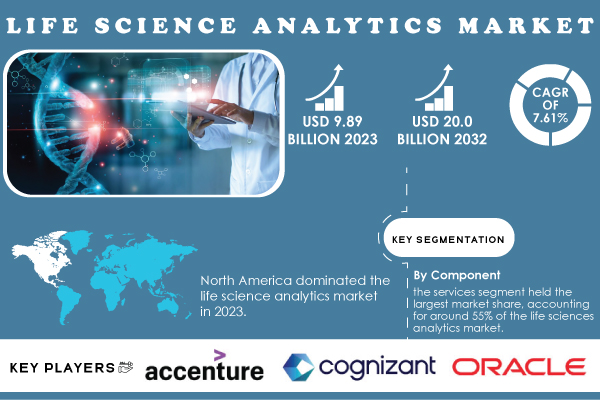

Pune, Nov. 06, 2024 (GLOBE NEWSWIRE) -- “According to S&S Insider, The Life Science Analytics Market Size was valued at USD 9.89 billion in 2023 and is projected to reach USD 20.0 billion by 2032, growing at a CAGR of 7.61% over the forecast period from 2024 to 2032.”

The growth of the market is primarily fueled by increasing investments in research and development, the demand for precision medicine, and the integration of advanced analytics technologies into the life sciences sector.

Life Science Analytics Market Overview

The Life Science Analytics Market is experiencing robust growth, driven by the rising need for data-driven insights in drug development, clinical trials, and patient management. The demand for analytics solutions in healthcare and life sciences is growing due to the increasing complexity of biological data and the need for efficient decision-making processes. Organizations are leveraging advanced analytics to enhance operational efficiency, improve patient outcomes, and reduce costs associated with research and development. With ongoing advancements in genomics, proteomics, and personalized medicine, life science analytics is becoming essential for integrating and analyzing vast datasets. As regulatory bodies emphasize data transparency and compliance, life science companies are investing in analytics solutions to ensure compliance and optimize research outcomes. The market is further bolstered by strategic partnerships and collaborations among technology providers and life sciences companies to innovate and improve analytical capabilities.

Get a Sample Report of Life Science Analytics Market@ https://www.snsinsider.com/sample-request/1896

Key Life Science Analytics Market Players:

- Allscripts Healthcare LLC

- Cerner Corporation

- CitiusTech Inc

- Health Catalyst

- Inovalon

- McKesson Corporation

- Saama Technologies Inc

- Optum Inc

- SCIOInspire Corp

- SAS Institute Inc

- Others

Life Science Analytics Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | US$ 9.89 Billion |

| Market Size by 2032 | US$ 20.0 Billion |

| CAGR | CAGR of 7.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Key Drivers | Driving Forces Behind the Growth of the Enteral Feeding Devices Market Amidst an Aging Population and Rising Chronic Diseases |

Segment Analysis

By Application: The oncology application segment dominated the Life Science Analytics market with a revenue share of 24% in 2023. This segment's growth is driven by the increasing demand for precision oncology, where advanced analytics assists in identifying genetic mutations responsible for cancer. Government health initiatives, such as the National Cancer Institute's USD 1.5 billion investment in precision medicine in 2023, significantly contribute to this growth. Furthermore, initiatives like the Genomics England project in the U.K. aim to integrate cancer genomics into routine healthcare, facilitating personalized treatment approaches.

By Product & Service: The consumables segment led the market, accounting for 48% of the total revenue in 2023. Consumables, including reagents and sample preparation kits, are vital for sequencing workflows and are consistently in demand due to an increase in genomic research projects supported by government funding. For instance, approximately USD 2 billion was allocated in the NIH's 2023 budget for genomic consumables. The continuous innovation in sequencing technologies further enhances the demand for consumables, making this segment pivotal for market growth.

