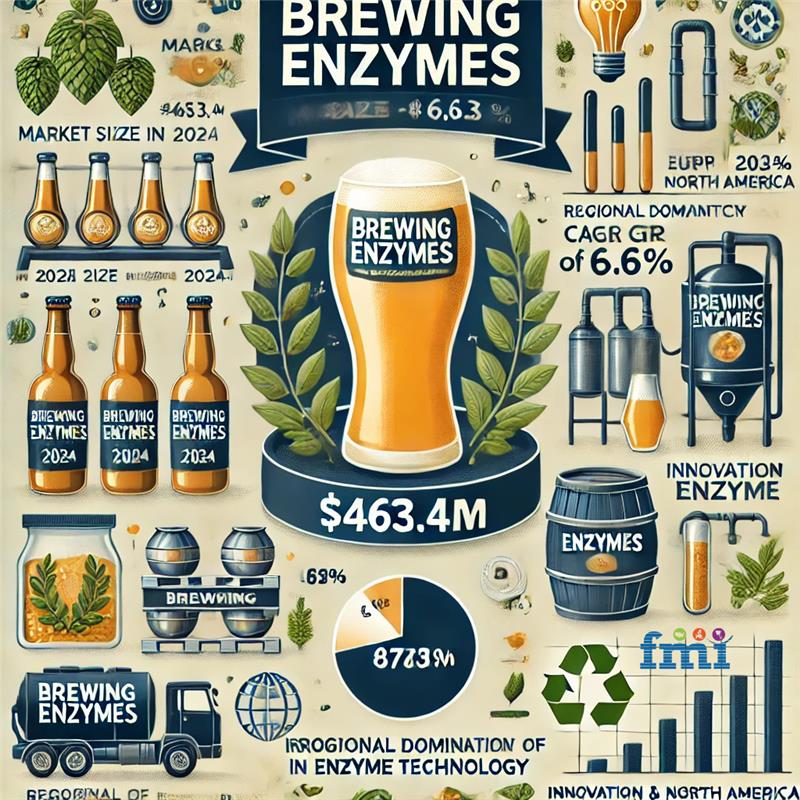

NEWARK, Del, Dec. 04, 2024 (GLOBE NEWSWIRE) -- The global brewing enzymes market is poised for substantial growth, with its valuation projected to expand from USD 463.4 million in 2024 to USD 878.0 million by 2034, reflecting a robust CAGR of 6.6% during the forecast period. The market's progression is fueled by rising demand for beer and alcoholic beverages, technological advancements in enzyme formulations, and growing interest in gluten-free and low-alcohol beer options.

This growth is driven by increasing consumer demand for beer and alcoholic beverages, which has sparked the proliferation of independent breweries, brewpubs, and microbreweries worldwide. These trends are significantly contributing to the expansion of the brewing enzymes market.

Regionally, Europe and North America lead the market, supported by extensive beer production capabilities and advancements in brewing technologies. Despite these drivers, regulatory constraints imposed by agencies such as the USDA, FDA, and EU remain a significant challenge to market growth.

The brewing enzymes market is characterized by continuous innovation in enzyme engineering and formulation. Industry players are investing substantially in research and development to create highly efficient and specialized enzyme products that cater to evolving market demands.

These innovations are particularly critical as breweries strive to lower production costs while maintaining high-quality standards. Furthermore, consumer preferences for diverse beer varieties, including low-alcohol beverages and gluten-free options, are reshaping the market landscape and amplifying the demand for tailored brewing enzymes.

Explore In-Depth Analysis-Click Here to Access the Report! https://www.fmisamplereport.com/sample/rep-gb-14922

How Is Increasing Demand For Alcoholic Beverages Boosting Brewing Enzymes Sales?

The brewing and distilling sectors have seen tremendous expansion over the last few years as a result of the growing demand for alcoholic beverages. Consumers are looking for unique and tasty beers, which is driving sales of brewing enzymes such as proteases, amylases, cellulose, and glucanase. According to the Brewers Association, the number of craft breweries in the USA has increased significantly during the last five years.

