New York, Nov. 19, 2024 (GLOBE NEWSWIRE) -- Overview

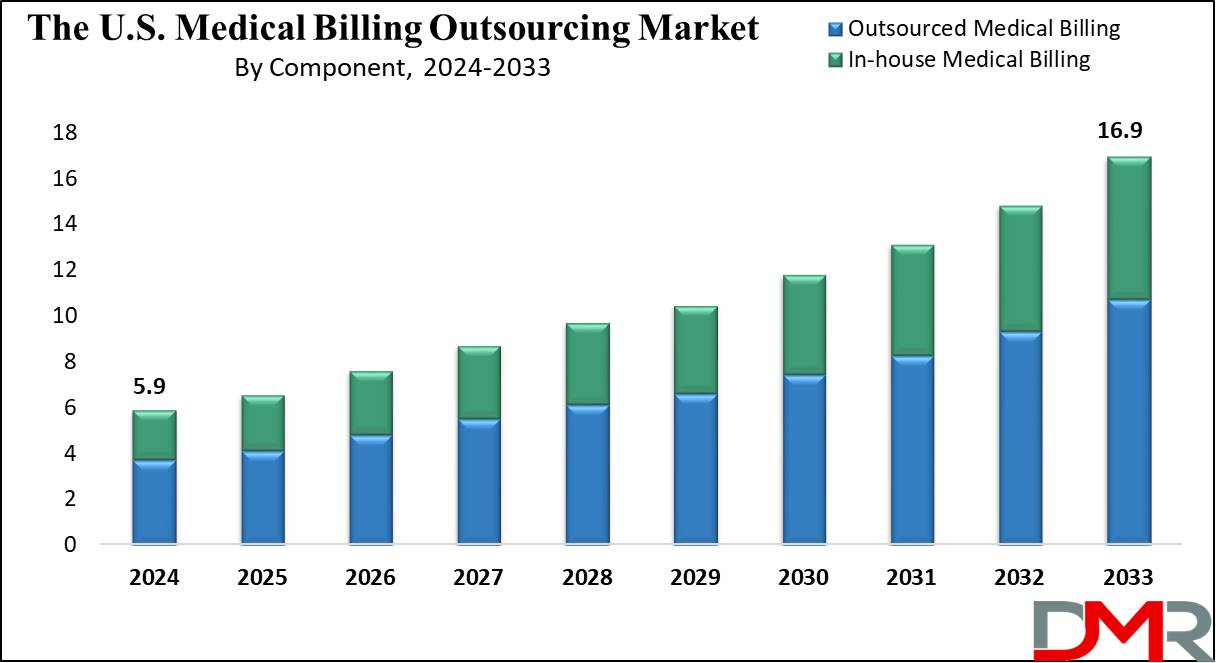

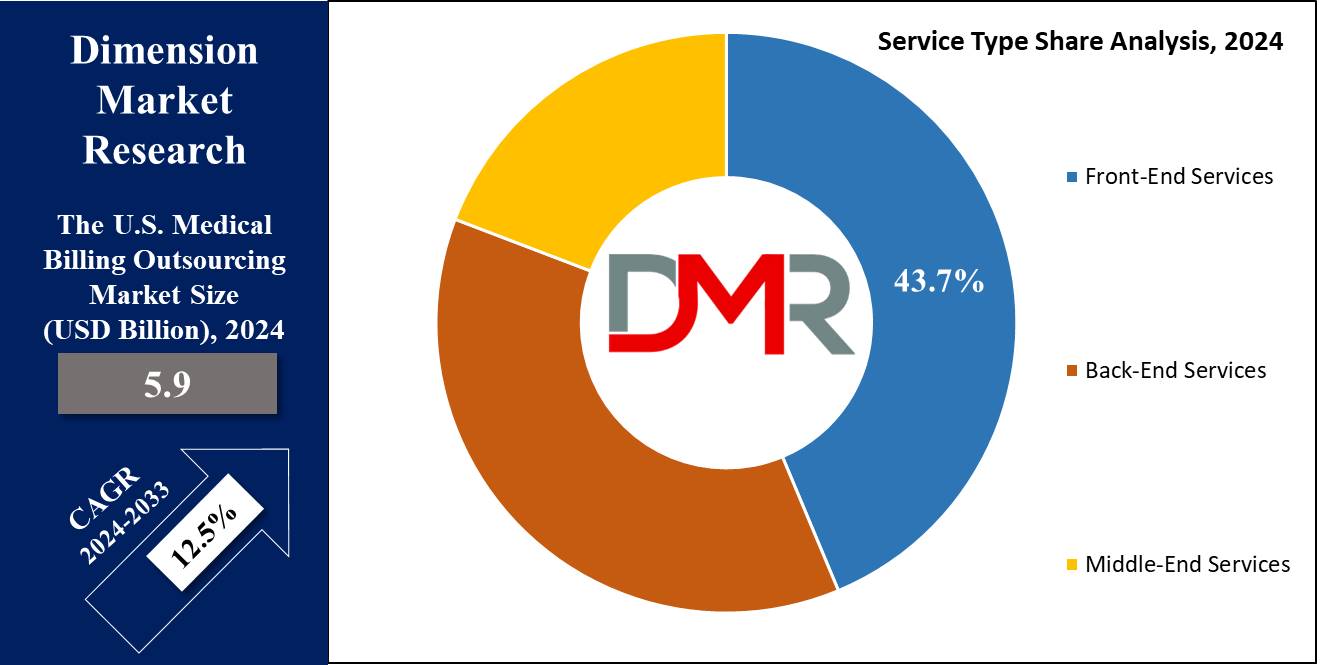

The U.S. Medical Billing Outsourcing Market is projected to reach USD 5.9 billion in 2024 which is further anticipated to reach USD 16.9 billion by 2033 at a CAGR of 12.5%.

The U.S. medical billing outsourcing market is showing rapid growth, as health expenditure and regulatory complications have increased in this region. In this respect, healthcare organizations choose to outsource some of the billing functions to improve operational efficiency, maintain minimal administrative complications, and eliminate the possibility of errors in billing.

In this regard, a complete medical billing process may include different tiers: front-end, mid-end, and back-end services. As more and more healthcare providers take advantage of cutting-edge billing software and electronic records of patients, the demand for outsourced services is expected to rise further in the coming years.

This reflects a strategic move to focus on core patient care while considering good revenue cycle management for better financial outcomes in the healthcare industry...

Click to Request Sample Report and Drive Impactful Decisions: https://dimensionmarketresearch.com/report/us-medical-billing-outsourcing-market/request-sample/

Important Insights

- Market Size: The U.S. Medical Billing Outsourcing Market is valued at USD 5.9 billion in 2024, projected to reach USD 16.9 billion by 2033.

- Component Segment: Outsourced medical billing dominates the component segment with a 63.1% market share in 2024, reflecting strong demand for efficient billing services.

- Service Type Segment: Front-end services lead the service type segment, holding 43.7% of the U.S. medical billing outsourcing market share in 2024.

- End User Segment: Hospitals dominate the end-user segment in the U.S. market, capturing the highest market share in 2024 due to billing complexities.

- Key Players: Major players include Cerner, Allscripts, R1 RCM, McKesson, eClinicalWorks, Kareo, AdvancedMD, Experian Health, and Change Healthcare, among others.

Latest Trends

- Advanced billing software and EHR integration are on the increase, which will contribute to an increased level of accuracy in data while smoothening the billing process. Such a trend, in this respect, serves to increase efficiency, minimize manual errors, and create a way for smoother billing processes for healthcare providers.

- With these value-based care models continuously placing pressure on quality and efficiency, so the demand for outsourced medical billing services meeting the standard for value-based care is thus on the rise. This will contribute to patient outcomes and cost control for healthcare providers.

