United States, New York, Oct. 29, 2024 (GLOBE NEWSWIRE) -- Metal Replacement Market refers to the process of substituting traditional metal materials with alternative, often lighter, materials like plastics, composites, or ceramics in various applications. This shift is primarily driven by the need to reduce weight, lower costs, improve corrosion resistance, and simplify manufacturing processes. In industries like automotive, aerospace, and electronics, replacing metals with advanced polymers or composite materials can lead to improved fuel efficiency, extended product lifespan, and enhanced design flexibility. For instance, using polymers in automotive parts can significantly reduce vehicle weight, contributing to better fuel economy and reduced emissions.

Introspective Market Research is excited to unveil its latest report, "Metal Replacement." This in-depth analysis shows that the global Metal Replacement Market, valued at USD 183.40 Billion in 2023, is poised for substantial growth and is expected to hit USD 408.32 Billion by 2032. This growth trajectory aligns with a strong CAGR of 9.3% during the forecast period from 2024 to 2032.

Engineered thermoplastics, carbon fiber composites, and reinforced plastics are popular metal replacement materials because they provide high strength-to-weight ratios, good thermal stability, and resilience against chemicals. These alternatives often allow for easier moldability, enabling complex part geometries and integrating challenging functions with metals. Limitations, such as lower thermal conductivity and reduced mechanical strength compared to metals, must be addressed depending on the application. As technology advances, ongoing improvements in material science continue to expand the potential for metal replacement, promoting efficiency, sustainability, and cost savings across industries.

The metal replacement market is expanding rapidly due to the rising demand for lightweight, durable, and cost-effective materials across various industries. Key drivers include the automotive, aerospace, and electronics sectors, where manufacturers are increasingly substituting metals with advanced plastics and composite materials to achieve weight reduction, fuel efficiency, and lower emissions. Lightweight materials enhance vehicle performance and contribute to meeting stringent environmental regulations, making them highly attractive to automakers.

Advances in materials science have produced high-performance polymers like polyamides, polycarbonates, and reinforced composites, which offer comparable or even superior properties to metals in specific applications. These materials are also more corrosion-resistant and require less maintenance, reducing costs. The construction industry is another significant contributor to this trend, where metal replacements are used to build longer-lasting and more sustainable structures.

Leading Factors Driving the Metal Replacement Market:

Engineering Plastics and Aerospace Demand

The metal replacement market is experiencing rapid growth, driven primarily by the rising demand for engineering plastics and their increasing use in aerospace applications. Engineering plastics, known for their high strength-to-weight ratio, durability, and resistance to heat and chemicals, are increasingly used to replace metals in structural applications. This shift is motivated by the need for lightweight, cost-effective materials that offer design flexibility without sacrificing performance. As industries seek to improve fuel efficiency and reduce environmental impact, particularly in aerospace, engineering plastics are becoming essential.

In the aerospace sector, weight reduction is critical, as lighter materials directly improve fuel efficiency and lower carbon emissions. Engineering plastics such as polyether ether ketone (PEEK), polycarbonate, and polyamide offer desirable mechanical properties, making them ideal for high-stress aerospace components. Additionally, these plastics can be engineered to withstand extreme temperatures and pressures, further widening their application scope.

The demand for lightweight, efficient, and high-performance materials is steering the market toward metal replacement solutions, with engineering plastics positioned as a primary alternative. As industries continue to innovate and demand grows, the metal replacement market is expected to expand, especially in sectors focused on sustainability and performance.

Download Sample 250 Pages of Metal Replacement Market Report @ https://introspectivemarketresearch.com/request/17979

What are the opportunities in the Metal Replacement Market?

Metal Replacement Materials: Reshaping Industries with Abundant Opportunity

The metal replacement market is experiencing rapid growth, reshaping various industries by substituting traditional metals with lighter, durable, and often more cost-effective materials like engineering plastics, composites, and ceramics. These alternatives not only reduce weight but also enhance corrosion resistance, electrical insulation, and design flexibility, making them ideal for sectors like automotive, aerospace, construction, and electronics. For example, the automotive industry increasingly relies on polymer composites to reduce vehicle weight, improve fuel efficiency, and cut emissions. Similarly, electronics and medical industries benefit from the non-conductive and biocompatible properties of metal replacement materials.

