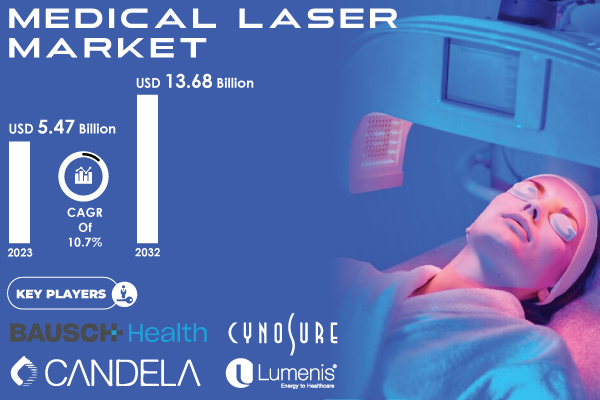

Austin, Oct. 24, 2024 (GLOBE NEWSWIRE) -- The S&S Insider report indicates that, “Medical Laser Market was USD 5.47 billion in 2023 and is expected to reach USD 13.68 billion by 2032 with a CAGR of 10.7% over the forecast period 2024-2032.” The market growth can be explained by the growing demand for minimally invasive procedures in concert with rising awareness of the benefits of laser-based therapies for the treatment of several medical conditions. The growth in the geriatric population, advancement in the use of lasers, and escalating incidences of chronic diseases are contributing factors.

Medical Laser Market Summary

The growth in the medical laser market is due to the increasing adoption of laser technologies in various medical applications, such as surgery, aesthetics, and diagnostics. Medical lasers are thus in heavy demand; the demand for them is predominantly based on their effectiveness in surgical procedures, aesthetic treatments, and diagnostics. The supply chain for the medical laser has gotten much stronger with the advancements in manufacturing technology and increased competition among key players. With lower costs and improved products, the trend towards non-invasive cosmetic procedures continues to increase demand in the market. Recent studies indicate that this aesthetic segment contributes nearly 40% of the market share and it further shows high interest in aesthetic improvement. Interests can be increased with the influence of social media and changing beauty standards in society. The growth pattern of the market shows that the prospects for the industry seem to be bright as innovative products and their applications are still appearing on the horizon.

Download PDF Sample of Medical Laser Market @ https://www.snsinsider.com/sample-request/3020

Key Players:

- Bausch Health Companies Inc. - LASIK and cataract laser systems

- Cynosure - Aesthetic laser systems for hair removal, skin rejuvenation, and tattoo removal

- Lumenis Be Ltd. - Dermatology, surgical, and ophthalmology laser devices

- Candela Corporation - GentleMax Pro laser system for hair removal and skin treatments

- TOPCON CORPORATION - Ophthalmic laser technology for retinal and cataract surgery

- IRIDEX Corporation - Lasers for glaucoma treatment and aesthetic applications

- Sisram Medical Ltd (Alma Lasers) - Aesthetic laser devices for skin resurfacing and body contouring

- BIOLASE, Inc. - Dental lasers for soft tissue surgery and teeth whitening

- El.En. S.p.A. - Aesthetic laser systems for hair removal and skin treatments

- LAMEDITECH - Laser technology for cosmetic and medical applications

- Artivion, Inc. - Laser technology for surgical applications, particularly in cardiovascular procedures

- Novartis AG - Laser therapies in ophthalmology

- Boston Scientific Corporation - Laser systems for surgical applications

- Lumibird Medical - Laser technologies for ophthalmology

- Koninklijke Philips N.V. - Laser solutions for medical applications

Medical Laser Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 5.47 Billion |

| Market Size by 2032 | USD 13.68 Billion |

| CAGR | CAGR of 10.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Solid State laser systems, Gas laser systems, Dye laser systems, Diode laser systems) • By Application (Ophthalmology lasers, Surgical lasers, Aesthetic and Dermatology Lasers, Others) • By End User (Hospital, Dermatology and Cosmetic Clinics, Ophthalmic Clinics, Others) |

| Key Drivers | • Rising Demand for Non-Surgical Cosmetic Procedures Driving a Shift Toward Minimally Invasive Treatments |

If You Need Any Customization on Medical Laser Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/3020

Market Segment Analysis

By Product Type

In the Medical Laser Market, in 2023, solid-state laser systems captured around 45.0% of the product market share. This is because solid-state lasers are versatile, reliable, and efficient and can be applied for several purposes, such as surgery, dermatology, and ophthalmology. The preference for solid-state lasers is because of their precision and superior performance.