Additionally, this has paved the way for a shift in consumer preferences, particularly among young and aspiring drinkers in emerging markets such as Asia Pacific and Europe, away from classic rum and whiskey and toward modern beer. Furthermore, because beer is a widely consumed, sold, and manufactured alcoholic beverage around the world, young people are drawn to it.

Key Growth Drivers

- Soaring Demand for Beer and Alcoholic Beverages

The global beer industry continues to thrive, bolstered by the increasing number of independent breweries, microbreweries, and brewpubs. Enhanced flavor profiles and innovative brewing methods, supported by specialized enzymes like alpha-amylase and glucanase, are driving the demand for brewing enzymes. - Advancements in Enzyme Technology

Continuous innovation in enzyme engineering enables brewers to achieve improved fermentation efficiency, flavor enhancements, and reduced production costs. These advancements support the production of high-quality beer while meeting the evolving tastes of consumers. - Popularity of Gluten-Free Beers

The growing adoption of gluten-free diets has pushed breweries to diversify their offerings, with gluten-free beer emerging as a major growth segment. Innovative enzyme blends are helping breweries optimize processes for gluten-free beer production while maintaining desirable sensory characteristics.

"Rising consumer demand for gluten-free products is reshaping the beer market, with breweries innovating to meet health-conscious preferences. Advances in enzyme technology are enabling consistent, high-quality gluten-free beer production, driving market growth and opening new revenue streams for both established and craft breweries," - says Nandini Roy Choudhury, Client Partner at Future Market Insights.

Regional Insights

- Europe and North America dominate the brewing enzymes market, attributed to large-scale beer production and technological advancements in the beer industry.

- Asia-Pacific, particularly China and India, is emerging as a lucrative market due to rising disposable income, urbanization, and growing consumer interest in premium and low-alcohol beer varieties.

- The USA is set to achieve a CAGR of 6.2% from 2024 to 2034, driven by increased beer production and the proliferation of craft breweries.

| Countries | CAGR 2024 to 2034 | |

| The USA | 3.4% | |

| Brazil | 4.2% | |

| India | 6.1% | |

| Japan | 5.5% | |

| China | 5.1% | |

Brewing Enzyme Demand Soars in China

The East Asian brewing enzyme market, led by China, is thriving due to rising beer demand, increasing disposable income, urbanization, and the expansion of major firms. Supportive government policies and investments in brewing technologies are driving the adoption of modern, enzyme-based processes for improved efficiency and sustainability.

China's breweries are increasingly embracing eco-friendly practices, using enzymes to reduce waste and energy usage. Growing consumer awareness, fueled by research into enzyme efficacy, and a surge in low-alcohol and alcohol-free product launches, further accelerate market growth.

USA Brewing Enzyme Sales on the Rise

The U.S. brewing enzyme market is projected to grow at a 6.2% CAGR (2024–2034) due to intensifying competition and demand for cost-effective beer production. With over 9,000 breweries operating in 2021 and 710 new openings, the sector employs 140,000 people directly at breweries. Increased beer production and the presence of key players like DowDuPont are bolstering market growth, supported by robust demand from bars and pubs.

Challenges and Opportunities

While regulatory restrictions by agencies such as the USDA, FDA, and EU pose challenges, the industry's focus on sustainability and R&D investment in innovative enzyme solutions opens new avenues for growth. Additionally, the increasing standardization in large-scale brewing operations ensures consistent product quality and efficiency.

Access the Full Report Brewing Enzyme Market Trends and Projections Now! https://www.futuremarketinsights.com/reports/brewing-enzymes-market

Category-Wise Insights

How is Increasing Consumption of Beer Pushing Sales of Brewing Enzymes?

Sales of Brewing Enzymes for Beer Production Will Remain High

Based on applications, sales in the beer segment will continue gaining taction over the assessment period. Shifting preference among millennials towards modern and craft beers over traditional alcoholic beverages will boost sales in this segment.