Rising environmental concerns and energy efficiency standards also drive demand for metal replacements, as industries seek sustainable and recyclable options. In addition, advancements in materials science and manufacturing techniques, such as 3D printing, further expand the applications of metal replacements. North America, Europe, and the Asia-Pacific regions are key players in the market, with ongoing investments in research and development. As industries prioritize performance and sustainability, the metal replacement market is poised to grow, offering significant opportunities for innovation and cost savings across multiple sectors.

High Cost of Replacement Material hamper Market Growth

The high cost of replacement materials is a significant challenge in the metal replacement market. Metal replacement materials, like high-performance polymers and composites, offer advantages over metals in terms of weight reduction, corrosion resistance, and design flexibility. The upfront costs of these materials are often substantially higher than traditional metals, which poses a barrier to adoption. In industries where cost competitiveness is essential, such as automotive, aerospace, and construction, the increased expenses associated with metal replacement materials can hinder their use.

One of the main reasons for these high costs is the advanced manufacturing processes required to produce high-quality, durable replacement materials. For instance, the production of composites involves sophisticated techniques, such as resin infusion and autoclaving, which are more costly than conventional metalworking processes. Additionally, these materials often require specialized equipment and skilled labor, further raising production expenses.

Another challenge lies in the need for rigorous testing and certification. Replacement materials must meet stringent safety and performance standards, particularly in sectors like aerospace and healthcare, where any failure can have serious consequences. This testing process, along with compliance with regulatory standards, adds to the cost burden for manufacturers, limiting their ability to price these products competitively.

The market is also affected by the limited availability of certain raw materials used in high-performance polymers and composites, leading to supply chain challenges and volatility in pricing. This is particularly true for rare additives and specialty chemicals that enhance the properties of replacement materials but come at a premium cost.

While metal replacement materials offer promising benefits, their high cost remains a considerable challenge. Reducing production expenses through technological innovation, optimizing supply chains, and achieving economies of scale will be crucial to overcoming this barrier and expanding the adoption of metal replacement solutions across various industries.

Do you need any industry insights on Metal Replacement Market, Make an enquiry now >>? https://introspectivemarketresearch.com/inquiry/17979

Key Manufacturers

Market key players and organizations within a specific industry or market that significantly influence its dynamics. Identifying these key players is essential for understanding competitive positioning, market trends, and strategic opportunities.

- BASF SE (Germany)

- Covestro AG (Germany)

- Dow Chemical Company (USA)

- DuPont de Nemours, Inc. (USA)

- SABIC (Saudi Arabia)

- Solvay S.A. (Belgium)

- Mitsubishi Chemical Corporation (Japan)

- LG Chem Ltd. (South Korea)

- Huntsman Corporation (USA)

- Evonik Industries AG (Germany)

- Toray Industries, Inc. (Japan)

- Celanese Corporation (USA)

- LANXESS AG (Germany)

- Sumitomo Chemical Co., Ltd. (Japan)

- Arkema S.A. (France)

- Teijin Limited (Japan)

- LyondellBasell Industries N.V. (Netherlands)

- DSM N.V. (Netherlands)

- PolyOne Corporation (USA)

- Asahi Kasei Corporation (Japan)

- RTP Company (USA)

- Celanese Corporation (USA)

- RTP Company (USA)

- Polyplastics Co., Ltd. (Japan)

- Ensinger GmbH (Germany)

- Ensinger GmbH (Germany)

- Quadrant AG (Switzerland)

- Röchling Group (Germany)

- Schulman AG (USA)

- Kuraray Co., Ltd. (Japan)

