Speciation Testing Market: The Global Meat Speciation Testing market was valued at USD 1.92 billion in 2021 and is expected to reach USD 3.02 billion by the year 2028, at a CAGR of 6.7%.

Cultured Meat Market: Cultured Meat Market Size Was Valued at USD 168.21 Billion in 2022, and is Projected to Reach USD 555.28 Billion by 2030, Growing at a CAGR of 16.1% From 2023-2030.

About Us:

Introspective Market Research is a premier global market research firm, leveraging big data and advanced analytics to provide strategic insights and consulting solutions that empower clients to anticipate future market dynamics. Our team of experts at IMR enables businesses to gain a comprehensive understanding of historical and current market trends, offering a clear vision for future developments.

Our strong professional network with industry-leading companies grants us access to critical market data, ensuring the generation of precise research data tables and the highest level of accuracy in market forecasting. Under the leadership of CEO Mrs. Swati Kalagate, who fosters a culture of excellence, we are committed to delivering high-quality data and supporting our clients in achieving their business goals.

The insights in our reports are derived from primary interviews with key executives of top companies in the relevant sectors. Our robust secondary data collection process includes extensive online and offline research, coupled with in-depth discussions with knowledgeable industry professionals and analysts.

Contact Us:

Canada Office

Introspective Market Research Private Limited, 138 Downes Street Unit 6203- M5E 0E4, Toronto, Canada.

APAC Office

Introspective Market Research Private Limited, Office No. 401, Saudamini Commercial Complex, Kothrud, Pune, India 411038

Ph no: +91-81800-96367 / +91-7410103736

Email: sales@introspectivemarketresearch.com

LinkedIn| Twitter| Facebook | Instagram