Furthermore, because beer is a widely enjoyed, marketed, and manufactured alcoholic beverage worldwide, millennials and young adults are preferring beers. Moreover, increasing production of non-alcoholic, low-alcohol beer, gluten-free beer, and low-calorie beers across the globe will augment the growth in the market.

Why is Amylase Brewing Enzyme Dominating the Market?

Demand for Amylase Enzyme for Beer Brewing Will Gain Traction

In terms of type, the amylase segment is expected to dominate the brewing enzymes market over the forecast period, owing to its widespread use in the brewing industry as it is cost-effective, timesaving, and space-saving.

Furthermore, due to limited access to malt in the Asia Pacific, amylase consumption is high, which is expected to drive sales in this segment. It is also used in mashing, fermentation, and cereal cooking in the food and beverage sector. One of the main aspects boosting product demand is stable and uniform mashing, as well as enhanced filtering.

Competition Outlook

The competition landscape of the Brewing Enzymes market is intense. Novozymes, DSM, Kerry Group, and Associated British Food are some of the major market players and contribute significantly in terms of R&D investment as well as further towards the creation of innovative sustainable feed concepts to tackle the market.

Such companies also seek to multiply the investment that they can dedicate to the efficient manufacturing of developing enzymes solutions to enhance product quality, growth rates, as well as its efficiency.

To expand their sales, manufacturers are embracing different strategies including vertical and strategic acquisitions. For instance, Novozymes was able to increase its market share by heavily investing in research & development to produce advance brewing enzyme solutions that improve brewing product quality and its efficiency. ABF prioritizes the quality and consistency of its enzyme products, which is essential for brewers seeking consistent results across sections and thereby capture the market.

For instance

- In 2024, International Flavors & Fragrances Inc. (IFF), launched a new brewing enzyme solution i.e. DIAZYME® NOLO designed to improve the efficiency, taste, and production capacity of no-and low alcohol (NOLO) beverages. It alters NOLO beer production by increasing efficiency and taste while avoiding the high energy costs of traditional methods.

- In 2020, DSM introduced a brewing enzyme to take advantage of locally grown un-malted grains. Brewers can raise the adjunct level in beer by switching from malted to un-malted raw materials owing to this enzyme produced from selected bacillus strains.

Leading Brands

- International Flavors & Fragrances Inc.

- Novozymes

- DowDuPont

- DSM

- Amano Enzyme

- Associated British Foods

- Chr. Hansen

- Kerry Group

- Brenntag

- Aumgene Biosciences

- Enzyme Development Corporation

- Megazyme

- Enzyme Innovation

- A Group Soufflet company

- Nature Bioscience Pvt. Ltd.

- Biolaxi Corporation

- Ultreze Enzymes

- Infinita Biotech

- Others

Key Segments of the Report

By Type:

As per Type, the industry has been categorized into Beta-glucanase, Amylase, Xylanase, Protease, Alphalase, and Other types.

By Source:

As per Source, the industry has been categorized into Plant and Microbial.

By Form:

As per Form, the industry has been categorized into Liquid, and Dry.

By Process:

As per Process, the industry has been categorized into Malting, Malnutrition, Wort separation and filtration, and Mashing & fermentation.

By Application:

This segment is further categorized into Beer and Wine.

By Region:

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltics, and the Middle East & Africa.

German Translation:

Der globale Markt für Brauenzyme ist bereit für ein erhebliches Wachstum, wobei seine Bewertung voraussichtlich von 463,4 Mio. USD im Jahr 2024 auf 878,0 Mio. USD bis 2034 steigen wird, was einer robusten CAGR von 6,6 % im Prognosezeitraum entspricht. Die Entwicklung des Marktes wird durch die steigende Nachfrage nach Bier und alkoholischen Getränken, technologische Fortschritte bei Enzymformulierungen und das wachsende Interesse an glutenfreien und alkoholarmen Biersorten angetrieben.

Dieses Wachstum wird durch die steigende Verbrauchernachfrage nach Bier und alkoholischen Getränken angetrieben, die weltweit die Verbreitung unabhängiger Brauereien, Brauereien und Mikrobrauereien ausgelöst hat. Diese Trends tragen erheblich zur Expansion des Marktes für Brauenzyme bei.