Key Segments of Market Report

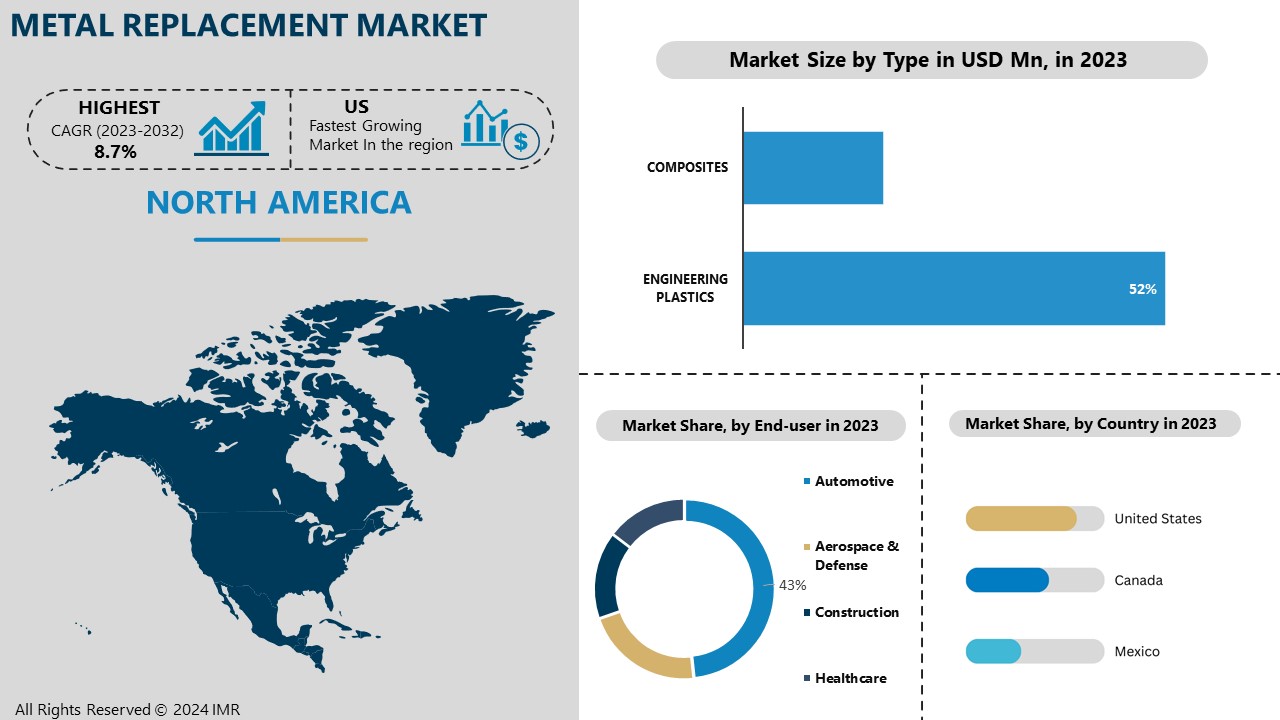

By Type, Engineering plastics Segment Is Expected to Dominate The Market During The Forecast Period

The engineering plastics segment is poised to dominate the metal replacement market during the forecast period due to its exceptional properties and versatility across diverse industries. Engineering plastics, such as polyamides, polycarbonates, polyacetals, and thermoplastic polyesters, are known for their strength, thermal stability, and resistance to chemicals and corrosion, making them an ideal choice for replacing traditional metal components. These materials offer a balance of lightness and durability, which not only helps reduce the overall weight of finished products but also enhances fuel efficiency and performance in applications like automotive, aerospace, and electronics.

In the automotive industry, there is an increasing push toward lightweight materials to meet stringent fuel efficiency and emissions standards. Engineering plastics enable significant weight reduction without compromising strength, durability, or safety, making them a preferred alternative to metals in parts such as gears, bushings, and fuel systems. The electronics industry also benefits from the use of engineering plastics, as these materials offer high electrical insulation properties, essential for components in consumer electronics and electrical enclosures.

The demand for sustainable and recyclable materials is further driving the adoption of engineering plastics, as they provide a eco-friendlier solution compared to metals. Advancements in polymer science are continuously enhancing the mechanical and thermal properties of these plastics, widening their applicability and appeal. Cost-effectiveness also plays a crucial role, as engineering plastics generally require lower production costs, leading to reduced manufacturing expenses. The engineering plastics segment is expected to continue leading the metal replacement market as industries increasingly prioritize lightweight, durable, and environmentally friendly materials.

By End-user, Automotive Segment Held the Largest Share In 2023

In 2023, the automotive sector dominated the global metal replacement market by end-user share, driven by increasing demand for lightweight and fuel-efficient vehicles. This trend is part of a broader shift in the automotive industry towards reducing vehicle weight to meet stringent emission standards and improve fuel economy. Lightweight materials, such as advanced polymers and composites, are replacing traditional metals like steel and aluminum in various automotive components, from structural parts to interior and exterior elements.

