Austin, Nov. 22, 2024 (GLOBE NEWSWIRE) -- Market Size & Growth Insights:

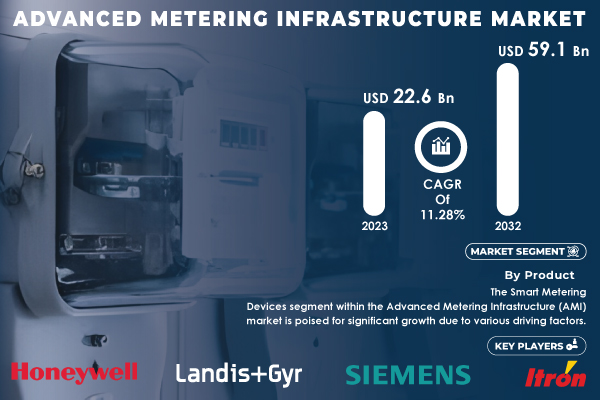

According to the SNS Insider, “The Advanced Metering Infrastructure (AMI) Market was valued at USD 22.65 billion in 2023 and is expected to reach USD 59.18 Billion by 2032, growing at a CAGR of 11.28% from 2024-2032.”

The Increasing Global Investment in Smart Grid Technology Is a Significant Driver For The Advanced Metering Infrastructure Market

The increasing global investment in smart grid technology is a significant driver for the Advanced Metering Infrastructure (AMI) market due to the growing need for modern, efficient, and sustainable energy management systems. Smart grids use digital communication technology to monitor and manage electricity flow more effectively, enabling utilities to improve their service delivery, reduce costs, and integrate renewable energy sources. As countries and regions focus on modernizing their energy infrastructure, there is a strong push to incorporate AMI as a key component. AMI is essential to the smart grid, as it provides real-time data collection, accurate energy consumption readings, and automated meter management, which improves billing accuracy and operational efficiency. The integration of AMI with smart grid technology allows utilities to perform demand response, manage peak loads, and reduce energy waste.

One Of the Primary Factors Propelling The Market Growth Is The Global Transition Towards Energy-Efficient Practices And The Adoption Of Smart Grid Technologies

For instance, the U.S. Department of Energy allocated USD 3.5 billion in 2023 to support grid modernization efforts, including the widespread implementation of smart meters. Similarly, the European Union’s goal to install 200 million smart meters by 2024 reflects the growing commitment to enhancing energy efficiency and sustainability.

Get a Sample Report of Advanced Metering Infrastructure Market Forecast @ https://www.snsinsider.com/sample-request/4686

Leading Market Players with their Product Listed in this Report are:

- Itron, Inc.

- Siemens AG

- Landis+Gyr

- Sensus (Xylem Inc.)

- Honeywell International Inc.

- Schneider Electric

- Aclara Technologies

- Elster Group

- Kamstrup A/S

- Oracle Corporation

- Cisco Systems, Inc.

- Trilliant Networks, Inc.

- GE Digital

- NEC Corporation

- Tantalus Systems Corp.

- Badger Meter, Inc.

- AccuWeather, Inc.

- Echelon Corporation

- Azbil Corporation

- ZIV Automation

Advanced Metering Infrastructure Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 22.65 billion |

| Market Size by 2032 | USD 59.18 billion |

| CAGR | CAGR of 11.28% From 2024 to 2032 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Smart Metering Devices,Solutions, Services) • By End-User (Residential, Commercial, Industrial) |

| Key Drivers | • Governments worldwide are promoting smart grids to reduce energy wastage and improve overall efficiency. • Rising energy consumption necessitates advanced solutions for accurate monitoring and efficient distribution. |

Do you Have any Specific Queries or Need any Customize Research on Advanced Metering Infrastructure Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/4686

“In-Depth Segment Analysis Unveils Key Drivers Shaping the Market's Growth Trajectory"

By Product:

The smart metering devices segment is set for substantial growth within the advanced metering infrastructure market during 2024-2032 due to the increasing demand for energy-efficient solutions. As energy consumption grows and the need for enhanced grid management intensifies, utilities are turning to smart meters for real-time data collection and improved grid management. These meters enable better energy usage optimization, driven by advances in connectivity and data analytics technologies. Governments worldwide are also mandating the installation of smart meters to promote energy conservation and reduce carbon emissions.

By End-Use:

The residential segment is anticipated to see significant expansion during 2024-2032, due to the rising demand for smart home technologies and increasing consumer interest in energy efficiency. Consumers are becoming more conscious of their energy consumption patterns, seeking ways to lower costs through real-time data provided by smart meters. Government initiatives aimed at developing smart grids and promoting sustainability further support the growth of this segment. The integration of renewable energy sources and energy management systems, alongside IoT advancements, is expected to drive continued expansion in residential advanced metering infrastructure applications.

"Regional Dynamics and Growth Trends in the Global Market: A Comprehensive Analysis"

North America held the largest revenue share of the advanced metering infrastructure market in 2023. The region benefits from high adoption rates of smart grid technologies, driven by population growth and government-backed initiatives. The U.S. leads the market with significant investments in smart grid projects, particularly in water and energy applications. For example, the U.S. Department of Energy’s grid modernization efforts are enhancing the deployment of smart meters to improve grid reliability and reduce outages, especially in extreme weather-prone areas.

The Asia-Pacific region is experiencing rapid advanced metering infrastructure market growth, fueled by large infrastructure projects in countries like China and India. In 2023, India launched its national smart metering program as part of the "Saubhagya" initiative, aiming to install 250 million smart meters across the country. This initiative seeks to improve billing accuracy and address electricity theft, a significant issue in the region. Increasing electricity demand, the need for real-time data analytics, and government mandates on carbon reduction are driving sustained advanced metering infrastructure market growth in Asia-Pacific.

Purchase Single User PDF of Advanced Metering Infrastructure Market Report (33% Discount) @ https://www.snsinsider.com/checkout/4686

Recent Developments:

- April 2024: Itron, Inc. revealed that Bangladesh Rural Electrification Board (BREB), the biggest power distributor in Bangladesh and a government entity, has chosen Itron to supply its Advanced Metering Infrastructure (advanced metering infrastructure ) solution to develop a stronger grid.

- November 2024: Siemens Smart Infrastructure introduced its inaugural semiconductor technology-based electronic starter. The SIMATIC ET 200SP e-Starter provides short-circuit protection that is 1000 times quicker and almost maintenance-free in comparison to traditional options like circuit breakers or fuses.

Table of Contents - Major Points

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Adoption Rates of Emerging Technologies

5.2 Network Infrastructure Expansion, by Region

5.3 Cybersecurity Incidents, by Region (2020-2023)

5.4 Cloud Services Usage, by Region

6. Competitive Landscape

7. Advanced Metering Infrastructure Market Segmentation, by Product

8. Advanced Metering Infrastructure Market Segmentation, by End-Use

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

Access More Research Insights of Advanced Metering Infrastructure Market Growth & Outlook Report 2024-2032@ https://www.snsinsider.com/reports/advanced-metering-infrastructure-market-4686

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.