Regional sind Europa und Nordamerika marktführend, unterstützt durch umfangreiche Bierproduktionskapazitäten und Fortschritte bei den Brautechnologien. Trotz dieser Treiber bleiben regulatorische Beschränkungen, die von Behörden wie USDA, FDA und EU auferlegt werden, eine erhebliche Herausforderung für das Marktwachstum.

Der Markt für Brauenzyme zeichnet sich durch kontinuierliche Innovation in der Enzymtechnik und -formulierung aus. Die Akteure der Branche investieren erheblich in Forschung und Entwicklung, um hocheffiziente und spezialisierte Enzymprodukte zu entwickeln, die den sich wandelnden Marktanforderungen gerecht werden.

Diese Innovationen sind besonders wichtig, da Brauereien bestrebt sind, die Produktionskosten zu senken und gleichzeitig hohe Qualitätsstandards aufrechtzuerhalten. Darüber hinaus verändern die Vorlieben der Verbraucher für verschiedene Biersorten, einschließlich alkoholarmer und glutenfreier Optionen, die Marktlandschaft und verstärken die Nachfrage nach maßgeschneiderten Brauenzymen.

Wichtige Wachstumstreiber

- Steigende Nachfrage nach Bier und alkoholischen Getränken

Die globale Bierindustrie floriert weiterhin, unterstützt durch die wachsende Zahl unabhängiger Brauereien, Mikrobrauereien und Brewpubs. Verbesserte Geschmacksprofile und innovative Braumethoden, unterstützt durch spezialisierte Enzyme wie Alpha-Amylase und Glucanase, treiben die Nachfrage nach Brauenzymen an. - Fortschritte in der Enzymtechnologie

Kontinuierliche Innovationen in der Enzymtechnik ermöglichen es Brauereien, eine verbesserte Fermentationseffizienz, Geschmacksverbesserungen und niedrigere Produktionskosten zu erzielen. Diese Fortschritte unterstützen die Produktion von hochwertigem Bier und treffen gleichzeitig den sich wandelnden Geschmack der Verbraucher. - Beliebtheit von glutenfreien Bieren

Die zunehmende Einführung glutenfreier Diäten hat die Brauereien dazu veranlasst, ihr Angebot zu diversifizieren, wobei sich glutenfreies Bier zu einem wichtigen Wachstumssegment entwickelt. Innovative Enzymmischungen helfen Brauereien, ihre Prozesse für die Herstellung von glutenfreiem Bier zu optimieren und gleichzeitig die gewünschten sensorischen Eigenschaften beizubehalten.

"Die steigende Nachfrage der Verbraucher nach glutenfreien Produkten verändert den Biermarkt, wobei Brauereien innovativ sind, um gesundheitsbewusste Vorlieben zu erfüllen. Fortschritte in der Enzymtechnologie ermöglichen eine gleichbleibende, qualitativ hochwertige glutenfreie Bierproduktion, treiben das Marktwachstum voran und eröffnen neue Einnahmequellen sowohl für etablierte als auch für Craft-Brauereien," - sagt Nandini Roy Choudhury, Client Partner bei Future Market Insights.

Regionale Einblicke

- Europa und Nordamerika dominieren den Markt für Brauenzyme, was auf die groß angelegte Bierproduktion und den technologischen Fortschritt in der Bierindustrie zurückzuführen ist.

- Der asiatisch-pazifische Raum, insbesondere China und Indien, entwickelt sich aufgrund des steigenden verfügbaren Einkommens, der Urbanisierung und des wachsenden Interesses der Verbraucher an hochwertigen und alkoholarmen Biersorten zu einem lukrativen Markt.

