Austin, Nov. 22, 2024 (GLOBE NEWSWIRE) -- Market Size & Growth Analysis:

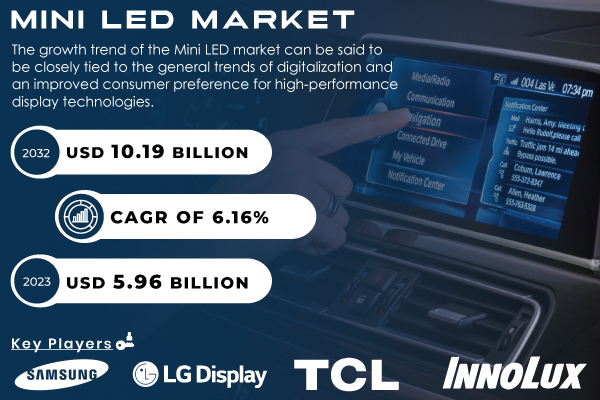

The SNS Insider report indicates that, “The Mini LED Market Size was valued at USD 5.96 Billion in 2023 and is projected to reach USD 10.19 Billion by 2032, growing at a robust CAGR of 6.16% over the forecast period 2024-2032.”

Mini LED Market Growth Driven by Digitalization and Rising Demand for High-Performance Displays

The Mini LED market growth aligns closely with trends in digitalization and consumer demand for advanced display technologies. In the U.S., automotive display module shipments reached over 450,000 units in 2023, with manufacturers like Ford, Jeep, and GM adopting Mini LED-backlit systems for dashboards, CIDs, and entertainment displays. These shipments are expected to nearly double in 2024, approaching 1 billion units as the technology matures. Mini LEDs are pivotal in advancing energy-efficient, miniaturized lighting solutions, widely adopted in automotive and smart lighting applications. Increased R&D investments highlight growing consumer and industry demand for thin displays and immersive viewing experiences, ensuring technologies in the coming years.

Get a Sample Report of Mini LED Market Forecast @ https://www.snsinsider.com/sample-request/4781

Dominant Market Players with their Products Listed in this Report are:

- Samsung Electronics (Samsung Neo QLED TV, Samsung Odyssey Gaming Monitor)

- LG Display (LG Mini LED TV, LG UltraFine Display)

- TCL Technology (TCL 6-Series Mini LED TV, TCL 8-Series Mini LED TV)

- AU Optronics (AUO Mini LED Backlit Panels, AUO Mini LED LCD Displays)

- Innolux Corporation (Innolux Mini LED Backlit Monitors, Innolux Mini LED TVs)

- Sharp Corporation (Sharp Mini LED TV, Sharp IGZO Mini LED Displays)

- Epistar Corporation (Epistar Mini LED Chips, Epistar Mini LED Modules)

- Osram Opto Semiconductors (Osram Mini LED Light Sources, Osram Mini LED Arrays)

- Taiwan Semiconductor Manufacturing Company (TSMC) (TSMC Mini LED Packages, TSMC Mini LED Driver ICs)

- NVIDIA Corporation (NVIDIA GeForce RTX Graphics Cards with Mini LED, NVIDIA Shield TV with Mini LED Display)

- Sony Corporation (Sony Mini LED Master Series TV, Sony Mini LED Pro Monitors)

- Philips Lighting (Signify) (Philips Mini LED Smart Light Bulbs, Philips Mini LED Lighting Fixtures)

- Zhen Ding Technology (Zhen Ding Mini LED Displays, Zhen Ding Mini LED Modules)

- Cree, Inc. (Cree Mini LED Chips, Cree Mini LED Lighting Products)

- Mitsubishi Electric (Mitsubishi Mini LED Displays, Mitsubishi Mini LED Signage)

- Seoul Semiconductor (Seoul Mini LED Solutions, Seoul Mini LED Modules)

- Adata Technology (Adata Mini LED RGB Gaming Accessories, Adata Mini LED Memory Modules)

- Rohm Semiconductor (Rohm Mini LED Drivers, Rohm Mini LED Packages)

- OSRAM (OSRAM Mini LED Solutions, OSRAM Mini LED Lighting Products)

- Everlight Electronics (Everlight Mini LED Modules, Everlight Mini LED Displays).

Mini LED Technology Paves the Way for Energy-Efficient and Sustainable Lighting

The growing demand for sustainable, energy-efficient lighting solutions is a key driver of the Mini LED market. Mini LEDs consume significantly less power than traditional LEDs, offering brighter illumination and longer lifespans, making them ideal for automotive lighting, smart lighting, and consumer electronics. Regulatory measures promoting energy conservation further accelerate adoption across industries.