By Application

Aesthetic and dermatology lasers accounted for the largest application share in 2023, holding about 40.0% of the total market share. The rising demand for non-invasive cosmetic treatments and skin health awareness have also influenced this growth. Laser hair removal, tattoo removal, and skin rejuvenation are a few of the main factors driving this increase in the market.

The ophthalmology lasers segment is expected to witness the highest growth rate during the forecast period at 12.0%. This is primarily because of the increasing prevalence of eye disorders, including cataracts and refractive errors, coupled with various innovations in technology leading to better treatment outcomes, including rising LASIK procedures, and the development of new laser systems.

By End User

The largest industry presence in the Medical Laser Market comes from hospitals, with a market share of around 50.0% in the year 2023. The enormous infrastructure and flexibility to carry out high-level laser applications in surgery and therapy further solidify hospitals' leading market position.

Regional Analysis

North America

North America dominates the Medical Laser Market at present and accounts for approximately 48.9% of the market share in 2023. The chronically raised health infrastructure and chronic diseases primarily contribute to the region leading the market. The presence of huge players and continuous innovations of technologies further make the region grow. Hospitals and specialty clinics in the US and Canada increasingly apply advanced laser technologies in a range of applications, from surgical interventions to aesthetic treatments.

Asia Pacific

The Asia-Pacific region is anticipated to be the fastest-growing market with an estimated CAGR of 12.5% over the forecast period. The growth is driven by higher disposable incomes, increased healthcare spending, and rising demand for aesthetic treatments within the population. Fast growth in medical infrastructure in China and India is propelling demand for medical lasers. Companies, however, are focusing on cost-effective laser solutions to cater to the increased demand in dermatology as well as in surgical applications.

Buy Full Research Report on Medical Laser Market 2024-2032 @ https://www.snsinsider.com/checkout/3020

Recent Developments

- September 2024: Alcon has launched its latest femtosecond laser system for cataract surgery, enhancing precision and significantly reducing surgical time.

- July 2024: The newly designed Xeo platform is released; aesthetic laser technologies include skin resurfacing and the removal of tattoos, among other new ones.

- June 2024: The generation of new picosecond lasers provides for the treatment of more advanced skin rejuvenation as well as improvement in pigmentation to cater to a patient who requires the treatment of two types of skin.

- May 2024: In this new platform, hair removal treatments made with efficient and safe modes through innovative laser technology are introduced.

- April 2024: Coherent's latest systems boast advanced technology for application in surgery, entailing high performance with reliability.

- March 2024: A collaborative research study published evidence on minimally invasive surgeries carried out using laser-assisted techniques indicated quicker recovery times and better patient outcomes.

Table of Contents – Major Key Points

1. Introduction

- Market Definition

- Scope (Inclusion and Exclusions)

- Research Assumptions

2. Executive Summary

- Market Overview

- Regional Synopsis

- Competitive Summary

3. Research Methodology

- Top-Down Approach

- Bottom-up Approach

- Data Validation

- Primary Interviews

4. Market Dynamics Impact Analysis

- Market Driving Factors Analysis

- PESTLE Analysis

- Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

- Incidence and Prevalence (2023)

- Prescription Trends, (2023), by Region

- Device Volume, by Region (2020-2032)

- Healthcare Spending, by Region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

- List of Major Companies, By Region

- Market Share Analysis, By Region

- Product Benchmarking

- Strategic Initiatives

- Technological Advancements

- Market Positioning and Branding

7. Medical Laser Market Segmentation, by Product Type

8. Medical Laser Market Segmentation, by Application

9. Medical Laser Market Segmentation, by End User

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/3020

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.