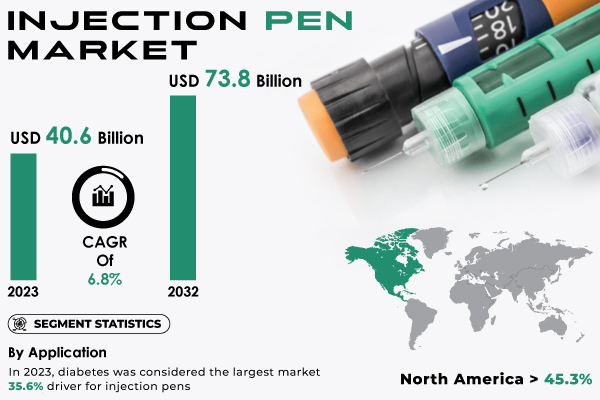

Austin, Oct. 29, 2024 (GLOBE NEWSWIRE) -- The S&S Insider report indicates that, “The injection pen market was valued at USD 40.6 Billion in 2023 and is projected to reach USD 73.8 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2032.”

Rising Demand for Injection Pen Driven by Chronic Disease Prevalence

The injection pen is a medical device used for injecting medication to the body. This is why these pens have become popular: They are easy to use, and they offer a better option for everyday delivery of medication as the diabetes patient population is expected to increase dramatically over the next few years, so vials and syringes simply won't cut it.

In addition, the growing demand for the health management of obesity and hormone-related disorders is adding to market growth. Increasing health problems associated with the aging population, along with government policies to facilitate the delivery of high-quality healthcare and availability of innovative smart devices have improved accessibility and continue to expand the growth potential for the global injection pen industry.

Download PDF Sample of Injection Pen Market @ https://www.snsinsider.com/sample-request/4615

Key Players:

- BD (BD Ultra-Fine Insulin Pen Needles, BD Insulin Pen)

- Lilly (Mounjaro (Tirzepatide), Humalog KwikPen, Basaglar KwikPen, Trulicity (auto-injector))

- Ypsomed AG (MyLife YpsoPen, MyLife Clickfine Pen Needles)

- Biocon (Basalog, Insulin Aspart Pen)

- AstraZeneca (Fasenra (auto-injector), bydureon Pen)

- Pfizer Inc. (Enbrel SureClick)

- Novartis AG (Aimovig, Zolgensma)

- Novo Nordisk A/S (Ozempic)

- Sanofi (Admelog SoloSTAR)

- Owen Mumford Ltd. (AutoJet)

- Merck KGaA (Bavencio)

- Hoffman-La Roche (Rituxan Hycela)

- Medtronic (MiniMed Insulin Pen)

- Wockhardt Ltd. (Wockhardt Insulin Lispro Injection)

- Sun Pharmaceutical Industries Ltd. (Sun Insulin Aspart Injection) and others.

Injection Pen Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 40.6 Billion |

| Market Size by 2032 | USD 73.8 Billion |

| CAGR | CAGR of 6.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Disposable, Reusable) • By Application (Diabetes, Anaphylaxis, Osteoporosis, Growth Hormone Deficiency, Arthritis, Others) • By End-Use (Hospital, Clinics, Home Care Settings) |

| Key Drivers | • Growing Demand for Injection Pens Driven by Diabetes Prevalence and Self-Administration Trends |

If You Need Any Customization on Injection Pen Market Report, Inquire Now @ https://www.snsinsider.com/enquiry/4615

Surge in Diabetes Cases Sparks Increased Adoption of Injection Pen

Increased number of diabetes cases is one of the key factors driving the market growth as injection pens are preferred due to their convenience, comfort and simplicity than other traditional methods. These devices are becoming increasingly popular among diabetic patients, as they are convenient to use, thus generating a large market for these devices with the availability of easy-to-use products in the regional markets such as UK that have more number of people suffering from obesity. Moreover, advancements in insulin formulations and introduction of new drugs such as Mounjaro from Eli Lilly- has propelled market development. The push for self-administration with the help of durable and pre-filled injection pens is also boosting demand from patients seeking painless, accurate dosage delivery.