- Die USA werden von 2024 bis 2034 eine CAGR von 6,2 % erreichen, was auf die gestiegene Bierproduktion und die Verbreitung von Craft-Brauereien zurückzuführen ist.

| Länder | CAGR 2024 bis 2034 | |

| The USA | 3.4% | |

| Brazilien | 4.2% | |

| Indien | 6.1% | |

| Japan | 5.5% | |

| China | 5.1% | |

Die Nachfrage nach Brauenzymen steigt in China

Der ostasiatische Markt für Brauenzyme, angeführt von China, floriert aufgrund der steigenden Biernachfrage, des steigenden verfügbaren Einkommens, der Urbanisierung und der Expansion großer Unternehmen. Unterstützende staatliche Maßnahmen und Investitionen in Brautechnologien treiben die Einführung moderner, enzymbasierter Prozesse für mehr Effizienz und Nachhaltigkeit voran.

Chinas Brauereien setzen zunehmend auf umweltfreundliche Praktiken und verwenden Enzyme, um Abfall und Energieverbrauch zu reduzieren. Das wachsende Bewusstsein der Verbraucher, angetrieben durch die Erforschung der Enzymwirksamkeit, und ein Anstieg der Markteinführungen alkoholarmer und alkoholfreier Produkte beschleunigen das Marktwachstum weiter.

US-Verkäufe von Brauenzymen steigen

Der US-Markt für Brauenzyme wird aufgrund des sich verschärfenden Wettbewerbs und der Nachfrage nach kostengünstiger Bierproduktion voraussichtlich mit einer CAGR von 6,2 % (2024–2034) wachsen. Mit über 9.000 Brauereien in Betrieb im Jahr 2021 und 710 Neueröffnungen beschäftigt die Branche 140.000 Menschen direkt in den Brauereien. Die gestiegene Bierproduktion und die Präsenz von Hauptakteuren wie DowDuPont stützen das Marktwachstum, unterstützt durch eine robuste Nachfrage von Bars und Pubs.

Herausforderungen und Chancen

Während regulatorische Beschränkungen durch Behörden wie USDA, FDA und EU Herausforderungen darstellen, eröffnet der Fokus der Branche auf Nachhaltigkeit und F&E-Investitionen in innovative Enzymlösungen neue Wachstumswege. Darüber hinaus sorgt die zunehmende Standardisierung in Großbrauereien für eine gleichbleibende Produktqualität und Effizienz.

Ausblick auf den Wettbewerb

Die Wettbewerbslandschaft auf dem Markt für Brauenzyme ist intensiv. Novozymes, DSM, Kerry Group und Associated British Food sind einige der wichtigsten Marktteilnehmer und tragen erheblich zu F&E-Investitionen sowie zur Schaffung innovativer nachhaltiger Futtermittelkonzepte bei, um den Markt zu erobern.

Diese Unternehmen versuchen auch, die Investitionen, die sie in die effiziente Herstellung von Enzymlösungen investieren können, zu vervielfachen, um die Produktqualität, die Wachstumsraten und die Effizienz der Produkte zu verbessern.

Um ihren Umsatz zu steigern, verfolgen die Hersteller verschiedene Strategien, einschließlich vertikaler und strategischer Akquisitionen. So konnte Novozymes beispielsweise seinen Marktanteil steigern, indem es stark in Forschung und Entwicklung investierte, um fortschrittliche Brauenzymlösungen herzustellen, die die Qualität und Effizienz des Brauprodukts verbessern. ABF legt großen Wert auf die Qualität und Konsistenz seiner Enzymprodukte, was für Brauereien, die in allen Bereichen konsistente Ergebnisse erzielen und so den Markt erobern wollen, von entscheidender Bedeutung ist.

Zum Beispiel

- In 2024, International Flavors & Fragrances Inc. (IFF), launched a new brewing enzyme solution i.e. DIAZYME® NOLO designed to improve the efficiency, taste, and production capacity of no-and low alcohol (NOLO) beverages. It alters NOLO beer production by increasing efficiency and taste while avoiding the high energy costs of traditional methods.

- In 2020, DSM introduced a brewing enzyme to take advantage of locally grown un-malted grains. Brewers can raise the adjunct level in beer by switching from malted to un-malted raw materials owing to this enzyme produced from selected bacillus strains.