U.S. Medical Billing Outsourcing Market: Competitive Landscape

- The competitive scenario of this service in the U.S. includes several key players presence of a few large multinational companies and many specialized, localized ones. Major companies aggressively pursue more service offerings and the use of advanced technologies to gain efficiency and accuracy in the billing process.

- It is a highly competitive market because health organizations want cost-effective solutions with better revenue cycle management. Companies are increasingly investing in automation and artificial intelligence to streamline operations in billing and reduce errors. Innovation and partnering, in turn, would facilitate providers storming the differentially changing marketplace.

Some of the prominent market players:

- Cerner Corporation

- Allscripts Healthcare Solutions, Inc.

- R1 RCM Inc.

- McKesson Corporation

- eClinicalWorks

- Kareo, Inc.

- AdvancedMD, Inc.

- Experian Health

- Change Healthcare

- Athenahealth

- HCA Healthcare

- GeBBS Healthcare Solutions

- Other Key Players

Transform your business approach with strategic insights from our report. Get in touch to request our brochure today! : https://dimensionmarketresearch.com/report/us-medical-billing-outsourcing-market/download-reports-excerpt/

U.S. Medical Billing Outsourcing Market Scope

| Report Highlights | Details |

| Market Size (2024) | USD 5.9 Bn |

| Forecast Value (2033) | USD 16.9 Bn |

| CAGR (2024-2033) | 12.5% |

| Historical Data | 2018 - 2023 |

| Forecast Data | 2024 - 2033 |

| Base Year | 2023 |

| Estimate Year | 2024 |

| Segments Covered | By Component, By Service Type, and By End User |

| Regional Coverage | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Analysis

Outsourced medical billing dominates the component segment of the U.S. market with 63.1% of the market share in 2024 because of the outsourced medical billing method, which offers complete services in simplifying the billing process. Outsourcing all their billing work to a third-party specialty provider will enable healthcare organizations to reduce their administrative work and increase efficiency in performance.

The service providers use advanced technology and expertise in the industry to minimize the percentage of errors in billing and keep up with forthcoming regulations. Outsourced billing services use scalable models, enabling hospitals and physician groups to ramp up or down much faster in response to changing patient volumes, without the added overhead of new in-house employees.

It was this flexibility and attention to efficiency that bred a preference for outsourced solutions among healthcare organizations.

Purchase the Competition Analysis Dashboard Today: https://dimensionmarketresearch.com/checkout/us-medical-billing-outsourcing-market/

U.S. Medical Billing Outsourcing Market Segmentation

By Component

- Outsourced Medical Billing

- In-house Medical Billing

By Service Type

- Front-End Services

- Patient Registration

- Insurance Verification

- Prior Authorization

- Middle-End Services

- Medical Coding

- Charge Entry

- Claims Processing

- Back-End Services

- Accounts Receivable Management

- Denial Management

- Payment Posting

- Patient Statements

By End User

- Hospitals

- Physician Offices

- Others

Growth Drivers

- Increasing healthcare costs are driving up demand for affordable billing solutions among providers, noting that administrative overhead is lower when operational functions are outsourced, thus enabling healthcare organizations to deploy resources in more value-added areas. This, in turn, fuels the adoption of outsourcing services.

- Complexities in today's healthcare regulations require specialized knowledge in billing. Outsourcing firms offer skilled regulatory compliance support through reduced billing errors, thereby helping healthcare providers manage the challenges of compliance effectively.

Request Your Exclusive Sample Report at https://dimensionmarketresearch.com/report/us-medical-billing-outsourcing-market/request-sample/

Restraints

- Such sensitive information about the patients being outsourced to third-party vendors raises concerns for HIPAA compliance because it increases the risks of data breaches. This may be one of the limiting factors in the growth of outsourcing medical billing because providers will not want to give out patient information.

- These can also lead to dependency problems whereby any operational disruptions with the outsourcing firms result in billing interruptions, hence taking away control from the healthcare provider.