The high share held by the automotive segment is attributed to the industry's reliance on metal replacement materials, especially in electric vehicles (EVs), where lighter components are crucial for optimizing battery life and range. Key materials driving metal replacement in this segment include high-performance plastics, glass-fiber reinforced plastics (GFRP), carbon-fiber reinforced plastics (CFRP), and various polyamide composites. These materials offer benefits such as high strength-to-weight ratios, corrosion resistance, design flexibility, and reduced production costs, making them ideal for automotive applications.

The rising consumer preference for sustainable products has pushed automotive manufacturers to adopt eco-friendly materials and production processes, further promoting metal replacement solutions. This demand aligns with initiatives to develop recyclable and biodegradable materials, positioning the automotive segment as a significant contributor to the market's growth. Leading automotive companies are investing in research and development to explore innovative applications for metal replacement materials to meet evolving regulatory requirements and consumer expectations.

The automotive segment's leadership in the metal replacement market reflects a transformative period in vehicle manufacturing, where the adoption of lightweight, high-performance alternatives is essential to achieving efficiency, sustainability, and performance goals in modern automotive design.

If you require any specific information that is not covered currently, we will provide the same as a part of the customization >> https://introspectivemarketresearch.com/custom-research/17979

Metal Replacement Market Regional Insights:

North America is Expected to Dominate the Market Over the Forecast Period

North America is projected to lead the global metal replacement market, driven by significant industrial growth, technological advancements, and robust demand across sectors like automotive, aerospace, and electronics. The region's mature manufacturing infrastructure and focus on innovation have accelerated the adoption of metal replacement materials, such as engineering plastics and composites, which offer substantial benefits over traditional metals, including reduced weight, corrosion resistance, and design flexibility.

The automotive industry, a major consumer of metal replacement materials, is particularly influential in North America's dominance in this market. Stringent regulations on fuel efficiency and carbon emissions are encouraging manufacturers to explore lightweight alternatives to metals, enhancing vehicle performance and fuel economy. Engineering plastics like polyamides, polycarbonate, and acrylonitrile butadiene styrene (ABS), along with advanced composites, are increasingly replacing metals in critical automotive applications like engine parts, structural components, and interior fittings.

In addition to automotive, the aerospace and electronics sectors are witnessing a shift towards metal replacement materials to achieve lighter, more efficient, and durable products. The aerospace industry, with its stringent performance and safety standards, is embracing high-performance polymers and composites to optimize aircraft weight and fuel efficiency. Likewise, the electronics industry relies on these materials for durable, lightweight housings and components, meeting consumer demand for sleek and reliable devices.

North America’s strong research and development (R&D) framework also supports innovations in metal replacement, paving the way for sustainable and high-performance materials. Leading companies in the U.S. and Canada are investing in material technologies that meet industrial standards while addressing environmental concerns. Given these factors, North America's role in driving adoption and innovation in metal replacement materials positions it as a key market leader in this growing industry.

Comprehensive Offerings:

- Historical Market Size and Competitive Analysis (2017–2023): Detailed assessment of market size and competitive landscape over the past years.

- Historical Pricing Trends and Regional Price Curve (2017–2023): Analysis of historical pricing data and price trends across different regions.

- Market Size, Share, and Forecast by Segment (2024–2032): Projections and detailed insights into market size, share, and future growth by segment.

- Market Dynamics: In-depth analysis of growth drivers, restraints, opportunities, and key trends, with a focus on regional variations.

- Market Trend Analysis: Evaluation of emerging trends that are shaping the market landscape.

- Import and Export Analysis: Examination of trade patterns and their impact on market dynamics.

- Market Segmentation: Comprehensive analysis of market segments and sub-segments, with a regional breakdown.

- Competitive Landscape: Strategic profiles of key players across regions, including competitive benchmarking.

- PESTLE Analysis: Evaluation of the market through Political, Economic, Social, Technological, Legal, and Environmental factors.

- PORTER’s Five Forces Analysis: Assessment of competitive forces influencing the market.

- Industry Value Chain Analysis: Examination of the value chain to identify key stages and contributors.

- Legal and Regulatory Environment by Region: Analysis of the legal landscape and its implications for business operations.

