Austin, Nov. 12, 2024 (GLOBE NEWSWIRE) -- Market Size & Growth Analysis:

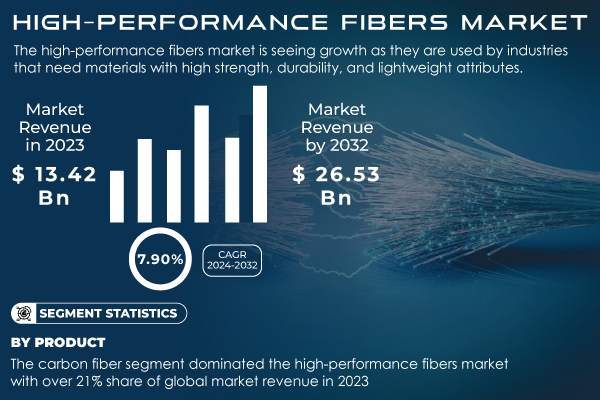

The S&S Insider report indicates that, “The High Performance Fibers Market Size was valued at USD 13.42 Billion in 2023 and is expected to reach USD 26.53 Billion by 2032 and grow at a CAGR of 7.90% over the forecast period 2024-2032.”

Driving Forces Behind the Growth of High-Performance Fibers in Defense, Aerospace, and Automotive Sectors

The growing demand for high-performance fibers in the defense, aerospace, and automotive sectors is driven by their exceptional strength-to-weight ratio, thermal resistance, and durability. These fibers are essential for protective gear, ballistic applications, and lightweight structural components, enhancing safety and performance. With increasing defense budgets and a focus on fuel efficiency and environmental impact in aerospace, the market is set for substantial growth, further fueled by the need for lightweight materials in electric vehicles and renewable energy applications.

High-Performance Fibers Gain Traction Across Industries for Enhanced Efficiency and Durability

The high-performance fibers market is growing as demand rises in aerospace, defense, automotive, and energy sectors. Aerospace applications such as the Airbus A350 XWB, which utilizes 53% composite materials (mainly carbon fiber) to reduce fuel consumption by 25%, and the F-35 Lightning II, made of 35% composites to improve fuel efficiency and lower maintenance costs, highlight the benefits of these materials. NASA’s James Webb Space Telescope uses carbon fiber composites, reducing weight by 30% for resilience in space. In automotive, Ford’s GT incorporates carbon fiber-reinforced plastic, reducing weight by 40% for improved acceleration and handling. Carbon fibers also strengthen wind turbine blades, boosting efficiency in energy applications.

Get a Sample Report of High Performance Fibers Market Forecast @ https://www.snsinsider.com/sample-request/4740

Dominant Market Players with their Products Listed in this Report are:

- Toray Industries, Inc. (Torayca Carbon Fiber, T300 Carbon Fiber)

- DuPont (Kevlar, Nomex)

- Teijin Ltd. (Twaron, Technora)

- Mitsubishi Chemical Corporation (MEC-Carbon, Dyneema)

- Honeywell International Inc. (Spectra Fiber, Spectra Shield)

- DSM (Dyneema, Spectra Shield)

- Kolon Industries, Inc. (Twaron, Technora)

- Kermel S.A. (Kermel Fiber, Kermel Aramid)

- Corning Incorporated (Glass Fiber, Hybrid Composites)

- PBI Performance Products (PBI Fiber, PBI Gold)

- AGY (S2 Glass Fiber, Aerospace Fiber)

- Zoltek Corporation (PX35 Carbon Fiber, Zoltek Carbon)

- Yantai Tayho Advanced Materials Co. (Carbon Fiber, S-Glass Fiber)

- SGL Carbon (Sigrafil Carbon Fiber, Sigraflex Graphite)

- Solvay (Solef PVDF, Torlon Polyamide)

- Owens Corning (Corning Glass Fiber, Aro-Vac)

- Toho Tenax Co., Ltd. (Tenax Carbon Fiber, Tenax Standard Fiber)

- Toyobo Co. Ltd. (Zylon Fiber, Polyphenylene Sulfide Fiber)

- Mitsubishi Rayon Co. (Panex Carbon Fiber, MR Carbon Fiber)

- China Jushi Group (Jushi Glass Fiber, Carbon Fiber Reinforced)

Market for high-performance fibers is driven by carbon fiber dominance and emerging PBI growth in aerospace, defense, and automotive sectors.