Mini LED Market Insights: Technology, Type, and Application Driving Growth Across Industries

By Technology

The mini display segment dominated the Mini LED market in 2023, capturing 65.67% of revenue share. These displays stand out for their compact size and advanced technological capabilities, offering superior image clarity compared to standard LED displays. The use of numerous tiny LEDs for backlighting enables precise local dimming, improved contrast, and enhanced HDR performance.

The mini lighting segment is projected to grow at the fastest CAGR during the forecast period. Designed for small spaces or specialized applications, mini lighting systems feature compact dimensions, low power consumption, and versatile mounting options, making them increasingly popular across various industries.

By Type

The standard mini-LED segment led the market in 2023, accounting for 41% of revenue. Renowned for energy efficiency, compact size, and longevity, these LEDs are widely used in residential and commercial lighting.

The ultra-high output mini-LED segment is poised for the fastest growth, driven by its superior luminous efficiency. These LEDs are ideal for applications requiring intense brightness beyond the capabilities of traditional incandescent or fluorescent lighting solutions.

By Application

In 2023, the consumer electronics segment dominated the Mini LED market with a 48% revenue share, driven by advancements in technology. Mini LEDs enhance brightness, contrast, and battery efficiency in devices like smartphones and tablets, improving the visual experience, especially for gaming.

The automotive segment is projected to grow at the fastest CAGR, with mini-LEDs enabling adaptive headlights, energy-efficient daytime running lights, and precise lighting control for safer and more dynamic driving conditions.

Do you Have any Specific Queries or Need any Customize Research on Mini LED Market, Request for Analyst Call @ https://www.snsinsider.com/request-analyst/4781

Key Market Segments:

By Technology

- Mini Display

- Mini Lighting

By Type

- Standard Mini LED

- Low-current Mini LED

- Ultra-high Output Mini LED

By Application

- Consumer Electronics

- Automotive

- Others

North America's Dominance and Middle East & Africa's Rapid Growth in the Mini LED Market

In 2023, North America dominated the Mini LED market with a 42.45% revenue share. driven by increasing demand for consumer electronics, advancements in automotive technology, and rising adoption of innovative technologies. The penetration of IoT and LED lighting into various fixtures has created new opportunities for energy-efficient and customized lighting solutions. Additionally, government-funded programs are promoting the adoption of mini and micro-LEDs, further accelerating market development in the region.

The Middle East & Africa is projected to grow at the fastest rate during the forecast period, fueled by the rising use of LED screens in military and automotive sectors and the growing popularity of IoT, driving demand for laptops, projectors, smartwatches, and smartphones. For instance, in May 2024, Dubai’s Roads and Transport Authority upgraded 900 lighting units on Sheikh Rashid Street to energy-efficient LED lighting, reflecting the region's commitment to advanced technologies.

Purchase an Enterprise User License of Mini LED Market Report at 40% Discount @ https://www.snsinsider.com/checkout/4781

Recent Development

- Aug 12, 2024: TCL increased its global TV shipments to 12.6% in Q1 2024, narrowing the gap with Samsung, whose market share dropped to 18.8% from 20.3%. TCL's growth in the premium mini LED TV segment highlights its rising competition with Samsung.

- Aug 20, 2024: Sony launched its Bravia 9 4K mini LED TV series in India, featuring 75-inch and 85-inch models priced at Rs 4,49,990 and Rs 5,99,990, respectively. The TVs offer high peak luminance and local dimming for enhanced contrast and are available across Sony Centers and major e-commerce platforms.

- April 22, 2024: Innolux will showcase its innovative AM miniLED, advanced miniLED, and AI software integration solutions at the 2024 Touch Taiwan event, held from April 24-26. The company will debut next-generation miniLED display technologies and emphasize its commitment to high value-added products and system integration services.

Table of Contents - Key Points Analysis

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

5.1 Mini LED Production Volumes, by Region (2023)

5.2 Mini LED Design Trends (Historic and Future)

5.3 Mini LED Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

7. Mini LED Market Segmentation, by Technology

8. Mini LED Market Segmentation, by Type

9. Mini LED Market Segmentation, by Application

10. Regional Analysis

11. Company Profiles

12. Use Cases and Best Practices

13. Conclusion

Access Complete Report Insights of Mini LED Market Growth & Outlook 2024-2032@ https://www.snsinsider.com/reports/mini-led-market-4781

[For more information or need any customization research mail us at info@snsinsider.com]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.