By End-user: The academic research segment held the largest revenue share of 49% in 2023, supported by significant government investments in research infrastructure. The NIH allocated USD 1.2 billion for genomic research in academic settings in 2023, emphasizing the crucial role of universities in advancing sequencing technologies. Additionally, the clinical research segment is projected to grow rapidly as Life Science Analytics finds increasing adoption in clinical trials, particularly for targeted therapies.

Do you have any specific queries or need any customization research on Life Science Analytics Market, Enquire Now@ https://www.snsinsider.com/enquiry/1896

Life Science Analytics Market Key Segmentation:

By Component

- Software

- Services

By Type

- Reporting

- Predictive

- Descriptive

- Prescriptive

By Application

- Research and Development

- Supply Chain Analytics

- Regulatory Compliance

- Pharmacovigilance

- Sales and Marketing Support

By Delivery

- On-demand

- On-premises

By End-user

- Medical Device

- Pharmaceutical

- Biotechnology

- Others

Regional Analysis

North America: In 2023, North America accounted for the largest share of the Life Science Analytics Market, at 42%. The region's dominance is attributed to the presence of major pharmaceutical companies, robust research funding, and a strong emphasis on precision medicine. The U.S. government's investment in healthcare analytics and collaborations between academic institutions and industry leaders foster innovation and technological advancements in the life sciences sector. Notable companies like IBM Watson Health and Oracle are actively engaged in providing analytics solutions that cater to the needs of the healthcare industry.

Asia Pacific: The Asia Pacific region is anticipated to experience the fastest growth in the Life Science Analytics Market, projected to achieve a CAGR of 9.5% during the forecast period. This growth is driven by rising investments in biotechnology and pharmaceutical research, particularly in China and India. The increasing adoption of analytics tools to support drug development and the focus on improving healthcare outcomes are key drivers. Government initiatives promoting genomics research and collaborations with private companies further enhance market growth. Companies like Roche and Illumina are expanding their presence in the region to capitalize on the growing demand for analytics solutions.

Request An Analyst Call@ https://www.snsinsider.com/request-analyst/1896

Recent Developments

- July 2024: Indegene partnered with Microsoft to scale generative AI adoption in life sciences, driving greater innovation and operational efficiency across the industry.

- June 2024: SAS launched the SAS Clinical Acceleration Repository, an advanced analytics platform designed to streamline clinical trial development, accelerate regulatory submissions, control clinical research data, and integrate with various data sources.

- June 2024: IQVIA introduced the One Home for Sites platform, a centralized dashboard that consolidates multiple systems, easing the administrative burden on research sites and enhancing clinical trial management.

- March 2024: Cognizant teamed up with NVIDIA to utilize the BioNeMo generative AI platform, focusing on accelerating drug discovery to boost productivity and reduce development costs in the life sciences sector.

- November 2023: Wipro and AWS launched the “Lab of the Future,” a cloud-based platform designed to streamline laboratory processes using generative AI and advanced analytics, aiming to cut costs and speed up drug development in life sciences.

Buy a Single-User PDF of Life Science Analytics Market Analysis & Outlook Report 2024-2032@ https://www.snsinsider.com/checkout/1896

Table of Contents – Major Key Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

- Adoption Rates, 2023

- User Demographics, By User Type and Roles, 2023

- Feature Analysis, by Feature Type

- Cost Analysis, by Software

- Integration Capabilities

- Regulatory Compliance, by Region

6. Competitive Landscape

7. Life Science Analytics Market Segmentation, by Component

8. Life Science Analytics Market Segmentation, by Type

9. Life Science Analytics Market Segmentation, by Application

10. Life Science Analytics Market Segmentation, by Delivery

11. Life Science Analytics Market Segmentation, by End-user

12. Regional Analysis

13. Company Profiles

14. Use Cases and Best Practices

15. Conclusion

Access Complete Report Details of Life Science Analytics Market Analysis & Outlook 2024-2032@ https://www.snsinsider.com/reports/life-science-analytics-market-1896

About Us:

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.