Dominance of Diabetes and Rising Awareness of Anaphylaxis Boosts Injection Pen Market

Diabetes remained the dominant outlet for injection pens in 2023 -- representing 35.6% of demand on account of the benefits this mode provides over conventional syringes and vials. This service provides users with better dosing accuracy, ease of use and undetectable usage thus fulfilling the daily management needs of exposes diabetes patients. Moreover, the rising incidence of anaphylaxis, particularly the pediatric population is also going to bolster growth due to the growing awareness and demand for epinephrine auto-injectors as lifesaving devices during life-threatening allergic reactions. The injection pen market will be driven by this dual steer of diabetes management and anaphylaxis treatment.

Hospitals Lead Injection Pen Market Growth with Clinics on the Rise

The injection pen market was led by hospitals and held a share of 56.3% in 2023 due to their rapid acceptance along with government needs for better health infrastructure. This is expected to augment growth along with the growing diabetes patient pool and increased health spending by consumers. On the other hand, we expect clinics to have highest compound annual growth rate (CAGR) because growing chronic conditions are driving a high demand for extended experience in monitoring patients. This is also expected to increase usage of injection pen in the coherent clinical settings which will further enhance market growth, as well as adherence towards prescribed treatment due to government programs.

North America Dominates Injection Pen Market While Asia Pacific Poised for Growth

North America generated 45.3% of the global injection pen market in 2023, owing to increasing prevalence of metabolic ailments like diabetes, cardiovascular disease in U.S & Canada. High healthcare expenditure, growing awareness of advanced drug delivery systems and easy accessibility to injection pens and cartridges are also factors contributing towards the overall growth of market in the region.

On the other hand Asia pacific injection pen market leave a promising footprint for growth in coming years with rising cases of chronic diseases such as diabetes. These changes, such as rapid urbanization and widespread societal lifestyle transformation in most countries like China are demanding self-administration of medications among the population over time which also include elderly people. The injection pen market presence in the Asia Pacific region continues to receive support due to demographic transitions and an increasing geriatric population.

Buy Full Research Report on Injection Pen Market 2024-2032 @ https://www.snsinsider.com/checkout/4615

Key Developments in Injection Pen Market

- In February 2023, the Sanofi company entered into partnership with Glooko Inc., focused on improving care for patients and healthcare professionals through integration of their SoloSmart device into the Glooko platform highlighting benefit as a seamless experience. Together, this collaboration seeks to enhance the availability of digital diabetes management solutions across every market where SoloSmart is introduced.

- UK became the fourth European nation to unveil obesity drug Mounjaro, which was introduced by Eli Lilly in February 2024. Mounjaro (tirzepatide) is marketed in the Mounjaro KwikPen, and has gained approval from the UK Medicines and Healthcare products Regulatory Agency (MHRA) for treating diabetes and controlling weight at a four-dose formulation.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.2 PESTLE Analysis

4.3 Porter’s Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Incidence and Prevalence (2023)

5.2 Prescription Trends, (2023), by Region

5.3 Device Volume, by Region (2020-2032)

5.4 Healthcare Spending, by Region, (Government, Commercial, Private, Out-of-Pocket), 2023

6. Competitive Landscape

6.1 List of Major Companies, by Region

6.2 Market Share Analysis, by Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and Supply Chain Strategies

6.4.3 Expansion plans and new Product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Injection Pen Market Segmentation, by Product

7.1 Chapter Overview

7.2 Disposable

7.3 Reusable

8. Injection Pen Market Segmentation, by Application

8.1 Chapter Overview

8.2 Diabetes

8.3 Anaphylaxis

8.4 Osteoporosis

8.5 Growth Hormone Deficiency

8.6 Arthritis

8.7 Others

9. Injection Pen Market Segmentation, by End-Use

9.1 Chapter Overview

9.2 Hospital

9.3 Clinics

9.4 Home Care Settings

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Speak with Our Expert Analyst Today to Gain Deeper Insights @ https://www.snsinsider.com/request-analyst/4615

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.