By Product

In 2023, the carbon fiber segment led the high-performance fibers market, holding over 21% of global revenue, thanks to its high tensile strength, lightweight nature, and chemical resistance. Carbon fibers are essential in aerospace, automotive, and sports equipment, where reducing weight without sacrificing strength enhances fuel efficiency and lowers emissions. In electric vehicles, carbon fiber-reinforced composites help improve battery efficiency by reducing vehicle weight. Meanwhile, Polybenzimidazole (PBI) fibers are projected to grow rapidly from 2024 to 2032 due to their exceptional thermal stability and flame resistance. Widely used in firefighting gear, aerospace, and military uniforms, PBI fibers provide essential protection in extreme heat while offering comfort and durability.

By Application

The aerospace and defense sector dominated the high-performance fibers market in 2023 with a 42.34% revenue share, driven by its demand for lightweight yet exceptionally strong materials. Carbon and aramid fibers are key in manufacturing aircraft parts like fuselage and wings, enhancing fuel efficiency and range. For instance, the Boeing 787 Dreamliner’s 50-60% carbon fiber-reinforced composition improves fuel efficiency by 20%. Defense applications utilize these fibers in ballistic vests and helmets, prioritizing strength-to-weight ratios. Meanwhile, the automotive sector is projected for strong growth (2024–2032) as automakers focus on vehicle light-weighting for fuel efficiency. BMW’s i3 EV, for example, incorporates 50% carbon fiber in body panels, enhancing energy efficiency and range.

Do you Have any Specific Queries or Need any Customize Research on High Performance Fibers Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/4740

Key Market Segments:

By Product

- Carbon Fiber

- Polybenzimidazole (PBI)

- Aramid Fiber, M5/PIPD

- Polybenzoxazole (PBO)

- Glass Fiber

- High Strength Polyethylene

- Others

By Application

- Electronics & Telecommunication

- Textile

- Aerospace & Defense

- Construction & Building

- Automotive

- Sporting Goods

- Others

Asia Pacific as the Pioneering Force in High-Performance Fibers Fueled by Industrial Growth and Electric Vehicle Demand

In 2023, the Asia Pacific region led the high-performance fibers market, capturing more than 44% of global revenue, and is expected to experience the highest CAGR from 2024 to 2032. This dominance is attributed to rapid industrialization, technological advancements, and the increasing use of lightweight materials across key sectors such as automotive, aerospace, and electronics. Countries like China, Japan, and South Korea are enhancing their manufacturing capabilities, with China leading as the largest automotive market globally. The country aims for 20% of all new car sales to be electric by 2025, which is expected to boost demand for carbon and high-strength polyethylene used in high-performance fibers. Notable manufacturers like BYD utilize carbon fiber composites in their EVs to reduce weight and improve battery efficiency. Furthermore, Japan and South Korea are heavily investing in advanced materials, with firms like Mitsubishi Heavy Industries and Korean Air collaborating on carbon fiber composites for aircraft, further propelling market growth in the region.

Purchase an Enterprise User License of High Performance Fibers Market Report at 40% Discount @ https://www.snsinsider.com/checkout/4740

Recent Development

- In August 2024, HFCL introduced a new range of high-performance cable solutions at ISE EXPO 2024 in Dallas, Texas. A standout feature was the debut of high-density single-jacket, single-armor Intermittently Bonded Ribbon (IBR) cables, which comprise 144-1728 fibers. This innovation garnered the company an ISE Innovators Award.

- In July 2024, China launched the world’s first passenger train made entirely of carbon fiber, representing a major advancement in high-speed rail technology and solidifying its leadership in the industry, as reported by Interesting Engineering.

- in July 2024, Technical Fibre Products (TFP), a subsidiary of James Cropper Advanced Materials, announced a significant advancement in battery technology with the introduction of its high-performance carbon fiber nonwovens.

Table of Contents - Key Points Analysis

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 High-Performance Fibers Demand & Supply Metrics, by Region, (2020-2023)

5.2 High-Performance Fibers Innovation & Technology Metrics, by Region, (2020- 2023)

5.3 High-Performance Fibers Manufacturing Facilities, by Region

5.4 High-Performance Fibers Supply Chain Metrics, by Region (2023)

6. Competitive Landscape

7. High Performance Fibers Market Segmentation, by Product

8. High Performance Fibers Market Segmentation, by Application

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Access Complete Report Insights of High Performance Fibers Market Growth & Outlook 2024-2032@ https://www.snsinsider.com/reports/high-performance-fibers-market-4740

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.