Growth Opportunities

- The sudden growth in telemedicine services has raised the demand for customized billing solutions. One of the key opportunities lies in virtual care-facilitated billing management by outsourcing companies, especially in the United States market.

- Specialty clinics will be forced to outsource because of the unique billing complexities arising for specialized services. This trend opens up avenues of growth for those firms that offer their services to niche healthcare segments, like oncology and cardiology.

Discover additional reports tailored to your industry needs.

- Data Extraction Software Market is projected to reach USD 1.5 billion in 2024 and grow at a compound annual growth rate of 14.2% from there until 2033 to reach a value of USD 4.9 billion.

- South Korea Warehousing Market size is expected to reach a value of USD 47.9 billion in 2024, and it is further anticipated to reach a market value of USD 86.3 billion by 2033 at a CAGR of 6.8%.

- South Korea Warehouse Automation Market size is expected to reach a value of USD 4,137.8 million in 2024, and it is further anticipated to reach a market value of USD 14,024.2 million by 2033 at a CAGR of 14.5%.

- Stained-Glass Market is expected to reach a market value of USD 4.8 billion in 2024 which is further expected to grow up to USD 7.7 billion by 2033, at a CAGR of 5.5%.

- Industrial Distribution Market size is expected to reach a value of USD 8,153.1 billion in 2024, and it is further anticipated to reach a market value of USD 12,975.4 billion by 2033 at a CAGR of 5.3%.

- Filter Rolling System Market is projected to reach USD 17.5 billion by the end of 2024 and is anticipated to value USD 36.2 billion in 2033 at a CAGR of 8.4%.

- Stainless Steel Cannula Market is projected to reach USD 187.0 million by the end of 2024 and grow exponentially until an anticipated value of USD 397.0 million in 2033 at a CAGR of 8.7%.

- Automotive Suspension Market size is estimated to reach USD 44.9 Billion in 2024 and is further anticipated to value USD 98.1 Billion by 2033, at a CAGR of 9.2%.

- Core Cutters Market is projected to reach USD 299.9 million in 2024 and grow at a compound annual growth rate of 5.7% from there until 2033 to reach a value of USD 494.4 million.

- Thermoplastic Solenoid Valves Market is projected to reach USD 389.1 million in 2024 and grow at a compound annual growth rate of 5.7% from there until 2033 to reach a value of USD 641.6 million.

Recent Developments in the U.S. Medical Billing Outsourcing Market

- December 2023: Experian launched Ascend Ops and Retro on Demand for improved revenue cycle management and decision-making, enhancing data processing and billing efficiency.

- December 2023: R1 RCM Inc. acquired Acclara, expanding its RCM technology solutions and strengthening patient and provider outcome improvements.

- November 2023: R1 RCM expanded its partnership with Microsoft to integrate Azure OpenAI for optimized healthcare operations and enhanced patient outcomes.

- October 2023: eClinicalWorks introduced Sunoh, an AI-powered EHR tool to improve clinical documentation and operational efficiency for healthcare providers.

- February 2023: GeBBS Healthcare Solutions acquired CPa Medical Billing, broadening its RCM offerings for health centers and multi-specialty practices.

- February 2023: Experian Health launched AI Advantage to manage healthcare insurance claim denials using AI and big data.

- January 2023: R1 RCM acquired Acclara from Providence, expanding its RCM solutions with advanced technologies.

- April 2022: Omega Healthcare acquired ApexonHealth, enhancing its AI-driven medical billing and virtual nursing solutions.

About Dimension Market Research (DMR)

Dimension Market Research (DMR) is a market research and consulting firm based in India & US, with its headquarters located in the USA (New York). The company believes in providing the best and most valuable data to its customers using the best resources analysts work, to create unmatchable insights into the industries, and markets while offering in-depth results of over 30 industries, and all major regions across the world.

We also believe that our clients don’t always want what they see, so we provide customized reports as well, as per their specific requirements to create the best possible outcomes for them and enhance their business through our data and insights in every possible way.