- Strategic Opportunities and SWOT Analysis: Identification of lucrative business opportunities, coupled with a SWOT analysis.

- Conclusion and Strategic Recommendations: Final insights and actionable recommendations for stakeholders.

Related Report Links:

Metal Casting Market: Metal Casting Market Size Was Valued at USD 136.7 Billion in 2023, and is Projected to Reach USD 221.3 Billion by 2032, Growing at a CAGR of 5.5% From 2024-2032.

Metal Cans Market: Metal Cans Market Size Was Valued at USD 66.4 Billion in 2023, and is Projected to Reach USD 81.5 Billion by 2032, Growing at a CAGR of 2.3% From 2024-2032.

Metal Alloy Market: Metal Alloy Market Size Was Valued at USD 17.34 Billion in 2023, and is Projected to Reach USD 38.92 Billion by 2032, Growing at a CAGR of 9.4 % From 2024-2032.

Precious Metals Market: Precious Metals Market Size Was Valued at USD 246.80 Billion in 2023 and is Projected to Reach USD 461.41 Billion by 2032, Growing at a CAGR of 7.20% From 2024 to 2032.

Metallocene Catalyst Market: Metallocene Catalyst Market Size Was Valued at USD 1.22 Billion in 2023 and is Projected to Reach USD 1.89 Billion by 2032, Growing at a CAGR of 4.97% From 2024-2032.

Metal Injection Molding (MIM) Market: Metal Injection Molding (MIM) Market size is expected to grow from USD 3.36 Billion in 2023 to USD 5.30 Billion by 2032, at a CAGR of 5.19% during the forecast period (2024–2032).

Polypropylene Catalyst Market: Polypropylene Catalyst Market Size is Valued at USD 1.88 Billion in 2023, and is Projected to Reach USD 4.65 Billion by 2032, Growing at a CAGR of 9.90% From 2024-2032.

Reusable Packaging Market: Reusable Packaging Market Size is Valued at USD 115.09 Billion in 2023, and is Projected to Reach USD 176.62 Billion by 2032, Growing at a CAGR of 5.50% From 2024-2032.

EMI Shielding Market: EMI Shielding Market Size Was Valued at USD 7.3 Billion in 2023, and is Projected to Reach USD 11.6 Billion by 2032, Growing at a CAGR of 5.3% From 2024-2032.

Electro-rheostatic Materials Market: Electro-rheostatic Materials Market Size is Valued at USD 172.7 Billion in 2023, and is Projected to Reach USD 331.74 Billion by 2032, Growing at a CAGR of 8.50% From 2024-2032.

About Us:

Introspective Market Research is a premier global market research firm, leveraging big data and advanced analytics to provide strategic insights and consulting solutions that empower clients to anticipate future market dynamics. Our team of experts at IMR enables businesses to gain a comprehensive understanding of historical and current market trends, offering a clear vision for future developments.

Our strong professional network with industry-leading companies grants us access to critical market data, ensuring the generation of precise research data tables and the highest level of accuracy in market forecasting. Under the leadership of CEO Mrs. Swati Kalagate, who fosters a culture of excellence, we are committed to delivering high-quality data and supporting our clients in achieving their business goals.

The insights in our reports are derived from primary interviews with key executives of top companies in the relevant sectors. Our robust secondary data collection process includes extensive online and offline research, coupled with in-depth discussions with knowledgeable industry professionals and analysts.

IMR Knowledge Cluster Reports:

India's Infrastructure Building Spree

Fintech in Africa: Powering the Future of Digital Finance

HOLCIM - Company Profile and SWOT Analysis

HAYDEN CORP - Company Profile and SWOT Analysis

Contact Us:

Canada Office

Introspective Market Research Private Limited, 138 Downes Street Unit 6203- M5E 0E4, Toronto, Canada.

APAC Office

Introspective Market Research Private Limited, Office No. 401, Saudamini Commercial Complex, Kothrud, Pune, India 411038

Ph no: +91-81800-96367 / +91-7410103736

Email: sales@introspectivemarketresearch.com

LinkedIn| Twitter| Facebook | Instagram

Ours Websites : https://introspectivemarketresearch.com | https://imrknowledgecluster.com/knowledge-cluster | https://imrtechsolutions.com | https://imrnewswire.com/ | https://marketnresearch.de |