Leading Brands

- International Flavors & Fragrances Inc.

- Novozymes

- DowDuPont

- DSM

- Amano Enzyme

- Associated British Foods

- Chr. Hansen

- Kerry Group

- Brenntag

- Aumgene Biosciences

- Enzyme Development Corporation

- Megazyme

- Enzyme Innovation

- A Group Soufflet company

- Nature Bioscience Pvt. Ltd.

- Biolaxi Corporation

- Ultreze Enzymes

- Infinita Biotech

- Others

Key Segments of the Report

By Type:

As per Type, the industry has been categorized into Beta-glucanase, Amylase, Xylanase, Protease, Alphalase, and Other types.

By Source:

As per Source, the industry has been categorized into Plant and Microbial.

By Form:

As per Form, the industry has been categorized into Liquid, and Dry.

By Process:

As per Process, the industry has been categorized into Malting, Malnutrition, Wort separation and filtration, and Mashing & fermentation.

By Application:

This segment is further categorized into Beer and Wine.

By Region:

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltics, and the Middle East & Africa.

Authored by:

Nandini Roy Choudhury (Client Partner for Food & Beverages at Future Market Insights, Inc.) has 7+ years of management consulting experience. She advises industry leaders and explores off-the-eye opportunities and challenges. She puts processes and operating models in place to support their business objectives.

She has exceptional analytical skills and often brings thought leadership to the table.

Nandini has vast functional expertise in key niches, including but not limited to food ingredients, nutrition & health solutions, animal nutrition, and marine nutrients. She is also well-versed in the pharmaceuticals, biotechnology, retail, and chemical sectors, where she advises market participants to develop methodologies and strategies that deliver results.

Her core expertise lies in corporate growth strategy, sales and marketing effectiveness, acquisitions and post-merger integration and cost reduction. Nandini has an MBA in Finance from MIT School of Business. She also holds a Bachelor’s Degree in Electrical Engineering from Nagpur University, India.

Nandini has authored several publications, and quoted in journals including Beverage Industry, Bloomberg, and Wine Industry Advisor.

Explore FMI’s related ongoing Coverage in the Food and Beverage Domain:

Explore trending News on Global Eggs and Products Market Analysis (2024 – 2034)

The insoluble dietary fiber market is set to register a CAGR of 9.1% through 2034.

The organic oats market is estimated to have a market value of USD 281.0 million in the year 2023.

According to Future Market Insights research, the global lipase market is expected to grow at a CAGR of 10.3% during the projected period.

The feed phytogenic market size is anticipated to be valued at USD 782.3 million in 2023.

The global mango puree market is set to gain from this phenomenon and jump from a value of USD 1.8 billion in 2024 to USD 3.56 billion by 2034

Global soy protein isolate sales are estimated to be worth USD 3,675.1 million in 2024.

The global guar gum market is anticipated to reach a value of USD 1,234.6 million in 2024.

Global sales of artificial sweeteners are set to soar at 2.9% CAGR, accumulating a total revenue of USD 3,600 million by 2034.

The global Frozen Ready Meal Market size is anticipated to reach USD 44,318.9 million in 2024.

The global spirulina powder market size is projected to rise from USD 461 million in 2024 to USD 702 million by 2034.

About Future Market Insights (FMI)

Future Market Insights, Inc. (ESOMAR certified, recipient of the Stevie Award, and a member of the Greater New York Chamber of Commerce) offers profound insights into the driving factors that are boosting demand in the market. FMI stands as the leading global provider of market intelligence, advisory services, consulting, and events for the Packaging, Food and Beverage, Consumer Technology, Healthcare, Industrial, and Chemicals markets. With a vast team of over 400 analysts worldwide, FMI provides global, regional, and local expertise on diverse domains and industry trends across more than 110 countries.

Join us as we commemorate 10 years of delivering trusted market insights. Reflecting on a decade of achievements, we continue to lead with integrity, innovation, and expertise.

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-347-918-3531

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube